Printable Bill of Sale Document for Texas

The Texas Bill of Sale form serves as an essential document for individuals engaged in the transfer of ownership of personal property, such as vehicles, boats, or equipment. This form not only provides a written record of the transaction but also helps protect the interests of both the buyer and the seller. It typically includes vital information such as the names and addresses of the parties involved, a detailed description of the item being sold, and the purchase price. Additionally, the form may contain clauses that address warranties or the absence thereof, ensuring clarity regarding the condition of the property at the time of sale. By documenting the transaction, the Bill of Sale can serve as evidence in case of disputes or legal issues that may arise in the future. Understanding the components of this form is crucial for anyone looking to engage in a sale, as it lays the groundwork for a transparent and legally sound exchange.

More State-specific Bill of Sale Forms

How to Sell a Car Privately in Florida - A Bill of Sale ensures both parties agree on sale terms.

Copy of a Bill of Sale for a Vehicle - A Bill of Sale is a straightforward document that carries significant value in transactions.

Common Questions

What is a Texas Bill of Sale?

A Texas Bill of Sale is a legal document that records the transfer of ownership of personal property from one person to another. This form is essential for both buyers and sellers as it serves as proof of the transaction and outlines the terms of the sale. It can apply to various items, including vehicles, boats, and personal goods.

Is a Bill of Sale required in Texas?

While a Bill of Sale is not legally required for every transaction in Texas, it is highly recommended. For items like vehicles, a Bill of Sale is often necessary for registration purposes. It protects both parties by documenting the details of the sale, including the purchase price and the condition of the item.

What information should be included in a Texas Bill of Sale?

A Texas Bill of Sale should include specific details to ensure clarity. Essential information includes the names and addresses of the buyer and seller, a description of the item being sold, the sale price, the date of the transaction, and any warranties or conditions agreed upon. Including signatures from both parties is also important to validate the document.

Can I create my own Bill of Sale in Texas?

Yes, you can create your own Bill of Sale in Texas. There are no specific state forms required, but it’s crucial to include all necessary information to make the document legally binding. Templates are widely available online, and they can guide you in drafting a comprehensive Bill of Sale that meets your needs.

What if the item being sold is a vehicle?

When selling a vehicle in Texas, a Bill of Sale is especially important. It should include the vehicle's make, model, year, Vehicle Identification Number (VIN), and odometer reading at the time of sale. Additionally, the seller must provide the buyer with the vehicle's title, which must be signed over to the new owner. This process helps ensure a smooth transfer of ownership.

Do I need to have the Bill of Sale notarized?

In Texas, notarization of a Bill of Sale is not required for most personal property transactions. However, having the document notarized can add an extra layer of security and authenticity. For vehicle sales, while not mandatory, a notarized Bill of Sale may be beneficial, especially if disputes arise in the future.

What should I do with the Bill of Sale after the transaction?

After the transaction is complete, both the buyer and seller should keep a copy of the Bill of Sale for their records. This document serves as proof of the sale and can be useful for tax purposes or if any disputes arise later. For vehicle sales, the buyer will need to present the Bill of Sale when registering the vehicle in their name.

