Free Vehicle Repayment Agreement Template

The Vehicle Repayment Agreement form plays a crucial role in the process of financing a vehicle, ensuring that both the lender and the borrower understand their rights and responsibilities. This document outlines the terms under which a borrower agrees to repay a loan taken out for the purchase of a vehicle. Key components of the form typically include the loan amount, interest rate, repayment schedule, and any applicable fees. Additionally, it often specifies the consequences of missed payments or default, providing clarity on what actions may be taken in such situations. By detailing the obligations of both parties, the Vehicle Repayment Agreement helps foster transparency and trust, ultimately contributing to a smoother transaction. Whether you are a first-time car buyer or someone with experience in vehicle financing, understanding this agreement is essential to navigating the complexities of vehicle loans effectively.

Find Common Templates

Landlord Friendly Rent Increase Letter - Sets a professional tone in the landlord’s communication with tenants.

When engaging in activities that may pose potential risks, it is crucial to have a comprehensive understanding of the Washington Hold Harmless Agreement. This document not only defines the responsibilities of each party but also specifies the extent to which one party can be protected from liability. For those looking for a reliable source to obtain this essential form, you can visit Washington Templates to ensure all your interests are adequately safeguarded.

Motorcycle Bill of Sale Pdf - Helps establish trust between buyer and seller.

Common Questions

What is a Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form is a document that outlines the terms and conditions under which an individual agrees to repay a loan or debt related to a vehicle. This agreement typically includes details such as the total amount owed, payment schedule, interest rates, and any penalties for late payments. It serves to protect both the lender and the borrower by clearly defining their responsibilities and expectations.

Who needs to fill out the Vehicle Repayment Agreement form?

This form is generally required for individuals who have taken out a loan to purchase a vehicle or who have entered into a financing agreement. It is essential for both the borrower and the lender to have a clear understanding of the repayment terms. Additionally, anyone refinancing an existing vehicle loan may also need to complete this form to formalize the new repayment terms.

What information is typically included in the form?

A standard Vehicle Repayment Agreement form will usually include the borrower's name, contact information, and details about the vehicle, such as its make, model, and VIN (Vehicle Identification Number). It will also outline the loan amount, interest rate, payment schedule, and any fees or penalties for missed payments. Both parties may need to sign the document to indicate their agreement to the terms.

How does the repayment process work?

Once the Vehicle Repayment Agreement is signed, the borrower is expected to make regular payments according to the agreed-upon schedule. Payments may be made monthly, bi-weekly, or at another frequency specified in the agreement. If a payment is missed, the borrower may incur late fees or other penalties as outlined in the agreement. It is crucial for borrowers to communicate with their lender if they encounter difficulties in making payments.

What happens if I cannot make a payment?

If a borrower is unable to make a scheduled payment, it is important to reach out to the lender as soon as possible. Many lenders are willing to discuss options, such as a payment extension or a revised payment plan. Ignoring the situation can lead to additional fees, negative impacts on credit scores, or even repossession of the vehicle in severe cases. Open communication can often lead to a more manageable solution.

Can the terms of the Vehicle Repayment Agreement be changed?

Yes, the terms of the Vehicle Repayment Agreement can be modified, but both parties must agree to any changes. This typically involves creating an amendment to the original agreement that details the new terms. It is essential to document any changes in writing and have both parties sign the amended agreement to ensure clarity and enforceability.

