Printable Lady Bird Deed Document for Texas

The Texas Lady Bird Deed, a unique estate planning tool, allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. This form provides a way to avoid probate, ensuring a smoother transition of property upon the owner’s passing. One of the key features of the Lady Bird Deed is the ability for the property owner to retain the right to live in and use the property, as well as the ability to sell or mortgage it without needing consent from the beneficiaries. This flexibility offers peace of mind, as the owner can maintain control over their property while also facilitating an efficient transfer of ownership. Additionally, the Lady Bird Deed can help protect the property from Medicaid estate recovery, making it a valuable option for those concerned about long-term care costs. Understanding the intricacies of this form is essential for individuals looking to safeguard their assets and ensure their wishes are honored after their death.

More State-specific Lady Bird Deed Forms

Lady Bird Deed States - This deed can help facilitate generational wealth transfer by keeping property in the family.

When engaging in the transfer of mobile home ownership, it is crucial to utilize the proper documentation to prevent misunderstandings. The Indiana Mobile Home Bill of Sale form serves as the primary legal instrument for this purpose. It not only confirms the sale but also includes critical information about the transaction. For further guidance on preparing this form, you can visit mobilehomebillofsale.com/blank-indiana-mobile-home-bill-of-sale.

Common Questions

What is a Texas Lady Bird Deed?

A Texas Lady Bird Deed is a unique type of property deed that allows a property owner to transfer their real estate to a beneficiary while retaining the right to use and control the property during their lifetime. This form of deed is particularly beneficial because it helps avoid probate, which can be a lengthy and costly process after a person's death.

Who can benefit from using a Lady Bird Deed?

Individuals who wish to pass on their property to family members or loved ones without the complications of probate may find the Lady Bird Deed advantageous. It is especially useful for elderly homeowners who want to ensure their property is transferred smoothly while maintaining control over it during their lifetime.

How does a Lady Bird Deed differ from a traditional deed?

Unlike a traditional deed, which transfers ownership immediately, a Lady Bird Deed allows the current owner to retain a life estate. This means the owner can live in, use, and manage the property as they wish until their passing. Upon their death, the property automatically transfers to the designated beneficiary without going through probate.

Are there any tax implications associated with a Lady Bird Deed?

Generally, a Lady Bird Deed does not trigger a gift tax at the time of transfer because the owner retains control over the property. However, it is essential to consider potential capital gains taxes when the beneficiary eventually sells the property. Consulting with a tax professional can provide clarity on any specific tax implications based on individual circumstances.

What are the steps to create a Lady Bird Deed?

Creating a Lady Bird Deed involves several steps. First, the property owner must draft the deed, clearly stating the intention to transfer the property upon death. This deed must then be signed and notarized. Finally, it must be filed with the county clerk's office where the property is located to ensure it is legally recognized. Seeking assistance from a legal professional can help streamline this process.

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or modified at any time while the property owner is alive. This flexibility allows the owner to adjust their estate plan as circumstances change, such as the addition of new beneficiaries or changes in personal relationships. It is advisable to document any changes formally to avoid confusion later on.

Is a Lady Bird Deed valid in all states?

No, the Lady Bird Deed is specific to Texas and may not be recognized in other states. Each state has its own laws regarding property transfer and estate planning. If you reside outside of Texas, it is important to explore the options available in your state and consult with a legal expert familiar with local laws.

