Printable Transfer-on-Death Deed Document for Texas

In the state of Texas, property owners have a valuable tool at their disposal for managing the transfer of their real estate upon their passing: the Transfer-on-Death Deed form. This legal document allows individuals to designate one or more beneficiaries who will automatically receive the property without the need for probate, simplifying the process for loved ones during a difficult time. By utilizing this deed, property owners can retain full control over their assets during their lifetime, ensuring that they can sell, mortgage, or otherwise manage their property as they see fit. The form must be properly executed and recorded to be effective, which includes providing clear identification of the property and the beneficiaries. Additionally, the Transfer-on-Death Deed can be revoked or modified at any point before the owner's death, offering flexibility as personal circumstances change. Understanding how to effectively use this form can empower property owners to make informed decisions about their estate planning, ensuring that their wishes are honored and their loved ones are taken care of in the future.

More State-specific Transfer-on-Death Deed Forms

Tod in California - This tool is a cost-effective way to handle property transfer in your estate plan.

Florida Transfer on Death Deed Form - Using a Transfer-on-Death Deed ensures your property goes where you want it to, without court intervention.

For businesses in Arizona, understanding the policies outlined in the Employee Handbook is essential for maintaining workplace harmony and productivity. This resource serves as a foundation for employee expectations and rights, ensuring that everyone is on the same page. To familiarize yourself with the specific guidelines, access the detailed Employee Handbook resource here: a practical guide to the Employee Handbook.

Free Printable Transfer on Death Deed Form Georgia - It is a legal option available in many states, making it a versatile tool for estate planning.

Common Questions

What is a Transfer-on-Death Deed in Texas?

A Transfer-on-Death Deed (TODD) in Texas allows property owners to designate beneficiaries who will receive their real estate upon their death. This deed functions similarly to a will but avoids the probate process, making it a more straightforward option for transferring property. The property owner retains full control during their lifetime and can sell or change the beneficiaries at any time before death.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed in Texas, you must complete a specific form that includes your name, the names of the beneficiaries, and a legal description of the property. After filling out the form, it must be signed in front of a notary public and recorded with the county clerk's office where the property is located. It is essential to ensure that the deed is executed correctly to avoid complications later.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked at any time before the property owner's death. To revoke the deed, the property owner must execute a new deed that explicitly states the revocation or file a formal revocation document with the county clerk's office. It is important to follow the proper procedures to ensure that the revocation is legally binding.

What happens if I do not name a beneficiary in the Transfer-on-Death Deed?

If no beneficiary is named in the Transfer-on-Death Deed, the property will not be transferred according to the deed upon the owner's death. Instead, the property will be subject to the state's intestacy laws, which determine how assets are distributed when someone dies without a will. This could lead to complications and delays in transferring the property to heirs.