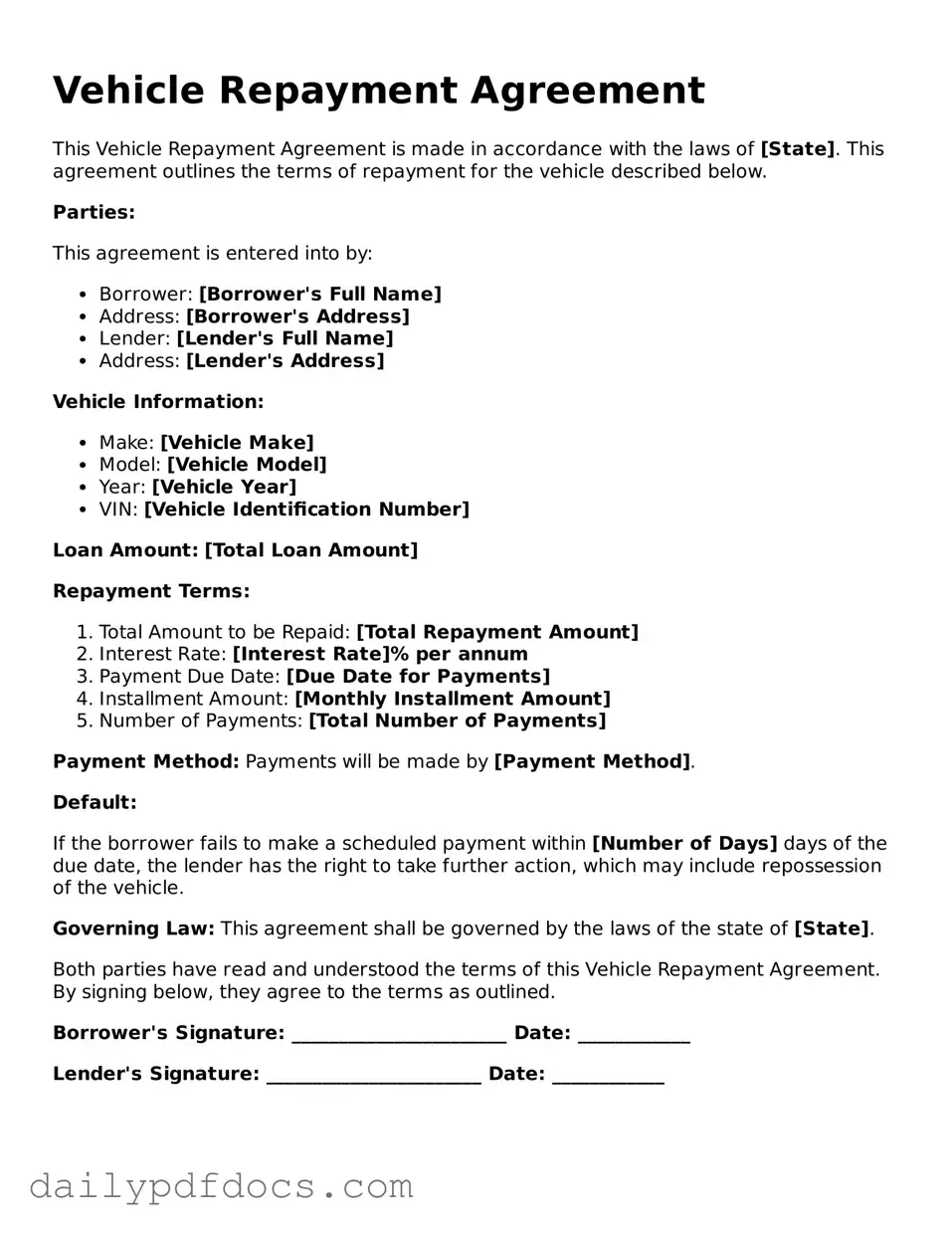

Preview - Vehicle Repayment Agreement Form

Vehicle Repayment Agreement

This Vehicle Repayment Agreement is made in accordance with the laws of [State]. This agreement outlines the terms of repayment for the vehicle described below.

Parties:

This agreement is entered into by:

- Borrower: [Borrower's Full Name]

- Address: [Borrower's Address]

- Lender: [Lender's Full Name]

- Address: [Lender's Address]

Vehicle Information:

- Make: [Vehicle Make]

- Model: [Vehicle Model]

- Year: [Vehicle Year]

- VIN: [Vehicle Identification Number]

Loan Amount: [Total Loan Amount]

Repayment Terms:

- Total Amount to be Repaid: [Total Repayment Amount]

- Interest Rate: [Interest Rate]% per annum

- Payment Due Date: [Due Date for Payments]

- Installment Amount: [Monthly Installment Amount]

- Number of Payments: [Total Number of Payments]

Payment Method: Payments will be made by [Payment Method].

Default:

If the borrower fails to make a scheduled payment within [Number of Days] days of the due date, the lender has the right to take further action, which may include repossession of the vehicle.

Governing Law: This agreement shall be governed by the laws of the state of [State].

Both parties have read and understood the terms of this Vehicle Repayment Agreement. By signing below, they agree to the terms as outlined.

Borrower's Signature: _______________________ Date: ____________

Lender's Signature: _______________________ Date: ____________

Similar forms

- Loan Agreement: This document outlines the terms under which a borrower receives funds from a lender. Like the Vehicle Repayment Agreement, it specifies repayment terms, interest rates, and consequences for defaulting.

