Printable Real Estate Purchase Agreement Document for Texas

The Texas Real Estate Purchase Agreement form is a crucial document for anyone involved in buying or selling property in Texas. This form outlines the terms and conditions of the sale, ensuring that both parties have a clear understanding of their rights and obligations. Key elements include the purchase price, the description of the property, and the closing date. Additionally, it addresses important contingencies, such as financing and inspections, which protect buyers and sellers alike. The agreement also specifies what happens if either party fails to meet their obligations, providing a framework for resolving disputes. Understanding this form is essential for a smooth transaction, as it helps prevent misunderstandings and ensures that both parties are on the same page throughout the process.

More State-specific Real Estate Purchase Agreement Forms

Purchasing Agreement - Helps establish a mutual understanding of the buyer's and seller's obligations.

Contract of Sale Real Estate - A contract outlining the terms of buying real estate.

Free Purchase Agreement Form - Property taxes and assessments may be addressed to clarify financial responsibilities.

Common Questions

What is the Texas Real Estate Purchase Agreement form?

The Texas Real Estate Purchase Agreement form is a legal document used to outline the terms and conditions of a real estate transaction in Texas. This agreement is essential for both buyers and sellers, as it specifies the purchase price, property details, and other critical elements of the sale. It serves to protect the interests of both parties and provides a clear framework for the transaction.

What are the key components of the agreement?

The agreement typically includes several important sections. These may cover the property description, purchase price, earnest money deposit, closing date, and contingencies. Contingencies might involve inspections, financing, or the sale of another property. Each component is designed to ensure that both parties understand their obligations and rights throughout the transaction.

How does earnest money work in this agreement?

Earnest money is a deposit made by the buyer to demonstrate their commitment to purchasing the property. This amount is typically held in an escrow account until closing. If the transaction proceeds as planned, the earnest money is applied toward the purchase price. However, if the buyer backs out without a valid reason, they may lose this deposit. Clear terms regarding earnest money should be outlined in the agreement.

Can the agreement be modified after it is signed?

Yes, the Texas Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and the seller to ensure clarity and enforceability. This process helps to avoid misunderstandings and provides a record of any agreed-upon changes.

What happens if the buyer or seller defaults on the agreement?

If either party defaults, the consequences depend on the specific terms outlined in the agreement. Generally, the non-defaulting party may have the right to seek remedies, which could include retaining the earnest money or pursuing legal action for damages. The agreement should specify the remedies available to both parties in the event of a default to provide clarity and guidance.

Is it necessary to have a real estate agent when using this agreement?

While it is not legally required to have a real estate agent when using the Texas Real Estate Purchase Agreement, having professional assistance can be beneficial. Real estate agents can provide valuable insights, help navigate the complexities of the transaction, and ensure that all necessary documents are completed accurately. Their expertise can lead to a smoother transaction process for both buyers and sellers.

