Free Promissory Note Template

A promissory note is a crucial financial document that serves as a written promise to pay a specified amount of money to a designated party at a determined future date or on demand. This form is often utilized in various lending scenarios, including personal loans, business financing, and real estate transactions. It outlines essential details such as the principal amount, interest rate, payment schedule, and the consequences of default. By clearly stating the obligations of the borrower and the rights of the lender, a promissory note helps to establish a legal framework for the transaction. Additionally, it may include provisions for prepayment, late fees, and the governing law, which can vary by jurisdiction. Understanding the nuances of this form is important for both borrowers and lenders, as it not only facilitates trust in the lending process but also provides a clear recourse in case of disputes.

Find Common Templates

Baseball Tryout Evaluation Sheet - Assess the effectiveness of a player's warm-up routine before evaluation begins.

In order to ensure a smooth verification process, utilizing reliable resources like Washington Templates can simplify the completion of the Washington Employment Verification form, making it easier for both employers and employees to confirm essential job details.

Bill of Sale for Mobile Home Template - This document not only serves as proof of purchase but also as a record for future transactions.

Promissory Note - Tailored for Individual States

Promissory Note Form Subtypes

Common Questions

What is a Promissory Note?

A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It serves as a financial instrument that outlines the terms of the loan, including the amount borrowed, interest rate, and repayment schedule.

Who uses a Promissory Note?

Individuals and businesses use promissory notes in various situations. For example, a person borrowing money from a friend may use one to formalize the agreement. Similarly, businesses often issue promissory notes when seeking loans from banks or investors. They provide clarity and legal protection for both parties involved.

What are the key components of a Promissory Note?

A typical promissory note includes several essential components: the names of the borrower and lender, the principal amount, interest rate, repayment terms, due date, and any penalties for late payment. It may also include clauses regarding default and any collateral securing the loan.

Do I need a lawyer to create a Promissory Note?

While it's not strictly necessary to hire a lawyer, consulting one can be beneficial. A legal professional can help ensure that the note complies with state laws and that all terms are clear and enforceable. For simple loans, individuals often use templates available online.

Can a Promissory Note be transferred to someone else?

Yes, a promissory note can be transferred, a process known as endorsement. The original lender can sell or assign the note to another party. This new holder then has the right to collect payments from the borrower. It's essential that the transfer is documented properly to avoid any confusion.

What happens if the borrower defaults on the Promissory Note?

If the borrower fails to make payments as agreed, they are considered in default. The lender may then pursue various actions, such as demanding immediate payment of the remaining balance, charging late fees, or initiating legal proceedings to recover the owed amount. The specific actions depend on the terms outlined in the note.

Is a Promissory Note legally binding?

Yes, a promissory note is a legally binding document as long as it meets certain criteria. It must contain clear terms and be signed by both parties. If a dispute arises, a court can enforce the terms of the note, provided it complies with applicable laws.

Can a Promissory Note include a co-signer?

Absolutely. A co-signer can be included in a promissory note to provide additional security for the loan. This means that if the primary borrower defaults, the co-signer is also responsible for repaying the debt. This arrangement can make it easier for borrowers with less favorable credit histories to obtain loans.

What is the difference between a Promissory Note and a Loan Agreement?

A promissory note is generally simpler and focuses on the borrower's promise to repay the loan. In contrast, a loan agreement is more comprehensive and includes detailed terms and conditions, such as covenants and representations. Both documents serve important purposes, but a loan agreement typically covers more complex arrangements.

Can I modify the terms of a Promissory Note after it has been signed?

Yes, the terms of a promissory note can be modified, but both parties must agree to the changes. It's best to document any modifications in writing and have both parties sign the revised note to ensure clarity and enforceability. This helps prevent misunderstandings in the future.