Preview - Texas Bill of Sale Form

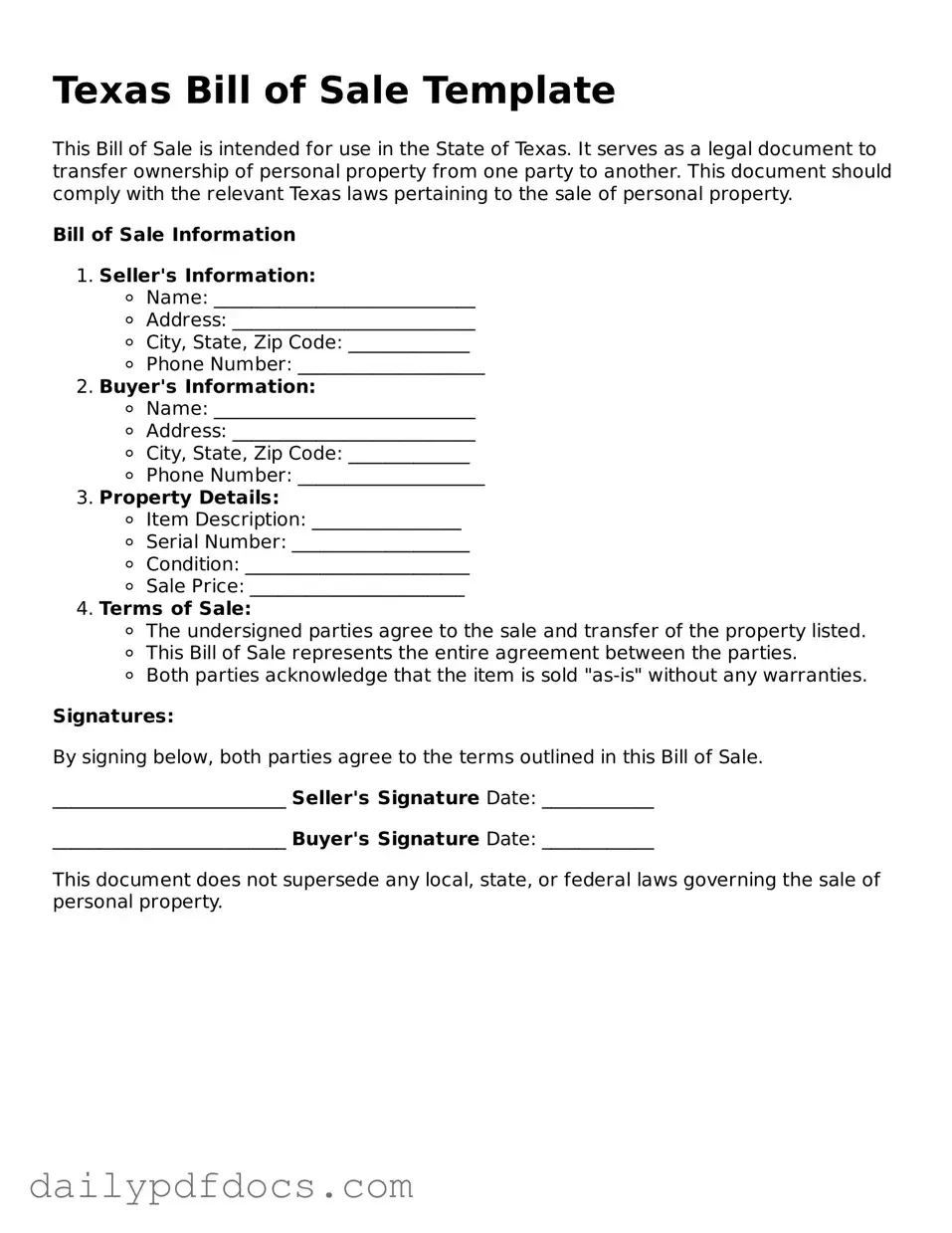

Texas Bill of Sale Template

This Bill of Sale is intended for use in the State of Texas. It serves as a legal document to transfer ownership of personal property from one party to another. This document should comply with the relevant Texas laws pertaining to the sale of personal property.

Bill of Sale Information

- Seller's Information:

- Name: ____________________________

- Address: __________________________

- City, State, Zip Code: _____________

- Phone Number: ____________________

- Buyer's Information:

- Name: ____________________________

- Address: __________________________

- City, State, Zip Code: _____________

- Phone Number: ____________________

- Property Details:

- Item Description: ________________

- Serial Number: ___________________

- Condition: ________________________

- Sale Price: _______________________

- Terms of Sale:

- The undersigned parties agree to the sale and transfer of the property listed.

- This Bill of Sale represents the entire agreement between the parties.

- Both parties acknowledge that the item is sold "as-is" without any warranties.

Signatures:

By signing below, both parties agree to the terms outlined in this Bill of Sale.

_________________________ Seller's Signature Date: ____________

_________________________ Buyer's Signature Date: ____________

This document does not supersede any local, state, or federal laws governing the sale of personal property.

