Free Real Estate Purchase Agreement Template

The Real Estate Purchase Agreement form serves as a crucial document in the process of buying and selling property. This legally binding contract outlines the terms and conditions agreed upon by both the buyer and the seller. Key components include the purchase price, the property description, and the closing date, which collectively establish the framework for the transaction. Additionally, the agreement addresses contingencies, such as financing and inspections, that must be satisfied before the sale can be finalized. Both parties must also consider the earnest money deposit, which demonstrates the buyer's commitment to the purchase. Furthermore, the agreement typically includes provisions for disclosures, warranties, and any applicable fees, ensuring transparency and protecting the interests of all involved. Understanding these elements is essential for anyone navigating the real estate market, as they play a vital role in facilitating a smooth transaction.

Find Common Templates

Sample Power of Attorney for Property - Designate a trusted individual to act in your best interest regarding your property.

Additionally, for those looking for a reliable resource to help with the process, you can find a customizable template at Washington Templates, which can simplify the creation of your Mobile Home Bill of Sale form.

Who Owns Geico and Progressive - Consult with your team to ensure all necessary details are provided.

Konami Deck List - All information must be printed legibly for easy reading.

Real Estate Purchase Agreement - Tailored for Individual States

Real Estate Purchase Agreement Form Subtypes

Common Questions

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement serves as a binding contract once both parties have signed it. It typically includes details such as the purchase price, financing arrangements, and any contingencies that must be met before the sale can proceed.

What key elements should be included in the agreement?

The agreement should contain several important elements. These include the names and contact information of both the buyer and seller, a detailed description of the property, the purchase price, and the closing date. Additionally, it should outline any contingencies, such as inspections or financing requirements, and specify what happens if either party fails to fulfill their obligations.

How does the negotiation process work?

Negotiation is a crucial part of finalizing a Real Estate Purchase Agreement. After the buyer submits an offer, the seller can accept, reject, or counter the offer. This back-and-forth may involve adjustments to the price or terms. Both parties should communicate openly and be prepared to compromise to reach an agreement that satisfies everyone involved.

What happens after the agreement is signed?

Once both parties have signed the agreement, it becomes legally binding. The buyer will typically need to make an earnest money deposit to demonstrate their commitment. Following this, the buyer will conduct any necessary inspections and secure financing. The closing process will then take place, during which the final paperwork is signed, and ownership of the property is transferred.

Can the agreement be modified after signing?

Yes, modifications can be made to the agreement after it has been signed, but both parties must agree to any changes. This is often done through an addendum, which outlines the specific modifications. It is important to document any changes in writing to ensure clarity and avoid potential disputes in the future.