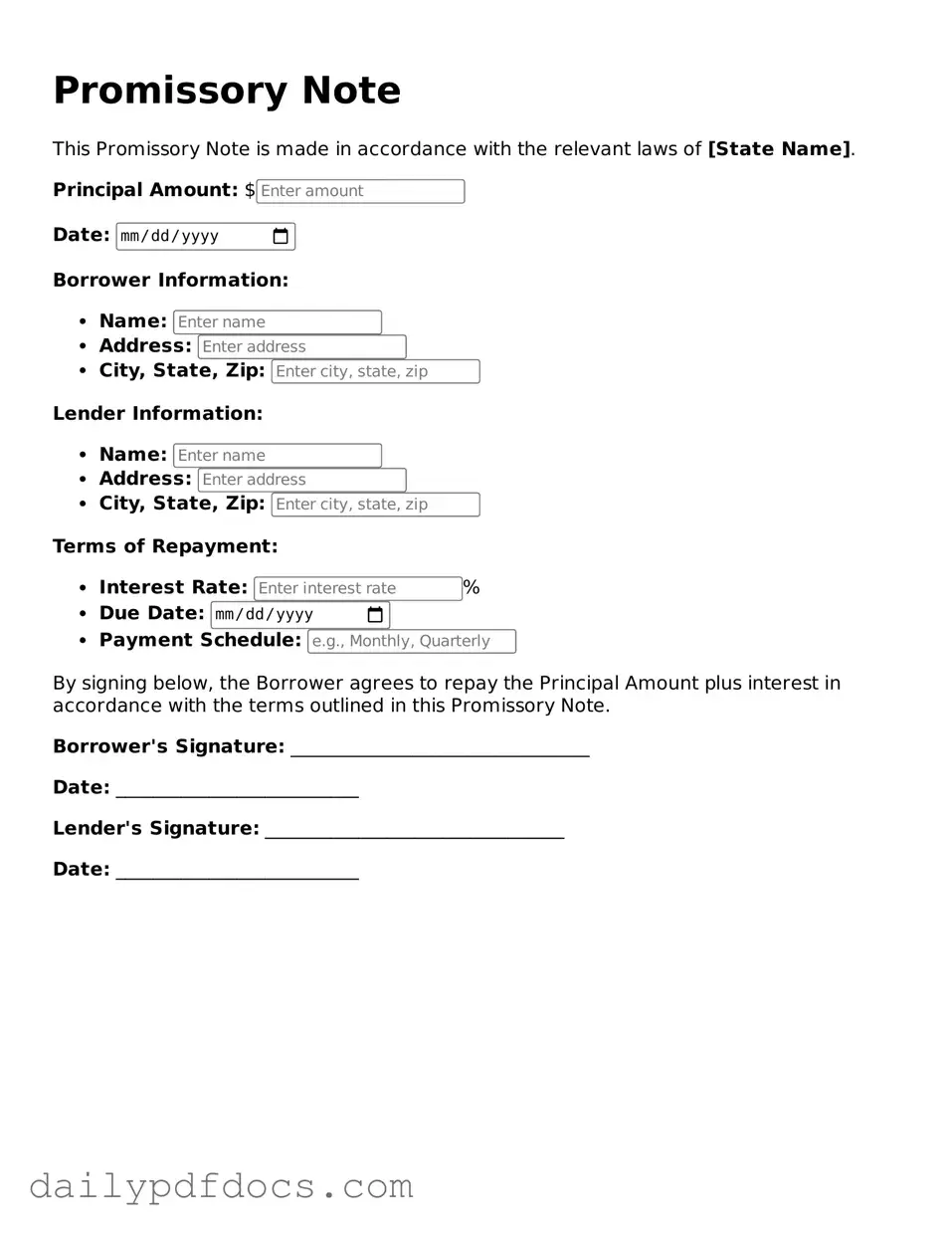

Preview - Promissory Note Form

Promissory Note

This Promissory Note is made in accordance with the relevant laws of [State Name].

Principal Amount: $

Date:

Borrower Information:

- Name:

- Address:

- City, State, Zip:

Lender Information:

- Name:

- Address:

- City, State, Zip:

Terms of Repayment:

- Interest Rate: %

- Due Date:

- Payment Schedule:

By signing below, the Borrower agrees to repay the Principal Amount plus interest in accordance with the terms outlined in this Promissory Note.

Borrower's Signature: ________________________________

Date: __________________________

Lender's Signature: ________________________________

Date: __________________________

Similar forms

A Promissory Note is a financial document that outlines a promise to pay a specific amount of money at a designated time. While it stands on its own, several other documents share similarities with it. Here are eight such documents:

- Loan Agreement: This document details the terms of a loan, including the amount borrowed, interest rates, and repayment schedules, similar to a Promissory Note but typically more comprehensive.

- Mortgage: A mortgage is a type of loan secured by real estate. Like a Promissory Note, it includes a promise to repay, but it also involves collateral, which is the property itself.

- Lease Agreement: This contract outlines the terms under which one party rents property from another. It shares the repayment promise aspect, as tenants agree to pay rent over a specified period.

- Mobile Home Bill of Sale: This legal document is essential for transferring ownership of a mobile home, detailing the buyer and seller's information, the mobile home's description, and sale price. For more information, you can visit mobilehomebillofsale.com/blank-new-york-mobile-home-bill-of-sale.

- Personal Guarantee: This document involves an individual agreeing to repay a debt if the primary borrower defaults. It mirrors the Promissory Note's promise to pay, adding personal accountability.

- Installment Agreement: This is an arrangement where a borrower agrees to repay a debt in installments. It resembles a Promissory Note in its structure of outlining payment terms over time.

- Credit Agreement: This document specifies the terms under which credit is extended to a borrower. Like a Promissory Note, it includes repayment obligations, often with interest.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. It includes a promise to pay, similar to a Promissory Note, albeit often for less than the original amount owed.

- Bond: A bond is a formal contract to repay borrowed money with interest at specified intervals. Like a Promissory Note, it represents a promise to pay, but it typically involves larger sums and is often issued by governments or corporations.

Misconceptions

Understanding the Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- All Promissory Notes are the Same: Many people believe that all promissory notes follow a standard format. In reality, the terms can vary widely based on the agreement between the parties involved.

- Promissory Notes are Only for Loans: While they are often associated with loans, promissory notes can also be used in other financial transactions, such as real estate deals or business agreements.

- A Promissory Note Guarantees Payment: Some assume that having a promissory note guarantees that payment will be made. However, if the borrower defaults, the lender may still need to pursue legal action to collect the debt.

- Notarization is Always Required: Many believe that a promissory note must be notarized to be valid. In most cases, notarization is not required, though it can add an extra layer of authenticity.

Addressing these misconceptions can help both borrowers and lenders navigate their financial agreements more effectively.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a defined time. |

| Key Elements | It typically includes the principal amount, interest rate, maturity date, and the signatures of the borrower and lender. |

| Governing Law | In the United States, promissory notes are generally governed by the Uniform Commercial Code (UCC) and state-specific laws. |

| Types | There are various types of promissory notes, including secured, unsecured, demand, and installment notes. |

| Enforceability | A properly executed promissory note can be legally enforced in a court of law, provided it meets all legal requirements. |

| State Variations | Different states may have specific requirements for promissory notes, such as witness signatures or notarization. |