Free Quitclaim Deed Template

A Quitclaim Deed is a useful legal document that allows one party to transfer their interest in a property to another party without making any guarantees about the title. This form is often utilized in situations such as transferring property between family members, handling divorce settlements, or clearing up title issues. Unlike a warranty deed, which provides assurances about the title's validity, a quitclaim deed simply conveys whatever interest the grantor may have, if any. This means that the recipient, or grantee, receives the property without any promises regarding its condition or any existing liens. It’s important to understand that while a quitclaim deed can simplify the transfer process, it does not protect the grantee against potential claims from third parties. Therefore, it’s crucial to approach this form with a clear understanding of its implications and to consider seeking legal advice if there are any uncertainties about the property’s title or the transfer process itself.

Popular Quitclaim Deed Templates:

What Is a Deed in Lieu of Foreclosure? - This document allows a homeowner to voluntarily give up their property to the bank instead of going through a lengthy foreclosure process.

What Is a Gift Deed in Real Estate - Be aware of the potential tax implications of gifting property officially.

By utilizing a Washington Durable Power of Attorney, you can ensure that your financial and legal matters are handled by a trusted individual during times of incapacity, providing peace of mind. For those interested in this important legal document, consider accessing the resources available through Washington Templates to assist in the process.

Sample Lady Bird Deed Florida - Give your heirs peace of mind with a clear and direct transfer process.

Quitclaim Deed - Tailored for Individual States

Common Questions

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of property from one person to another. Unlike other types of deeds, it does not guarantee that the person transferring the property has clear title to it. Instead, it simply conveys whatever interest the grantor has in the property, if any.

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in situations where property is transferred between family members, such as during a divorce or inheritance. They can also be used to clear up title issues or to add someone to a property title. However, it is important to understand that this type of deed does not provide any protection against claims from other parties.

What are the risks associated with a Quitclaim Deed?

The main risk is that the grantee may not receive clear title to the property. If the grantor has debts or liens against the property, the new owner could be held responsible. Additionally, if there are disputes about ownership, a Quitclaim Deed does not provide any legal recourse for the grantee.

How do I complete a Quitclaim Deed?

To complete a Quitclaim Deed, you will need to fill out the form with the necessary information, including the names of the grantor and grantee, a description of the property, and the date of transfer. After completing the form, it must be signed by the grantor in the presence of a notary public. Some states may also require the form to be filed with a local government office.

Do I need a lawyer to create a Quitclaim Deed?

While it is not legally required to have a lawyer, it can be beneficial to consult one, especially if you have concerns about the property title or potential disputes. A lawyer can help ensure that the deed is completed correctly and that your interests are protected.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked. However, if the transfer was based on fraud or undue influence, legal action may be taken to challenge the deed. It is important to understand the implications of signing a Quitclaim Deed before proceeding.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor has clear title to the property and will defend against any claims. In contrast, a Quitclaim Deed offers no such assurances, making it a riskier option for the grantee.

