Printable Operating Agreement Document for Texas

In the realm of business formation, particularly for limited liability companies (LLCs) in Texas, the Operating Agreement serves as a crucial document that outlines the internal workings and governance of the entity. This agreement is not mandated by law, yet it is highly recommended for all LLCs, as it helps to establish clear expectations among members and provides a framework for decision-making. Key aspects of the Texas Operating Agreement include the distribution of profits and losses, the roles and responsibilities of each member, procedures for admitting new members, and guidelines for resolving disputes. Additionally, it addresses the management structure, whether the company will be member-managed or manager-managed, and outlines the process for amending the agreement in the future. By thoughtfully crafting this document, members can protect their interests and ensure that their business operates smoothly, thereby fostering a collaborative environment that promotes growth and stability.

More State-specific Operating Agreement Forms

How to File Operating Agreement Llc - This essential document defines the roles and responsibilities of members within the LLC.

When preparing for unforeseen circumstances, utilizing a legal tool like a Power of Attorney can be crucial. This form not only allows you to appoint a trusted individual to handle your affairs but also ensures that your preferences are respected. For those in need of guidance, resources such as Washington Templates can provide valuable assistance in drafting this important document.

How to File Operating Agreement Llc - It serves as an important reference in case of legal disputes.

Common Questions

What is a Texas Operating Agreement?

A Texas Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Texas. It serves as a foundational contract among members, detailing their rights, responsibilities, and the rules governing the LLC's operations.

Is an Operating Agreement required in Texas?

While Texas law does not mandate an Operating Agreement for LLCs, having one is highly recommended. It provides clarity and helps prevent disputes among members by clearly defining roles and responsibilities. Without it, the LLC will be governed by state default rules, which may not align with the members' intentions.

Who should draft the Operating Agreement?

The Operating Agreement can be drafted by any member of the LLC, but it is often beneficial to have it prepared with the assistance of a legal professional. This ensures that the document complies with Texas laws and adequately reflects the members' wishes.

What key elements should be included in the Operating Agreement?

Essential elements of a Texas Operating Agreement typically include the LLC's name, purpose, member contributions, distribution of profits and losses, management structure, voting rights, and procedures for adding or removing members. It may also address how disputes will be resolved and what happens if a member wants to exit the LLC.

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. The process for making changes should be outlined in the agreement itself. Typically, amendments require the approval of a certain percentage of members, ensuring that all voices are considered in the decision-making process.

What happens if there is no Operating Agreement?

If an LLC operates without an Operating Agreement, it will be subject to Texas state laws governing LLCs. This can lead to ambiguity in management and profit distribution, potentially resulting in conflicts among members. Having an Operating Agreement helps to avoid such issues by providing clear guidelines.

How does an Operating Agreement affect liability protection?

An Operating Agreement reinforces the limited liability status of an LLC. By clearly defining the business structure and operational procedures, it helps protect members' personal assets from business liabilities. Without it, members may inadvertently expose themselves to greater risks.

Can a single-member LLC have an Operating Agreement?

Yes, a single-member LLC can and should have an Operating Agreement. Even though there is only one member, this document helps establish the business as a separate legal entity and provides a framework for operations, which is important for maintaining liability protection.

How often should the Operating Agreement be reviewed?

It is advisable to review the Operating Agreement periodically, especially after significant changes in the business or membership structure. Regular reviews ensure that the document remains relevant and accurately reflects the current intentions and agreements of the members.

Where should the Operating Agreement be kept?

The Operating Agreement should be kept in a safe and accessible location, such as a secure filing cabinet or a digital storage system. All members should have access to the agreement, as it serves as an important reference for the LLC's operations and governance.