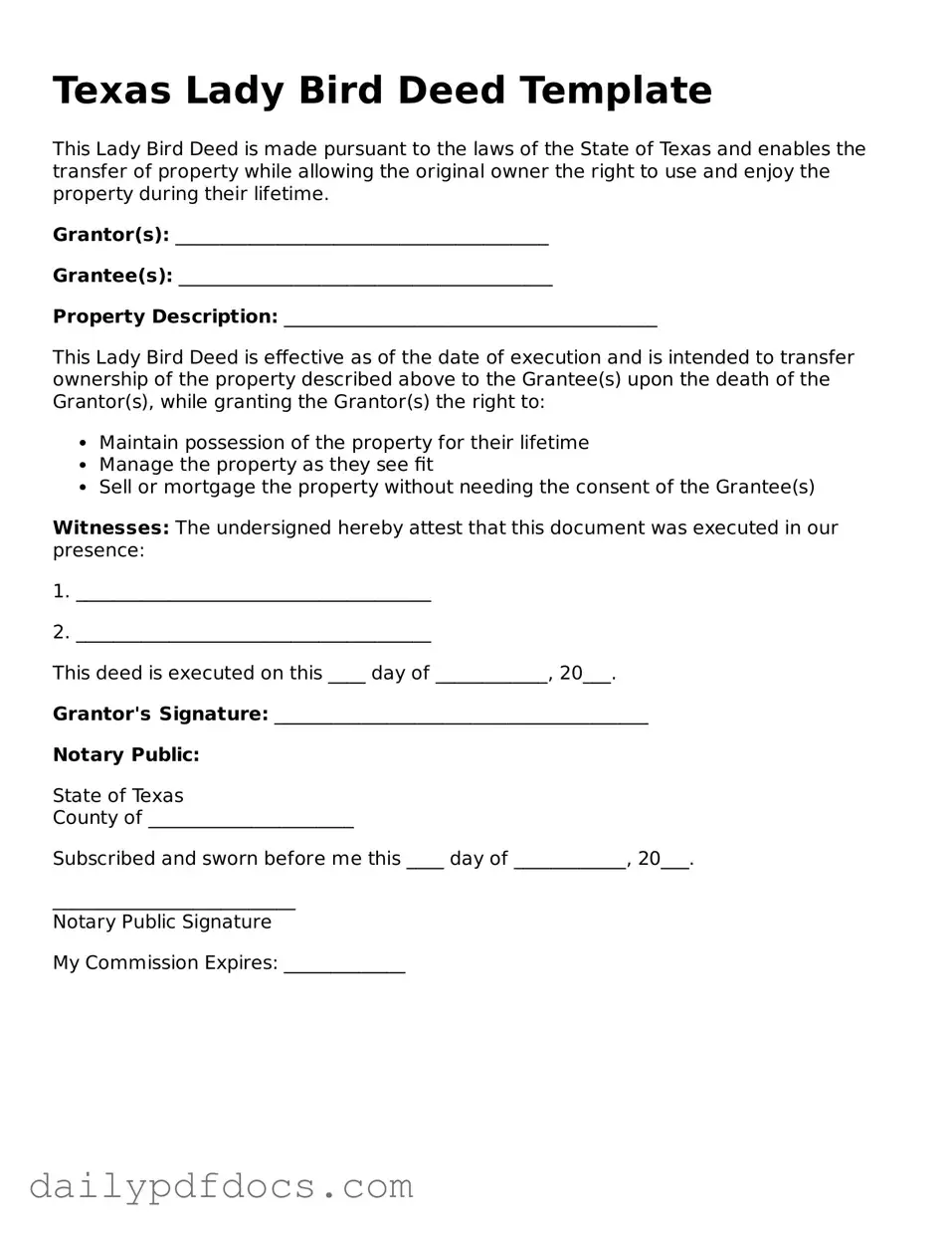

Preview - Texas Lady Bird Deed Form

Texas Lady Bird Deed Template

This Lady Bird Deed is made pursuant to the laws of the State of Texas and enables the transfer of property while allowing the original owner the right to use and enjoy the property during their lifetime.

Grantor(s): ________________________________________

Grantee(s): ________________________________________

Property Description: ________________________________________

This Lady Bird Deed is effective as of the date of execution and is intended to transfer ownership of the property described above to the Grantee(s) upon the death of the Grantor(s), while granting the Grantor(s) the right to:

- Maintain possession of the property for their lifetime

- Manage the property as they see fit

- Sell or mortgage the property without needing the consent of the Grantee(s)

Witnesses: The undersigned hereby attest that this document was executed in our presence:

1. ______________________________________

2. ______________________________________

This deed is executed on this ____ day of ____________, 20___.

Grantor's Signature: ________________________________________

Notary Public:

State of Texas

County of ______________________

Subscribed and sworn before me this ____ day of ____________, 20___.

__________________________

Notary Public Signature

My Commission Expires: _____________

Similar forms

- Transfer on Death Deed (TOD Deed): Similar to a Lady Bird Deed, a Transfer on Death Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death, bypassing probate.

- Life Estate Deed: This document creates a life estate, allowing the owner to retain rights to the property during their lifetime while transferring future ownership to another party. Both deeds facilitate the transfer of property outside of probate.