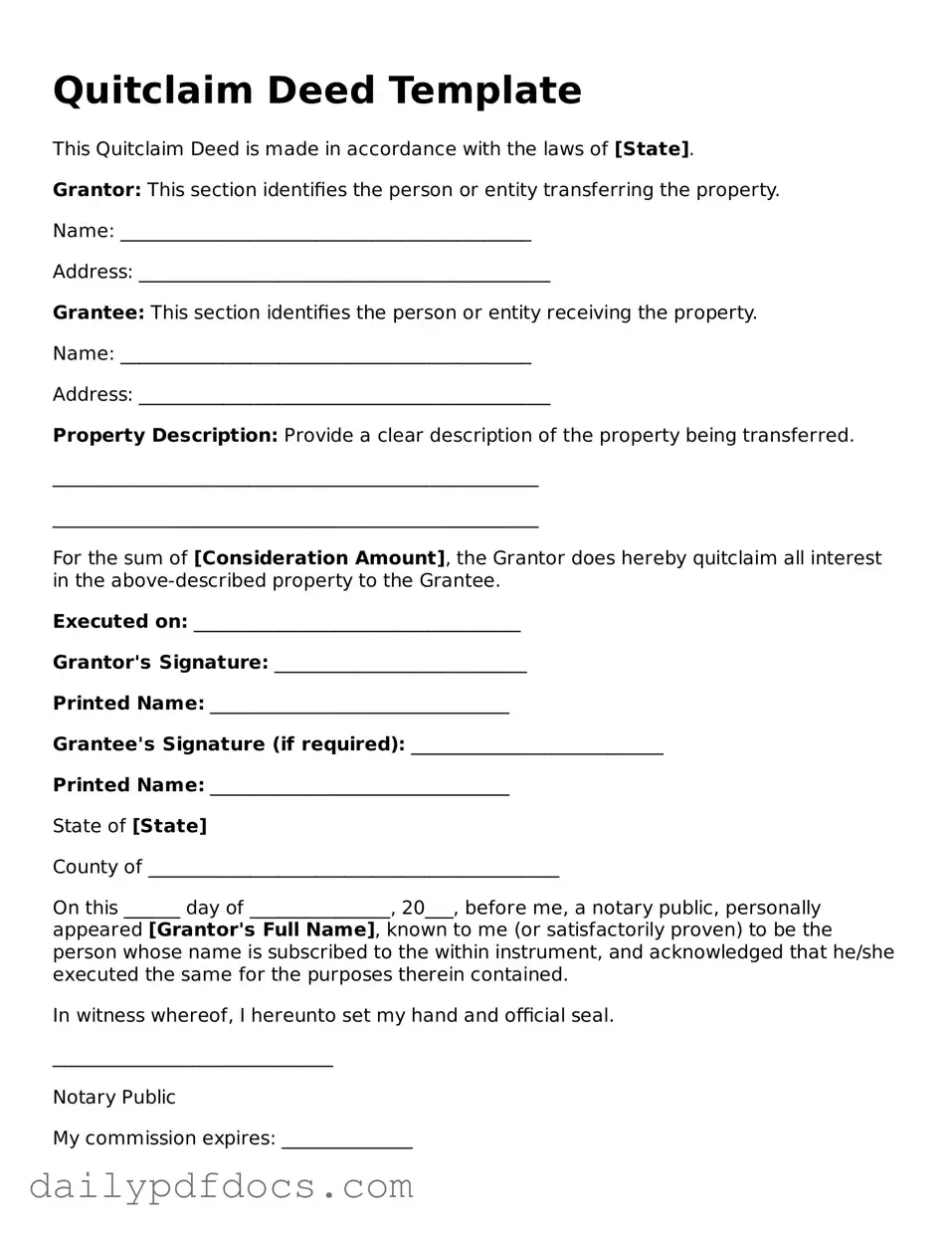

Preview - Quitclaim Deed Form

Quitclaim Deed Template

This Quitclaim Deed is made in accordance with the laws of [State].

Grantor: This section identifies the person or entity transferring the property.

Name: ____________________________________________

Address: ____________________________________________

Grantee: This section identifies the person or entity receiving the property.

Name: ____________________________________________

Address: ____________________________________________

Property Description: Provide a clear description of the property being transferred.

____________________________________________________

____________________________________________________

For the sum of [Consideration Amount], the Grantor does hereby quitclaim all interest in the above-described property to the Grantee.

Executed on: ___________________________________

Grantor's Signature: ___________________________

Printed Name: ________________________________

Grantee's Signature (if required): ___________________________

Printed Name: ________________________________

State of [State]

County of ____________________________________________

On this ______ day of _______________, 20___, before me, a notary public, personally appeared [Grantor's Full Name], known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

______________________________

Notary Public

My commission expires: ______________

Similar forms

Warranty Deed: This document transfers ownership of property and guarantees that the seller holds clear title to the property. Unlike a quitclaim deed, a warranty deed provides a warranty of title, meaning the seller is legally responsible for any claims against the property.

Grant Deed: Similar to a warranty deed, a grant deed conveys property ownership and includes some assurances about the title. However, it does not offer as extensive protections as a warranty deed. It guarantees that the property has not been sold to anyone else and that there are no undisclosed encumbrances.

Special Purpose Deed: This type of deed is used for specific situations, such as transferring property from a trust or during a divorce. Like a quitclaim deed, it often does not provide warranties or guarantees about the title, focusing instead on the specific circumstances of the transfer.

- Prenuptial Agreement Form: To safeguard your assets, consider the detailed prenuptial agreement form options available in Arizona.

Deed of Trust: While primarily used in real estate financing, a deed of trust involves the transfer of property to a trustee as security for a loan. It is similar to a quitclaim deed in that it can facilitate the transfer of property rights, but it serves a different purpose related to securing debt.

Affidavit of Title: This document is a sworn statement regarding the ownership of a property. It is often used in conjunction with other deeds to clarify the title's status. Like a quitclaim deed, it does not guarantee the title but provides information about the seller’s claims to ownership.

Misconceptions

Understanding the Quitclaim Deed form is essential for anyone involved in real estate transactions. However, several misconceptions often arise regarding its use and implications. Here are five common misconceptions:

-

Quitclaim Deeds Transfer Ownership Completely.

Many people believe that a quitclaim deed transfers full ownership of a property. While it does convey whatever interest the grantor has, it does not guarantee that the grantor holds any legal title to the property.

-

Quitclaim Deeds Are Only Used in Divorce Cases.

This form is often associated with divorce settlements, but it can be used in various situations, such as transferring property between family members or clearing up title issues.

-

Quitclaim Deeds Provide a Warranty of Title.

Unlike warranty deeds, quitclaim deeds do not provide any warranty or guarantee about the title. Buyers should be cautious, as they assume the risk of any existing claims or liens against the property.

-

All States Recognize Quitclaim Deeds in the Same Way.

Each state has its own laws governing quitclaim deeds. While they are generally recognized, the specific requirements for execution and recording can vary significantly.

-

Using a Quitclaim Deed Is a Complicated Process.

In reality, the process of using a quitclaim deed is relatively straightforward. However, it is advisable to seek legal guidance to ensure that all necessary steps are followed correctly.

By dispelling these misconceptions, individuals can make more informed decisions regarding property transfers and understand the limitations of a quitclaim deed.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of real estate from one party to another without any warranties or guarantees regarding the property title. |

| Usage | Commonly used in situations like transferring property between family members, clearing up title issues, or transferring property into a trust. |

| State-Specific Forms | Each state has its own version of the quitclaim deed form, often governed by state property laws. For example, California's quitclaim deed is governed by the California Civil Code Section 1092. |

| Limitations | This deed does not guarantee that the grantor has a valid title to the property. The grantee accepts the property "as is," which can lead to potential issues. |

| Tax Implications | While a quitclaim deed itself typically does not trigger tax consequences, the transfer may affect property taxes, depending on state and local regulations. |

| Execution Requirements | Most states require the quitclaim deed to be signed by the grantor and notarized to be legally valid. |

| Recording | It is advisable to record the quitclaim deed with the appropriate county office to provide public notice of the ownership change. |

| Revocation | Once executed, a quitclaim deed cannot be revoked unilaterally. The grantor must create a new document to reverse the transfer. |

| Common Misconceptions | Many people mistakenly believe that a quitclaim deed guarantees a clear title. In reality, it merely transfers whatever interest the grantor has in the property. |