Free Prenuptial Agreement Template

When couples decide to marry, they often consider various aspects of their future together, including financial matters. One important tool that can help clarify these issues is a prenuptial agreement. This legal document outlines how assets and debts will be managed during the marriage and what will happen in the event of a divorce. Key components of a prenuptial agreement include the identification of separate and marital property, provisions for spousal support, and guidelines for the division of assets. Couples can also address potential future income, inheritance, and business interests. By discussing these matters before tying the knot, partners can protect their individual interests and foster open communication. Ultimately, a well-crafted prenuptial agreement can provide peace of mind and a solid foundation for a lasting relationship.

Find Common Templates

Revocation of Power of Attorney Form - Signals that a previous arrangement is officially null and void.

The Ohio Lease Agreement form is a legally binding document that outlines the terms and conditions between a landlord and tenant for the rental of property in Ohio. It serves to protect the rights of both parties while ensuring that all expectations are clearly defined. This form includes details such as rent amount, lease duration, and responsibilities of each party, making it a critical tool for a successful rental arrangement. For more information, you can visit https://legalformspdf.com/.

New Roof Warranty - Learn about warranty exclusions to avoid misunderstandings.

Prenuptial Agreement - Tailored for Individual States

Common Questions

What is a prenuptial agreement?

A prenuptial agreement, often referred to as a prenup, is a legal contract between two individuals before they get married. This document outlines the division of assets and financial responsibilities in the event of a divorce or separation. It helps clarify expectations and protect individual interests, ensuring both parties understand their rights and obligations.

Why should I consider a prenuptial agreement?

Considering a prenuptial agreement can provide peace of mind for both partners. It protects personal assets, clarifies financial responsibilities, and can help prevent disputes in the future. If one partner has significant assets, debts, or children from a previous relationship, a prenup can address these complexities. Additionally, it encourages open communication about finances before marriage.

How do I create a prenuptial agreement?

To create a prenuptial agreement, both parties should discuss their financial situations and goals openly. It is advisable to consult with legal professionals to ensure the agreement complies with state laws and adequately protects both parties. Each person should have their own legal representation to avoid conflicts of interest. Once drafted, both parties must review, agree, and sign the document before the wedding.

Can a prenuptial agreement be modified after marriage?

Yes, a prenuptial agreement can be modified after marriage. Both parties must agree to any changes, and it is recommended to document these modifications formally. This ensures that any adjustments are legally binding. However, it is essential to consult with legal professionals to ensure that the updated agreement complies with state laws and remains enforceable.

