Fill Your Stock Transfer Ledger Form

The Stock Transfer Ledger form plays a crucial role in maintaining accurate records of stock ownership and transfers within a corporation. This document is designed to capture essential information about stockholders and the shares they hold. Each entry includes the corporation’s name, ensuring clarity about which entity the shares belong to. Stockholders' names and their places of residence are recorded, providing a clear view of ownership. The form details the certificates issued, including their unique numbers and the dates they were issued. It also notes the number of shares transferred and from whom they were acquired, making it easy to trace the history of ownership. If the shares are being issued for the first time, this is indicated on the form. Additionally, the amount paid for the shares is documented, along with the date of transfer and the recipient of the shares. Surrendered certificates are accounted for, ensuring that the ledger reflects current holdings accurately. Finally, the form concludes with a tally of the number of shares held by the stockholder, offering a comprehensive snapshot of their investment in the corporation.

Find Other Documents

Odometer Disclosure Statement Ca - This statement is effective for both private and dealership vehicle sales.

The Washington Articles of Incorporation form is a legal document that establishes a corporation in the state of Washington. This form outlines essential details about the corporation, such as its name, purpose, and registered agent. For more information on how to properly complete this form, you can refer to Washington Templates, which provides guidance to ensure you start your business on the right foot.

What Is a W9 for a Business - Completing a W-9 ensures the correct recipient is taxed appropriately.

Common Questions

What is the purpose of the Stock Transfer Ledger form?

The Stock Transfer Ledger form is used to document the issuance and transfer of shares within a corporation. It provides a detailed record of stockholders, the number of shares issued, and the transactions related to those shares. This form helps maintain accurate ownership records and ensures compliance with corporate governance requirements.

Who should fill out the Stock Transfer Ledger form?

The form should be filled out by corporate officers or designated personnel responsible for managing stock transactions. This typically includes the secretary or treasurer of the corporation. Accurate completion of the form is crucial for maintaining the integrity of the corporation's stock records.

What information is required on the Stock Transfer Ledger form?

Essential information includes the corporation's name, the name and residence of the stockholder, details of the shares issued (including certificate numbers and dates), the amount paid for the shares, and specifics regarding any transfers. The form also requires information about the shares surrendered and the remaining balance of shares held by each stockholder.

How do I record a transfer of shares on the form?

To record a transfer, enter the name of the stockholder who is transferring shares, the number of shares being transferred, and the date of the transfer. You must also include the name of the individual or entity receiving the shares. If applicable, note the certificate number of the shares being surrendered in the transaction.

What should I do if shares are transferred multiple times?

In cases of multiple transfers, each transaction should be documented separately on the Stock Transfer Ledger form. This ensures a clear and accurate history of ownership. Each entry should include the relevant details such as the date of each transfer and the parties involved.

Is it necessary to maintain a physical copy of the Stock Transfer Ledger form?

Yes, maintaining a physical or digital copy of the Stock Transfer Ledger form is essential. This record serves as legal proof of stock ownership and transactions. Corporations should keep these records for a specified period, as required by state law and corporate bylaws.

Can the Stock Transfer Ledger form be modified?

While the format of the Stock Transfer Ledger form can be adapted to meet the needs of a corporation, it is important to ensure that all required information is included. Any modifications should not compromise the clarity and accuracy of the records. Consult with legal counsel if significant changes are needed.

What happens if there are discrepancies in the Stock Transfer Ledger?

If discrepancies arise, it is crucial to investigate and resolve them promptly. This may involve reviewing transaction records, contacting stockholders, and making necessary corrections. Maintaining accurate records is vital for legal compliance and shareholder trust.

How often should the Stock Transfer Ledger be updated?

The Stock Transfer Ledger should be updated immediately following any stock issuance or transfer. Timely updates help ensure that ownership records are current, which is essential for effective corporate governance and shareholder communication.

