Free Release of Promissory Note Template

The Release of Promissory Note form serves a crucial function in the realm of financial transactions, particularly when a borrower has fulfilled their obligation to repay a loan. This form signifies the lender's acknowledgment that the debt has been satisfied and that the borrower is no longer liable for the amount previously owed. It typically includes essential details such as the names of the parties involved, the original loan amount, and the date of repayment. By documenting the release, both parties can avoid potential disputes in the future, ensuring clarity and peace of mind. The form may also require signatures from both the lender and borrower, which further solidifies the agreement. In essence, this form is a vital tool for protecting the interests of both parties, providing a clear record that the financial obligation has been fully met.

Popular Release of Promissory Note Templates:

Promissory Note Friendly Loan Agreement Format - Can include specific terms tied to the condition of the vehicle.

When creating a loan, it's crucial to ensure that all terms are clearly defined, which is where the New Jersey Promissory Note comes into play. This document not only formalizes the borrower's promise to repay the loan but also helps prevent misunderstandings by detailing essential elements like repayment schedules and interest rates. For those looking to draft or modify their note, resources such as newjerseyformspdf.com/editable-promissory-note/ can provide valuable templates and guidance.

Common Questions

What is a Release of Promissory Note form?

A Release of Promissory Note form is a legal document that signifies the discharge of obligations under a promissory note. When a borrower repays a loan in full, the lender issues this form to confirm that the borrower has fulfilled their repayment obligations. This document serves as proof that the debt has been satisfied, preventing any future claims regarding the same obligation.

Why is it important to obtain a Release of Promissory Note?

Obtaining a Release of Promissory Note is crucial for both parties involved in the transaction. For the borrower, it provides clear evidence that the debt has been paid off, which can be important for credit reporting and future borrowing. For the lender, issuing this release protects them from potential claims or disputes regarding the loan. It solidifies the conclusion of the financial relationship between the two parties.

How do I complete the Release of Promissory Note form?

To complete the form, you will need to provide specific details such as the names of both the borrower and lender, the original loan amount, and the date of repayment. Additionally, both parties should sign and date the document to validate it. Ensure that you keep a copy for your records, as this document may be required in the future to demonstrate that the loan has been settled.

What happens if I do not receive a Release of Promissory Note after repayment?

If you do not receive a Release of Promissory Note after repaying your loan, it is important to follow up with the lender. You should request the release in writing, as it is your right to receive this documentation. If the lender refuses or fails to respond, you may need to seek legal advice to understand your options for enforcing your rights regarding the repayment and securing the release.

