Printable Deed in Lieu of Foreclosure Document for Texas

In Texas, homeowners facing financial difficulties may find a Deed in Lieu of Foreclosure to be a viable option. This legal document allows a homeowner to voluntarily transfer the title of their property back to the lender, effectively avoiding the lengthy and often stressful foreclosure process. By signing this form, the homeowner can settle their mortgage obligations without the adverse effects of foreclosure on their credit score. The Deed in Lieu of Foreclosure can also provide a smoother transition for both the homeowner and the lender, as it can eliminate the need for costly legal proceedings. It’s important to understand the terms and conditions associated with this form, as it involves relinquishing ownership of the property and may have implications for any remaining debt. Homeowners should carefully consider their options and consult with a knowledgeable professional to ensure they make the best decision for their situation.

More State-specific Deed in Lieu of Foreclosure Forms

California Voluntary Property Surrender Document - Utilizing a Deed in Lieu can be part of a financial recovery strategy for struggling homeowners.

The Ohio Residential Lease Agreement is a legal document that outlines the terms and conditions between a landlord and a tenant for renting residential property in Ohio. This form serves as a vital tool for both parties, ensuring that everyone understands their rights and responsibilities. By clearly defining the agreement, it helps prevent misunderstandings and protects the interests of both landlords and tenants. For those looking for this template, you can find it at Ohio PDF Forms.

Foreclosure in Georgia - The process is typically faster and less costly than traditional foreclosure proceedings.

Will I Owe Money After a Deed in Lieu of Foreclosure - Clients may find this option preferable if they wish to avoid judicial foreclosure processes.

Will I Owe Money After a Deed in Lieu of Foreclosure - It is important to understand how the Deed in Lieu process varies by state and lender practices.

Common Questions

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document where a homeowner voluntarily transfers their property to the lender to avoid foreclosure. This option is often considered when the homeowner is unable to keep up with mortgage payments and wishes to resolve the situation without going through the lengthy foreclosure process.

Who can use a Deed in Lieu of Foreclosure?

Homeowners who are facing financial difficulties and are at risk of foreclosure may consider this option. It is important that the property is not subject to any additional liens or encumbrances that would complicate the transfer. Additionally, lenders typically require that the homeowner demonstrates a genuine inability to continue making mortgage payments.

What are the benefits of a Deed in Lieu of Foreclosure?

One of the primary benefits is that it can help homeowners avoid the negative impact of a foreclosure on their credit score. It can also expedite the process of relinquishing the property, allowing the homeowner to move on more quickly. Furthermore, lenders may be more willing to negotiate terms that could alleviate some of the homeowner's financial burdens.

What are the drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also potential drawbacks. Homeowners may still face tax implications, as forgiven debt can sometimes be considered taxable income. Additionally, lenders may not agree to this option if there are multiple liens on the property, and homeowners may lose any equity they have built up in the home.

How does the process work?

The process typically begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then evaluate the homeowner's financial situation and the property’s condition. If approved, the homeowner will sign the deed, transferring ownership to the lender, and the lender may agree to release the homeowner from further liability on the mortgage.

What should homeowners prepare before initiating a Deed in Lieu of Foreclosure?

Homeowners should gather all relevant financial documents, including income statements, tax returns, and information about any other debts. It is also advisable to obtain a current property appraisal to understand the home’s value. This information will help facilitate discussions with the lender.

Can homeowners negotiate the terms of a Deed in Lieu of Foreclosure?

Yes, homeowners can negotiate the terms with their lender. They may be able to discuss issues such as potential debt forgiveness, relocation assistance, or the timeline for vacating the property. Open communication is key to reaching an agreement that works for both parties.

What happens to the homeowner's credit score?

A Deed in Lieu of Foreclosure will typically have a less severe impact on a homeowner's credit score compared to a full foreclosure. However, it is still important to note that it may still affect the score negatively. Homeowners should check their credit reports to understand how this action might influence their credit standing.

Is legal advice recommended before proceeding?

Yes, it is highly recommended that homeowners seek legal advice before proceeding with a Deed in Lieu of Foreclosure. An attorney can provide guidance on the implications of the deed, help negotiate terms with the lender, and ensure that the homeowner’s rights are protected throughout the process.

What should homeowners do after completing a Deed in Lieu of Foreclosure?

After completing the Deed in Lieu of Foreclosure, homeowners should keep all documentation related to the transaction for their records. They should also monitor their credit reports for any changes and consult with a financial advisor to discuss their next steps in rebuilding their financial health.