- Trailer Bill of Sale: The Ohio PDF Forms provide essential resources for completing this legal document, which records the sale and transfer of ownership of a trailer in Ohio, helping to avoid disputes and ensure registration clarity.

- Joint Tenancy Deed: A joint tenancy deed allows two or more individuals to hold property together with rights of survivorship. Upon the death of one owner, their share automatically passes to the surviving owners, similar to the beneficiary aspect of a Lady Bird Deed.

- Revocable Living Trust: A revocable living trust allows individuals to manage their assets during their lifetime and specify how those assets will be distributed after death. This provides a way to avoid probate, akin to the Lady Bird Deed.

- Will: A will outlines how a person's assets should be distributed upon their death. While it does not avoid probate, it serves a similar purpose of directing property transfer, much like a Lady Bird Deed.

- Quitclaim Deed: A quitclaim deed transfers any interest the grantor has in the property without guaranteeing that interest is valid. While it does not provide the same protections as a Lady Bird Deed, it can facilitate property transfers.

- Special Warranty Deed: This deed offers limited warranties on the title, ensuring that the grantor is only responsible for claims during their ownership. It provides a level of assurance in property transfer, similar to the assurances found in a Lady Bird Deed.

- General Warranty Deed: A general warranty deed provides the highest level of protection to the buyer, guaranteeing that the title is clear of any claims. This contrasts with the Lady Bird Deed but shares the goal of ensuring a smooth transfer of property.

- Power of Attorney (POA): A power of attorney allows one person to act on behalf of another in legal matters, including property transactions. While not a deed, it can be used to facilitate property transfers similar to the effects of a Lady Bird Deed.

- Community Property Agreement: In community property states, this agreement allows spouses to manage property jointly. It can simplify the transfer of property upon death, paralleling the intent behind a Lady Bird Deed.

Misconceptions

The Texas Lady Bird Deed, also known as an enhanced life estate deed, is a powerful estate planning tool. However, many misconceptions surround it. Here are ten common misunderstandings about this deed:

- It avoids probate completely. While a Lady Bird Deed can help transfer property outside of probate, it does not eliminate probate for all assets.

- Only married couples can use it. Any individual can use a Lady Bird Deed, regardless of marital status.

- It protects against creditors. The property is still subject to creditors' claims during the owner's lifetime, which means it does not provide full protection from debts.

- It is only for real estate. The Lady Bird Deed applies specifically to real property and does not cover personal property or financial accounts.

- Once executed, it cannot be changed. The grantor retains the right to revoke or modify the deed at any time during their lifetime.

- It automatically transfers property upon death. The property transfers only upon the death of the grantor, and only if the designated beneficiaries are alive at that time.

- It is the same as a traditional life estate deed. Unlike a traditional life estate, a Lady Bird Deed allows the grantor to sell or mortgage the property without the consent of the beneficiaries.

- All states recognize Lady Bird Deeds. This type of deed is specific to Texas law and may not be recognized or available in other states.

- It requires a lawyer to create. While it is advisable to consult a lawyer, individuals can create a Lady Bird Deed themselves using proper forms.

- It guarantees tax benefits. The deed does not guarantee any tax benefits, and property taxes may still apply to the beneficiaries after the transfer.

Understanding these misconceptions is essential for anyone considering a Lady Bird Deed as part of their estate planning. Clarity on this topic can help individuals make informed decisions about their property and legacy.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed is a type of transfer deed that allows property owners in Texas to transfer their property to beneficiaries while retaining the right to use the property during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Texas Property Code, specifically Section 5.041. |

| Retained Rights | With a Lady Bird Deed, the property owner retains the right to sell, mortgage, or change the beneficiaries without their consent. |

| Transfer on Death | The property automatically transfers to the designated beneficiaries upon the death of the owner, avoiding the probate process. |

| Tax Implications | There are potential tax benefits, as the property may receive a step-up in basis upon the owner's death, which can minimize capital gains tax for beneficiaries. |

| Revocability | A Lady Bird Deed can be revoked at any time by the property owner, allowing for flexibility in estate planning. |

| Eligibility | Only real property, such as land and homes, can be transferred using a Lady Bird Deed in Texas. |

| Execution Requirements | The deed must be signed by the property owner and must be recorded in the county where the property is located to be effective. |