Printable Quitclaim Deed Document for Pennsylvania

The Pennsylvania Quitclaim Deed is an essential legal document used in real estate transactions to transfer ownership of property from one party to another. This form is particularly useful when the grantor wishes to convey their interest in a property without making any guarantees about the title. It is often employed in situations such as transferring property between family members, settling estates, or clearing up title issues. The Quitclaim Deed includes key information such as the names of the grantor and grantee, a legal description of the property, and the date of the transfer. Additionally, it may require notarization to ensure the document is legally binding. Understanding the Quitclaim Deed is crucial for anyone involved in property transactions in Pennsylvania, as it provides a straightforward method for conveying property rights while minimizing potential disputes over ownership. Properly completing this form can facilitate a smooth transfer and help protect the interests of all parties involved.

More State-specific Quitclaim Deed Forms

Quit Claim Deed Form Texas Pdf - A Quitclaim Deed is often used in divorce settlements to transfer property ownership.

To establish effective communication and understanding among employees, it is vital to reference the updated Employee Handbook guidelines. This document serves as a key resource outlining essential company policies and expectations, ensuring all team members are informed and aligned. For thorough insights into the company’s practices, consider exploring the detailed overview of the Employee Handbook resources available online.

Quit Claim Deed Form Ohio - It is important to properly fill out a Quitclaim Deed to avoid misunderstandings.

Florida Quit Claim Deed Filled Out - A quitclaim deed is a legal document used to transfer ownership of real estate from one person to another without any guarantees.

How Much Does an Attorney Charge for a Quit Claim Deed - This form clarifies ownership among co-owners of a property.

Common Questions

What is a Quitclaim Deed in Pennsylvania?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. In Pennsylvania, this type of deed allows the seller, or grantor, to convey their interest in a property to the buyer, or grantee, without guaranteeing that the title is clear. Essentially, the grantor is saying, "I am transferring whatever interest I have in this property, but I make no promises about its condition or any liens against it."

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in situations where the parties know each other well, such as between family members or in divorce settlements. They are also commonly used to clear up title issues or to add or remove someone from the title of a property. However, if you are purchasing property from someone you do not know, a Quitclaim Deed may not be the best option, as it does not provide the same protections as a warranty deed.

How do I complete a Quitclaim Deed in Pennsylvania?

To complete a Quitclaim Deed, you will need to provide specific information, including the names of the grantor and grantee, a description of the property, and the date of the transfer. It is important to ensure that the deed is signed by the grantor in the presence of a notary public. Once completed, the deed should be filed with the county recorder of deeds where the property is located to make the transfer official.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. In contrast, a Quitclaim Deed transfers whatever interest the grantor has without any warranties. Because of this, a Warranty Deed offers more protection to the grantee.

Are there any tax implications when using a Quitclaim Deed in Pennsylvania?

Yes, there can be tax implications when using a Quitclaim Deed. In Pennsylvania, the transfer of real estate may be subject to a real estate transfer tax. This tax is typically calculated based on the sale price or the fair market value of the property. It is advisable to consult with a tax professional or attorney to understand the specific tax obligations associated with your transaction.

Can I revoke a Quitclaim Deed after it has been executed?

Once a Quitclaim Deed has been executed and recorded, it generally cannot be revoked unilaterally. The transfer of ownership is considered final. If the grantor wishes to regain ownership, they would typically need to execute a new deed transferring the property back, which may require the consent of the grantee.

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to have an attorney prepare a Quitclaim Deed, it is highly recommended. An attorney can help ensure that the deed is properly drafted, executed, and recorded. They can also provide guidance on any potential legal issues that may arise during the transfer process.

What happens if there are liens on the property when using a Quitclaim Deed?

If there are liens on the property, a Quitclaim Deed does not remove them. The grantee takes on the property subject to any existing liens or encumbrances. This means that the new owner may be responsible for paying off those liens, which can include mortgages, tax liens, or other claims against the property.

How do I find a Quitclaim Deed form for Pennsylvania?

Quitclaim Deed forms can often be found online through legal websites or state government resources. Many counties in Pennsylvania also provide templates that can be downloaded and filled out. It is important to ensure that any form used complies with Pennsylvania law and includes all necessary information.