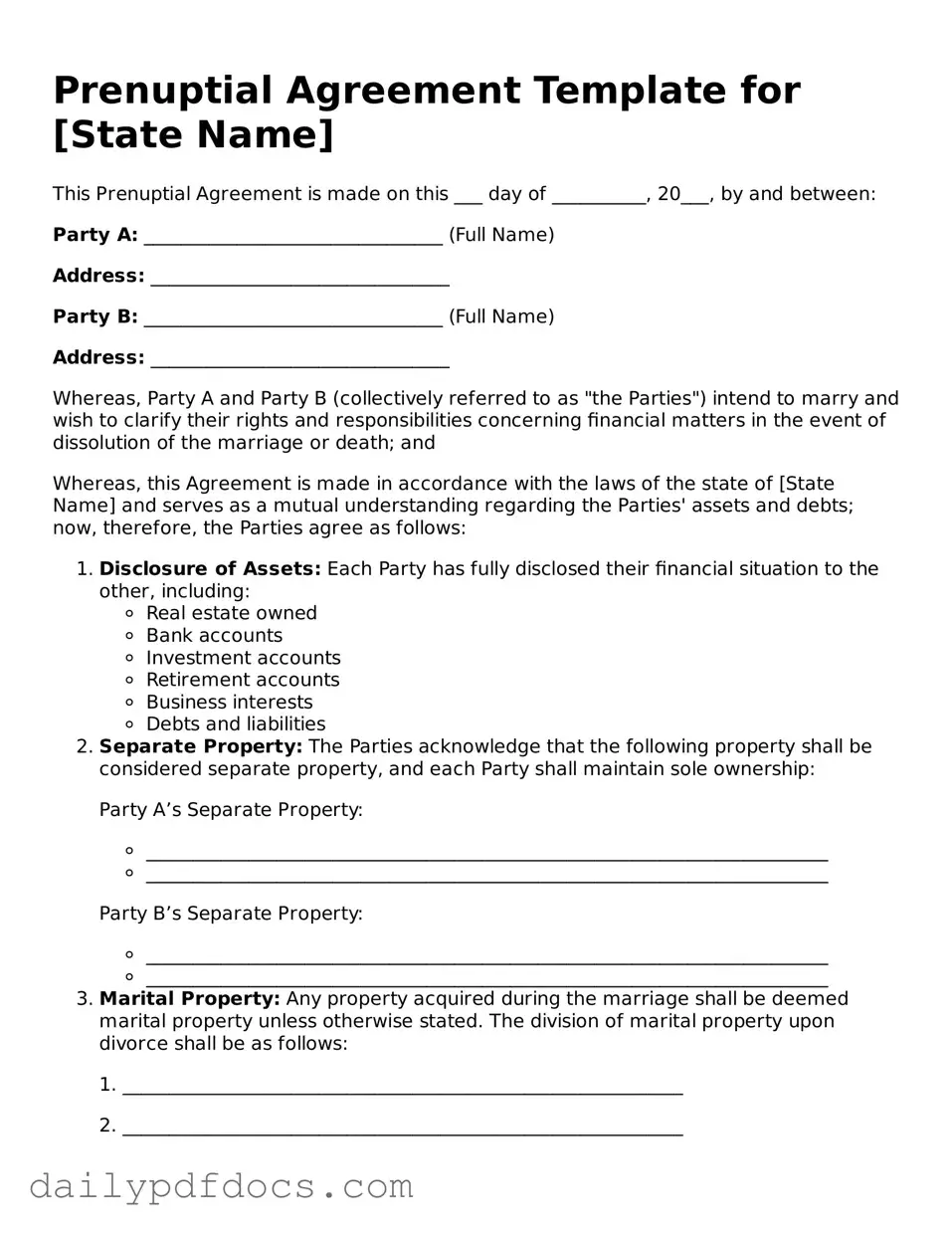

Preview - Prenuptial Agreement Form

Prenuptial Agreement Template for [State Name]

This Prenuptial Agreement is made on this ___ day of __________, 20___, by and between:

Party A: ________________________________ (Full Name)

Address: ________________________________

Party B: ________________________________ (Full Name)

Address: ________________________________

Whereas, Party A and Party B (collectively referred to as "the Parties") intend to marry and wish to clarify their rights and responsibilities concerning financial matters in the event of dissolution of the marriage or death; and

Whereas, this Agreement is made in accordance with the laws of the state of [State Name] and serves as a mutual understanding regarding the Parties' assets and debts; now, therefore, the Parties agree as follows:

- Disclosure of Assets: Each Party has fully disclosed their financial situation to the other, including:

- Real estate owned

- Bank accounts

- Investment accounts

- Retirement accounts

- Business interests

- Debts and liabilities

- Separate Property: The Parties acknowledge that the following property shall be considered separate property, and each Party shall maintain sole ownership:

- _________________________________________________________________________

- _________________________________________________________________________

- _________________________________________________________________________

- _________________________________________________________________________

- Marital Property: Any property acquired during the marriage shall be deemed marital property unless otherwise stated. The division of marital property upon divorce shall be as follows:

- Spousal Support: In the event of separation, divorce, or death, the Parties agree to the following terms regarding spousal support:

- _________________________________________________________________________

- _________________________________________________________________________

- Amendment and Revocation: This Agreement may only be amended or revoked in writing, signed by both Parties.

