Printable Loan Agreement Document for Texas

The Texas Loan Agreement form serves as a critical document for individuals and businesses engaging in lending transactions within the state. This form outlines the terms and conditions under which a borrower receives funds from a lender, ensuring clarity and legal protection for both parties involved. Key aspects of the agreement include the loan amount, interest rate, repayment schedule, and any collateral required to secure the loan. Additionally, the form typically specifies the consequences of default, including late fees and potential legal actions. It may also address other important factors such as prepayment options and governing law, which dictates how disputes will be resolved. By clearly laying out these terms, the Texas Loan Agreement form helps foster trust and accountability, making it an essential tool in the realm of personal and commercial finance.

More State-specific Loan Agreement Forms

California Promissory Note Template - States the purpose of the loan and any restrictions on its use.

The Ohio Lease Agreement form is essential for anyone entering into a rental arrangement, as it clearly establishes the responsibilities and rights of both landlords and tenants in the state. This legally binding document details crucial aspects such as the rent amount, lease duration, and other pertinent terms, thereby avoiding misunderstandings. For more comprehensive information about lease agreements, you can visit https://legalformspdf.com/.

Promissory Note Template New York - The document may require the borrower to provide personal financial information.

Promissory Note Georgia - This document outlines the terms and conditions under which funds will be borrowed and repaid.

Common Questions

What is a Texas Loan Agreement form?

A Texas Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Texas. This agreement specifies the amount of money being borrowed, the interest rate, repayment schedule, and any collateral involved. It serves to protect both parties by clearly defining their rights and obligations under the loan arrangement.

Who should use a Texas Loan Agreement form?

Anyone involved in a lending transaction in Texas can benefit from using a Loan Agreement form. This includes individuals, businesses, and financial institutions. Whether you are lending money to a friend, family member, or conducting a formal business transaction, having a written agreement helps prevent misunderstandings and provides a reference point if disputes arise.

What are the key components of a Texas Loan Agreement?

A comprehensive Texas Loan Agreement should include several essential components. First, it should identify the parties involved, specifying the lender and borrower. Next, it should detail the loan amount and interest rate, along with the repayment terms, including due dates and payment methods. Additionally, any collateral securing the loan should be described, and provisions for default or late payments should be included to protect the lender's interests.

Is a Texas Loan Agreement form legally binding?

Yes, a Texas Loan Agreement form is legally binding as long as it meets the necessary requirements of a contract. This includes having mutual consent from both parties, a lawful purpose, and consideration (something of value exchanged). It is advisable for both parties to review the agreement carefully and consider seeking legal advice to ensure that their rights are adequately protected before signing.

