Printable Golf Cart Bill of Sale Document for Texas

When buying or selling a golf cart in Texas, having a Golf Cart Bill of Sale form is essential. This document serves as a legal record of the transaction, protecting both the buyer and the seller. It includes important details such as the names and addresses of both parties, a description of the golf cart, and the purchase price. Additionally, the form may outline any warranties or conditions related to the sale. Having a clear and complete bill of sale can prevent disputes and ensure that both parties understand their rights and responsibilities. This form is not just a piece of paper; it is a safeguard for your investment and a key part of the buying process. Understanding its components can help you navigate the transaction smoothly and with confidence.

More State-specific Golf Cart Bill of Sale Forms

Golf Cart Bill of Sale Texas - Acts as a formal acknowledgment of the sale's completion.

A Lease Agreement form is essential for establishing a clear understanding between a landlord and tenant. By detailing the rights and responsibilities of both parties, this contract helps to prevent misunderstandings regarding the rental terms. For those interested in learning more about rental agreements and accessing templates, you can visit https://legalformspdf.com/ for additional resources.

Do Golf Carts Have Titles in Texas - In case of disputes, a Golf Cart Bill of Sale serves as a legal reference point for both parties.

Common Questions

What is a Texas Golf Cart Bill of Sale?

A Texas Golf Cart Bill of Sale is a legal document that records the sale and transfer of ownership of a golf cart in Texas. This form provides essential details about the transaction, including the names of the buyer and seller, the description of the golf cart, and the sale price. It serves as proof of ownership and can be useful for future reference or registration purposes.

Do I need a Bill of Sale for a golf cart in Texas?

While a Bill of Sale is not legally required for all golf cart transactions in Texas, it is highly recommended. Having this document can protect both the buyer and seller by providing a clear record of the sale. It can also simplify the process of registering the golf cart with the state or local authorities.

What information should be included in the Bill of Sale?

A comprehensive Texas Golf Cart Bill of Sale should include several key pieces of information. This includes the full names and addresses of both the buyer and seller, the golf cart's make, model, year, and Vehicle Identification Number (VIN), if applicable. Additionally, the sale price and date of the transaction should be clearly stated. Both parties should sign the document to validate the sale.

Can I create my own Golf Cart Bill of Sale?

Yes, you can create your own Golf Cart Bill of Sale as long as it contains all the necessary information. Many templates are available online that can help guide you in drafting a document that meets your needs. Just ensure that it includes all pertinent details and is signed by both parties to make it valid.

Is the Bill of Sale enough for registering the golf cart?

The Bill of Sale is an important document for registering your golf cart, but it may not be the only requirement. Check with your local Department of Motor Vehicles (DMV) or relevant authority to understand what additional documentation may be necessary. This could include proof of insurance or an application for registration.

What if the golf cart has a lien?

If the golf cart has a lien, it’s crucial to address this before completing the sale. A lien indicates that a third party has a legal claim to the golf cart, often due to unpaid loans. The seller should ensure that the lien is satisfied and that the lienholder provides a release before the sale. This will help avoid complications for the buyer in the future.

How should I handle payment when selling a golf cart?

When selling a golf cart, it’s important to choose a secure payment method. Cash is often the simplest option, but if you prefer to accept a check, ensure that it is certified or cashable before handing over the golf cart. Once payment is received, both parties should complete the Bill of Sale to finalize the transaction.

What should I do if there are issues after the sale?

If issues arise after the sale, such as disputes over the condition of the golf cart or payment problems, refer back to the Bill of Sale. This document can serve as evidence of the terms agreed upon during the transaction. If necessary, consider seeking legal advice to resolve any disputes effectively.

