Free Promissory Note for a Car Template

The Promissory Note for a Car is an essential document that outlines the terms of a loan for purchasing a vehicle. This form serves as a written agreement between the borrower and the lender, detailing the amount borrowed, the interest rate, and the repayment schedule. It specifies the consequences of defaulting on the loan, ensuring that both parties understand their rights and obligations. Additionally, the form may include provisions regarding collateral, which typically involves the car itself, providing security for the lender. By clearly defining the terms of the loan, the Promissory Note helps prevent misunderstandings and disputes, making it a crucial component of the car financing process. Understanding the structure and components of this document can empower borrowers and lenders alike, facilitating smoother transactions in the automotive market.

Popular Promissory Note for a Car Templates:

Release of Promissory Note - Having this release form adds credibility to the borrower’s financial history.

Understanding the significance of a Texas Promissory Note is crucial for anyone engaging in lending or borrowing money, as it ensures that all parties are clear on their obligations. For a comprehensive understanding of how to create this essential document, you can refer to All Texas Forms, which provides the necessary templates and guidance to navigate this process effectively.

Common Questions

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines the agreement between a borrower and a lender regarding the financing of a vehicle. This note specifies the amount borrowed, the interest rate, the repayment schedule, and any other terms agreed upon by both parties. It serves as a written promise to repay the loan under the specified conditions.

Why do I need a Promissory Note for a Car?

This document is essential for protecting both the lender and the borrower. For the lender, it provides a clear record of the loan agreement and the borrower's commitment to repay. For the borrower, it offers evidence of the terms of the loan, which can prevent misunderstandings in the future. Having a written note can also be beneficial if legal action becomes necessary due to non-payment.

What information should be included in the Promissory Note?

The Promissory Note should include several key details. These include the names and addresses of both the borrower and the lender, the total loan amount, the interest rate, the repayment schedule (including due dates), and any penalties for late payments. Additionally, it should state whether the loan is secured by the vehicle itself and outline the consequences of defaulting on the loan.

Can I customize the Promissory Note for my specific situation?

Yes, you can customize the Promissory Note to fit your specific needs. While there are standard elements that should be included, you may also add clauses that reflect unique agreements between you and the other party. For example, you might include terms regarding early repayment or specific conditions under which the loan may be considered in default.

What happens if I default on the loan?

If you default on the loan, the lender has the right to take action as outlined in the Promissory Note. This may include repossessing the vehicle if the loan is secured by it. Additionally, the lender may pursue legal action to recover the owed amount. It is crucial to communicate with the lender if you are facing difficulties in making payments, as they may be willing to work out a solution.

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding document once both parties have signed it. This means that both the borrower and the lender are obligated to adhere to the terms outlined in the note. If either party fails to meet their obligations, the other party can seek legal recourse to enforce the terms of the agreement.

