Printable Quitclaim Deed Document for Texas

The Texas Quitclaim Deed is a useful legal document that allows property owners to transfer their interest in real estate to another party without making any guarantees about the title. This form is particularly beneficial in situations where the property owner wants to simplify the transfer process, such as during a divorce, inheritance, or when transferring property to family members. Unlike other types of deeds, a quitclaim deed does not provide a warranty of ownership, meaning the new owner takes on the property "as is." It’s important to understand that while this form can expedite the transfer of property, it does not protect the new owner from any existing liens or claims against the property. Additionally, the Texas Quitclaim Deed must be properly filled out, signed, and notarized to be legally binding. Once completed, it should be filed with the county clerk's office where the property is located to ensure the transfer is recorded and recognized by the state. This process can help avoid future disputes over ownership and clarify the rights of all parties involved.

More State-specific Quitclaim Deed Forms

How Much Does an Attorney Charge for a Quit Claim Deed - The Quitclaim Deed is a preferred option for non-commercial transfers.

When engaging in the sale of a trailer in Washington, it is crucial to utilize the appropriate documentation, which includes the Washington Trailer Bill of Sale. This form not only facilitates the transfer of ownership but also provides a record of the transaction. For those seeking templates to simplify this process, Washington Templates offers helpful resources that can guide you in completing this essential document accurately.

Quitclaim Deed Attorney - This form is widely accepted across the United States.

Common Questions

What is a Texas Quitclaim Deed?

A Texas Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. Unlike other types of deeds, it does not guarantee that the property is free of liens or other claims. Instead, it simply conveys whatever interest the grantor has in the property at the time of transfer.

When should I use a Quitclaim Deed?

This type of deed is commonly used in situations where property is transferred between family members, such as during a divorce or inheritance. It is also used to clear up title issues or to add or remove someone from the title of the property.

How does a Quitclaim Deed differ from a Warranty Deed?

A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. In contrast, a Quitclaim Deed offers no such assurances. The grantor simply relinquishes any claim to the property, which means that the buyer may inherit any existing issues with the title.

Do I need an attorney to complete a Quitclaim Deed in Texas?

While it is not legally required to have an attorney, consulting one can be beneficial. An attorney can help ensure that the deed is filled out correctly and meets all legal requirements, which can prevent future disputes or complications.

What information is required on a Texas Quitclaim Deed?

A Texas Quitclaim Deed typically requires the names of the grantor and grantee, a legal description of the property, and the date of the transfer. It must also be signed by the grantor and notarized to be valid.

Is there a fee associated with filing a Quitclaim Deed?

Yes, there is usually a fee for filing a Quitclaim Deed with the county clerk’s office. The fee can vary depending on the county, so it’s advisable to check with your local office for the exact amount.

How do I file a Quitclaim Deed in Texas?

To file a Quitclaim Deed, you must first complete the form accurately. After signing it in front of a notary, you will take the signed deed to the county clerk’s office in the county where the property is located. There, you will pay the filing fee and submit the document for recording.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and filed, it cannot be revoked unilaterally. However, the grantor and grantee can agree to reverse the transaction through another legal document, such as a new deed. It is essential to follow proper legal procedures to ensure the reversal is valid.

What are the tax implications of using a Quitclaim Deed?

While transferring property via a Quitclaim Deed may not trigger immediate tax consequences, it can affect property taxes and capital gains taxes in the future. It is advisable to consult a tax professional to understand the potential implications specific to your situation.

Is a Quitclaim Deed suitable for all types of property transfers?

While a Quitclaim Deed is useful for many situations, it may not be the best choice for every property transfer. If you are purchasing property or if there are concerns about the title, a Warranty Deed might be more appropriate. Always consider the specific circumstances before deciding on the type of deed to use.

