Free Transfer-on-Death Deed Template

The Transfer-on-Death Deed (TODD) form represents a significant advancement in estate planning, allowing individuals to designate beneficiaries for real property without the need for probate. This form streamlines the transfer process, ensuring that property automatically passes to named heirs upon the owner’s death. By utilizing a TODD, property owners can maintain full control over their assets during their lifetime, while also providing a clear and efficient pathway for inheritance. The form must be executed with specific legal formalities, including notarization and recording with the appropriate local authority, to be effective. Importantly, a TODD can be revoked or altered at any time before the owner's death, offering flexibility in estate management. Understanding the implications of this deed is crucial, as it not only impacts the distribution of property but also influences tax considerations and the overall estate plan. As more individuals seek to simplify their estate planning, the Transfer-on-Death Deed emerges as a valuable tool, combining ease of use with legal efficacy.

Popular Transfer-on-Death Deed Templates:

Sample Lady Bird Deed Florida - A Lady Bird Deed provides flexibility in how you manage your property during your lifetime.

The Ohio Trailer Bill of Sale form is a legal document used to record the sale and transfer of ownership of a trailer in Ohio. This form serves as proof of the transaction between the seller and the buyer, ensuring that both parties have a clear understanding of the terms. Having a properly completed bill of sale can help avoid disputes and provide essential information for registration purposes. For those looking for a convenient way to access this form, visit Ohio PDF Forms.

Quick Title Deed - It is not recommended for complex property ownership situations.

Transfer-on-Death Deed - Tailored for Individual States

Common Questions

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD deed) is a legal document that allows property owners to designate a beneficiary who will automatically receive the property upon the owner's death. This type of deed bypasses the probate process, making it a simpler and often quicker way to transfer real estate to heirs.

How does a Transfer-on-Death Deed work?

When the property owner signs a Transfer-on-Death Deed and files it with the appropriate county office, the deed becomes effective immediately. However, the beneficiary does not have any rights to the property until the owner passes away. Once the owner dies, the property transfers directly to the beneficiary without going through probate.

Who can be named as a beneficiary in a Transfer-on-Death Deed?

Any individual or entity can be named as a beneficiary in a Transfer-on-Death Deed. This includes family members, friends, or even organizations. It’s important to choose someone you trust, as they will inherit the property without any additional legal hurdles.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you must create a new deed that explicitly states the changes or file a revocation form with the county office. It’s advisable to consult with a legal professional to ensure that the changes are properly documented.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences for the property owner. However, the beneficiary may be responsible for property taxes after the transfer. Additionally, estate taxes could apply depending on the overall value of the estate. Consulting with a tax advisor is recommended to understand potential tax liabilities.

Is a Transfer-on-Death Deed valid in all states?

No, not all states recognize Transfer-on-Death Deeds. While many states have adopted laws allowing this type of deed, some do not. It’s crucial to check the specific laws in your state or consult with a legal expert to ensure that a Transfer-on-Death Deed is a viable option for your situation.

What happens if I don’t have a Transfer-on-Death Deed?

If you do not have a Transfer-on-Death Deed, your property will typically go through the probate process after your death. This can be time-consuming and costly, as the court will oversee the distribution of your assets according to your will or state laws if there is no will. Creating a TOD deed can help avoid this lengthy process.

Can I use a Transfer-on-Death Deed for any type of property?

Transfer-on-Death Deeds are generally used for real estate, such as homes or land. However, they cannot be used for personal property like vehicles or bank accounts. It’s important to understand the limitations of a TOD deed and consider other estate planning tools for different types of assets.