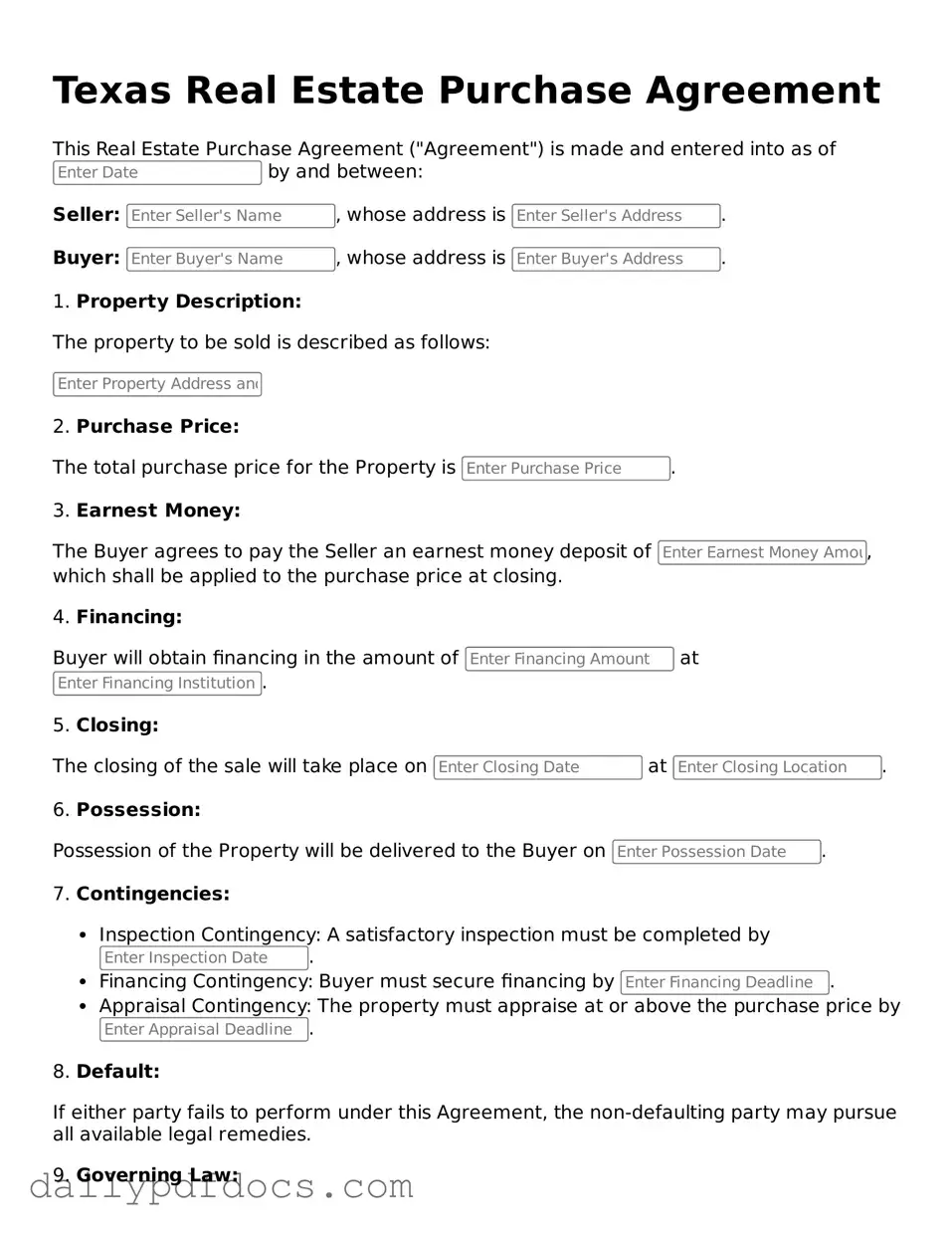

Preview - Texas Real Estate Purchase Agreement Form

Texas Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into as of by and between:

Seller: , whose address is .

Buyer: , whose address is .

1. Property Description:

The property to be sold is described as follows:

2. Purchase Price:

The total purchase price for the Property is .

3. Earnest Money:

The Buyer agrees to pay the Seller an earnest money deposit of , which shall be applied to the purchase price at closing.

4. Financing:

Buyer will obtain financing in the amount of at .

5. Closing:

The closing of the sale will take place on at .

6. Possession:

Possession of the Property will be delivered to the Buyer on .

7. Contingencies:

- Inspection Contingency: A satisfactory inspection must be completed by .

- Financing Contingency: Buyer must secure financing by .

- Appraisal Contingency: The property must appraise at or above the purchase price by .

8. Default:

If either party fails to perform under this Agreement, the non-defaulting party may pursue all available legal remedies.

9. Governing Law:

This Agreement shall be governed by the laws of the State of Texas.

IN WITNESS WHEREOF, the parties have executed this Real Estate Purchase Agreement as of the date first above written.

Seller’s Signature: Date:

Buyer’s Signature: Date:

Similar forms

- Lease Agreement: This document outlines the terms under which a tenant can occupy a property. Like the Real Estate Purchase Agreement, it specifies the rights and responsibilities of both parties, although it typically involves renting rather than buying.

- Option to Purchase Agreement: This agreement gives a tenant the right to buy the property at a later date. Similar to a Real Estate Purchase Agreement, it details the purchase price and terms, but it is contingent upon the tenant exercising their option.

- Employment Verification Form: This is essential for confirming employment status and history within California. For those needing the right documentation, consider utilizing Top Document Templates to streamline the process.

- Sales Contract: A sales contract is used for various types of transactions, not just real estate. It serves a similar purpose by outlining the terms of a sale, including price and conditions, making it akin to a Real Estate Purchase Agreement.

- Joint Venture Agreement: This document is used when two or more parties collaborate on a real estate project. It shares similarities in that it defines roles, contributions, and profit-sharing, much like how a Real Estate Purchase Agreement defines the roles of buyer and seller.

- Escrow Agreement: An escrow agreement involves a neutral third party holding funds until certain conditions are met. This is similar to a Real Estate Purchase Agreement in that both involve conditions that must be fulfilled before the transaction is completed.

- Listing Agreement: This document is between a property owner and a real estate agent. It outlines the agent’s responsibilities and the terms of sale, paralleling the Real Estate Purchase Agreement's focus on the transaction details.

- Title Transfer Document: This document is used to officially transfer ownership of property from one party to another. It is similar to a Real Estate Purchase Agreement as it formalizes the change of ownership and includes essential details about the property and parties involved.

Misconceptions

Many people have misunderstandings about the Texas Real Estate Purchase Agreement form. Here are five common misconceptions:

- It’s a one-size-fits-all document. Some believe that the Texas Real Estate Purchase Agreement is the same for every transaction. In reality, it can be customized to fit the specific needs of the buyer and seller.

- It only protects the seller. Many think that the agreement is designed solely to benefit the seller. However, it includes provisions that protect both parties, ensuring fairness in the transaction.

- Once signed, it cannot be changed. Some assume that the agreement is final once signed. In fact, amendments can be made if both parties agree to the changes.

- It doesn’t cover financing details. There is a belief that financing terms are not included in the agreement. In truth, the document outlines financing options and requirements, making them clear to both parties.

- It’s only for residential properties. Many think the agreement is limited to residential real estate. However, it can also be used for commercial properties and land transactions.

Understanding these misconceptions can help buyers and sellers navigate the real estate process more effectively.

Form Overview

| Fact Name | Details |

|---|---|

| Governing Law | The Texas Real Estate Purchase Agreement is governed by Texas state law. |

| Standard Form | This agreement is a standard form provided by the Texas Real Estate Commission (TREC). |

| Parties Involved | The agreement outlines the buyer and seller, including their legal names and contact information. |

| Property Description | A detailed description of the property being sold is included, such as address and legal description. |

| Purchase Price | The total purchase price of the property must be clearly stated in the agreement. |

| Earnest Money | Earnest money requirements are specified, including the amount and the method of payment. |

| Closing Date | A closing date is typically included, indicating when the transaction will be finalized. |

| Contingencies | The agreement may include contingencies, such as financing or inspection, that must be satisfied. |

| Disclosures | Disclosure requirements are mandated, ensuring that all known issues with the property are communicated. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |