Printable Articles of Incorporation Document for Texas

When starting a business in Texas, one of the first steps is to establish your company as a legal entity through the Texas Articles of Incorporation form. This essential document serves as the foundation for your corporation, outlining key details such as the corporation's name, purpose, and duration. Additionally, it requires information about the registered agent, who will be responsible for receiving legal documents on behalf of the corporation. The form also includes provisions for the initial board of directors and any stock structure, detailing the number of shares the corporation is authorized to issue. By completing and filing the Articles of Incorporation with the Texas Secretary of State, you not only comply with state regulations but also gain the legal protections and benefits that come with incorporation. Understanding the components of this form is crucial for any entrepreneur looking to navigate the complexities of business formation in Texas.

More State-specific Articles of Incorporation Forms

How to Obtain an Llc - The Articles help define how the corporation will operate and be governed.

In the realm of mobile home transactions, having the proper documentation is essential, and the Texas Mobile Home Bill of Sale plays a critical role in this process. By using this form, both the buyer and seller can ensure that all necessary details are accurately recorded, which includes the relevant specifications of the mobile home being transferred. For those seeking a reliable template, you can find a useful resource at https://mobilehomebillofsale.com/blank-texas-mobile-home-bill-of-sale. This helps avoid any ambiguities and fosters a smooth transaction for all parties involved.

Pa Division of Corporations - State-specific requirements can vary, so checking local rules is crucial.

Common Questions

What is the Texas Articles of Incorporation form?

The Texas Articles of Incorporation form is a legal document that establishes a corporation in the state of Texas. It outlines essential information about the business, such as its name, purpose, and structure. This form is a crucial first step for anyone looking to start a corporation in Texas.

Who needs to file the Articles of Incorporation?

Anyone planning to start a corporation in Texas must file the Articles of Incorporation. This includes individuals or groups forming a new business entity, whether it’s a for-profit or non-profit corporation. If you want to limit your personal liability and establish a formal business structure, this form is essential.

What information is required on the form?

The form typically requires basic information such as the corporation's name, the duration of the corporation (if not perpetual), the address of the principal office, the registered agent's name and address, and the purpose of the corporation. Additionally, you will need to include details about the initial directors and the number of shares the corporation is authorized to issue.

How much does it cost to file the Articles of Incorporation?

The filing fee for the Texas Articles of Incorporation varies based on the type of corporation you are forming. As of October 2023, the fee for a for-profit corporation is generally around $300, while a non-profit corporation may have a different fee structure. Always check the latest fee schedule on the Texas Secretary of State's website for the most accurate information.

How do I submit the Articles of Incorporation?

You can submit the Articles of Incorporation online through the Texas Secretary of State's website or by mail. If you choose to file online, the process is typically quicker and more efficient. If mailing, ensure you send the completed form along with the appropriate fee to the designated address provided by the Secretary of State.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Generally, if filed online, you may receive confirmation within a few business days. Mail submissions can take longer, often up to several weeks. For expedited service, you may have the option to pay an additional fee for faster processing.

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are approved, you will receive a certificate of incorporation from the Texas Secretary of State. This document serves as proof that your corporation is officially recognized. After that, you can proceed with obtaining any necessary licenses, opening a bank account, and conducting business activities under your new corporate structure.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after filing. If there are changes to your corporation’s name, address, or structure, you will need to file an amendment with the Texas Secretary of State. This ensures that your corporation's information remains up-to-date and compliant with state regulations.

Do I need a lawyer to file the Articles of Incorporation?

While it’s not mandatory to hire a lawyer to file the Articles of Incorporation, many choose to do so for peace of mind. A legal professional can help ensure that all information is accurate and compliant with state laws. However, if you feel confident in your understanding of the process, you can complete the filing on your own.

What is the difference between Articles of Incorporation and a business license?

Articles of Incorporation establish your corporation as a legal entity, while a business license is a permit that allows you to operate legally within your city or state. Think of the Articles of Incorporation as the foundation of your business, while the business license is like a permission slip to conduct your activities. Both are important, but they serve different purposes.