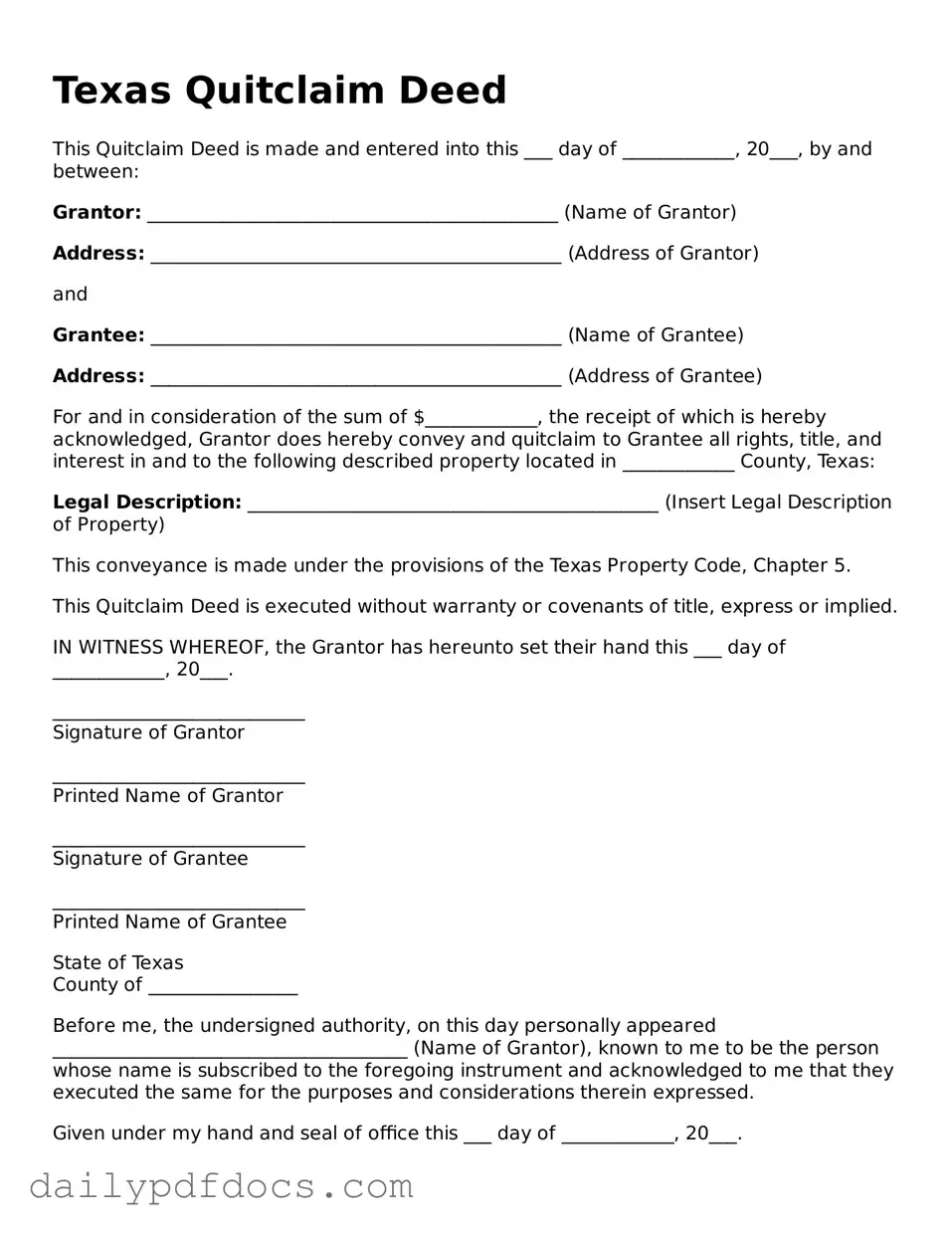

Preview - Texas Quitclaim Deed Form

Texas Quitclaim Deed

This Quitclaim Deed is made and entered into this ___ day of ____________, 20___, by and between:

Grantor: ____________________________________________ (Name of Grantor)

Address: ____________________________________________ (Address of Grantor)

and

Grantee: ____________________________________________ (Name of Grantee)

Address: ____________________________________________ (Address of Grantee)

For and in consideration of the sum of $____________, the receipt of which is hereby acknowledged, Grantor does hereby convey and quitclaim to Grantee all rights, title, and interest in and to the following described property located in ____________ County, Texas:

Legal Description: ____________________________________________ (Insert Legal Description of Property)

This conveyance is made under the provisions of the Texas Property Code, Chapter 5.