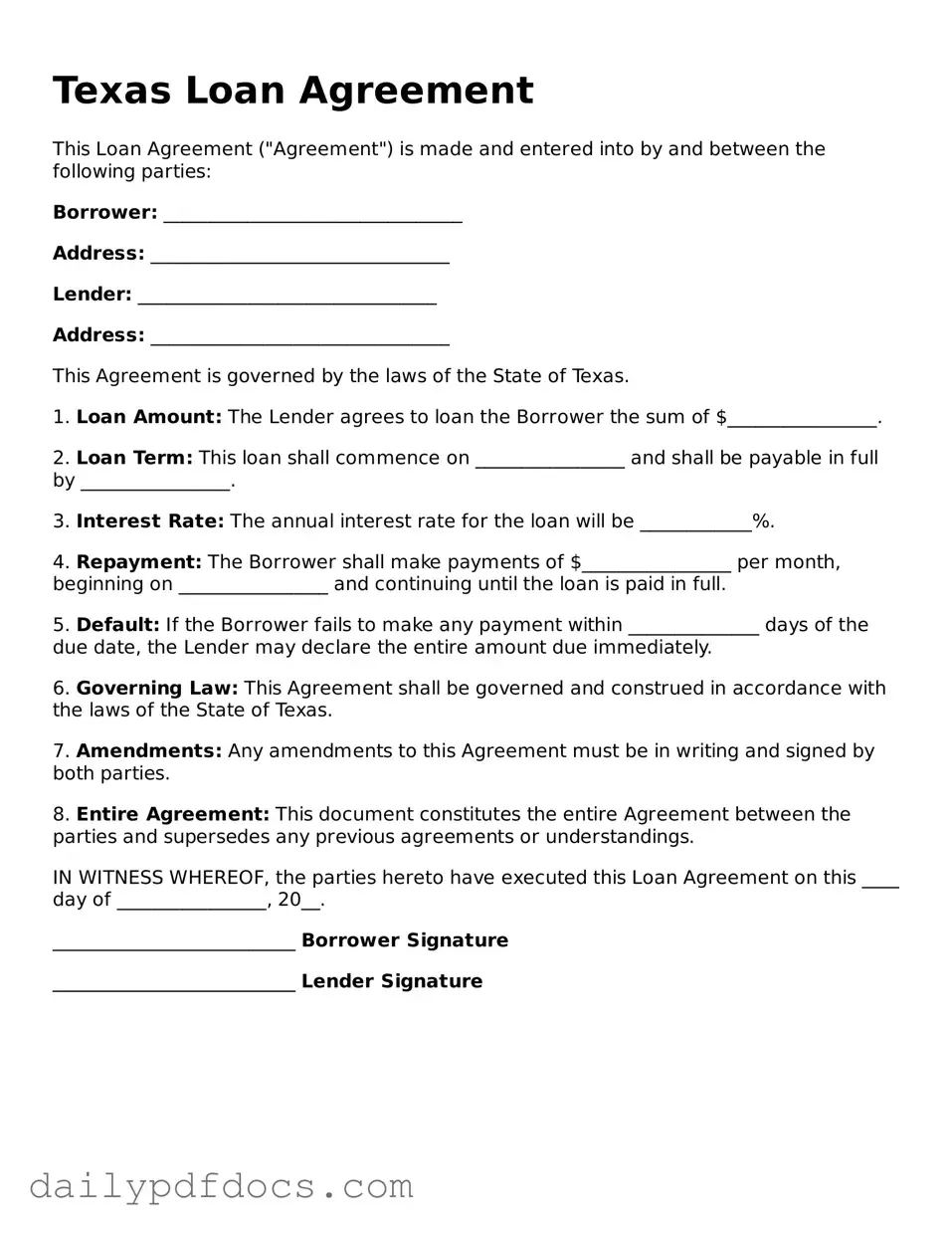

Preview - Texas Loan Agreement Form

Texas Loan Agreement

This Loan Agreement ("Agreement") is made and entered into by and between the following parties:

Borrower: ________________________________

Address: ________________________________

Lender: ________________________________

Address: ________________________________

This Agreement is governed by the laws of the State of Texas.

1. Loan Amount: The Lender agrees to loan the Borrower the sum of $________________.

2. Loan Term: This loan shall commence on ________________ and shall be payable in full by ________________.

3. Interest Rate: The annual interest rate for the loan will be ____________%.

4. Repayment: The Borrower shall make payments of $________________ per month, beginning on ________________ and continuing until the loan is paid in full.

5. Default: If the Borrower fails to make any payment within ______________ days of the due date, the Lender may declare the entire amount due immediately.

6. Governing Law: This Agreement shall be governed and construed in accordance with the laws of the State of Texas.

7. Amendments: Any amendments to this Agreement must be in writing and signed by both parties.

8. Entire Agreement: This document constitutes the entire Agreement between the parties and supersedes any previous agreements or understandings.

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement on this ____ day of ________________, 20__.

__________________________ Borrower Signature

__________________________ Lender Signature

Similar forms

- Promissory Note: A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a defined time. Like a loan agreement, it outlines the terms of repayment, including interest rates and payment schedules. However, it is typically simpler and focuses primarily on the borrower's promise to repay.

