Printable Transfer-on-Death Deed Document for Pennsylvania

The Pennsylvania Transfer-on-Death Deed (TODD) form is an important legal tool for property owners looking to streamline the transfer of real estate upon their death. This form allows individuals to designate beneficiaries who will automatically inherit their property, bypassing the often lengthy and costly probate process. By executing a TODD, property owners can maintain control over their assets during their lifetime while ensuring a smooth transition to their chosen heirs. It is crucial to understand that the TODD must be properly completed and recorded with the county to be effective. Additionally, the form provides flexibility, allowing the owner to revoke or change beneficiaries at any time before their death. This mechanism not only simplifies estate planning but also provides peace of mind, knowing that your property will go directly to your loved ones without unnecessary legal complications. Understanding the nuances of the Pennsylvania TODD form is essential for anyone looking to secure their estate and protect their heirs from potential disputes or delays. Time is of the essence; taking the necessary steps now can safeguard your wishes for the future.

More State-specific Transfer-on-Death Deed Forms

Ohio Transfer on Death Form - Different states may have varying requirements for the execution and recording of this deed.

In addition to its importance in the transaction process, it is advisable for both buyers and sellers to familiarize themselves with the specific requirements and legal implications of the form. For those looking to obtain a template, you can visit https://mobilehomebillofsale.com/blank-connecticut-mobile-home-bill-of-sale for a blank Connecticut Mobile Home Bill of Sale form.

Ladybird Deed Texas Form - Email or mail your Transfer-on-Death Deed to your local recorder’s office for filing.

Common Questions

What is a Transfer-on-Death Deed in Pennsylvania?

A Transfer-on-Death Deed allows property owners in Pennsylvania to transfer their real estate to a beneficiary upon their death. This deed is recorded while the owner is still alive, and it does not require the beneficiary to take any action until the owner's death. This can help avoid probate and simplify the transfer process.

Who can use a Transfer-on-Death Deed?

Any property owner in Pennsylvania can use a Transfer-on-Death Deed. This includes individuals and married couples. However, it’s important to ensure that the deed complies with state laws and that the property is eligible for transfer in this manner.

How does a Transfer-on-Death Deed work?

The owner fills out the Transfer-on-Death Deed form, naming one or more beneficiaries. After signing and dating the deed, it must be recorded with the county recorder of deeds. Once the owner passes away, the property automatically transfers to the named beneficiaries without going through probate.

Are there any limitations on using a Transfer-on-Death Deed?

Yes, there are limitations. For example, the deed cannot be used for property that is part of a trust or for property that has a mortgage that needs to be paid off. Additionally, the property must be residential real estate, such as a house or a condo, and not commercial property.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you must create a new deed or file a revocation form with the county. It’s important to ensure that any changes are properly recorded to avoid confusion later.

What happens if the beneficiary dies before the property owner?

If the beneficiary named in the Transfer-on-Death Deed dies before the property owner, the transfer will not occur. The property owner should consider naming alternate beneficiaries in the deed to ensure that the property still has a designated recipient.

Is there a fee to record a Transfer-on-Death Deed?

Yes, there is typically a fee to record a Transfer-on-Death Deed with the county recorder of deeds. The fee varies by county, so it’s advisable to check with the local office for the exact amount.

Do I need legal assistance to create a Transfer-on-Death Deed?