- Lease Agreement: A lease agreement is similar as it details the rental terms for a vehicle. Both documents establish payment schedules and responsibilities, though a lease focuses on temporary use rather than ownership.

- Promissory Note: This document serves as a written promise to pay a specified amount. Like the Vehicle Repayment Agreement, it includes repayment terms and can be used in legal proceedings if payments are missed.

- Sales Contract: A sales contract formalizes the sale of a vehicle, detailing the purchase price and payment method. Both documents involve financial obligations and outline what happens if terms are not met.

- Mobile Home Bill of Sale: This form is specifically designed for the transfer of mobile home ownership, incorporating necessary details such as buyer and seller information, mobile home description, and sale price. For a reliable template, you can visit https://mobilehomebillofsale.com/blank-ohio-mobile-home-bill-of-sale/.

- Title Transfer Document: This document is used when ownership of a vehicle changes hands. Similar to a Vehicle Repayment Agreement, it signifies a financial transaction and can include terms related to outstanding payments.

- Collateral Agreement: In cases where the vehicle serves as collateral for a loan, this document specifies the terms of the collateral arrangement. It shares similarities with the Vehicle Repayment Agreement in terms of security interests and obligations.

- Default Notice: This document notifies a borrower of missed payments. It is similar in that it addresses the consequences of failing to adhere to the repayment terms outlined in the Vehicle Repayment Agreement.

- Payment Plan Agreement: This agreement outlines a structured repayment plan for debts. Like the Vehicle Repayment Agreement, it details the payment schedule and the total amount owed.

- Debt Settlement Agreement: This document is used when negotiating reduced payment amounts for outstanding debts. It parallels the Vehicle Repayment Agreement in that both involve financial obligations and potential consequences for non-compliance.

Misconceptions

Understanding the Vehicle Repayment Agreement form is crucial for anyone entering into a vehicle financing arrangement. However, several misconceptions can lead to confusion. Here are nine common misconceptions about this form:

- It is only for buyers with bad credit. Many believe this form is only necessary for individuals with poor credit histories. In reality, anyone financing a vehicle may need to complete this form, regardless of their credit status.

- It guarantees loan approval. Some think that filling out the Vehicle Repayment Agreement guarantees that they will receive financing. However, approval depends on multiple factors, including creditworthiness and lender policies.

- It is a legally binding contract. While the form is important, it may not be a legally binding contract until both parties sign the final loan agreement. The Vehicle Repayment Agreement serves as an outline of repayment terms.

- All lenders use the same form. People often assume that all lenders use a standardized Vehicle Repayment Agreement. In fact, different lenders may have their own versions or requirements.

- It can be ignored if the vehicle is returned. Some believe that returning the vehicle cancels the agreement. This is not true; obligations may still exist, including any outstanding balance or fees.

- It only covers the vehicle's purchase price. Many think the form only addresses the vehicle's cost. In reality, it may also include interest rates, fees, and other financial obligations.

- It is only relevant during the initial purchase. Some assume the agreement is only important at the time of purchase. However, it can also impact future transactions, such as trade-ins or refinancing.

- Signing it means you understand all terms. Just signing the form does not mean that a person fully understands all terms and conditions. It is essential to read and ask questions about the agreement.

- It is a one-size-fits-all document. Lastly, many believe the Vehicle Repayment Agreement is the same for everyone. In truth, terms can vary widely based on individual circumstances and lender requirements.

By addressing these misconceptions, individuals can make more informed decisions when dealing with vehicle financing and repayment agreements.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is designed to outline the terms under which a borrower agrees to repay a loan for a vehicle. |

| Key Components | This form typically includes details such as the loan amount, interest rate, payment schedule, and consequences of default. |

| Governing Law | In many states, the governing laws for vehicle repayment agreements are based on the Uniform Commercial Code (UCC) and state-specific consumer protection laws. |

| Signature Requirement | Both the borrower and lender must sign the form to make it legally binding. |

| State Variations | Each state may have its own version of the Vehicle Repayment Agreement form, reflecting local laws and regulations. |

| Default Consequences | The agreement will specify what happens if the borrower defaults, which may include repossession of the vehicle. |

| Record Keeping | It is essential for both parties to keep a copy of the signed agreement for their records, as it serves as proof of the terms agreed upon. |