Printable Promissory Note Document for Texas

The Texas Promissory Note form serves as a crucial document in financial transactions, outlining the terms under which one party borrows money from another. This legally binding agreement specifies the amount borrowed, the interest rate, and the repayment schedule, ensuring clarity for both the lender and borrower. Additionally, it addresses potential penalties for late payments and the conditions under which the lender can demand full repayment. The form is designed to protect the interests of both parties, providing a clear framework for expectations and responsibilities. Properly executed, the Texas Promissory Note can facilitate smooth transactions and help prevent misunderstandings that may arise during the repayment period.

More State-specific Promissory Note Forms

Promissory Note Template Florida Pdf - This note helps establish trust and clarity in financial dealings between individuals or entities.

Georgia Promissory Note Template - The form may include conditions for default and remedies available to the lender.

In situations where you feel threatened or unlawfully targeted, a Washington Cease and Desist Letter can be a proactive step in protecting your rights; for further assistance, you may find the necessary resources at Washington Templates, which can guide you in addressing your concerns effectively.

Ohio Promissory Note - Promissory notes can facilitate trust in lending transactions.

Common Questions

What is a Texas Promissory Note?

A Texas Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender. This document includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. It serves as a binding agreement between the parties involved, ensuring that both understand their rights and obligations.

Who can use a Texas Promissory Note?

Any individual or business can use a Texas Promissory Note. Whether you are lending money to a friend, family member, or a business entity, this document formalizes the loan agreement. It is crucial for both parties to clearly understand the terms before signing the note.

What are the key components of a Texas Promissory Note?

Key components include the names of the borrower and lender, the principal amount, interest rate, repayment terms, due dates, and any applicable fees or penalties. Additionally, it may include clauses regarding default and remedies. Each section must be clearly stated to avoid misunderstandings.

Is a Texas Promissory Note legally binding?

Yes, a properly executed Texas Promissory Note is legally binding. Once both parties sign the document, it creates enforceable obligations. If the borrower fails to repay the loan as agreed, the lender can take legal action to recover the owed amount.

Do I need a lawyer to create a Texas Promissory Note?

While it is not mandatory to have a lawyer draft a Texas Promissory Note, consulting one can be beneficial. A lawyer can ensure that the document meets all legal requirements and adequately protects your interests. If you choose to draft it yourself, make sure to follow the necessary guidelines and include all essential information.

Can a Texas Promissory Note be modified?

Yes, a Texas Promissory Note can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement. This helps prevent future disputes regarding the terms of the loan.