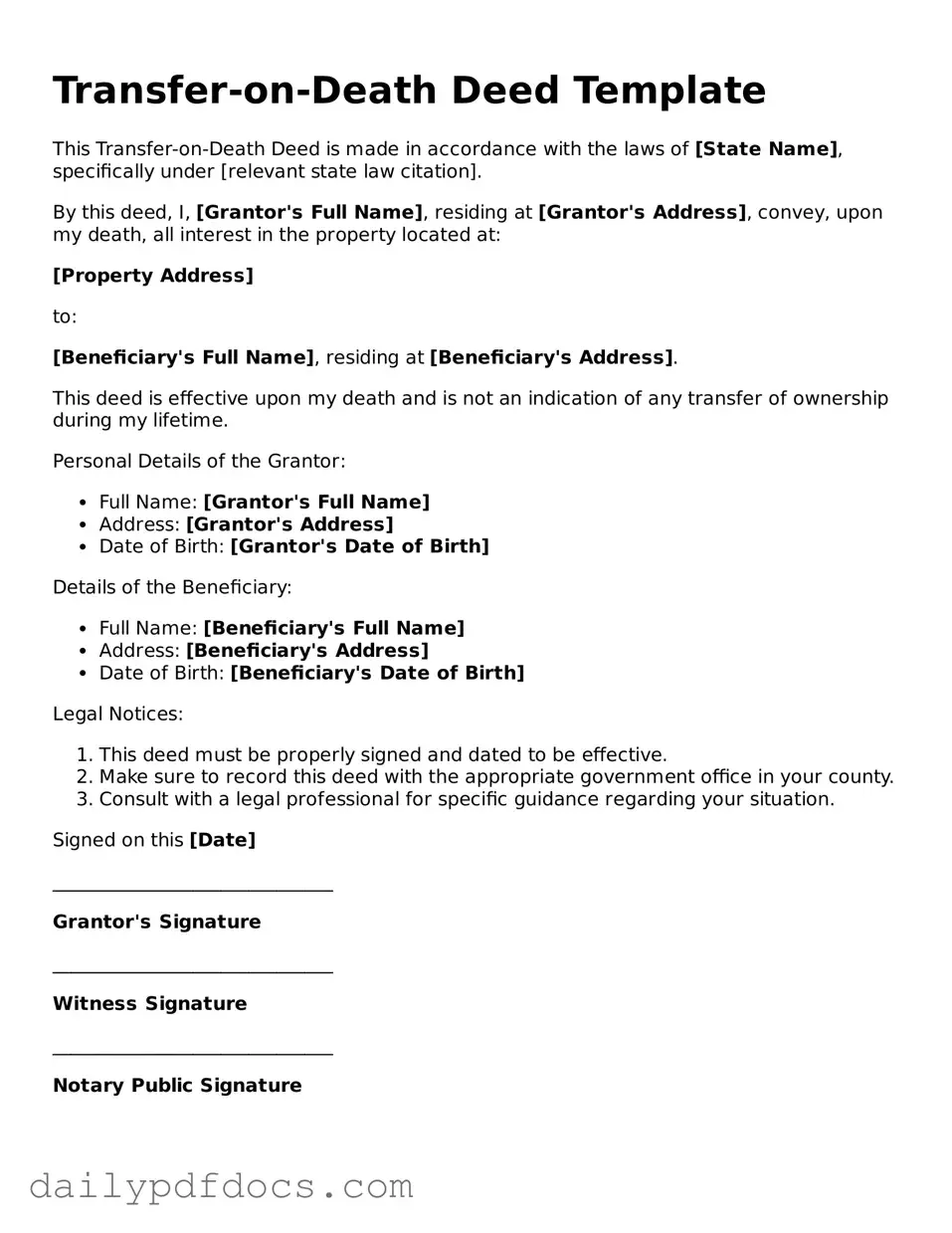

Preview - Transfer-on-Death Deed Form

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with the laws of [State Name], specifically under [relevant state law citation].

By this deed, I, [Grantor's Full Name], residing at [Grantor's Address], convey, upon my death, all interest in the property located at:

[Property Address]

to:

[Beneficiary's Full Name], residing at [Beneficiary's Address].

This deed is effective upon my death and is not an indication of any transfer of ownership during my lifetime.

Personal Details of the Grantor:

- Full Name: [Grantor's Full Name]

- Address: [Grantor's Address]

- Date of Birth: [Grantor's Date of Birth]

Details of the Beneficiary:

- Full Name: [Beneficiary's Full Name]

- Address: [Beneficiary's Address]

- Date of Birth: [Beneficiary's Date of Birth]

Legal Notices:

- This deed must be properly signed and dated to be effective.

