Free Real Estate Power of Attorney Template

In the realm of real estate transactions, a Real Estate Power of Attorney (POA) serves as a vital tool that allows individuals to delegate authority over their property affairs to another person. This legal document can streamline processes such as buying, selling, or managing real estate, ensuring that decisions can be made efficiently, even when the property owner is unavailable. The form typically outlines specific powers granted to the agent, who acts on behalf of the principal, and may include the ability to sign contracts, handle negotiations, and manage financial transactions related to the property. Importantly, a Real Estate Power of Attorney can be tailored to meet the unique needs of the principal, whether it is for a one-time transaction or ongoing management of multiple properties. Additionally, it is essential to understand the implications of this document, including the rights of the agent and the responsibilities they assume, as well as the potential for revocation should circumstances change. By carefully considering the use of a Real Estate Power of Attorney, property owners can ensure their interests are well-represented, even in their absence.

Popular Real Estate Power of Attorney Templates:

Poa Car - This form is essential when you need someone to act in your stead for vehicle documentation.

The Arizona Power of Attorney form is a legal document that allows an individual, known as the principal, to designate another person, called the agent, to make decisions on their behalf. This form can cover various aspects, including financial matters and healthcare decisions. For more information on how to correctly execute this form, you can visit https://azformsonline.com/power-of-attorney/. Understanding its purpose and requirements is essential for anyone considering this important legal tool.

When Is Power of Attorney Needed - It is important to discuss your wishes with your agent before signing this document.

Revocation of Power of Attorney Form - A formal declaration that a power of attorney is no longer valid.

Common Questions

What is a Real Estate Power of Attorney?

A Real Estate Power of Attorney is a legal document that allows one person to act on behalf of another in real estate transactions. This could include buying, selling, or managing property. The person granting this authority is called the principal, while the person receiving it is known as the agent or attorney-in-fact. This arrangement can be very helpful when the principal is unable to be present for the transaction.

When should I use a Real Estate Power of Attorney?

You might consider using a Real Estate Power of Attorney if you are unable to attend a closing due to travel, health issues, or other commitments. It can also be useful if you are handling the affairs of someone who is incapacitated or otherwise unable to manage their property. This document ensures that the necessary actions can still be taken without delay.

How do I create a Real Estate Power of Attorney?

Creating a Real Estate Power of Attorney typically involves drafting the document with clear language that specifies the powers granted. It should include the names of the principal and agent, a description of the property involved, and the specific powers the agent will have. After drafting, the document usually needs to be signed by the principal in the presence of a notary public to ensure its validity.

Can I revoke a Real Estate Power of Attorney?

Yes, a Real Estate Power of Attorney can be revoked at any time as long as the principal is mentally competent. To revoke it, the principal should create a written notice stating the revocation and provide copies to the agent and any relevant parties, such as banks or real estate agents. This ensures that everyone is aware that the agent no longer has authority to act on behalf of the principal.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated, a durable Real Estate Power of Attorney remains in effect, allowing the agent to continue acting on their behalf. However, if the document is not durable, it may become void upon the principal's incapacity. Therefore, it is crucial to specify that the power of attorney is durable if that is the intent.

Are there any risks associated with granting a Real Estate Power of Attorney?

Yes, there are some risks involved. Granting someone power of attorney gives them significant control over your property. It's important to choose someone you trust completely. Misuse of this power can lead to financial loss or disputes. To mitigate risks, consider setting clear limits on the authority granted and regularly reviewing the arrangement.