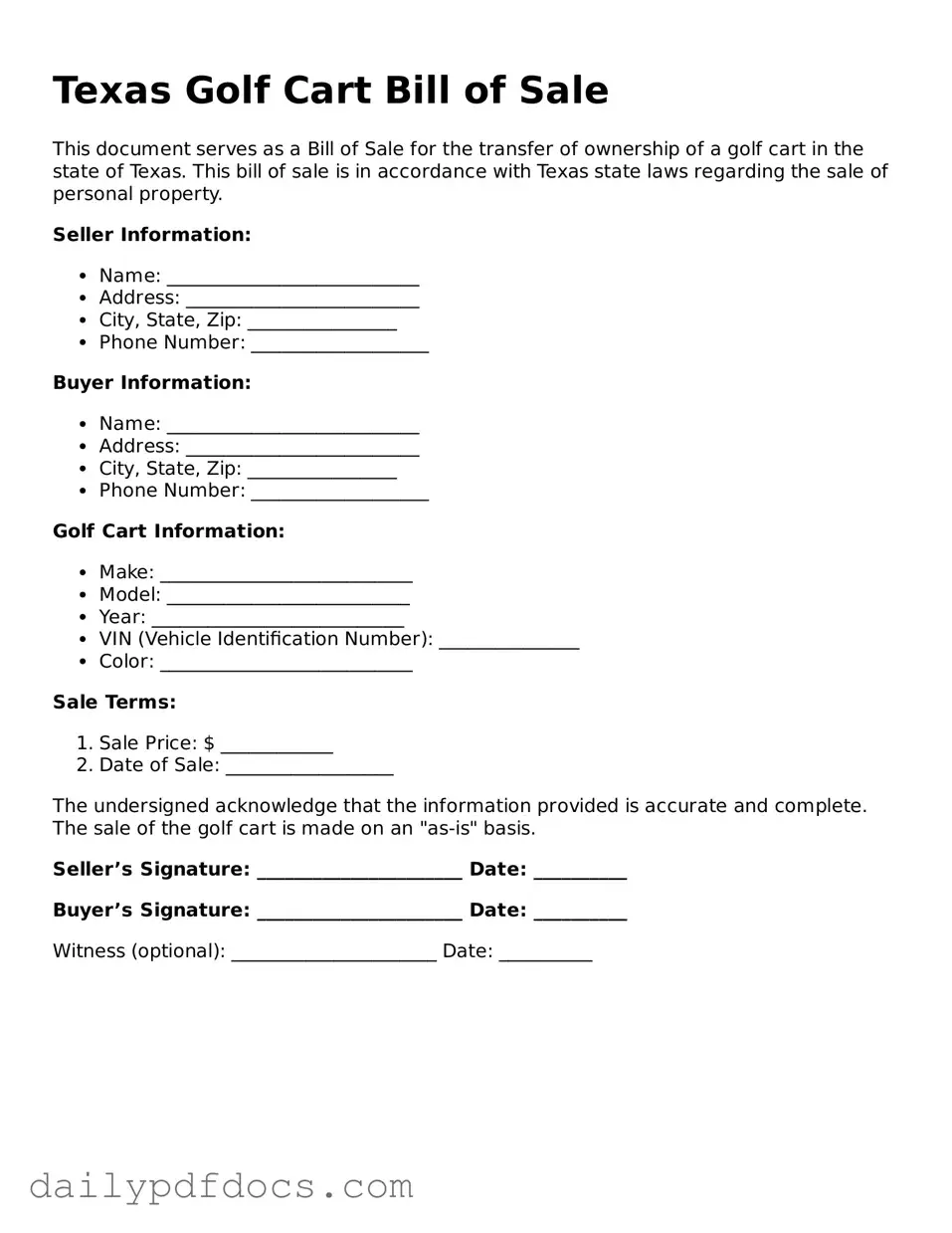

Preview - Texas Golf Cart Bill of Sale Form

Texas Golf Cart Bill of Sale

This document serves as a Bill of Sale for the transfer of ownership of a golf cart in the state of Texas. This bill of sale is in accordance with Texas state laws regarding the sale of personal property.