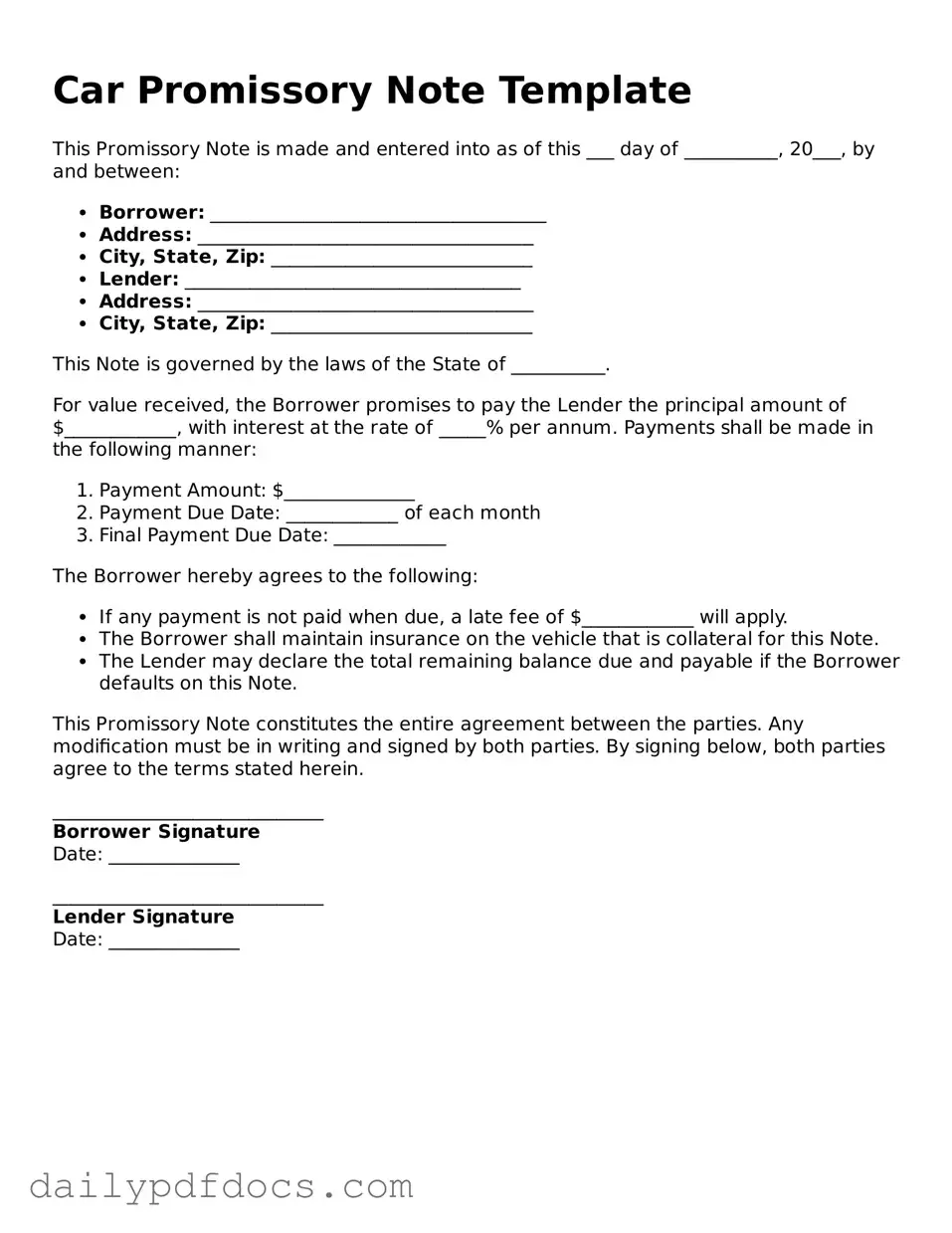

Preview - Promissory Note for a Car Form

Car Promissory Note Template

This Promissory Note is made and entered into as of this ___ day of __________, 20___, by and between:

- Borrower: ____________________________________

- Address: ____________________________________

- City, State, Zip: ____________________________

- Lender: ____________________________________

- Address: ____________________________________

- City, State, Zip: ____________________________

This Note is governed by the laws of the State of __________.

For value received, the Borrower promises to pay the Lender the principal amount of $____________, with interest at the rate of _____% per annum. Payments shall be made in the following manner:

- Payment Amount: $______________

- Payment Due Date: ____________ of each month

- Final Payment Due Date: ____________

The Borrower hereby agrees to the following:

- If any payment is not paid when due, a late fee of $____________ will apply.

- The Borrower shall maintain insurance on the vehicle that is collateral for this Note.

- The Lender may declare the total remaining balance due and payable if the Borrower defaults on this Note.

This Promissory Note constitutes the entire agreement between the parties. Any modification must be in writing and signed by both parties. By signing below, both parties agree to the terms stated herein.

_____________________________

Borrower Signature

Date: ______________

_____________________________

Lender Signature

Date: ______________

Similar forms

The Promissory Note for a Car is a key document in the financing of a vehicle. It establishes a borrower's promise to repay a loan, but it shares similarities with several other financial documents. Here are eight documents that are similar to a Promissory Note for a Car:

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of borrowing money. It includes details such as the loan amount, interest rate, and repayment schedule.

- Mortgage: A mortgage is a type of promissory note specifically for real estate. It secures the loan with the property itself, ensuring that the lender has a claim if the borrower defaults.

- Lease Agreement: While primarily used for renting property, a lease agreement can resemble a promissory note in that it outlines payment obligations for the duration of the lease term.

- New York Promissory Note: For those needing a formal loan agreement, access our comprehensive Promissory Note template to ensure clarity in your financial transactions.

- Personal Loan Agreement: This document is similar in nature to a promissory note, as it also details the borrower's commitment to repay a personal loan, including terms and conditions.

- Credit Card Agreement: A credit card agreement lays out the terms under which a borrower can use credit. It includes payment terms and interest rates, similar to a promissory note.

- Student Loan Agreement: This document specifies the terms of borrowing for educational purposes. It includes repayment schedules and interest rates, akin to a promissory note.

- Business Loan Agreement: For business financing, this agreement functions like a promissory note by detailing the loan amount, interest rate, and repayment plan specific to a business context.

- IOU (I Owe You): An informal acknowledgment of debt, an IOU is simpler than a promissory note but serves a similar purpose in recognizing a borrower's obligation to repay.

Misconceptions

Understanding the Promissory Note for a Car form is essential for anyone involved in financing a vehicle. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings regarding this important document.

- It is the same as a car loan agreement. Many people believe that a promissory note and a car loan agreement are identical. In reality, the promissory note is a legal document that outlines the borrower's promise to repay the loan, while the car loan agreement includes additional terms and conditions.

- Only banks can issue promissory notes. This is not true. Individuals can create promissory notes as well, especially in private sales where a buyer finances the purchase directly with the seller.

- A promissory note guarantees financing. A promissory note is a commitment to pay, but it does not guarantee that financing will be approved. Lenders still evaluate creditworthiness and other factors before approving a loan.

- Once signed, a promissory note cannot be changed. While it is difficult to change a signed promissory note, it can be amended if both parties agree to the changes. Documentation of the amendment is crucial.

- Promissory notes do not require interest. Although some promissory notes may be interest-free, many include interest rates. This depends on the agreement between the borrower and lender.

- They are only used for car purchases. Promissory notes are versatile and can be used for various types of loans, not just for purchasing vehicles. They are common in personal loans and other financing arrangements.

- Signing a promissory note means you own the car. Signing the note indicates a commitment to repay the loan, but ownership of the vehicle is typically transferred only after the loan is paid in full, depending on the terms of the agreement.

By clarifying these misconceptions, individuals can better navigate the process of financing a vehicle and understand their rights and obligations under a promissory note.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount for the purchase of a vehicle. |

| Key Components | It typically includes the names of the borrower and lender, the amount borrowed, interest rate, and repayment terms. |

| State-Specific Laws | In the U.S., the governing laws vary by state. For example, California follows the California Commercial Code. |

| Enforceability | The note is legally binding, meaning the lender can take legal action if the borrower fails to repay. |