Where do I file a Quitclaim Deed in Pennsylvania?

A Quitclaim Deed must be filed with the county recorder of deeds in the county where the property is located. This filing makes the transfer of ownership a matter of public record. There may be a small fee associated with the filing, and it is advisable to check with the local recorder’s office for specific requirements and procedures.

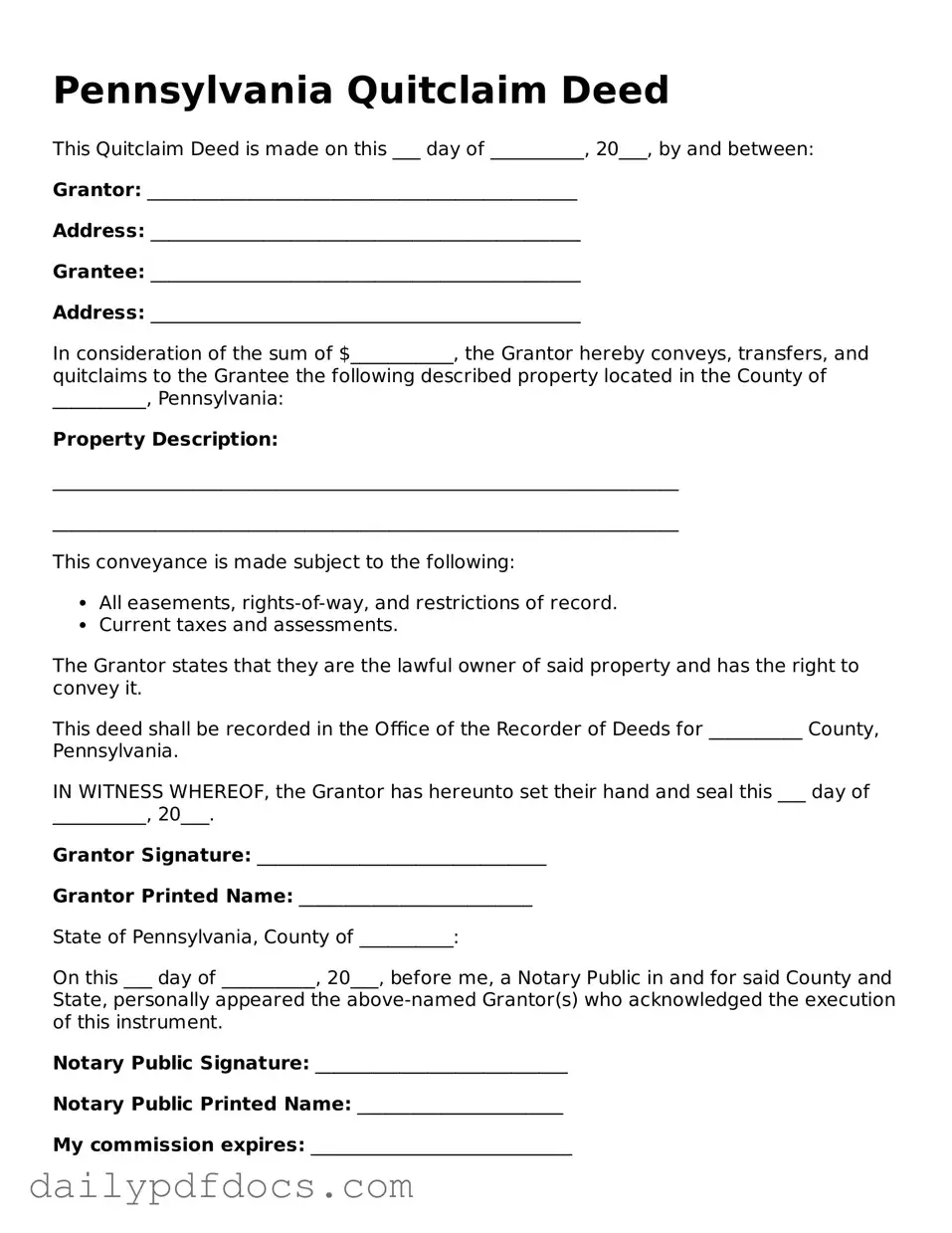

Preview - Pennsylvania Quitclaim Deed Form

Pennsylvania Quitclaim Deed

This Quitclaim Deed is made on this ___ day of __________, 20___, by and between:

Grantor: ______________________________________________

Address: ______________________________________________

Grantee: ______________________________________________

Address: ______________________________________________

In consideration of the sum of $___________, the Grantor hereby conveys, transfers, and quitclaims to the Grantee the following described property located in the County of __________, Pennsylvania:

Property Description:

___________________________________________________________________

___________________________________________________________________

This conveyance is made subject to the following:

- All easements, rights-of-way, and restrictions of record.

