Printable Promissory Note Document for Pennsylvania

In Pennsylvania, a promissory note serves as a crucial financial document that outlines the terms of a loan agreement between a borrower and a lender. This form typically includes essential details such as the amount borrowed, the interest rate, and the repayment schedule. It also specifies the due date for payments and any penalties for late payments. Both parties must understand their rights and obligations as outlined in the note. The document can be simple or complex, depending on the specific terms agreed upon. Importantly, a promissory note can be secured or unsecured, which means it may or may not involve collateral. Understanding these aspects is vital for anyone entering into a loan agreement in Pennsylvania, as it helps ensure clarity and legal protection for both parties involved.

More State-specific Promissory Note Forms

Promissory Note Template Florida Pdf - This note is widely recognized and accepted in various lending situations across the country.

Free Promissory Note Template Texas - It may include details about collateral if the loan is secured by an asset.

Ohio Promissory Note - Both parties should retain a copy of the signed promissory note for their records.

Having a proper Texas Mobile Home Bill of Sale is essential in real estate transactions involving mobile homes, as it helps clarify the ownership transfer process and protects both the buyer and the seller. For those looking for a standard form to facilitate this process, you can find a suitable template at https://mobilehomebillofsale.com/blank-texas-mobile-home-bill-of-sale/, ensuring all necessary details are correctly documented.

Georgia Promissory Note Template - This note may include restrictions on transferability of the debt.

Common Questions

What is a Pennsylvania Promissory Note?

A Pennsylvania Promissory Note is a legal document in which one party, known as the borrower or maker, promises to pay a specific amount of money to another party, referred to as the lender or payee. This note outlines the terms of the loan, including the repayment schedule, interest rate, and any other conditions that may apply. It serves as a formal agreement and can be enforced in court if necessary.

What information is typically included in a Promissory Note?

Typically, a Promissory Note includes the names and addresses of both the borrower and lender, the principal amount being borrowed, the interest rate, the repayment schedule, and any late fees or penalties for missed payments. Additionally, it may contain clauses regarding default, acceleration, and the governing law. This comprehensive information helps ensure clarity and mutual understanding between the parties involved.

Is a Promissory Note legally binding in Pennsylvania?

Yes, a Promissory Note is legally binding in Pennsylvania, provided it meets certain criteria. It must be signed by the borrower, clearly state the amount owed, and include the terms of repayment. Once executed, it can be enforced in court, meaning that if the borrower fails to repay, the lender has legal recourse to recover the funds.

Do I need a lawyer to create a Promissory Note?

While it is not strictly necessary to have a lawyer draft a Promissory Note, it is highly advisable. A legal professional can ensure that the document complies with Pennsylvania laws and addresses all necessary terms and conditions. This can help prevent misunderstandings and disputes in the future.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the amended note. This ensures that there is a clear record of the changes and helps maintain the enforceability of the agreement.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults on the Promissory Note, the lender has several options. They may choose to pursue legal action to recover the owed amount, which could involve filing a lawsuit. Additionally, the lender may be able to collect any late fees specified in the note. It's important to note that the terms regarding default should be clearly outlined in the Promissory Note to guide the lender’s actions.

Is it necessary to notarize a Promissory Note in Pennsylvania?

No, notarization is not required for a Promissory Note to be legally binding in Pennsylvania. However, having the document notarized can add an extra layer of protection. It serves as proof of the identities of the parties involved and the authenticity of their signatures, which can be beneficial in case of disputes.

How long is a Promissory Note valid in Pennsylvania?

The validity of a Promissory Note in Pennsylvania does not have a set expiration date. However, it is important to consider the statute of limitations for enforcing the note. In Pennsylvania, the statute of limitations for written contracts, including Promissory Notes, is typically four years. After this period, the lender may lose the ability to legally enforce the note.

Can a Promissory Note be transferred to another person?

Yes, a Promissory Note can generally be transferred or assigned to another person, known as the assignee. This transfer must typically be documented in writing, and the borrower should be notified of the change. The new holder of the note then assumes the rights to collect payments as outlined in the original agreement.