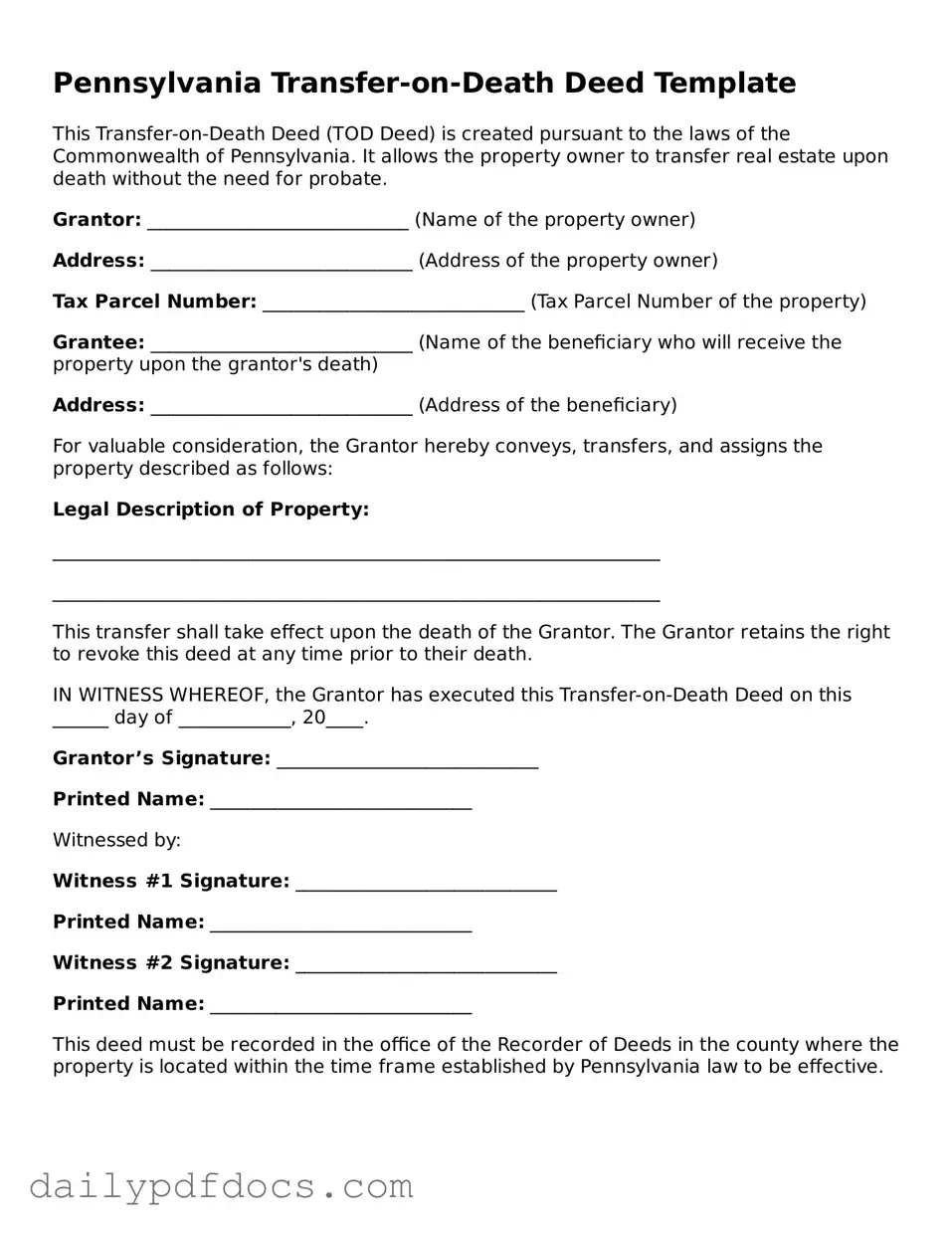

Preview - Pennsylvania Transfer-on-Death Deed Form

Pennsylvania Transfer-on-Death Deed Template

This Transfer-on-Death Deed (TOD Deed) is created pursuant to the laws of the Commonwealth of Pennsylvania. It allows the property owner to transfer real estate upon death without the need for probate.

Grantor: ____________________________ (Name of the property owner)

Address: ____________________________ (Address of the property owner)

Tax Parcel Number: ____________________________ (Tax Parcel Number of the property)

Grantee: ____________________________ (Name of the beneficiary who will receive the property upon the grantor's death)

Address: ____________________________ (Address of the beneficiary)

For valuable consideration, the Grantor hereby conveys, transfers, and assigns the property described as follows:

Legal Description of Property:

_________________________________________________________________

_________________________________________________________________

This transfer shall take effect upon the death of the Grantor. The Grantor retains the right to revoke this deed at any time prior to their death.

IN WITNESS WHEREOF, the Grantor has executed this Transfer-on-Death Deed on this ______ day of ____________, 20____.

Grantor’s Signature: ____________________________

Printed Name: ____________________________

Witnessed by:

Witness #1 Signature: ____________________________

Printed Name: ____________________________

Witness #2 Signature: ____________________________

Printed Name: ____________________________

This deed must be recorded in the office of the Recorder of Deeds in the county where the property is located within the time frame established by Pennsylvania law to be effective.