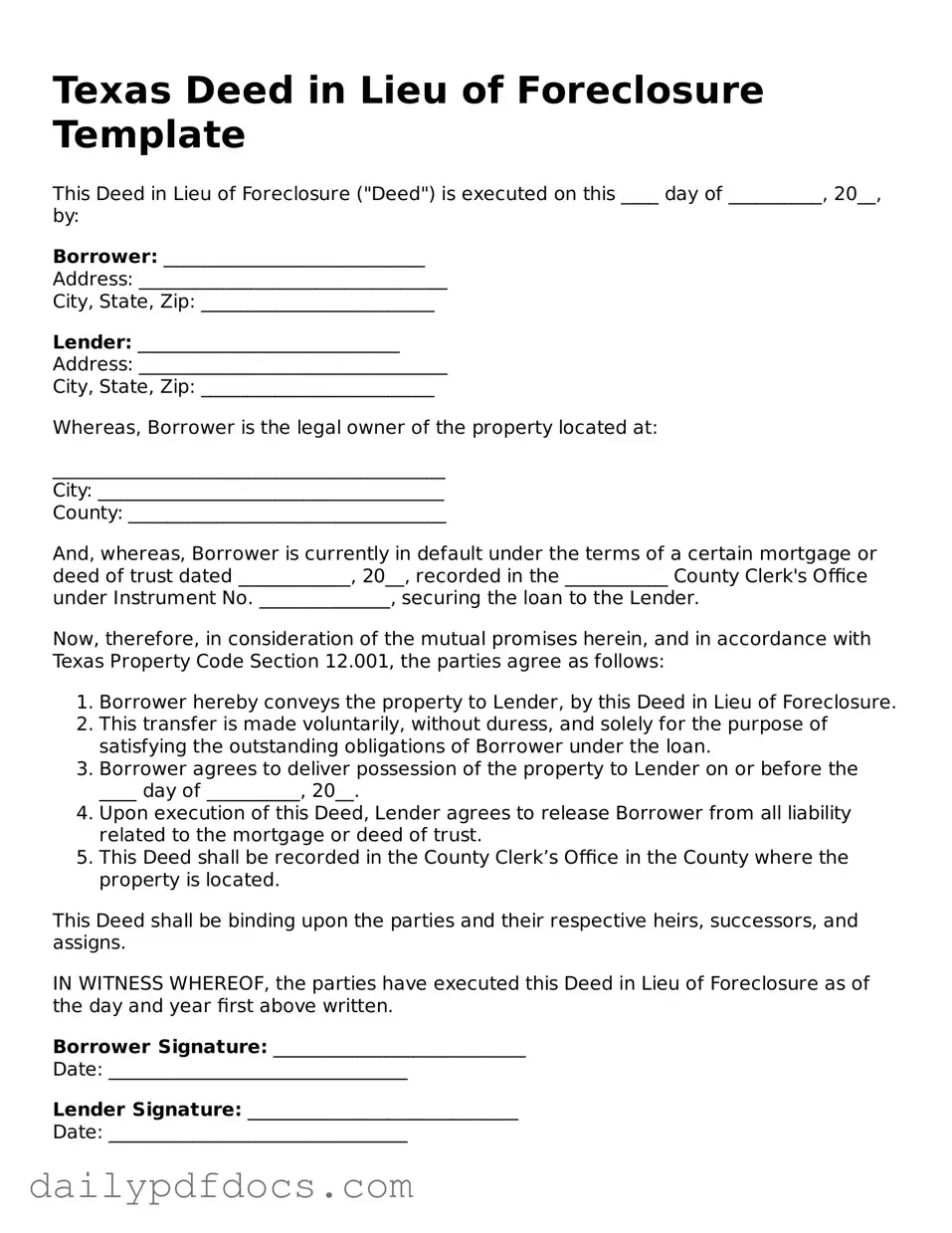

Preview - Texas Deed in Lieu of Foreclosure Form

Texas Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure ("Deed") is executed on this ____ day of __________, 20__, by:

Borrower: ____________________________

Address: _________________________________

City, State, Zip: _________________________

Lender: ____________________________

Address: _________________________________

City, State, Zip: _________________________

Whereas, Borrower is the legal owner of the property located at:

__________________________________________

City: _____________________________________

County: __________________________________

And, whereas, Borrower is currently in default under the terms of a certain mortgage or deed of trust dated ____________, 20__, recorded in the ___________ County Clerk's Office under Instrument No. ______________, securing the loan to the Lender.

Now, therefore, in consideration of the mutual promises herein, and in accordance with Texas Property Code Section 12.001, the parties agree as follows:

- Borrower hereby conveys the property to Lender, by this Deed in Lieu of Foreclosure.