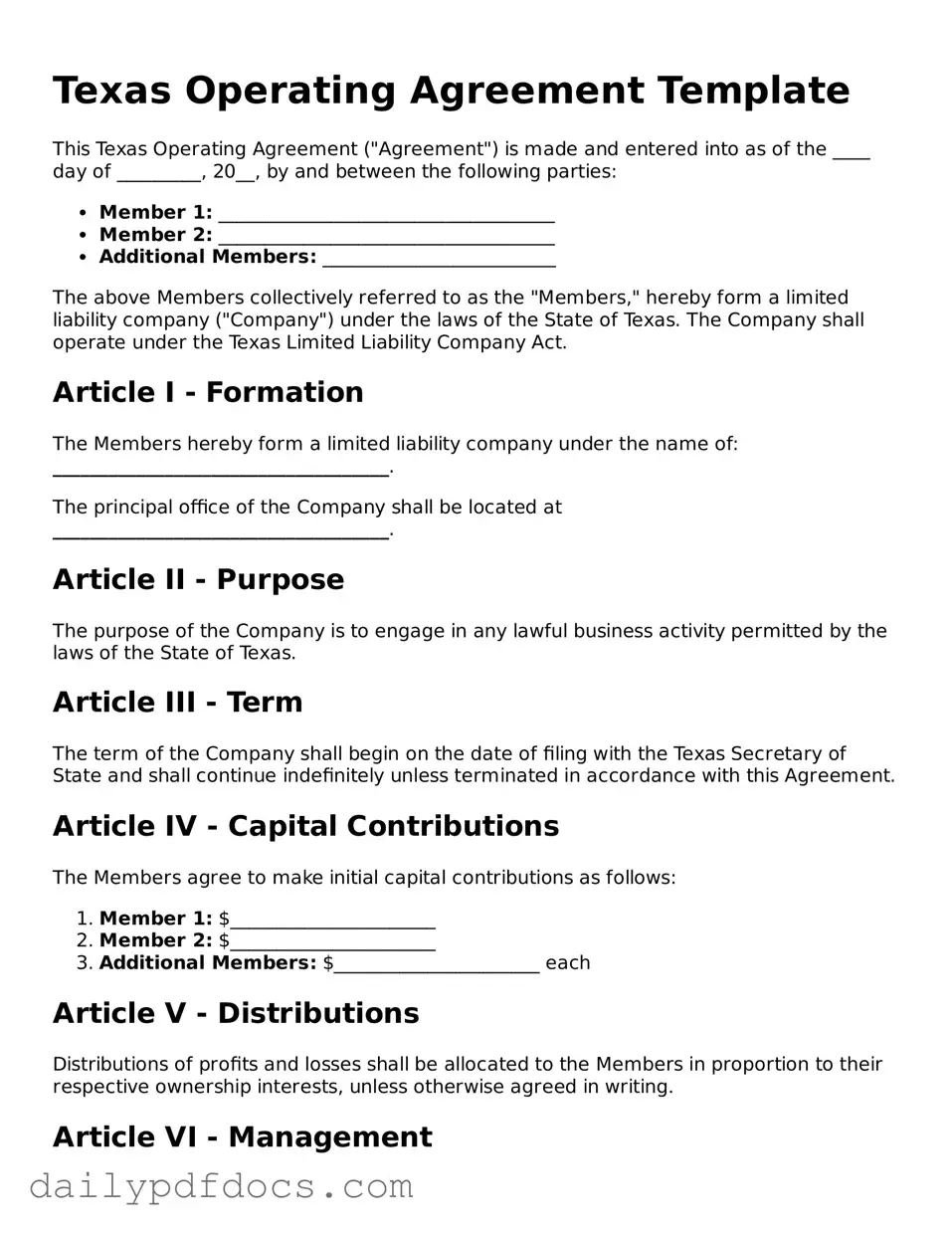

Preview - Texas Operating Agreement Form

Texas Operating Agreement Template

This Texas Operating Agreement ("Agreement") is made and entered into as of the ____ day of _________, 20__, by and between the following parties:

- Member 1: ____________________________________

- Member 2: ____________________________________

- Additional Members: _________________________

The above Members collectively referred to as the "Members," hereby form a limited liability company ("Company") under the laws of the State of Texas. The Company shall operate under the Texas Limited Liability Company Act.

Article I - Formation

The Members hereby form a limited liability company under the name of: ____________________________________.

The principal office of the Company shall be located at ____________________________________.

Article II - Purpose

The purpose of the Company is to engage in any lawful business activity permitted by the laws of the State of Texas.

Article III - Term

The term of the Company shall begin on the date of filing with the Texas Secretary of State and shall continue indefinitely unless terminated in accordance with this Agreement.

Article IV - Capital Contributions

The Members agree to make initial capital contributions as follows:

- Member 1: $______________________

- Member 2: $______________________

- Additional Members: $______________________ each

Article V - Distributions

Distributions of profits and losses shall be allocated to the Members in proportion to their respective ownership interests, unless otherwise agreed in writing.