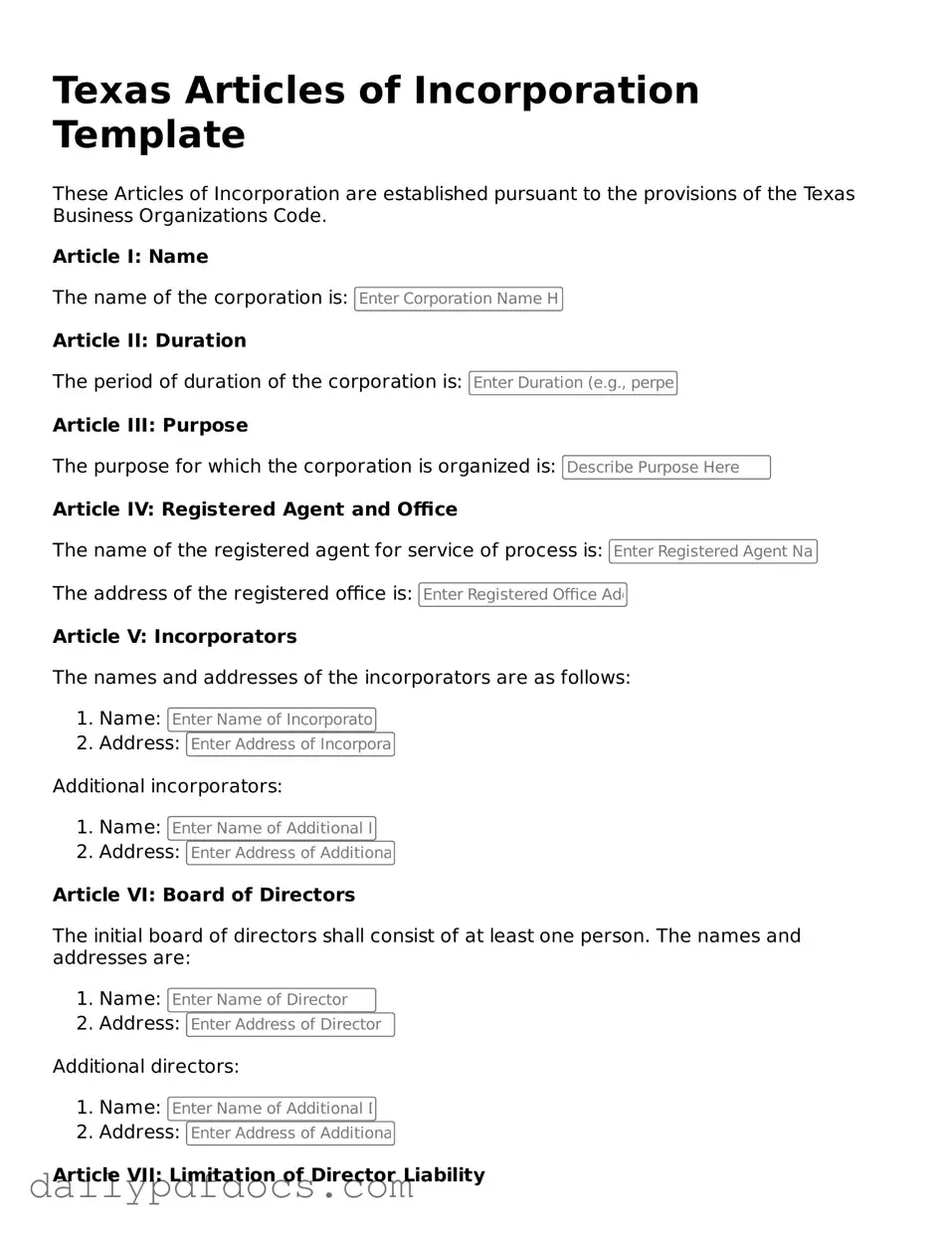

Preview - Texas Articles of Incorporation Form

Texas Articles of Incorporation Template

These Articles of Incorporation are established pursuant to the provisions of the Texas Business Organizations Code.