- Make sure to record this deed with the appropriate government office in your county.

- Consult with a legal professional for specific guidance regarding your situation.

Signed on this [Date]

______________________________

Grantor's Signature

______________________________

Witness Signature

______________________________

Notary Public Signature

Similar forms

The Transfer-on-Death Deed (TOD Deed) serves as a useful estate planning tool, allowing individuals to transfer property upon their death without going through probate. Several other documents share similarities with the TOD Deed in terms of their purpose and functionality. Below are four such documents:

- Will: A will outlines how a person's assets will be distributed after their death. Like the TOD Deed, it allows individuals to specify beneficiaries, but it requires probate to be valid, whereas the TOD Deed bypasses this process.

- Living Trust: A living trust holds assets during a person's lifetime and distributes them after death according to the trust's terms. Similar to the TOD Deed, a living trust can avoid probate, but it requires more formal management and documentation.

- Beneficiary Designation: Commonly used for financial accounts and insurance policies, a beneficiary designation allows individuals to name who will receive assets upon their death. This is akin to the TOD Deed's function of designating a recipient for real property, both avoiding probate.

- California Lease Agreement: This form provides a written contract between a landlord and tenant for renting property in California, detailing terms like rent and obligations, and is essential for protecting both parties involved in the rental process. More information can be found at legalformspdf.com/.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows two or more individuals to own property together, with the surviving owner automatically receiving the deceased owner's share. Like the TOD Deed, this arrangement facilitates a smooth transfer of property without probate, although it involves joint ownership during the owner's lifetime.

Misconceptions

Understanding the Transfer-on-Death (TOD) Deed form can be challenging, and misconceptions often arise. Here are nine common misunderstandings about this important estate planning tool:

- It eliminates the need for a will. Many people believe that a TOD deed replaces the need for a will. In reality, it is just one part of a comprehensive estate plan. A will is still necessary for addressing other assets and wishes.

- It is only for wealthy individuals. Some think that only those with significant assets can benefit from a TOD deed. However, it can be a useful tool for anyone who wants to simplify the transfer of property upon death.

- It automatically transfers all assets. A common myth is that a TOD deed transfers all assets owned by the deceased. In truth, it only applies to the specific property mentioned in the deed.

- It is irrevocable once signed. Many believe that once a TOD deed is executed, it cannot be changed. This is not true; the owner can revoke or alter the deed at any time before their death.

- It avoids probate entirely. Some assume that using a TOD deed means their estate will completely avoid probate. While it does allow for the property to pass outside of probate, other assets may still go through the probate process.

- It is only applicable to real estate. There is a misconception that a TOD deed can only be used for real property. However, some states allow for TOD designations on other types of assets, like bank accounts.

- All states recognize TOD deeds. Not everyone realizes that not all states have adopted the TOD deed. It is essential to check local laws to see if this option is available.

- Beneficiaries cannot be changed. A misconception exists that once beneficiaries are named in a TOD deed, they cannot be altered. In fact, the property owner can change beneficiaries at any time prior to death.

- It creates a joint ownership situation. Some believe that a TOD deed means the beneficiary will have ownership rights during the owner's lifetime. This is incorrect; the beneficiary only gains rights after the owner's death.

Being aware of these misconceptions can help individuals make informed decisions about their estate planning strategies. Always consider consulting with a professional to navigate the complexities of property transfer and estate planning.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed (TOD) allows property owners to transfer their real estate to designated beneficiaries upon their death without going through probate. |

| Governing Law | In the United States, the use of Transfer-on-Death Deeds is governed by state law. Many states have adopted specific statutes that outline how these deeds should be created and executed. |

| Revocability | One significant feature of a TOD deed is that it can be revoked or changed at any time before the property owner's death, giving them flexibility in their estate planning. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the TOD deed. This designation is critical, as it determines who will inherit the property after the owner passes away. |