Printable Gift Deed Document for Texas

The Texas Gift Deed form serves as a crucial legal instrument for individuals wishing to transfer property without the exchange of monetary compensation. This document facilitates the voluntary transfer of ownership from one party, the donor, to another, the donee, ensuring that the process adheres to state laws. Essential components of the form include a clear description of the property being gifted, the identities of both the donor and donee, and the statement of intent to make a gift. Importantly, the form must be signed by the donor, and it often requires notarization to validate the transfer. By utilizing this form, individuals can effectively avoid potential disputes over property ownership in the future, as it provides a clear record of the transaction. Additionally, understanding the implications of gifting property, including potential tax consequences and the impact on estate planning, is vital for both parties involved. The Texas Gift Deed thus not only formalizes the transfer but also serves as a safeguard for the interests of the donor and donee alike.

More State-specific Gift Deed Forms

How to Add Someone to House Title in California - With a Gift Deed, the donor gives property to the recipient voluntarily and without exchange.

When renting a residential property, understanding the nuances of a well-structured Residential Lease Agreement guide can be invaluable. This document not only clarifies the agreements between the landlord and tenant but also sets the terms of occupancy, making it crucial for a smooth rental experience.

Common Questions

What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. It is often used when someone wishes to give property as a gift to a family member or friend. The deed must be signed by the person giving the gift (the grantor) and typically requires notarization to be valid.

Who can use a Gift Deed in Texas?

Any property owner in Texas can use a Gift Deed to transfer property. This includes individuals, married couples, or even business entities. However, the recipient of the gift must also be a legal entity, such as an individual or a trust, capable of holding property. It is important to ensure that the property being gifted is not subject to any liens or encumbrances that could complicate the transfer.

Are there tax implications when using a Gift Deed?

Yes, there may be tax implications when using a Gift Deed. The IRS allows individuals to gift a certain amount each year without incurring gift tax. As of 2023, the annual exclusion is $17,000 per recipient. If the value of the property exceeds this amount, the giver may need to file a gift tax return. It is advisable to consult a tax professional to understand the specific tax consequences related to your situation.

What information is required on a Texas Gift Deed?

A Texas Gift Deed must include specific information to be valid. This includes the names and addresses of both the grantor and the grantee, a legal description of the property being transferred, and the statement that the property is being given as a gift. Additionally, both parties must sign the document, and it should be notarized to ensure its legality.

How do I file a Gift Deed in Texas?

To file a Gift Deed in Texas, you must first complete the deed with all required information. After signing and notarizing the document, you must file it with the county clerk's office in the county where the property is located. This filing makes the transfer official and provides public notice of the new ownership.

Can a Gift Deed be revoked in Texas?

Once a Gift Deed is executed and filed, it is generally considered final and cannot be revoked. However, if the deed includes specific conditions or if the gift was made under duress or fraud, it may be possible to challenge the validity of the deed in court. Consulting with a legal professional can provide guidance on this matter if revocation is a concern.