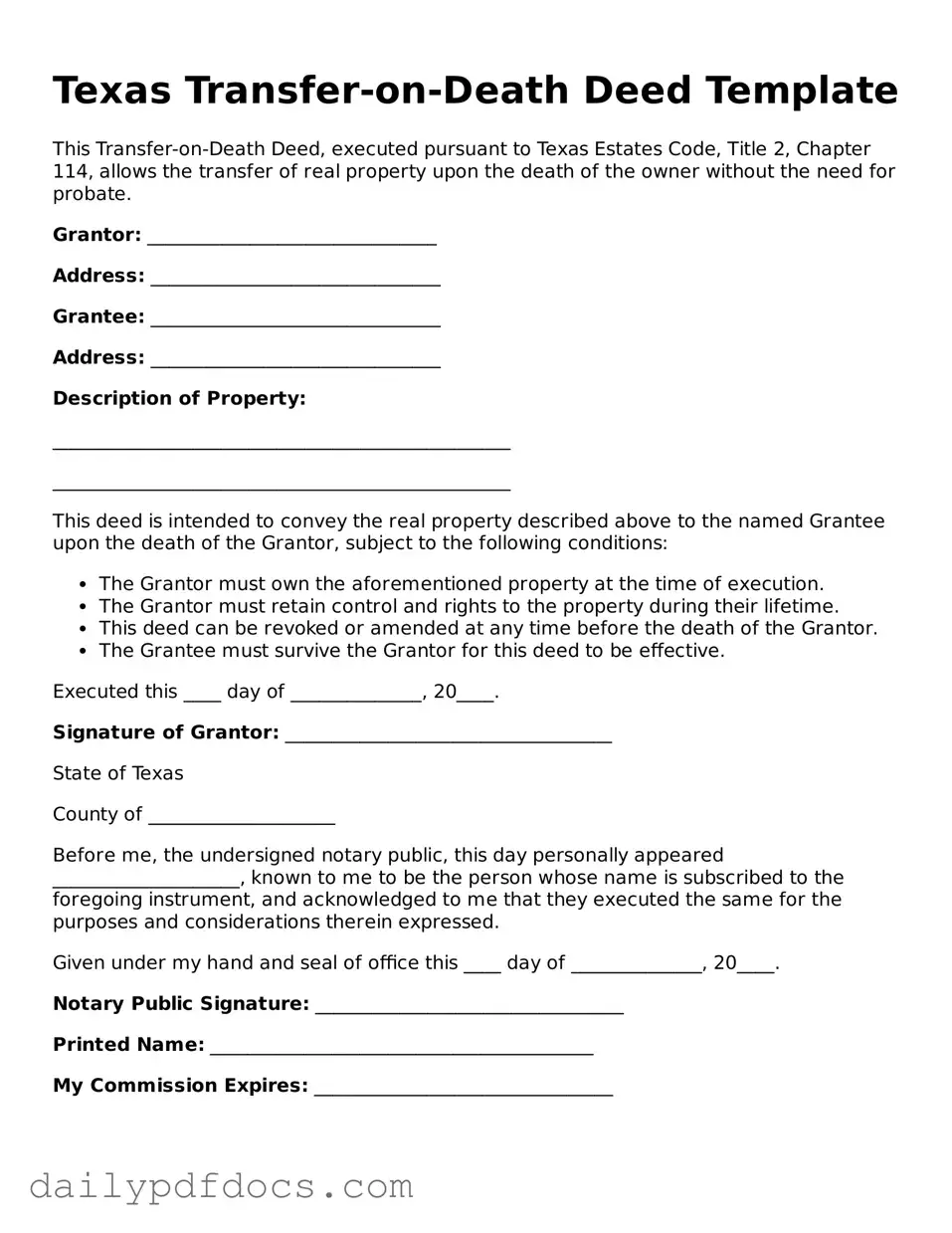

Preview - Texas Transfer-on-Death Deed Form

Texas Transfer-on-Death Deed Template

This Transfer-on-Death Deed, executed pursuant to Texas Estates Code, Title 2, Chapter 114, allows the transfer of real property upon the death of the owner without the need for probate.

Grantor: _______________________________

Address: _______________________________

Grantee: _______________________________

Address: _______________________________

Description of Property:

_________________________________________________

_________________________________________________

This deed is intended to convey the real property described above to the named Grantee upon the death of the Grantor, subject to the following conditions:

- The Grantor must own the aforementioned property at the time of execution.

- The Grantor must retain control and rights to the property during their lifetime.

- This deed can be revoked or amended at any time before the death of the Grantor.

- The Grantee must survive the Grantor for this deed to be effective.

Executed this ____ day of ______________, 20____.

Signature of Grantor: ___________________________________

State of Texas

County of ____________________

Before me, the undersigned notary public, this day personally appeared ____________________, known to me to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that they executed the same for the purposes and considerations therein expressed.

Given under my hand and seal of office this ____ day of ______________, 20____.

Notary Public Signature: _________________________________

Printed Name: _________________________________________

My Commission Expires: ________________________________

Similar forms

- Will: A will specifies how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to designate beneficiaries for their property.

- Living Trust: A living trust holds a person's assets during their lifetime and specifies distribution after death. Similar to a Transfer-on-Death Deed, it avoids probate and allows for direct transfer to beneficiaries.

- Beneficiary Designation Form: This form is used for financial accounts and insurance policies to name beneficiaries. Like the Transfer-on-Death Deed, it facilitates direct transfer of assets upon death.

- Payable-on-Death (POD) Account: A POD account allows the account holder to name a beneficiary who receives the funds upon the account holder's death. This is similar to a Transfer-on-Death Deed in its direct transfer of assets.

- Motor Vehicle Bill of Sale: This document is essential for anyone transferring ownership of a vehicle in Washington. For more details, visit Washington Templates.

- Joint Tenancy with Right of Survivorship: This property ownership method allows co-owners to inherit each other's share upon death. Like a Transfer-on-Death Deed, it provides a way to transfer property without going through probate.

- Life Estate Deed: This deed allows a person to retain rights to property during their lifetime while designating a beneficiary for after their death. It shares similarities with the Transfer-on-Death Deed in its transfer mechanism.

- Transfer-on-Death Registration for Securities: This registration allows individuals to name beneficiaries for stocks and bonds. It operates like a Transfer-on-Death Deed by enabling direct transfer upon death.

- Designation of Agent under a Durable Power of Attorney: This document allows a person to appoint someone to manage their financial affairs. While not directly a transfer document, it can function similarly by facilitating management of assets for beneficiaries.

Misconceptions

The Texas Transfer-on-Death Deed (TODD) is a useful estate planning tool, but several misconceptions exist about its use and implications. Here are four common misunderstandings:

- Misconception 1: A Transfer-on-Death Deed avoids probate entirely.

- Misconception 2: The Transfer-on-Death Deed is the same as a will.

- Misconception 3: You cannot change or revoke a Transfer-on-Death Deed.

- Misconception 4: The Transfer-on-Death Deed can only be used for primary residences.

While a TODD allows property to pass directly to beneficiaries without going through probate, it does not eliminate the need for probate for other assets or debts. Additionally, if the property is subject to liens or other claims, those issues must still be addressed.

A TODD is not a will. It specifically transfers real property upon death, while a will covers all aspects of an estate, including personal property and debts. They serve different purposes in estate planning.

This is incorrect. A TODD can be revoked or modified at any time during the grantor's life, as long as the grantor is competent. The revocation must be executed properly to ensure it is legally recognized.

A TODD can be used for any real property, not just primary residences. This includes rental properties, vacation homes, and land. It is a versatile tool for various types of real estate.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Texas Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Texas Transfer-on-Death Deed is governed by Chapter 114 of the Texas Estates Code. |

| Eligibility | Any individual who owns real property in Texas can execute a Transfer-on-Death Deed. |

| Execution Requirements | The deed must be signed by the property owner and acknowledged by a notary public to be valid. |

| Revocation | Property owners can revoke the deed at any time before their death by executing a new deed or a written revocation. |

| Beneficiary Designation | Multiple beneficiaries can be named, and the property can be divided among them as specified in the deed. |