Article I: Name

The name of the corporation is:

Article II: Duration

The period of duration of the corporation is:

Article III: Purpose

The purpose for which the corporation is organized is:

Article IV: Registered Agent and Office

The name of the registered agent for service of process is:

The address of the registered office is:

Article V: Incorporators

The names and addresses of the incorporators are as follows:

- Name:

- Address:

Additional incorporators:

- Name:

- Address:

Article VI: Board of Directors

The initial board of directors shall consist of at least one person. The names and addresses are:

- Name:

- Address:

Additional directors:

- Name:

- Address:

Article VII: Limitation of Director Liability

To the fullest extent permitted by Texas law, no director of the corporation shall be personally liable to the corporation or its members for monetary damages for an act or omission in the director's capacity as a director.

Article VIII: Indemnification

The corporation shall have the power to indemnify its directors and officers to the fullest extent permitted under Texas law.

IN WITNESS WHEREOF, these Articles of Incorporation have been executed this .

Signature of Incorporator:

Printed Name:

Similar forms

- Bylaws: Bylaws outline the internal rules and procedures for a corporation. While the Articles of Incorporation establish the existence of the corporation, bylaws govern its operations and management.

-

Mobile Home Bill of Sale - A crucial document for transferring ownership of a mobile home, it includes the seller's and buyer's details, a description of the mobile home, and the sale price. Ensure you have the right form from Washington Templates for a smooth transaction.

- Operating Agreement: Similar to bylaws, an operating agreement is used by LLCs to define the management structure and operating procedures. Both documents are essential for outlining how the entity will function.

- Certificate of Formation: This document serves a similar purpose to the Articles of Incorporation but is used for limited liability companies (LLCs). It also establishes the legal existence of the entity with the state.

- Partnership Agreement: A partnership agreement outlines the terms of a partnership, including roles and responsibilities. Like the Articles of Incorporation, it formalizes the structure of a business entity.

- Business License: A business license is required to operate legally. While the Articles of Incorporation create the entity, the business license allows it to conduct business within a specific jurisdiction.

- Tax Identification Number (TIN): A TIN is necessary for tax purposes. It complements the Articles of Incorporation by enabling the corporation to file taxes and open bank accounts under its legal name.

Misconceptions

Understanding the Texas Articles of Incorporation form can be challenging. Here are nine common misconceptions about this important document:

-

All businesses must file Articles of Incorporation.

Not every business entity is required to file this form. Only corporations need to submit Articles of Incorporation. Sole proprietorships and partnerships do not.

-

The Articles of Incorporation are the same as the business license.

These are distinct documents. The Articles of Incorporation establish a corporation, while a business license allows you to operate legally within your locality.

-

Filing Articles of Incorporation guarantees tax-exempt status.

Incorporating does not automatically grant tax-exempt status. Organizations must apply separately for this designation through the IRS.

-

Once filed, Articles of Incorporation cannot be changed.

Changes can be made, but they require filing an amendment. This allows for updates to the corporation’s structure or purpose.

-

Articles of Incorporation are only for large businesses.

Small businesses and startups also need to file this document if they choose to incorporate. It is not exclusive to large corporations.

-

Filing fees are the same for all types of corporations.

Fees vary based on the type of corporation and the number of shares authorized. It’s important to check the current fee schedule.

-

All states have the same Articles of Incorporation requirements.

Each state has its own rules and requirements. Texas has specific guidelines that differ from those in other states.

-

Incorporation is a one-time process.

While filing Articles of Incorporation is a crucial first step, ongoing compliance with state regulations is necessary to maintain good standing.

-

Legal assistance is unnecessary for filing.

While individuals can file on their own, consulting a legal professional can help ensure accuracy and completeness, avoiding potential pitfalls.

Clarifying these misconceptions can help ensure that individuals and businesses navigate the incorporation process more effectively.

Form Overview

| Fact Name | Details |

|---|---|

| Purpose | The Texas Articles of Incorporation are used to create a corporation in Texas. |

| Governing Law | The Texas Business Organizations Code governs the incorporation process. |

| Filing Requirement | Filing with the Texas Secretary of State is required to officially incorporate. |

| Information Needed | Basic information about the corporation, such as its name and address, is needed. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Share Structure | The form requires details about the corporation's share structure, including types and number of shares. |

| Duration | The corporation can be established for a specific duration or perpetually. |

| Initial Directors | Names and addresses of the initial directors may need to be included in the form. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation. |

| Amendments | Changes to the Articles of Incorporation can be made by filing an amendment form. |