This Quitclaim Deed is executed without warranty or covenants of title, express or implied.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand this ___ day of ____________, 20___.

___________________________

Signature of Grantor

___________________________

Printed Name of Grantor

___________________________

Signature of Grantee

___________________________

Printed Name of Grantee

State of Texas

County of ________________

Before me, the undersigned authority, on this day personally appeared ______________________________________ (Name of Grantor), known to me to be the person whose name is subscribed to the foregoing instrument and acknowledged to me that they executed the same for the purposes and considerations therein expressed.

Given under my hand and seal of office this ___ day of ____________, 20___.

___________________________

Notary Public, State of Texas

My Commission Expires: ________________

Similar forms

- Warranty Deed: A warranty deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, it offers protection to the buyer against any future claims on the property.

- Grant Deed: Similar to a warranty deed, a grant deed transfers ownership and includes assurances that the property has not been sold to anyone else. However, it does not provide as extensive protection as a warranty deed.

- Deed of Trust: A deed of trust is used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. While it serves a different purpose, it also involves the transfer of interest in property.

- Special Purpose Deed: A special purpose deed is often used in specific situations, such as transferring property as part of a divorce settlement or a gift. Like a quitclaim deed, it may not guarantee clear title but facilitates the transfer of ownership.

Misconceptions

Understanding the Texas Quitclaim Deed form is essential for anyone involved in property transactions. However, several misconceptions can lead to confusion. Below are nine common misconceptions about the Texas Quitclaim Deed form, along with clarifications.

- A Quitclaim Deed Transfers Ownership Completely. Many believe that a quitclaim deed transfers full ownership of a property. In reality, it only transfers whatever interest the grantor has, if any.

- Quitclaim Deeds Are Only for Family Transfers. While quitclaim deeds are often used among family members, they can be used in various situations, including transfers between unrelated parties.

- A Quitclaim Deed Eliminates All Liens on the Property. This is a misconception. A quitclaim deed does not remove any existing liens or encumbrances on the property. The buyer may still be responsible for these debts.

- Quitclaim Deeds Are Only Used in Texas. Quitclaim deeds are used in many states across the U.S. Each state may have different rules regarding their use, but the concept remains the same.

- You Do Not Need a Lawyer for a Quitclaim Deed. While it is possible to create a quitclaim deed without a lawyer, consulting one is advisable to ensure that the deed is executed correctly and legally binding.

- A Quitclaim Deed Is the Same as a Warranty Deed. This is incorrect. A warranty deed provides guarantees about the title, while a quitclaim deed offers no such assurances.

- Once a Quitclaim Deed Is Signed, It Cannot Be Revoked. A quitclaim deed can be revoked if both parties agree to it, but this process must be documented legally.

- Quitclaim Deeds Are Only for Real Estate. While they are primarily used for real estate transactions, quitclaim deeds can also apply to other types of property, such as vehicles or personal belongings.

- All Quitclaim Deeds Must Be Notarized. In Texas, a quitclaim deed must be signed in front of a notary public to be valid. However, some states may have different requirements.

Awareness of these misconceptions can help individuals make informed decisions regarding property transfers in Texas. Understanding the true nature of a quitclaim deed is crucial for avoiding potential pitfalls.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that allows a property owner to transfer their interest in a property to another party without making any guarantees about the title. |

| Governing Law | The Texas Quitclaim Deed is governed by Texas Property Code, specifically Section 5.022. |

| No Warranties | Unlike warranty deeds, quitclaim deeds do not provide any warranties or guarantees about the property’s title, which means the grantee assumes the risk. |

| Use Cases | Commonly used in situations like transferring property between family members, clearing up title issues, or in divorce settlements. |

| Filing Requirements | To be effective, the quitclaim deed must be signed by the grantor and filed with the county clerk's office in the county where the property is located. |

| Consideration | While a quitclaim deed can be executed without payment, it is often accompanied by nominal consideration, which can be as little as $10. |