Article VI - Management

The Company shall be managed by:

- Members: Management shall be vested in the Members.

- Manager: The Members may appoint a manager to operate the Company.

The rights and duties of the Members and any appointed Manager shall be outlined in future resolutions of the Members.

Article VII - Meetings

Meetings of Members shall be held at least annually. Notice of meetings must be provided at least ____ days in advance.

Article VIII - Amendment

This Agreement may be amended only by a written agreement executed by all Members.

Article IX - Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Texas.

Article X - Miscellaneous

If any provision of this Agreement is deemed invalid or unenforceable, the remaining provisions shall remain in full force and effect.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

___________________________ ___________________________

Member 1 Member 2

___________________________ ___________________________

Additional Member Additional Member

Similar forms

- Partnership Agreement: This document outlines the terms and conditions between partners in a business. Similar to an Operating Agreement, it defines roles, responsibilities, and profit-sharing among partners.

- Bylaws: Bylaws govern the internal management of a corporation. Like an Operating Agreement, they detail the rights and duties of members or shareholders, ensuring smooth operations.

- Shareholder Agreement: This agreement is between shareholders of a corporation. It addresses ownership rights and responsibilities, much like an Operating Agreement does for LLC members.

- Joint Venture Agreement: When two or more parties collaborate on a specific project, this document outlines their contributions and profit-sharing. It shares similarities with an Operating Agreement in defining the scope and governance of the venture.

- Limited Partnership Agreement: This document establishes the relationship between general and limited partners in a limited partnership. It mirrors the Operating Agreement in clarifying roles and responsibilities within the partnership.

- Membership Agreement: This is often used in cooperatives or associations to define the rights and obligations of members. It serves a similar purpose as an Operating Agreement by setting expectations and guidelines for member participation.

- Franchise Agreement: This document governs the relationship between a franchisor and franchisee. Like an Operating Agreement, it specifies operational procedures, fees, and responsibilities, ensuring both parties are aligned.

Misconceptions

Understanding the Texas Operating Agreement form is crucial for business owners, but several misconceptions can lead to confusion. Here are nine common misconceptions:

- It is only necessary for large businesses. Many believe that only large companies need an operating agreement. In reality, even small businesses benefit from having one, as it outlines management structure and ownership.

- It is a legally required document. While an operating agreement is not mandatory in Texas, having one is highly recommended. It helps prevent disputes and clarifies the roles of members.

- It cannot be changed once created. Some think that an operating agreement is set in stone. However, it can be amended as needed, provided all members agree to the changes.

- It only covers financial matters. Many assume the operating agreement focuses solely on finances. In fact, it addresses management roles, decision-making processes, and member responsibilities as well.

- All members must sign the agreement. While it is best practice for all members to sign, it is not a strict requirement. The agreement is still valid if signed by a majority.

- It is the same as a partnership agreement. An operating agreement is not the same as a partnership agreement. The former is specific to LLCs, while the latter pertains to partnerships.

- It can be verbal. Some may think that a verbal agreement suffices. However, a written document is essential for clarity and legal protection.

- Once filed, it is public information. Unlike some business documents, operating agreements are not filed with the state and remain private unless shared voluntarily.

- It only needs to be created once. Many people believe that creating the agreement is a one-time task. In reality, it should be reviewed and updated regularly to reflect any changes in the business.

These misconceptions can lead to misunderstandings about the importance and functionality of the Texas Operating Agreement. Understanding the facts can help business owners make informed decisions.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Texas Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC) in Texas. |

| Governing Law | This agreement is governed by the Texas Business Organizations Code, specifically Title 3, Chapter 101. |

| Members | All members of the LLC are typically included in the agreement, detailing their rights and responsibilities. |

| Flexibility | Texas law allows for significant flexibility in how the operating agreement can be structured, accommodating various business needs. |

| Amendments | The agreement can be amended as needed, provided that all members agree to the changes, ensuring adaptability over time. |

| Dispute Resolution | It often includes provisions for resolving disputes among members, which can help avoid costly litigation. |

| Importance | Having a well-drafted operating agreement is crucial for protecting members' interests and clarifying the LLC's operational framework. |