Preview - Texas Gift Deed Form

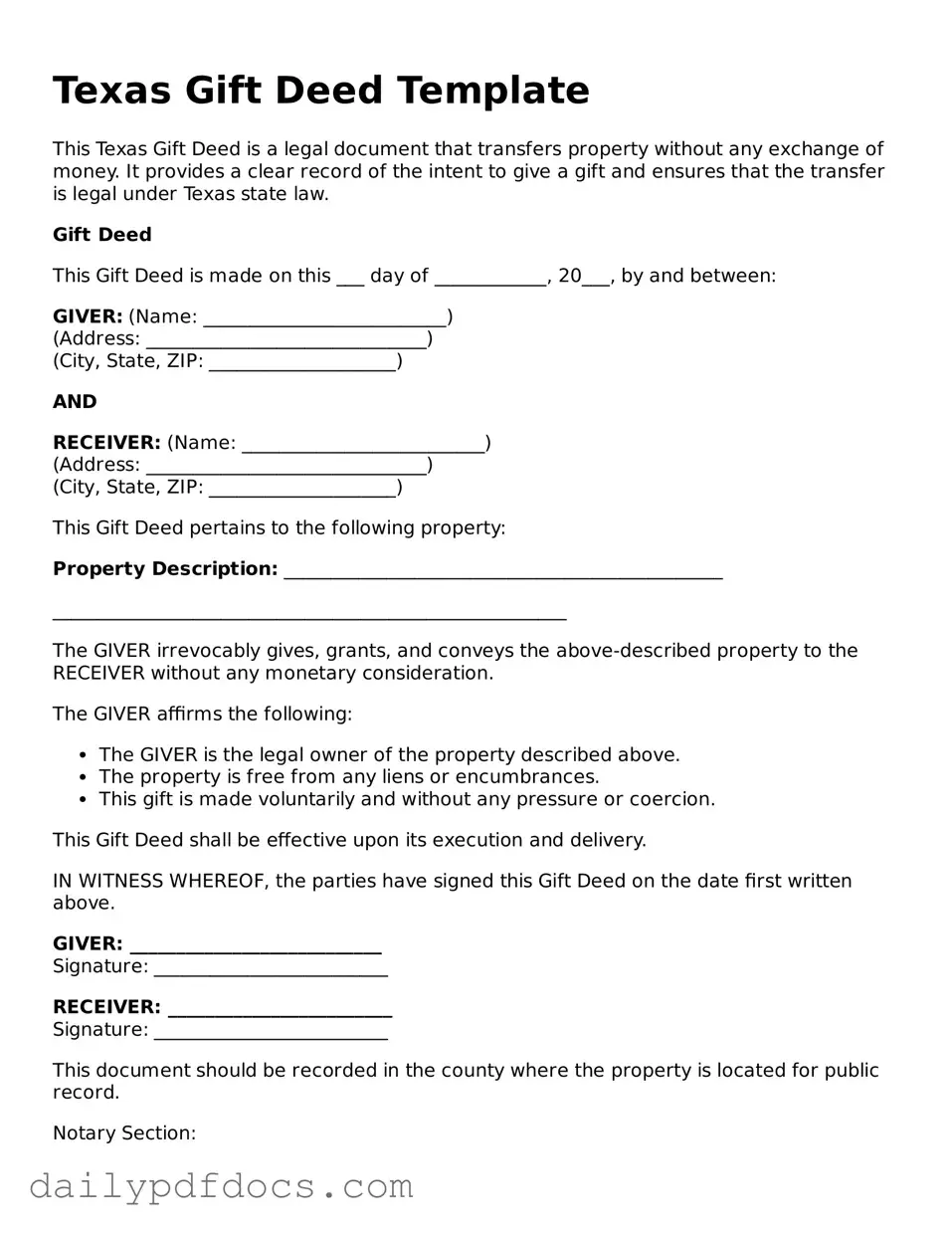

Texas Gift Deed Template

This Texas Gift Deed is a legal document that transfers property without any exchange of money. It provides a clear record of the intent to give a gift and ensures that the transfer is legal under Texas state law.

Gift Deed

This Gift Deed is made on this ___ day of ____________, 20___, by and between:

GIVER: (Name: __________________________)

(Address: ______________________________)

(City, State, ZIP: ____________________)

AND

RECEIVER: (Name: __________________________)

(Address: ______________________________)

(City, State, ZIP: ____________________)

This Gift Deed pertains to the following property:

Property Description: _______________________________________________

_______________________________________________________

The GIVER irrevocably gives, grants, and conveys the above-described property to the RECEIVER without any monetary consideration.

The GIVER affirms the following:

- The GIVER is the legal owner of the property described above.

- The property is free from any liens or encumbrances.

- This gift is made voluntarily and without any pressure or coercion.

This Gift Deed shall be effective upon its execution and delivery.

IN WITNESS WHEREOF, the parties have signed this Gift Deed on the date first written above.

GIVER: ___________________________

Signature: _________________________

RECEIVER: ________________________

Signature: _________________________

This document should be recorded in the county where the property is located for public record.

Notary Section:

State of Texas

County of ____________

Subscribed and sworn to before me this ____ day of ____________, 20___.

Notary Public: ____________________________

My Commission Expires: __________

Similar forms

Will: A will outlines how a person's assets should be distributed after their death. Like a gift deed, it involves the transfer of property, but a will takes effect only upon death, while a gift deed is effective immediately.