- Mortgage Agreement: A mortgage agreement is a specific type of loan agreement used when purchasing real estate. It details the loan amount, interest rate, and repayment terms, while also establishing the property as collateral. This document shares similarities with a loan agreement in its structure and purpose but includes additional provisions related to the property.

- Credit Agreement: A credit agreement governs the terms under which a borrower can access a line of credit. It outlines the credit limit, interest rates, and repayment terms. Both documents serve to formalize the borrowing process, but a credit agreement often allows for repeated borrowing up to a specified limit, unlike a standard loan agreement.

- Mobile Home Bill of Sale: This legal document is essential for transferring ownership of a mobile home and includes vital transaction details for both parties involved. For more information, visit mobilehomebillofsale.com/blank-missouri-mobile-home-bill-of-sale.

- Security Agreement: A security agreement provides a lender with a claim on specific assets if the borrower defaults on the loan. It details the collateral involved and the rights of the lender. While a loan agreement may reference collateral, a security agreement focuses solely on the secured assets and the lender's rights concerning them.

- Installment Sale Agreement: An installment sale agreement allows a buyer to purchase property over time through scheduled payments. Similar to a loan agreement, it outlines payment terms and conditions. However, in this case, the seller retains ownership of the property until all payments are made, which distinguishes it from a traditional loan arrangement.

- Lease Agreement: A lease agreement permits one party to use another's property for a specified period in exchange for payment. While primarily focused on rental arrangements, it shares the structure of outlining terms, conditions, and payment schedules. Both documents establish a financial obligation, although a lease agreement typically involves the temporary use of property rather than a loan.

Misconceptions

Understanding the Texas Loan Agreement form is crucial for anyone involved in lending or borrowing. However, several misconceptions can lead to confusion. Here are eight common misconceptions about the Texas Loan Agreement form:

- It is a one-size-fits-all document. Many believe the Texas Loan Agreement is standard for all loans. In reality, it can be customized to fit the specific terms of the loan, including interest rates and repayment schedules.

- Only banks can use this form. Some think that only financial institutions can utilize the Texas Loan Agreement. In fact, individuals and private lenders can also use this form for personal loans.

- It does not require legal review. A common belief is that the Texas Loan Agreement is straightforward enough to forgo legal scrutiny. However, having a legal professional review the document is advisable to ensure compliance with state laws.

- It is only for large loans. Many assume that the form is only applicable for significant amounts. In truth, it can be used for both small and large loans, making it versatile for various financial needs.

- All terms must be filled out. Some people think that every section of the form must be completed. While it is important to fill in essential terms, certain sections may be left blank if they do not apply to the specific loan.

- It is a binding agreement without signatures. There is a misconception that the Texas Loan Agreement is automatically binding once completed. However, it requires signatures from both parties to become enforceable.

- Verbal agreements are sufficient. Many believe that a verbal agreement can replace the written Texas Loan Agreement. This is misleading; having a written document protects both parties and clarifies the terms.

- It cannot be amended once signed. Some think that once the Texas Loan Agreement is signed, it cannot be changed. In fact, amendments can be made if both parties agree and document the changes properly.

Addressing these misconceptions can lead to a better understanding of the Texas Loan Agreement form and foster more effective lending practices.

Form Overview

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Loan Agreement is governed by the Texas Business and Commerce Code. |

| Purpose | This form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Loan Amount | The agreement specifies the total amount of money being borrowed. |

| Interest Rate | The form includes the interest rate applicable to the loan, which can be fixed or variable. |

| Repayment Terms | It details the repayment schedule, including due dates and amounts. |

| Default Conditions | The agreement outlines what constitutes a default and the consequences of defaulting on the loan. |

| Security Interest | In some cases, the loan may be secured by collateral, which is described in the agreement. |

| Governing Jurisdiction | Disputes arising from the agreement are typically resolved in Texas courts. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

| Amendments | The form allows for amendments, which must be documented in writing and signed by both parties. |