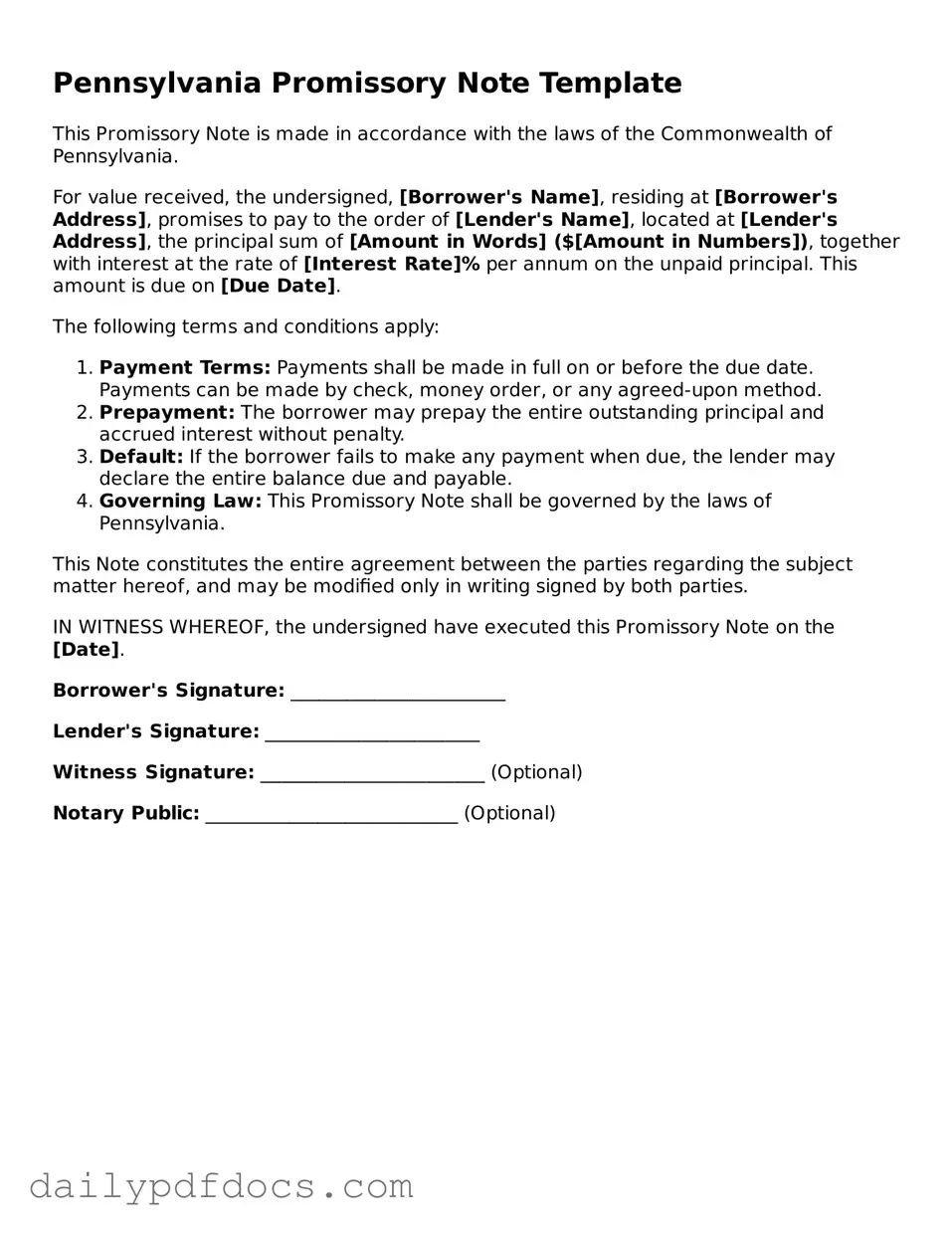

Preview - Pennsylvania Promissory Note Form

Pennsylvania Promissory Note Template

This Promissory Note is made in accordance with the laws of the Commonwealth of Pennsylvania.

For value received, the undersigned, [Borrower's Name], residing at [Borrower's Address], promises to pay to the order of [Lender's Name], located at [Lender's Address], the principal sum of [Amount in Words] ($[Amount in Numbers]), together with interest at the rate of [Interest Rate]% per annum on the unpaid principal. This amount is due on [Due Date].