- Current taxes and assessments.

The Grantor states that they are the lawful owner of said property and has the right to convey it.

This deed shall be recorded in the Office of the Recorder of Deeds for __________ County, Pennsylvania.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand and seal this ___ day of __________, 20___.

Grantor Signature: _______________________________

Grantor Printed Name: _________________________

State of Pennsylvania, County of __________:

On this ___ day of __________, 20___, before me, a Notary Public in and for said County and State, personally appeared the above-named Grantor(s) who acknowledged the execution of this instrument.

Notary Public Signature: ___________________________

Notary Public Printed Name: ______________________

My commission expires: ____________________________

Similar forms

- Warranty Deed: A warranty deed provides a guarantee that the seller has clear title to the property and the right to sell it. Unlike a quitclaim deed, it offers legal protection to the buyer against future claims on the property.

- Mobile Home Bill of Sale: This document is essential for transferring ownership of a mobile home and includes important details such as buyer and seller information, mobile home description, and sale price. To learn more about this form, visit Washington Templates.

- Grant Deed: A grant deed transfers ownership of property and includes promises that the property has not been sold to anyone else. This document, like a quitclaim deed, conveys interest but offers more assurances about the title.

- Deed of Trust: A deed of trust is used in real estate transactions to secure a loan. While it does not transfer ownership outright, it is similar in that it involves the transfer of property rights, but it serves as collateral for a loan.

- Special Purpose Deed: This type of deed is used for specific transactions, such as transferring property between family members or in divorce settlements. It shares similarities with a quitclaim deed in that it may not provide warranties about the title.

- Affidavit of Title: An affidavit of title is a sworn statement confirming the seller's ownership of the property and that there are no liens or claims against it. While it does not transfer property, it can accompany a quitclaim deed to provide additional assurance about the title.

Misconceptions

When it comes to the Pennsylvania Quitclaim Deed, several misconceptions can lead to confusion. Understanding the truth behind these myths is essential for anyone considering using this type of deed.

- Misconception 1: A quitclaim deed transfers ownership of property without any guarantees.

- Misconception 2: Quitclaim deeds are only for transferring property between family members.

- Misconception 3: A quitclaim deed can remove a person's name from a mortgage.

- Misconception 4: Quitclaim deeds are only valid if notarized.

- Misconception 5: Using a quitclaim deed is the same as using a warranty deed.

This is true, but it’s often misunderstood. A quitclaim deed does transfer ownership, but it does not guarantee that the title is free of defects. The new owner takes on any risks associated with the property’s title.

While they are commonly used in family transactions, quitclaim deeds can be used in any situation where the parties agree to the transfer. This includes sales, gifts, or even resolving disputes.

This is incorrect. A quitclaim deed transfers ownership of the property but does not affect the mortgage. The original borrower remains responsible for the loan unless the lender agrees to release them.

In Pennsylvania, a quitclaim deed must be signed by the grantor and notarized to be valid. However, it also needs to be recorded with the county to provide public notice of the transfer.

This is a significant misconception. A warranty deed provides guarantees about the title, including protection against claims. In contrast, a quitclaim deed offers no such assurances, making it a riskier option for buyers.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership interest in a property without guaranteeing that the title is clear. |

| Governing Law | The Pennsylvania Quitclaim Deed is governed by Title 21, Chapter 5 of the Pennsylvania Consolidated Statutes. |

| Use Cases | Commonly used between family members or in situations where the parties know each other well, such as transferring property to a trust. |

| Limitations | The quitclaim deed does not provide any warranties; therefore, the grantee assumes the risk of any title issues. |