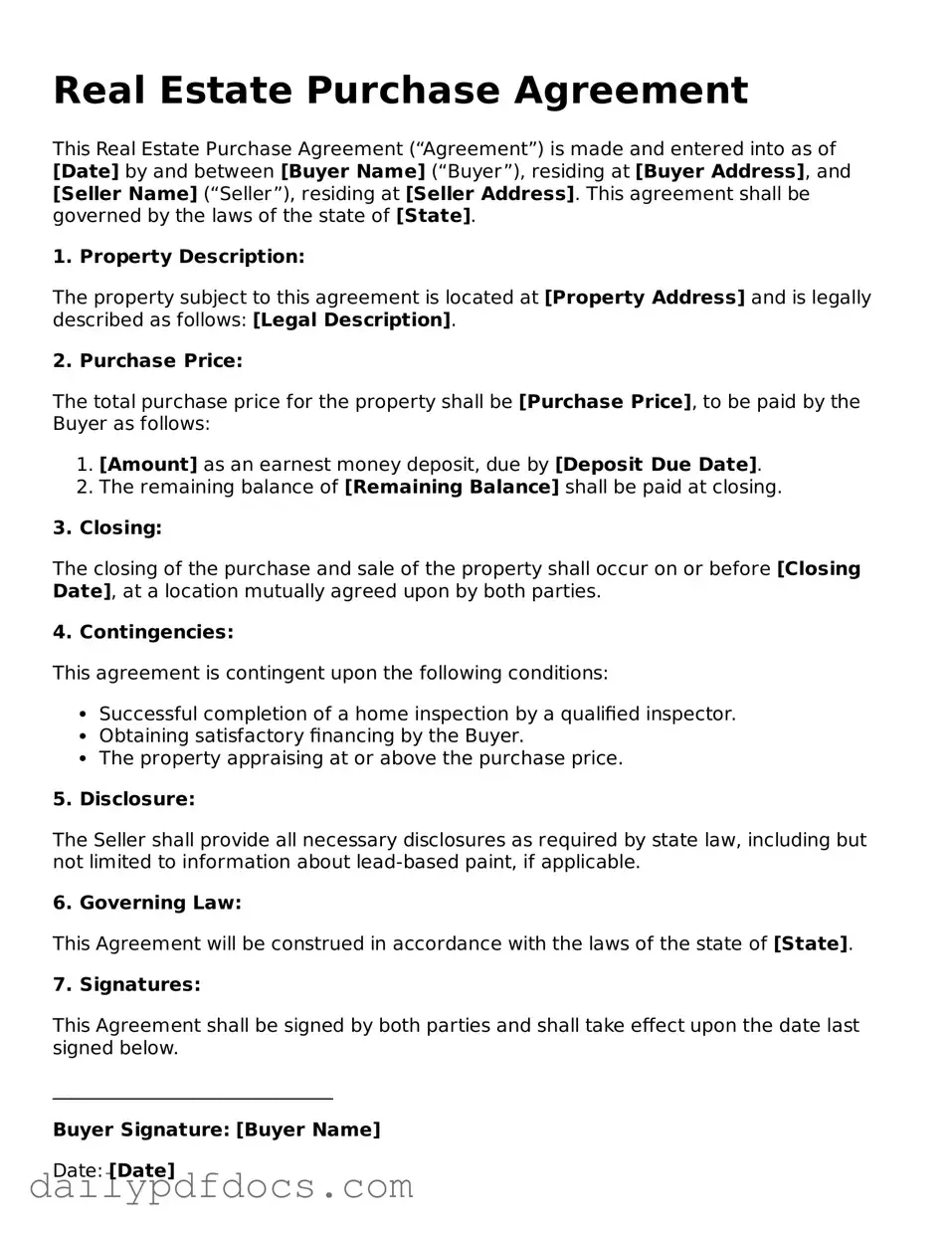

Preview - Real Estate Purchase Agreement Form

Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made and entered into as of [Date] by and between [Buyer Name] (“Buyer”), residing at [Buyer Address], and [Seller Name] (“Seller”), residing at [Seller Address]. This agreement shall be governed by the laws of the state of [State].

1. Property Description:

The property subject to this agreement is located at [Property Address] and is legally described as follows: [Legal Description].

2. Purchase Price:

The total purchase price for the property shall be [Purchase Price], to be paid by the Buyer as follows:

- [Amount] as an earnest money deposit, due by [Deposit Due Date].

- The remaining balance of [Remaining Balance] shall be paid at closing.

3. Closing:

The closing of the purchase and sale of the property shall occur on or before [Closing Date], at a location mutually agreed upon by both parties.

4. Contingencies:

This agreement is contingent upon the following conditions:

- Successful completion of a home inspection by a qualified inspector.

- Obtaining satisfactory financing by the Buyer.

- The property appraising at or above the purchase price.

5. Disclosure:

The Seller shall provide all necessary disclosures as required by state law, including but not limited to information about lead-based paint, if applicable.

6. Governing Law:

This Agreement will be construed in accordance with the laws of the state of [State].

7. Signatures:

This Agreement shall be signed by both parties and shall take effect upon the date last signed below.

______________________________

Buyer Signature: [Buyer Name]

Date: [Date]

______________________________

Seller Signature: [Seller Name]

Date: [Date]

Similar forms

- Lease Agreement: This document outlines the terms under which a landlord allows a tenant to occupy a property. Similar to a Real Estate Purchase Agreement, it specifies the property details, duration, and payment terms, but focuses on rental rather than ownership.

- Option to Purchase Agreement: This agreement provides a potential buyer the right to purchase a property at a predetermined price within a specified timeframe. Like the Real Estate Purchase Agreement, it includes essential details about the property and the terms of the sale.

