Free Single-Member Operating Agreement Template

When starting a single-member LLC, having a well-crafted operating agreement is essential. This document serves as a roadmap for how your business will operate and outlines your rights and responsibilities as the sole owner. It includes key aspects such as the management structure, decision-making processes, and financial arrangements. By detailing how profits and losses will be handled, the agreement provides clarity and can help prevent misunderstandings down the line. Additionally, it can protect your personal assets by reinforcing the separation between your business and personal finances. While a single-member operating agreement may not be legally required in all states, having one can lend credibility to your business and demonstrate professionalism. Whether you’re just starting out or looking to formalize your existing business structure, this agreement is a vital tool for any single-member LLC owner.

Common Questions

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a document that outlines the management structure and operating procedures for a single-member limited liability company (LLC). It serves as a guideline for how the business will be run, even if there is only one owner. This agreement can help protect your personal assets and clarify your business operations.

Why do I need a Single-Member Operating Agreement?

Having a Single-Member Operating Agreement is important for several reasons. First, it provides a clear framework for your business operations, which can help prevent misunderstandings. Second, it reinforces the limited liability status of your LLC, protecting your personal assets from business liabilities. Lastly, it can be beneficial in situations like opening a business bank account or securing financing, as it demonstrates professionalism and organization.

What should be included in a Single-Member Operating Agreement?

Your Single-Member Operating Agreement should include several key elements. These typically consist of the name of the LLC, the purpose of the business, the management structure, and the rights and responsibilities of the member. Additionally, it may cover topics like profit distribution, decision-making processes, and procedures for amending the agreement in the future.

Is a Single-Member Operating Agreement legally required?

While a Single-Member Operating Agreement is not legally required in all states, it is highly recommended. Some states do not mandate the formation of an operating agreement for LLCs, but having one can provide significant legal protections and clarify your business operations. It’s a good practice to create one to ensure your business runs smoothly and to maintain the integrity of your LLC status.

Can I create my own Single-Member Operating Agreement?

Yes, you can create your own Single-Member Operating Agreement. Many resources are available online that provide templates and guidance. However, it’s essential to ensure that your agreement complies with your state’s laws and addresses your specific business needs. If you’re unsure, consulting a legal professional can provide added assurance and help tailor the agreement to your situation.