The following terms and conditions apply:

- Payment Terms: Payments shall be made in full on or before the due date. Payments can be made by check, money order, or any agreed-upon method.

- Prepayment: The borrower may prepay the entire outstanding principal and accrued interest without penalty.

- Default: If the borrower fails to make any payment when due, the lender may declare the entire balance due and payable.

- Governing Law: This Promissory Note shall be governed by the laws of Pennsylvania.

This Note constitutes the entire agreement between the parties regarding the subject matter hereof, and may be modified only in writing signed by both parties.

IN WITNESS WHEREOF, the undersigned have executed this Promissory Note on the [Date].

Borrower's Signature: _______________________

Lender's Signature: _______________________

Witness Signature: ________________________ (Optional)

Notary Public: ___________________________ (Optional)

Similar forms

-

Loan Agreement: A loan agreement outlines the terms and conditions under which a borrower receives funds from a lender. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, it often includes more detailed clauses regarding default, collateral, and other obligations of both parties.

-

Mortgage: A mortgage is a specific type of loan used to purchase real estate. Similar to a promissory note, it involves a promise to repay borrowed money. However, a mortgage also involves a lien on the property, meaning the lender has a legal claim to the property until the loan is fully paid off.

- Mobile Home Bill of Sale: The Mobile Home Bill of Sale is essential for transferring ownership of a mobile home legally. It includes vital details about the buyer and seller, the mobile home description, and the sale price. For more information, visit Washington Templates.

-

Personal Guarantee: A personal guarantee is a promise made by an individual to repay a debt if the primary borrower defaults. This document is similar to a promissory note in that it establishes a financial obligation. However, it typically involves a third party who is agreeing to take responsibility for the debt.

-

Installment Agreement: An installment agreement allows a borrower to repay a debt in smaller, scheduled payments over time. Like a promissory note, it outlines the payment terms and total amount owed. The key difference lies in the structure of payments and the potential for additional terms regarding late fees or penalties.

-

IOU (I Owe You): An IOU is a simple acknowledgment of a debt between two parties. It is less formal than a promissory note but serves a similar purpose by documenting the amount owed and the promise to pay it back. Unlike a promissory note, an IOU may not include specific repayment terms or interest rates.

Misconceptions

Understanding the Pennsylvania Promissory Note form is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are nine common misunderstandings:

-

All promissory notes are the same.

This is not true. While the basic structure is similar, each state has specific requirements. Pennsylvania's form may include unique elements that differ from other states.

-

A promissory note does not need to be in writing.

Although verbal agreements can be binding, having a written promissory note provides clear evidence of the terms agreed upon, which is especially important in legal disputes.

-

Only banks can issue promissory notes.

This is a misconception. Individuals can also create promissory notes for personal loans, not just financial institutions.

-

A promissory note is the same as a loan agreement.

While related, these documents serve different purposes. A promissory note focuses on the promise to pay back a specific amount, while a loan agreement outlines the terms of the loan in greater detail.

-

Once signed, a promissory note cannot be changed.

This is misleading. Parties can modify the terms of a promissory note if both agree to the changes and document them appropriately.

-

Promissory notes do not require a witness or notary.

While not always necessary, having a witness or notary can add an extra layer of legitimacy and can be helpful in case of disputes.

-

Interest rates on promissory notes are always fixed.

Interest rates can be either fixed or variable, depending on what the parties agree upon. It is essential to specify this in the note.

-

Defaulting on a promissory note has no consequences.

This is a dangerous assumption. Defaulting can lead to legal action, damage to credit scores, and other financial repercussions.

-

All promissory notes are enforceable.

Not every note is enforceable. If the terms are unclear or if the note was signed under duress, it may not hold up in court.

By addressing these misconceptions, individuals can better navigate the complexities of promissory notes in Pennsylvania.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money at a designated time or on demand. |

| Governing Law | The Pennsylvania Promissory Note is governed by the Pennsylvania Uniform Commercial Code (UCC), specifically Title 13, Chapter 3104. |

| Parties Involved | The note typically involves two parties: the maker, who promises to pay, and the payee, who is entitled to receive payment. |

| Interest Rate | Interest may be included in the terms of the note. If specified, it must comply with Pennsylvania usury laws. |

| Enforcement | In case of default, the payee has the right to pursue legal action to enforce the terms of the note. |