Party A’s Separate Property:

Party B’s Separate Property:

1. ____________________________________________________________

2. ____________________________________________________________

In witness whereof, the Parties have executed this Prenuptial Agreement as of the date first written above.

Party A Signature: ____________________________ Date: ______________

Party B Signature: ____________________________ Date: ______________

Witness Signature: ____________________________ Date: ______________

Witness Signature: ____________________________ Date: ______________

This document should be reviewed by a qualified attorney to ensure that it appropriately reflects the Parties' intentions and complies with current state laws.

Similar forms

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It outlines the distribution of assets and responsibilities in case of divorce or separation.

- Separation Agreement: This document is used when a couple decides to live apart. It details the terms of their separation, including property division and child custody arrangements.

- Divorce Settlement Agreement: This agreement is reached during divorce proceedings. It covers the division of assets, debts, and other relevant issues, ensuring both parties understand their rights and obligations.

- Co-habitation Agreement: For couples living together but not married, this document clarifies property rights and responsibilities. It can help prevent disputes in case of separation.

-

Motor Vehicle Bill of Sale: Essential for vehicle transactions in Minnesota, this form not only records the sale's details but also provides legal protection for both parties involved. To facilitate the process, you can download a blank document for easy use.

- Living Will: While primarily focused on healthcare decisions, a living will can include financial aspects, similar to how a prenuptial agreement addresses financial matters in a marriage.

- Will: A will outlines how a person’s assets will be distributed after their death. Like a prenuptial agreement, it addresses the management of assets, though it applies posthumously.

- Power of Attorney: This document allows someone to make decisions on behalf of another. It can relate to financial matters, similar to how a prenuptial agreement manages financial expectations in a marriage.

- Business Partnership Agreement: This agreement governs the relationship between business partners. It outlines financial contributions and profit distribution, akin to how a prenuptial agreement addresses financial assets in a marriage.

- Trust Agreement: A trust agreement establishes how assets will be managed for beneficiaries. It serves a similar purpose to a prenuptial agreement by detailing asset management, though it is often used for estate planning.

Misconceptions

Many people hold misconceptions about prenuptial agreements. Understanding these can help clarify their purpose and benefits. Here are four common misconceptions:

- Prenuptial agreements are only for wealthy individuals. This is not true. Anyone can benefit from a prenuptial agreement, regardless of their financial situation. It can help protect personal assets and clarify financial responsibilities.

- Prenuptial agreements are unromantic. Some believe that discussing a prenuptial agreement undermines the romantic aspect of marriage. In reality, it can foster open communication about finances, which is essential for a healthy relationship.

- Prenuptial agreements are only enforceable if both parties are represented by lawyers. While it is advisable for both parties to have legal representation, an agreement can still be enforceable without it. However, having legal counsel helps ensure that the agreement is fair and legally sound.

- Prenuptial agreements can cover anything. There are limitations on what can be included in a prenuptial agreement. For example, courts typically do not enforce provisions related to child custody or child support. These matters are determined based on the best interests of the child at the time of divorce.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a contract between two people before they marry, outlining the distribution of assets and responsibilities in case of divorce or separation. |

| Legal Requirements | For a prenuptial agreement to be enforceable, it generally must be in writing and signed by both parties. |

| State-Specific Laws | Each state has its own laws governing prenuptial agreements. For example, California follows the Uniform Premarital Agreement Act. |

| Disclosure | Both parties must fully disclose their assets and liabilities for the agreement to be valid. |

| Enforceability | A prenuptial agreement can be challenged in court if it is deemed unfair or if one party did not understand the terms. |

| Modification | Couples can modify a prenuptial agreement after marriage, but this typically requires a written amendment signed by both parties. |

| Common Misconceptions | Many believe prenuptial agreements are only for the wealthy, but they can benefit anyone wanting to protect their assets. |

| Timing | It is advisable to create a prenuptial agreement well before the wedding to avoid any pressure and ensure both parties can negotiate fairly. |

| Confidentiality | Prenuptial agreements can include clauses that maintain confidentiality about financial matters and personal information. |