Similar forms

Purchase Agreement: This document outlines the terms and conditions of a sale between a buyer and a seller. Like a Bill of Sale, it serves as proof of the transaction and details the item being sold, the purchase price, and the parties involved.

Receipt: A receipt is a simple document that acknowledges payment for goods or services. It confirms that the buyer has received the item, similar to how a Bill of Sale confirms the transfer of ownership.

Title Transfer Document: When selling a vehicle, a title transfer document is necessary to officially change ownership. This is akin to a Bill of Sale, as both documents serve to verify that ownership has shifted from one party to another.

Lease Agreement: A lease agreement outlines the terms under which one party rents property from another. While it focuses on rental rather than sale, both documents establish rights and responsibilities between the involved parties.

Warranty Deed: This document is used in real estate transactions to transfer property ownership. Like a Bill of Sale, it provides legal proof of the transfer and includes details about the property and the parties.

- Lease Agreement Form: For a comprehensive tool for both landlords and tenants in California, consider the Top Document Templates which outlines important terms and conditions for rental agreements.

Sales Contract: A sales contract is more detailed than a Bill of Sale and often includes additional terms regarding payment, delivery, and warranties. Both documents serve to formalize a sale and protect the interests of both parties.

Gift Deed: A gift deed transfers property ownership without any exchange of money. Similar to a Bill of Sale, it serves as a legal record of the transfer, though it does not involve a sale.

Affidavit of Sale: This is a sworn statement confirming that a sale has occurred. It may accompany a Bill of Sale to provide additional legal backing to the transaction.

Consignment Agreement: This document allows a seller to place goods in the possession of another party to sell on their behalf. While it differs in purpose, both documents establish the terms of a transaction.

Service Agreement: This document outlines the terms under which services will be provided. Like a Bill of Sale, it serves as a formal agreement between parties, detailing what is to be exchanged.

Misconceptions

Understanding the Texas Bill of Sale form is crucial for both buyers and sellers in a transaction. However, several misconceptions often arise regarding its purpose and requirements. Below are nine common misconceptions about this form:

-

It is only necessary for vehicle sales.

Many believe that a Bill of Sale is required only for vehicles. In reality, it can be used for various types of personal property transactions, including boats, trailers, and even furniture.

-

It must be notarized.

Some think that notarization is mandatory for a Bill of Sale to be valid. While notarization can add an extra layer of authenticity, it is not a legal requirement in Texas.

-

It serves as a title transfer.

People often confuse a Bill of Sale with a title transfer. A Bill of Sale serves as a receipt and proof of purchase but does not transfer the title of a vehicle or property.

-

It is not legally binding.

There is a misconception that a Bill of Sale holds no legal weight. In fact, it is a legally binding document that can be used in court to prove ownership and the terms of the sale.

-

All sales require a Bill of Sale.

Not every sale necessitates a Bill of Sale. For example, sales involving items of minimal value may not require this document, although having one is still advisable for record-keeping.

-

It can be a verbal agreement.

Some believe that a verbal agreement suffices in place of a written Bill of Sale. However, having a written document provides clear evidence of the transaction and is strongly recommended.

-

It must be filed with a government agency.

There is a belief that a Bill of Sale must be submitted to a government office. In Texas, this is not required; the document is typically retained by the buyer and seller.

-

It can be used for any type of property.

While versatile, a Bill of Sale is not appropriate for all transactions. For instance, it cannot be used for real estate transactions, which require different legal documents.

-

It is only for private sales.

Many think that Bills of Sale are only relevant for private transactions. However, businesses can also use them for sales, providing a clear record of the transaction.

Clarifying these misconceptions can help individuals navigate the process of buying and selling personal property in Texas more effectively.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Texas Bill of Sale form is used to document the sale and transfer of personal property from one party to another. |

| Governing Laws | The form is governed by Texas Business and Commerce Code, Section 2.201, which outlines the requirements for the sale of goods. |

| Required Information | The form typically requires details such as the names of the buyer and seller, a description of the property, and the sale price. |

| Signatures | Both parties must sign the Bill of Sale for it to be legally binding, although notarization is not required in Texas. |