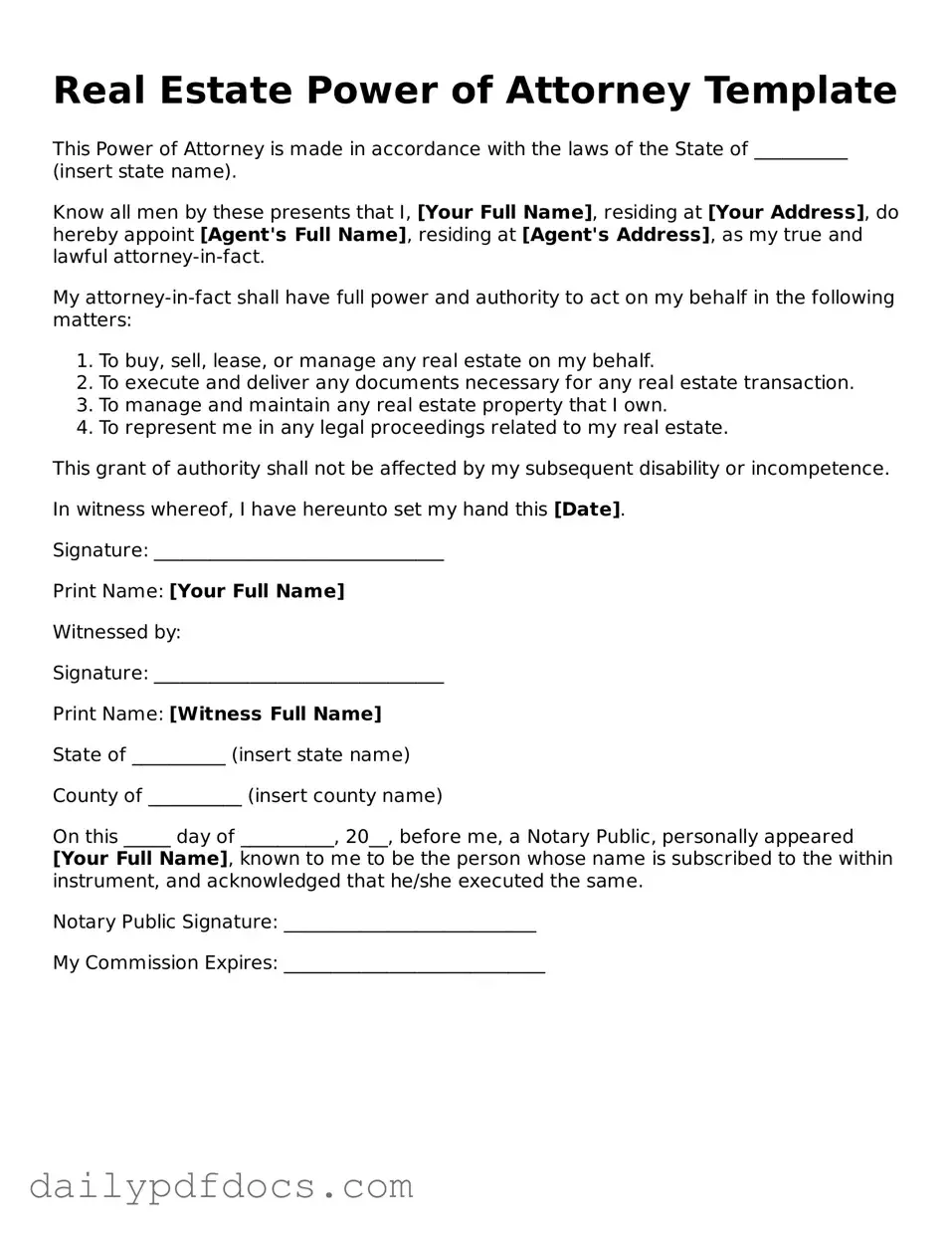

Preview - Real Estate Power of Attorney Form

Real Estate Power of Attorney Template

This Power of Attorney is made in accordance with the laws of the State of __________ (insert state name).

Know all men by these presents that I, [Your Full Name], residing at [Your Address], do hereby appoint [Agent's Full Name], residing at [Agent's Address], as my true and lawful attorney-in-fact.

My attorney-in-fact shall have full power and authority to act on my behalf in the following matters:

- To buy, sell, lease, or manage any real estate on my behalf.