Seller Information:

- Name: ___________________________

- Address: _________________________

- City, State, Zip: ________________

- Phone Number: ___________________

Buyer Information:

- Name: ___________________________

- Address: _________________________

- City, State, Zip: ________________

- Phone Number: ___________________

Golf Cart Information:

- Make: ___________________________

- Model: __________________________

- Year: ___________________________

- VIN (Vehicle Identification Number): _______________

- Color: ___________________________

Sale Terms:

- Sale Price: $ ____________

- Date of Sale: __________________

The undersigned acknowledge that the information provided is accurate and complete. The sale of the golf cart is made on an "as-is" basis.

Seller’s Signature: ______________________ Date: __________

Buyer’s Signature: ______________________ Date: __________

Witness (optional): ______________________ Date: __________

Similar forms

- Vehicle Bill of Sale: Similar to the Golf Cart Bill of Sale, this document transfers ownership of a vehicle. It includes details about the buyer, seller, and the vehicle itself.

- Boat Bill of Sale: This document serves the same purpose for boats. It records the sale and includes information about the vessel, ensuring proper ownership transfer.

- Motorcycle Bill of Sale: Like the Golf Cart Bill of Sale, this document facilitates the transfer of ownership for motorcycles. It details the transaction and protects both parties involved.

Quitclaim Deed: This legal document is crucial for transferring real estate ownership in Ohio. It allows the grantor to relinquish their interest without warranties, making it a straightforward approach. For more information, visit Ohio PDF Forms to ensure you understand how to complete and file this form correctly.

- ATV Bill of Sale: This document is used for all-terrain vehicles. It outlines the sale terms and provides proof of ownership, similar to the golf cart transaction.

- Trailer Bill of Sale: This form is used for the sale of trailers. It ensures that ownership is officially transferred and includes necessary details about the trailer.

- Mobile Home Bill of Sale: This document is essential for transferring ownership of mobile homes. It includes buyer and seller information and specific details about the home.

- Equipment Bill of Sale: Used for various types of equipment, this document serves to transfer ownership and includes a description of the equipment, much like the golf cart.

Misconceptions

When it comes to the Texas Golf Cart Bill of Sale form, several misconceptions often arise. Understanding these misconceptions is crucial for both buyers and sellers in ensuring a smooth transaction. Here are four common misunderstandings:

- Misconception 1: A bill of sale is not necessary for golf cart transactions.

- Misconception 2: The form must be notarized to be valid.

- Misconception 3: The bill of sale must be filed with the state.

- Misconception 4: The bill of sale includes warranty information.

Many people believe that a bill of sale is optional when buying or selling a golf cart. However, this document serves as a crucial record of the transaction, protecting both parties in case of disputes.

While notarization can add an extra layer of security, it is not a requirement for the Texas Golf Cart Bill of Sale. As long as both parties sign the document, it is legally binding.

Some individuals think that they need to file the bill of sale with a state agency. In Texas, this is not necessary. The document is primarily for personal records and does not need to be submitted to any government office.

Buyers often expect the bill of sale to include warranties or guarantees regarding the golf cart's condition. However, the standard bill of sale simply documents the sale and does not imply any warranties unless explicitly stated.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Texas Golf Cart Bill of Sale form serves as a legal document to transfer ownership of a golf cart from one party to another. |

| Governing Law | This form is governed by Texas state law, specifically the Texas Vehicle Code. |

| Required Information | Buyers and sellers must provide their names, addresses, and contact information on the form. |

| Vehicle Details | Details about the golf cart, including make, model, year, and Vehicle Identification Number (VIN), must be included. |

| Sales Price | The form must indicate the agreed-upon sales price for the golf cart. |

| Signatures | Both the seller and buyer must sign the form to validate the transaction. |

| Notarization | While notarization is not mandatory, it is recommended for added legal protection. |

| Record Keeping | It is advisable for both parties to keep a copy of the bill of sale for their records. |