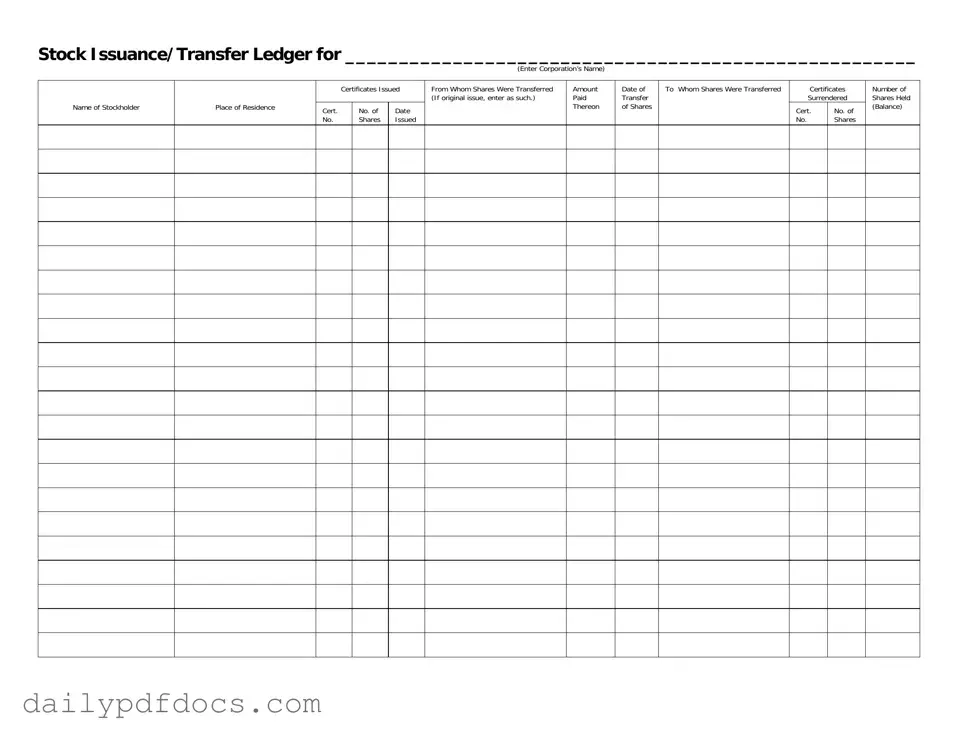

Preview - Stock Transfer Ledger Form

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Similar forms

The Stock Transfer Ledger form serves a critical role in the management of corporate stocks, tracking the issuance and transfer of shares. It shares similarities with several other documents commonly used in corporate governance and financial management. Below is a list of eight documents that exhibit comparable functions or features:

- Shareholder Register: Like the Stock Transfer Ledger, the shareholder register records the details of stockholders, including their names and addresses. It serves as an official record of ownership, documenting the number of shares held by each shareholder.

- Stock Certificate: This document represents ownership of shares in a corporation. Similar to the Stock Transfer Ledger, it contains information about the shareholder, including the number of shares owned and the certificate number, which aids in tracking ownership.

- Transfer Agreement: A transfer agreement formalizes the terms under which shares are sold or transferred. It parallels the Stock Transfer Ledger in that both documents must accurately reflect the transaction details, including the parties involved and the number of shares transferred.

- Dividend Payment Record: This document tracks the distribution of dividends to shareholders. It shares a similar purpose with the Stock Transfer Ledger in maintaining accurate records of shareholder transactions and ensuring that payments are made to the correct parties.

- Corporate Bylaws: While not a transactional document, corporate bylaws outline the rules governing the management of the corporation, including share transfers. They relate to the Stock Transfer Ledger by providing the framework within which stock transfers must occur.

- Annual Report: This document provides a comprehensive overview of a corporation's financial performance and shareholder information. It is similar to the Stock Transfer Ledger in that both include data relevant to shareholders and their equity in the company.

Mobile Home Bill of Sale: This document is essential for any mobile home transaction, as it officially transfers ownership and provides legal protection for both buyer and seller. To learn more, visit mobilehomebillofsale.com/blank-missouri-mobile-home-bill-of-sale.

- Form 10-K: This is a comprehensive annual report filed by publicly traded companies. It includes detailed financial information and disclosures, including stockholder information, making it similar to the Stock Transfer Ledger in its purpose of transparency and record-keeping.

- Stock Option Agreement: This agreement outlines the terms under which employees can purchase stock options. It is akin to the Stock Transfer Ledger, as both documents track ownership and transfer of stock, albeit in different contexts.

Each of these documents plays a vital role in corporate governance and the management of shareholder relationships, reinforcing the importance of accurate record-keeping and transparency in business operations.

Misconceptions

Misconceptions about the Stock Transfer Ledger form can lead to confusion and errors. Here are six common misunderstandings:

- It is only for large corporations. Many believe that only large companies need a Stock Transfer Ledger. In reality, any corporation, regardless of size, should maintain this record to track ownership changes.

- It is not necessary if the company has few shareholders. Some think that a small number of shareholders means a ledger is unnecessary. However, keeping accurate records is crucial for all corporations to ensure transparency and compliance.

- Only the original stock certificates need to be recorded. There is a misconception that only the initial issuance of shares must be noted. Every transfer of shares, regardless of the number of transactions, should be documented.

- It can be completed at any time. Many assume that the Stock Transfer Ledger can be filled out whenever convenient. In truth, it should be updated immediately following any transfer to maintain accuracy.

- It is the responsibility of the stockholder to maintain the ledger. Some believe that individual stockholders should manage their records. In fact, it is the corporation's duty to maintain the Stock Transfer Ledger accurately.

- Electronic records are not valid. There is a belief that only physical records are acceptable. However, electronic formats are valid as long as they meet the necessary legal requirements for record-keeping.

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger form tracks the issuance and transfer of stock shares within a corporation. |

| Information Required | It requires details such as the corporation’s name, stockholder information, certificate numbers, and share amounts. |

| Transfer Documentation | Each transfer must document the date of transfer and the parties involved in the transaction. |

| State-Specific Laws | In many states, the governing law for stock transfers is found in the Business Corporation Act. |

| Record Keeping | Maintaining an accurate Stock Transfer Ledger is crucial for compliance and corporate governance. |

| Balance Tracking | The form includes a section to track the number of shares held by each stockholder after transfers. |