Trust Deed: A trust deed establishes a trust to manage assets for beneficiaries. Both documents facilitate the transfer of property, but a trust deed often involves ongoing management, whereas a gift deed is a one-time transfer.

Quitclaim Deed: This document transfers any ownership interest in a property without guaranteeing that the title is clear. Similar to a gift deed, it involves a transfer of property, but it does not provide the same assurances about ownership.

Warranty Deed: A warranty deed guarantees that the grantor holds clear title to the property. Both documents transfer property, but a warranty deed offers more legal protection to the grantee compared to a gift deed.

Sale Deed: A sale deed transfers property ownership in exchange for payment. Like a gift deed, it involves a transfer of property, but a sale deed requires consideration, while a gift deed does not.

Lease Agreement: This document allows one party to use another's property for a specified time in exchange for rent. Both involve property rights, but a lease agreement does not transfer ownership, unlike a gift deed.

Power of Attorney: This document gives someone the authority to act on another's behalf. Similar to a gift deed, it can involve property, but it does not transfer ownership; instead, it allows for management or decision-making.

Deed of Trust: A deed of trust secures a loan by transferring property to a trustee until the loan is paid. Both documents involve property transfer, but a deed of trust is typically tied to a financial obligation.

Quitclaim Deed: This document is used in Ohio to transfer ownership of real estate with no warranties, which allows the grantor to relinquish their interest in the property. For more detailed information, you can visit Ohio PDF Forms.

Affidavit of Heirship: This document establishes the heirs of a deceased person's estate. Similar to a gift deed, it deals with property rights, but it is used to clarify ownership after death rather than during a person's lifetime.

Misconceptions

- Misconception 1: A Gift Deed is the same as a Will.

- Misconception 2: You don’t need witnesses for a Gift Deed.

- Misconception 3: A Gift Deed can be revoked at any time.

- Misconception 4: Gift Deeds are only for real estate.

- Misconception 5: There are no tax implications for a Gift Deed.

- Misconception 6: A Gift Deed does not require a formal process.

- Misconception 7: The recipient automatically takes on the property’s liabilities.

Many people confuse a Gift Deed with a Will. A Gift Deed transfers ownership of property immediately, while a Will only takes effect after the owner's death.

Some believe that a Gift Deed can be valid without witnesses. However, Texas law requires at least two witnesses to sign the document for it to be legally binding.

Once a Gift Deed is executed and delivered, it generally cannot be revoked without the consent of the recipient. This is different from a promise to give a gift in the future.

While many use Gift Deeds for real estate, they can also be used for personal property, such as vehicles or valuable items. The key is to clearly identify the property being gifted.

People often think that gifting property has no tax consequences. In reality, the IRS has rules regarding gift taxes that may apply, especially if the value exceeds a certain threshold.

Some individuals believe that creating a Gift Deed is as simple as writing it down. In Texas, the document must be properly executed, notarized, and recorded to ensure its validity.

It’s a common belief that receiving a property through a Gift Deed means accepting all associated liabilities. However, the specifics can depend on the terms of the deed and local laws.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Texas Gift Deed is a legal document used to transfer ownership of real property as a gift without any exchange of money. |

| Governing Law | The Texas Gift Deed is governed by the Texas Property Code, specifically Chapter 5. |

| Requirements | The deed must be in writing, signed by the donor, and must identify the property being transferred. |

| Consideration | No monetary consideration is required for a gift deed, distinguishing it from a sale deed. |

| Notarization | A Texas Gift Deed must be notarized to be legally valid and enforceable. |

| Recording | It is advisable to record the deed with the county clerk's office to provide public notice of the property transfer. |

| Revocation | Once executed, a gift deed is generally irrevocable unless specific conditions for revocation are stated. |

| Tax Implications | Gift tax may apply depending on the value of the property and the relationship between the donor and the recipient. |

| Eligibility | Any individual or entity can be a donor or recipient, provided they have the legal capacity to own property. |

| Common Uses | Gift deeds are often used to transfer property to family members or friends as a gesture of goodwill. |