- Purchase and Sale Agreement: Often used interchangeably with the Real Estate Purchase Agreement, this document formalizes the sale of property, detailing the price, closing date, and other conditions. Both agreements serve the same purpose but may vary in terminology based on jurisdiction.

- Property Disclosure Statement: This document informs potential buyers about the condition of the property, including any known issues. It complements the Real Estate Purchase Agreement by ensuring transparency regarding the property’s condition before the sale.

- Mobile Home Bill of Sale: Similar to other sale agreements, the Texas Mobile Home Bill of Sale is essential when transferring ownership of a mobile home. This form ensures that all necessary details are documented, vital for both buyer and seller to protect their interests. For more information, visit https://mobilehomebillofsale.com/blank-texas-mobile-home-bill-of-sale/.

- Title Insurance Policy: While not a purchase agreement, this document protects the buyer against any legal claims to the property. It relates closely to the Real Estate Purchase Agreement by ensuring that the buyer receives clear title to the property.

- Closing Disclosure: This form outlines the final terms and costs of the mortgage. It is similar to the Real Estate Purchase Agreement as it provides crucial financial details that both parties need to understand before finalizing the sale.

- Escrow Agreement: This document establishes the terms under which a neutral third party holds funds and documents until the transaction is complete. Like the Real Estate Purchase Agreement, it helps ensure that both parties fulfill their obligations.

- Home Inspection Report: This document provides an assessment of the property’s condition. It is similar to the Real Estate Purchase Agreement in that it influences the buyer's decision and may lead to negotiations regarding repairs or price adjustments.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. While the Real Estate Purchase Agreement outlines the terms of the sale, the deed is the final step in the process, formally completing the transaction.

Misconceptions

Understanding the Real Estate Purchase Agreement (REPA) is crucial for anyone involved in buying or selling property. However, several misconceptions can lead to confusion. Here are seven common misconceptions about the REPA:

-

It’s a standard form that requires no customization.

Many people believe that the REPA is a one-size-fits-all document. In reality, each agreement should be tailored to the specific transaction and parties involved. Customization can address unique terms and conditions relevant to the sale.

-

Once signed, the agreement cannot be changed.

Some assume that signing the REPA locks them into its terms indefinitely. However, parties can negotiate changes before the closing date, provided both agree to the modifications.

-

It only protects the seller’s interests.

This misconception overlooks the fact that the REPA is designed to protect both parties. Buyers have rights and protections outlined in the agreement, ensuring their interests are also safeguarded.

-

Verbal agreements are just as binding as written ones.

While verbal agreements can sometimes hold weight, they are often difficult to enforce. A written REPA provides clear documentation of the terms, making it the preferred method for establishing an agreement.

-

The REPA guarantees a successful closing.

Signing the REPA does not guarantee that the sale will close. Various factors, such as financing issues or inspection results, can affect whether the transaction proceeds as planned.

-

It’s only necessary for residential transactions.

Some people believe the REPA is only relevant for residential real estate. However, this agreement is applicable to commercial properties as well, serving as a critical document in various real estate transactions.

-

Real estate agents can fill it out without any legal input.

While agents can assist in completing the REPA, it is essential to have legal oversight. A qualified attorney can ensure that the agreement complies with state laws and adequately protects the parties involved.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Purchase Agreement is a legally binding contract between a buyer and seller outlining the terms of a real estate transaction. |

| Essential Elements | The agreement typically includes the purchase price, property description, and closing date. |

| Governing Law | The agreement is governed by state laws, which can vary significantly. For example, California's laws apply to agreements made within the state. |

| Contingencies | Common contingencies may include financing, inspections, and the sale of the buyer's current home. |

| Earnest Money | Buyers often provide earnest money to demonstrate their commitment, which is held in escrow until closing. |

| Disclosure Requirements | Sellers are usually required to disclose known defects or issues with the property, ensuring transparency. |

| Amendments | The agreement can be amended if both parties agree to the changes in writing, allowing flexibility. |

| Default Consequences | If either party defaults, the other may seek legal remedies, which could include damages or specific performance. |