- To execute and deliver any documents necessary for any real estate transaction.

- To manage and maintain any real estate property that I own.

- To represent me in any legal proceedings related to my real estate.

This grant of authority shall not be affected by my subsequent disability or incompetence.

In witness whereof, I have hereunto set my hand this [Date].

Signature: _______________________________

Print Name: [Your Full Name]

Witnessed by:

Signature: _______________________________

Print Name: [Witness Full Name]

State of __________ (insert state name)

County of __________ (insert county name)

On this _____ day of __________, 20__, before me, a Notary Public, personally appeared [Your Full Name], known to me to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same.

Notary Public Signature: ___________________________

My Commission Expires: ____________________________

Similar forms

Durable Power of Attorney: This document allows one person to make decisions on behalf of another, even if the latter becomes incapacitated. Like the Real Estate Power of Attorney, it grants authority to manage financial matters, including property transactions.

- Financial Power of Attorney: This document specifically grants authority for financial matters, allowing someone to manage finances on your behalf. Understanding this form is crucial, just like accessing resources from Washington Templates can help streamline the process.

Limited Power of Attorney: This form is tailored for specific tasks or a limited duration. Similar to the Real Estate Power of Attorney, it empowers someone to act on behalf of another, but with defined restrictions on the scope of authority.

Healthcare Power of Attorney: This document designates someone to make medical decisions for another individual. While focused on health matters, it shares the core principle of granting decision-making authority, akin to how the Real Estate Power of Attorney allows for property-related decisions.

Financial Power of Attorney: This form specifically authorizes an individual to handle financial affairs, including banking and investments. Like the Real Estate Power of Attorney, it provides a trusted person the ability to manage significant financial transactions.

Living Will: Although primarily focused on end-of-life decisions, a Living Will works in tandem with a Healthcare Power of Attorney. Both documents ensure that a person's wishes are respected, paralleling the Real Estate Power of Attorney's role in safeguarding property interests.

Misconceptions

Many people have misunderstandings about the Real Estate Power of Attorney form. This document can be a powerful tool in real estate transactions, but misconceptions can lead to confusion. Here are five common misconceptions:

-

It can only be used by real estate agents.

Many believe that only licensed real estate agents can use this form. In reality, anyone can designate another person to act on their behalf in real estate matters, as long as they are of sound mind and legal age.

-

It grants unlimited power.

Some think that a Power of Attorney gives the agent complete control over all personal affairs. However, the powers granted can be specifically limited to real estate transactions, meaning the agent can only act within the scope defined in the document.

-

It is permanent and cannot be revoked.

This is a common myth. A Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. This flexibility allows individuals to maintain control over their decisions.

-

It is only necessary for large transactions.

Many assume that a Power of Attorney is only required for significant real estate deals. However, it can be beneficial for any transaction, regardless of size, especially if the principal cannot be present to sign documents.

-

It requires a lawyer to create.

While legal advice can be helpful, it is not strictly necessary to have a lawyer draft a Power of Attorney. Many templates are available, and individuals can create one that meets their needs, provided it complies with state laws.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Power of Attorney is a legal document that allows one person to authorize another to act on their behalf in real estate transactions. |

| Purpose | This form is typically used for buying, selling, or managing real estate properties when the principal cannot be present. |

| Principal and Agent | The person granting authority is called the principal, while the person receiving authority is known as the agent or attorney-in-fact. |

| State-Specific Forms | Each state may have its own version of the form. For example, California follows the California Probate Code Section 4260. |

| Revocation | The principal can revoke the power of attorney at any time, provided they are mentally competent to do so. |

| Durability | A durable power of attorney remains in effect even if the principal becomes incapacitated, unless stated otherwise. |

| Notarization Requirements | Most states require the form to be notarized to be legally binding, ensuring authenticity and preventing fraud. |

| Limitations | Some powers may be restricted by law or by the terms set forth in the document itself, depending on the state. |