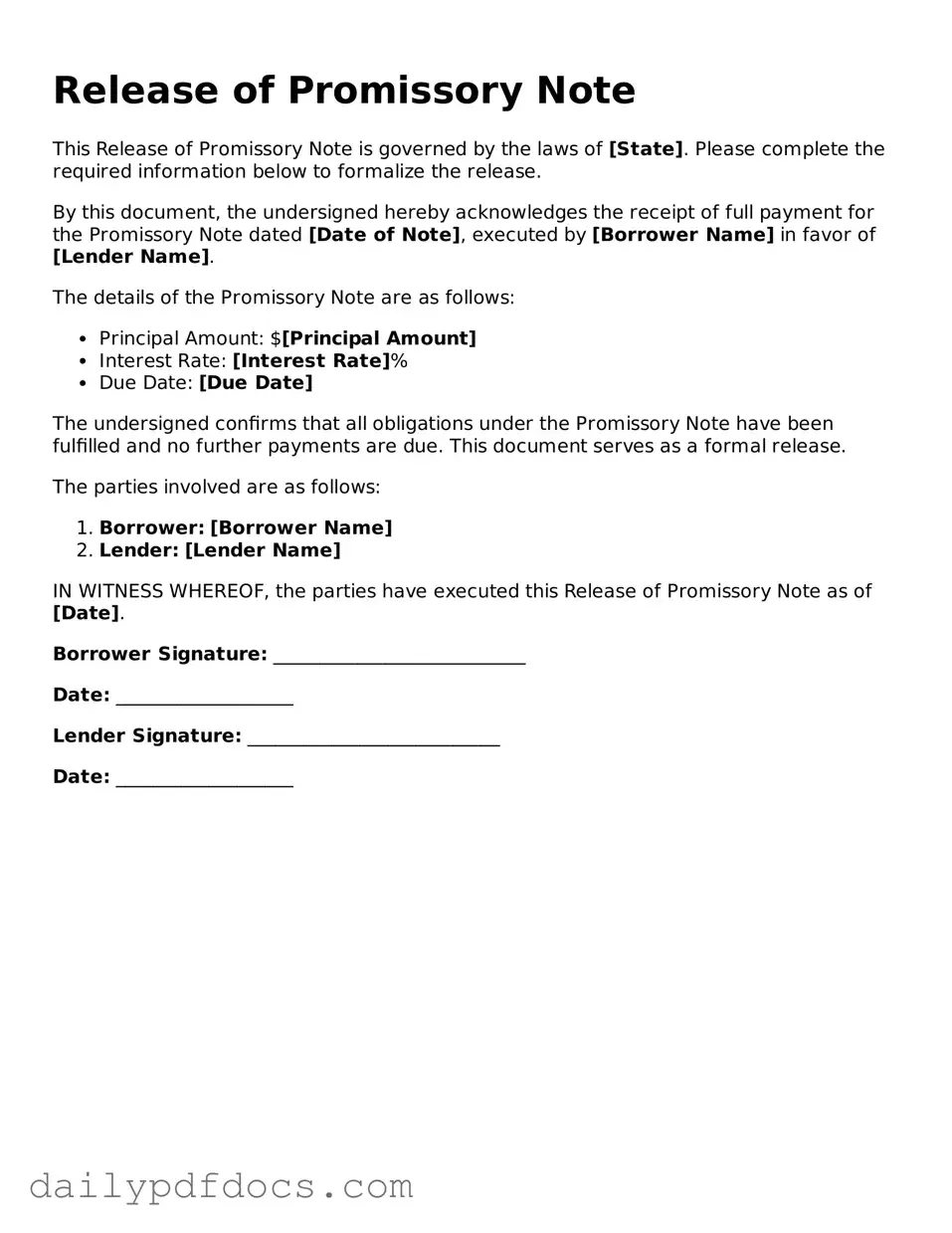

Preview - Release of Promissory Note Form

Release of Promissory Note

This Release of Promissory Note is governed by the laws of [State]. Please complete the required information below to formalize the release.

By this document, the undersigned hereby acknowledges the receipt of full payment for the Promissory Note dated [Date of Note], executed by [Borrower Name] in favor of [Lender Name].

The details of the Promissory Note are as follows:

- Principal Amount: $[Principal Amount]

- Interest Rate: [Interest Rate]%

- Due Date: [Due Date]

The undersigned confirms that all obligations under the Promissory Note have been fulfilled and no further payments are due. This document serves as a formal release.

The parties involved are as follows:

- Borrower: [Borrower Name]

- Lender: [Lender Name]

IN WITNESS WHEREOF, the parties have executed this Release of Promissory Note as of [Date].

Borrower Signature: ___________________________

Date: ___________________

Lender Signature: ___________________________

Date: ___________________

Similar forms

The Release of Promissory Note form shares similarities with several other important documents in financial and legal contexts. Below are four documents that exhibit comparable characteristics:

- Loan Agreement: This document outlines the terms and conditions under which a borrower receives funds from a lender. Like the Release of Promissory Note, it serves to formalize the relationship between the parties and includes details about repayment schedules and interest rates.

- Deed of Trust: A Deed of Trust secures a loan by transferring the title of a property to a trustee until the borrower repays the loan. Similar to the Release of Promissory Note, it signifies the completion of obligations once the debt is settled, providing a clear release of claims on the property.

- Settlement Agreement: This document is used to resolve disputes between parties without going to court. It often includes terms that release one party from further obligations, akin to how the Release of Promissory Note signifies the end of a borrower’s repayment responsibilities.

- Promissory Note Template: A customizable document essential for outlining the specifics of a loan agreement, ensuring all parties have a clear understanding of repayment terms. For access to diverse templates, visit All California Forms.

- Quitclaim Deed: A Quitclaim Deed transfers any interest one party has in a property to another without guaranteeing that the title is clear. It parallels the Release of Promissory Note in that both documents effectively relinquish claims or interests, ensuring that the involved parties have settled their respective obligations.

Misconceptions

The Release of Promissory Note form is often misunderstood, leading to confusion for those involved in financial agreements. Here are seven common misconceptions about this important document:

- It is only necessary for large loans. Many believe that the release form is only relevant for significant financial transactions. In reality, it is essential for any promissory note, regardless of the amount, to ensure that all parties are clear about their obligations.

- Once a promissory note is signed, it cannot be changed. Some individuals think that a signed note is set in stone. However, amendments can be made, and a release form is a way to formally document the conclusion of the agreement.

- The release form is just a formality. While it may seem like a simple piece of paper, the release of a promissory note serves a critical legal purpose. It protects both parties by providing clear evidence that the debt has been satisfied.

- It only protects the lender. Many assume that the release form is solely for the lender's benefit. In truth, it also protects the borrower by ensuring that they are not held liable for a debt that has already been paid.

- Verbal agreements are sufficient. Some people think that a verbal agreement to release a promissory note is enough. However, without a written release, disputes can arise, making it essential to have a formal document.

- It must be notarized to be valid. While notarization can add an extra layer of authenticity, it is not always required for a release form to be legally binding. The key is that both parties agree to the terms.

- The release form is only needed at the end of the loan term. Many believe that the release is only necessary when the loan is fully paid off. However, it can also be useful if the parties agree to modify or terminate the agreement early.

Understanding these misconceptions can help individuals navigate the complexities of financial agreements more effectively. Clarity around the release of a promissory note can lead to better financial practices and stronger relationships between parties.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note is a legal document that officially cancels a promissory note, indicating that the borrower has fulfilled their obligation to repay the loan. |

| Purpose | This form serves to provide proof that the debt has been settled, protecting the borrower's credit and ensuring the lender cannot pursue further claims on the same debt. |

| Governing Law | The laws governing the release of promissory notes can vary by state. For example, in California, the relevant laws are found in the California Civil Code. |

| Signature Requirement | The form must be signed by the lender to be valid. This signature confirms that the lender acknowledges the debt has been paid in full. |

| Record Keeping | It is essential for both parties to keep a copy of the signed Release of Promissory Note for their records, as it serves as proof of the transaction. |

| Filing | While not always required, some states may require the release to be filed with a local government office to ensure public record of the debt cancellation. |