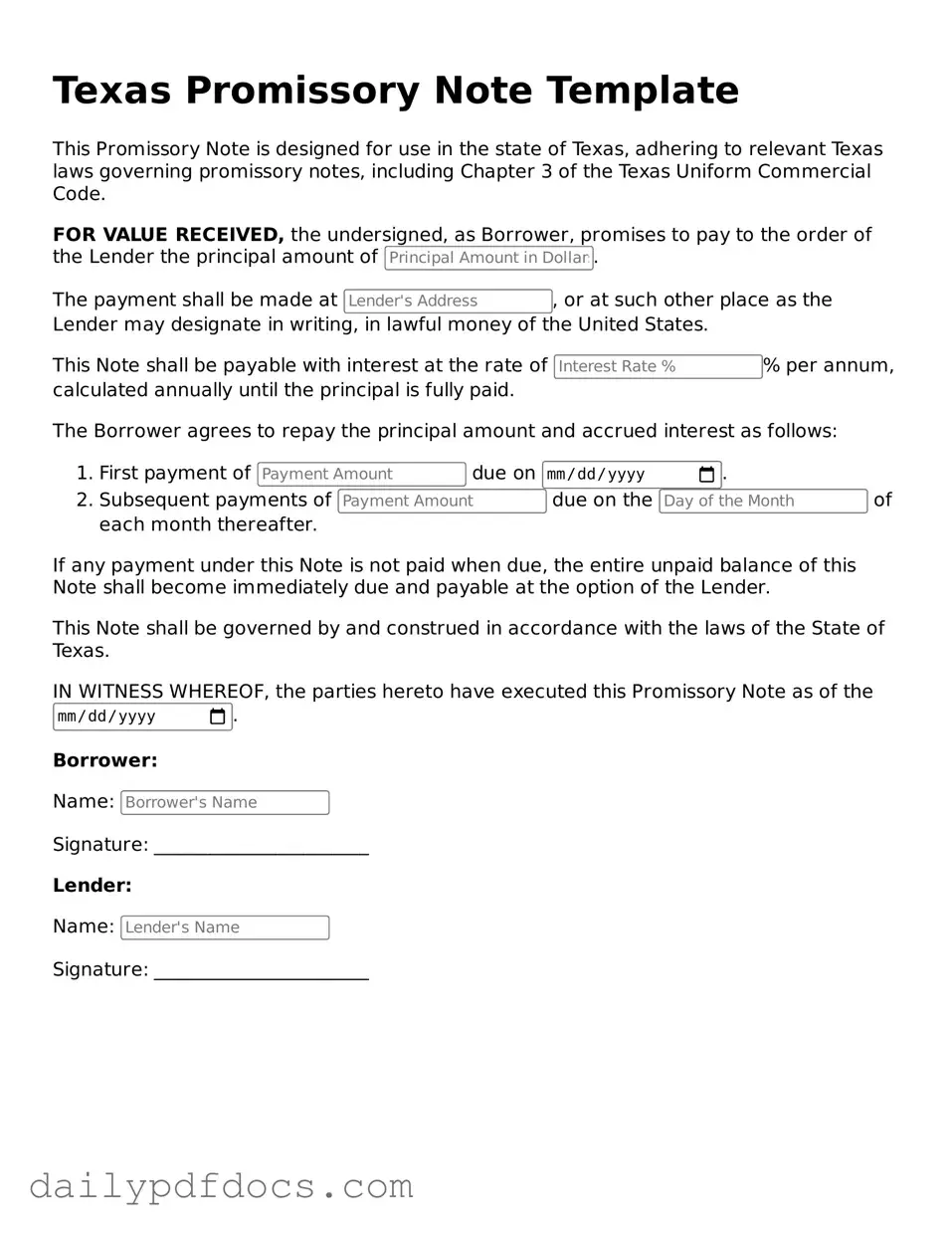

Preview - Texas Promissory Note Form

Texas Promissory Note Template

This Promissory Note is designed for use in the state of Texas, adhering to relevant Texas laws governing promissory notes, including Chapter 3 of the Texas Uniform Commercial Code.

FOR VALUE RECEIVED, the undersigned, as Borrower, promises to pay to the order of the Lender the principal amount of .

The payment shall be made at , or at such other place as the Lender may designate in writing, in lawful money of the United States.

This Note shall be payable with interest at the rate of % per annum, calculated annually until the principal is fully paid.

The Borrower agrees to repay the principal amount and accrued interest as follows:

- First payment of due on .

- Subsequent payments of due on the of each month thereafter.

If any payment under this Note is not paid when due, the entire unpaid balance of this Note shall become immediately due and payable at the option of the Lender.

This Note shall be governed by and construed in accordance with the laws of the State of Texas.

IN WITNESS WHEREOF, the parties hereto have executed this Promissory Note as of the .

Borrower:

Name:

Signature: _______________________

Lender:

Name:

Signature: _______________________

Similar forms

The Promissory Note form is a crucial document in financial transactions, particularly in lending agreements. It shares similarities with several other legal documents. Below are eight documents that resemble the Promissory Note, along with explanations of their similarities:

- Loan Agreement: This document outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule, much like a Promissory Note.

- Marital Separation Agreement: For those navigating the process of separation, the important Marital Separation Agreement form resources can help outline key terms between spouses and simplify the legal aspects involved.

- Mortgage Agreement: A mortgage agreement secures a loan with property as collateral, similar to how a Promissory Note establishes the obligation to repay a loan.

- Credit Agreement: This document details the terms under which credit is extended, paralleling the repayment obligations found in a Promissory Note.

- Installment Agreement: Like a Promissory Note, this agreement specifies the payment terms for a loan, including the schedule and amounts due.

- Security Agreement: This document grants a lender a security interest in collateral, akin to how a Promissory Note may imply a lender's rights to repayment.

- Debt Acknowledgment: This document confirms a borrower’s debt to a lender, similar to how a Promissory Note formally recognizes the obligation to repay.

- Guaranty Agreement: This agreement involves a third party guaranteeing repayment, much like how a Promissory Note may involve multiple parties in the repayment process.

- Forbearance Agreement: This document outlines temporary relief from payments, which can be associated with the terms of a Promissory Note in cases of financial hardship.

Misconceptions

When it comes to the Texas Promissory Note form, many people have misunderstandings that can lead to confusion. Here’s a list of common misconceptions and clarifications to help you navigate this important document.

- Misconception 1: A promissory note is the same as a loan agreement.

- Misconception 2: You don’t need to have a written promissory note.

- Misconception 3: Interest rates on promissory notes are always fixed.

- Misconception 4: A promissory note can only be used for personal loans.

- Misconception 5: Signing a promissory note means you can’t change the terms later.

- Misconception 6: You don’t need to include a repayment schedule.

- Misconception 7: All promissory notes are legally enforceable.

- Misconception 8: A promissory note doesn’t need to be notarized.

- Misconception 9: You can’t transfer a promissory note to someone else.

While both involve borrowing money, a promissory note is a simple promise to pay back a specific amount, whereas a loan agreement includes more detailed terms and conditions.

Though verbal agreements can be legally binding, having a written promissory note provides clear evidence of the terms and helps avoid disputes.

Interest rates can be either fixed or variable, depending on what the parties agree upon in the note.

Promissory notes are versatile and can be used for business loans, real estate transactions, and other financial agreements.

Terms can be modified if both parties agree to the changes and document them appropriately.

A repayment schedule is crucial. It clarifies when payments are due and helps both parties manage their expectations.

For a promissory note to be enforceable, it must meet certain legal requirements, such as clarity in terms and mutual consent.

While notarization isn’t always required, having a note notarized adds an extra layer of credibility and can be beneficial in case of disputes.

Promissory notes can often be transferred or sold to another party, but the terms of the original note will dictate how this can be done.

Understanding these misconceptions can help you make informed decisions when dealing with promissory notes in Texas. Always consider consulting with a legal professional if you have specific questions or concerns.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The Texas Promissory Note is governed by the Texas Business and Commerce Code, particularly Chapter 3, which outlines the laws related to negotiable instruments. |

| Components | Essential components include the principal amount, interest rate, payment schedule, and signatures of the parties involved. |

| Types | There are various types of promissory notes, including secured and unsecured notes, which differ based on whether collateral is involved. |

| Enforceability | For a promissory note to be enforceable, it must meet specific legal requirements, such as being in writing and signed by the borrower. |