- This transfer is made voluntarily, without duress, and solely for the purpose of satisfying the outstanding obligations of Borrower under the loan.

- Borrower agrees to deliver possession of the property to Lender on or before the ____ day of __________, 20__.

- Upon execution of this Deed, Lender agrees to release Borrower from all liability related to the mortgage or deed of trust.

- This Deed shall be recorded in the County Clerk’s Office in the County where the property is located.

This Deed shall be binding upon the parties and their respective heirs, successors, and assigns.

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Borrower Signature: ___________________________

Date: ________________________________

Lender Signature: _____________________________

Date: ________________________________

Witness Signature: ___________________________

Date: ________________________________

Notary Public for the State of Texas

My commission expires: _____________________

Similar forms

- Short Sale Agreement: A short sale allows a homeowner to sell their property for less than the amount owed on the mortgage. Similar to a deed in lieu of foreclosure, it helps the homeowner avoid foreclosure and minimizes the lender's losses.

- Loan Modification Agreement: This document modifies the terms of an existing loan to make payments more manageable. Like a deed in lieu, it aims to prevent foreclosure by providing the borrower with a more affordable payment plan.

- Forbearance Agreement: In this agreement, the lender allows the borrower to temporarily reduce or suspend payments. This approach is similar to a deed in lieu because it provides the borrower with an opportunity to keep their home while addressing financial difficulties.

- Mobile Home Bill of Sale: A crucial legal document for transferring ownership of a mobile home, ensuring all transaction details are clear. For more information, visit https://mobilehomebillofsale.com/blank-indiana-mobile-home-bill-of-sale.

- Mortgage Release: A mortgage release occurs when the lender agrees to release the borrower from the mortgage obligation. This is akin to a deed in lieu, as it allows the homeowner to relinquish the property without going through foreclosure.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide the borrower with a chance to reorganize their debts. While it differs in process, it shares the goal of protecting the homeowner from losing their property.

- Property Settlement Agreement: This document outlines the division of property and debts during a divorce. Similar to a deed in lieu, it can involve transferring ownership of a property to resolve financial obligations and avoid foreclosure.

Misconceptions

Many people have misconceptions about the Texas Deed in Lieu of Foreclosure form. Understanding the facts can help homeowners make informed decisions. Here are nine common misconceptions:

-

It completely eliminates the homeowner's debt.

A deed in lieu of foreclosure transfers ownership of the property to the lender, but it does not automatically erase all debts. If there are other liens or obligations, those may still remain.

-

It guarantees a quick process.

The process can still take time. While it may be faster than a foreclosure, it requires negotiation and approval from the lender.

-

It is the same as a short sale.

A deed in lieu involves transferring the property back to the lender, while a short sale involves selling the property for less than the mortgage balance with the lender's approval.

-

Homeowners can just walk away from their mortgage.

Homeowners must formally agree to the deed in lieu. It is not a unilateral decision; the lender must accept the terms.

-

It has no impact on credit scores.

A deed in lieu of foreclosure can negatively affect a credit score, though typically less severely than a foreclosure. The impact varies based on individual credit history.

-

All lenders accept a deed in lieu.

Not all lenders offer this option. Each lender has its own policies, and some may prefer to proceed with foreclosure instead.

-

It releases the homeowner from all liability.

Homeowners may still be liable for any deficiency judgments if the property sells for less than the mortgage amount, unless the lender agrees to waive this right.

-

It is a simple and straightforward solution.

The process can involve complex negotiations and legal considerations. Homeowners should seek legal advice to navigate it properly.

-

It is only for homeowners in severe financial distress.

While often used by those facing financial difficulties, some homeowners may choose this option for other reasons, such as wanting to avoid a lengthy foreclosure process.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Texas Deed in Lieu of Foreclosure form allows a borrower to voluntarily transfer property ownership to the lender to avoid foreclosure. |

| Governing Law | This form is governed by Texas Property Code, Chapter 51, which outlines the foreclosure process and alternatives. |

| Eligibility | Homeowners facing financial difficulties may qualify for this option if they are unable to continue making mortgage payments. |

| Process | The borrower must negotiate with the lender to agree on the terms before executing the deed. |

| Impact on Credit | A deed in lieu of foreclosure may have a less severe impact on credit scores compared to a formal foreclosure. |

| Deficiency Judgments | In Texas, lenders may not pursue deficiency judgments against borrowers who complete a deed in lieu of foreclosure. |

| Tax Implications | Borrowers should consult a tax professional, as there may be tax consequences related to the cancellation of debt. |

| Documentation | Proper documentation, including the original mortgage, is required to complete the transaction effectively. |