Similar forms

- Last Will and Testament: Like a Transfer-on-Death Deed, a Last Will outlines how a person's assets should be distributed after their death. However, a will must go through probate, while a Transfer-on-Death Deed allows for direct transfer without court involvement.

- Living Trust: A Living Trust holds assets during a person's lifetime and specifies how they are to be distributed upon death. Both documents facilitate the transfer of property, but a Living Trust can also manage assets during the grantor's lifetime.

- Power of Attorney: The Ohio Power of Attorney form is crucial for delegating decision-making authority to someone else, ensuring your preferences are honored. For more information, visit Ohio PDF Forms.

- Beneficiary Designation: Similar to a Transfer-on-Death Deed, beneficiary designations are used for accounts like life insurance or retirement plans. They allow for the direct transfer of assets to named beneficiaries upon death, bypassing probate.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows two or more people to own property together. When one owner passes away, their share automatically goes to the surviving owner, similar to how a Transfer-on-Death Deed operates.

- Payable-on-Death Accounts: These accounts allow individuals to name beneficiaries who will receive the funds upon their death. This is akin to a Transfer-on-Death Deed in that it facilitates direct transfer without going through probate.

- Transfer-on-Death Registration for Securities: This allows individuals to designate beneficiaries for stocks and bonds. Like the Transfer-on-Death Deed, it enables the direct transfer of ownership upon death.

- Life Estate Deed: This deed allows a person to retain the right to use property during their lifetime while transferring the remainder interest to another party. Both documents deal with future interests in property, though a Life Estate Deed is more complex.

- Revocable Trust: A Revocable Trust can be altered during the grantor's lifetime, allowing for flexibility in asset management and distribution. Similar to a Transfer-on-Death Deed, it can facilitate the transfer of property outside of probate.

- Family Limited Partnership: This structure allows family members to share ownership of assets while maintaining control. It can provide similar benefits to a Transfer-on-Death Deed by facilitating the transfer of assets while minimizing tax implications.

- Corporate Stock Transfer Agreements: These agreements outline how shares in a corporation can be transferred upon death. Like a Transfer-on-Death Deed, they ensure that ownership passes smoothly without court intervention.

Misconceptions

Understanding the Pennsylvania Transfer-on-Death Deed form can be challenging. Below are some common misconceptions that may lead to confusion.

- It is a will. Many people think a Transfer-on-Death Deed is the same as a will. In reality, it is a separate legal instrument that allows property to pass directly to a beneficiary upon the owner’s death, avoiding probate.

- It only applies to real estate. While primarily used for real estate, the Transfer-on-Death Deed can also be used for other types of property in certain situations. However, its main focus is on real estate transactions.

- It requires the consent of the beneficiary. The property owner can create and record a Transfer-on-Death Deed without the beneficiary’s knowledge or consent. The beneficiary will only learn of the deed upon the owner’s passing.

- It cannot be revoked. This form can be revoked or changed at any time before the owner’s death. The owner must follow the proper procedures to ensure the revocation is legally binding.

- It is only for married couples. Any individual can use a Transfer-on-Death Deed, regardless of marital status. It is a versatile tool for anyone looking to transfer property upon death.

- It avoids all taxes. While a Transfer-on-Death Deed can help avoid probate, it does not exempt the property from estate taxes or other financial obligations that may arise upon the owner's death.

- It guarantees the beneficiary will receive the property. If the beneficiary predeceases the owner or if certain conditions are not met, the property may not pass as intended. It’s essential to consider these factors when naming beneficiaries.

- It is the best option for everyone. A Transfer-on-Death Deed may not be suitable for all situations. Individuals should consider their unique circumstances and consult a legal expert to determine the best approach for property transfer.

By addressing these misconceptions, individuals can make informed decisions regarding their estate planning needs.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The Pennsylvania Transfer-on-Death Deed is governed by 20 Pa.C.S. § 6111.3. |

| Eligibility | Any individual who owns real estate in Pennsylvania can create a TOD Deed for their property. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the TOD Deed, and they can change this designation at any time before death. |

| Revocation | A TOD Deed can be revoked or modified by the property owner at any time, as long as they are competent to do so. |

| Effect on Creditors | The property transferred via a TOD Deed is still subject to the owner's debts and creditors until the owner's death. |

| Filing Requirements | The completed TOD Deed must be recorded in the county where the property is located to be effective. |