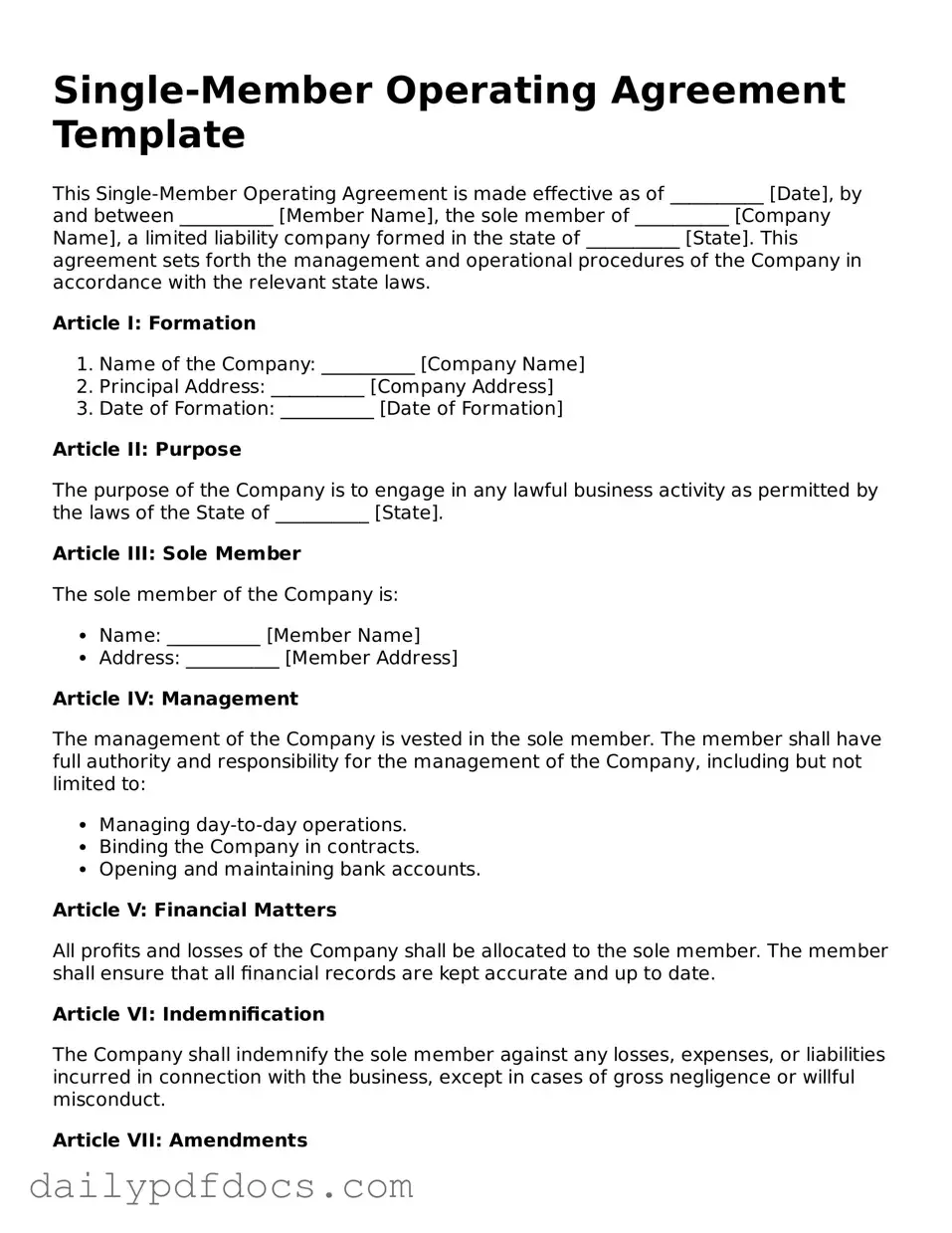

Preview - Single-Member Operating Agreement Form

Single-Member Operating Agreement Template

This Single-Member Operating Agreement is made effective as of __________ [Date], by and between __________ [Member Name], the sole member of __________ [Company Name], a limited liability company formed in the state of __________ [State]. This agreement sets forth the management and operational procedures of the Company in accordance with the relevant state laws.

Article I: Formation

- Name of the Company: __________ [Company Name]

- Principal Address: __________ [Company Address]

- Date of Formation: __________ [Date of Formation]

Article II: Purpose

The purpose of the Company is to engage in any lawful business activity as permitted by the laws of the State of __________ [State].

Article III: Sole Member

The sole member of the Company is:

- Name: __________ [Member Name]

- Address: __________ [Member Address]

Article IV: Management

The management of the Company is vested in the sole member. The member shall have full authority and responsibility for the management of the Company, including but not limited to:

- Managing day-to-day operations.

- Binding the Company in contracts.

- Opening and maintaining bank accounts.

Article V: Financial Matters

All profits and losses of the Company shall be allocated to the sole member. The member shall ensure that all financial records are kept accurate and up to date.

Article VI: Indemnification

The Company shall indemnify the sole member against any losses, expenses, or liabilities incurred in connection with the business, except in cases of gross negligence or willful misconduct.

Article VII: Amendments

This Operating Agreement may be amended only by a written instrument signed by the sole member.

Article VIII: Governing Law

This Agreement shall be governed by the laws of the State of __________ [State].

IN WITNESS WHEREOF, the undersigned has executed this Single-Member Operating Agreement as of the date first written above.

Sole Member: ________________________________

Name: __________ [Member Name]

Date: __________ [Date]

Similar forms

- Partnership Agreement: Similar to a Single-Member Operating Agreement, a Partnership Agreement outlines the roles and responsibilities of partners in a business. It details how profits and losses are shared, and how decisions are made, though it involves multiple members rather than just one.

Operating Agreement: This essential document outlines the operational framework of your LLC, providing clarity on management structure. For further information, the comprehensive Operating Agreement guidelines are available to assist in the creation of your agreement.

- Bylaws: Bylaws govern the internal management of a corporation. Like a Single-Member Operating Agreement, they establish rules for operation, including how meetings are conducted and how decisions are made, but they apply to corporations with multiple shareholders.

- Shareholder Agreement: This document is used in corporations and outlines the rights and obligations of shareholders. It shares similarities with a Single-Member Operating Agreement in terms of defining ownership interests and management roles, but it applies to multiple shareholders.

- Operating Agreement for Multi-Member LLC: This document serves a similar purpose as the Single-Member Operating Agreement but is designed for LLCs with more than one member. It includes provisions for profit distribution, management structure, and member responsibilities.

- Joint Venture Agreement: A Joint Venture Agreement outlines the terms of a partnership between two or more parties for a specific project. Like a Single-Member Operating Agreement, it defines roles and responsibilities, but it is temporary and project-focused.

- Franchise Agreement: This document governs the relationship between a franchisor and a franchisee. It includes operational guidelines and standards, similar to how a Single-Member Operating Agreement sets forth the operational framework for a single-member LLC.

- Employment Agreement: An Employment Agreement outlines the terms of employment between an employer and an employee. While it focuses on employment terms, it shares similarities with a Single-Member Operating Agreement in that it establishes clear expectations and responsibilities.

Misconceptions

The Single-Member Operating Agreement is an essential document for anyone who owns a single-member LLC. However, several misconceptions surround this form that can lead to confusion. Here are four common misunderstandings:

- It’s Not Necessary for Single-Member LLCs: Some believe that since they are the only owner, an operating agreement is unnecessary. However, having this document can help clarify your business structure and protect your personal assets.

- It Can Be Verbal: There’s a misconception that a verbal agreement suffices. While verbal agreements may hold some weight, a written document is far more reliable and can prevent disputes down the line.

- It’s Only for Legal Compliance: Many think the operating agreement is merely a formality to satisfy legal requirements. In reality, it serves as a foundational tool that outlines management procedures, decision-making processes, and financial distributions.

- It Cannot Be Changed: Some individuals assume that once an operating agreement is created, it cannot be altered. In fact, you can modify this document as your business evolves, ensuring it remains relevant to your operations.

Understanding these misconceptions can empower you to make informed decisions about your single-member LLC and its management. By clarifying the purpose and importance of an operating agreement, you can better protect your business interests.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement outlines the management structure and operational guidelines for a single-member LLC. |

| Governing Law | The agreement is governed by the laws of the state where the LLC is formed, such as Delaware, California, or Texas. |

| Importance | This document is crucial for establishing the legal separation between personal and business liabilities. |

| Flexibility | It allows the owner to customize management and operational procedures according to their specific needs. |