Printable Operating Agreement Document for Pennsylvania

In Pennsylvania, the Operating Agreement is a vital document for any Limited Liability Company (LLC). This agreement outlines the structure and management of the business, ensuring that all members are on the same page regarding their roles and responsibilities. Key aspects include the distribution of profits and losses, procedures for adding or removing members, and guidelines for decision-making processes. Additionally, the Operating Agreement addresses how the company will be managed—whether by members or appointed managers—and sets forth the procedures for resolving disputes among members. Having a well-drafted Operating Agreement not only protects the interests of all parties involved but also helps to clarify expectations, reduce misunderstandings, and promote a harmonious working relationship within the LLC. It serves as a foundational document that can guide the company through its operational lifecycle, making it an essential tool for business owners in Pennsylvania.

More State-specific Operating Agreement Forms

How Much Does It Cost to Start an Llc in Texas - An Operating Agreement may address dispute resolution methods among members.

Understanding your financial obligations and rights is crucial before entering into marriage. A well-drafted prenuptial agreement can help you achieve this clarity. For more information, visit our page on the important prenuptial agreement guidelines to ensure your assets are protected.

Ohio Llc Operating Agreement - Members can customize the Operating Agreement to fit their specific needs and preferences.

Common Questions

What is a Pennsylvania Operating Agreement?

A Pennsylvania Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Pennsylvania. This agreement serves as a blueprint for how the LLC will function, detailing the roles and responsibilities of its members, how profits and losses will be distributed, and the procedures for making decisions. Having a well-drafted Operating Agreement can help prevent disputes among members and provide clarity in the operation of the business.

Is an Operating Agreement required in Pennsylvania?

No, Pennsylvania does not legally require LLCs to have an Operating Agreement. However, it is highly recommended. Without this agreement, the LLC will be governed by the default rules set by Pennsylvania law, which may not align with the members’ intentions. An Operating Agreement can provide a tailored framework that reflects the specific needs and goals of the business, helping to avoid potential conflicts down the line.

Who should draft the Operating Agreement?

Can the Operating Agreement be changed after it is created?

Yes, the Operating Agreement can be amended after it has been established. Most agreements will include a section outlining the process for making changes, which often requires a vote or consent from the members. It’s important to document any amendments in writing to maintain clarity and avoid misunderstandings in the future. Regularly reviewing and updating the Operating Agreement can help ensure that it continues to meet the evolving needs of the LLC.

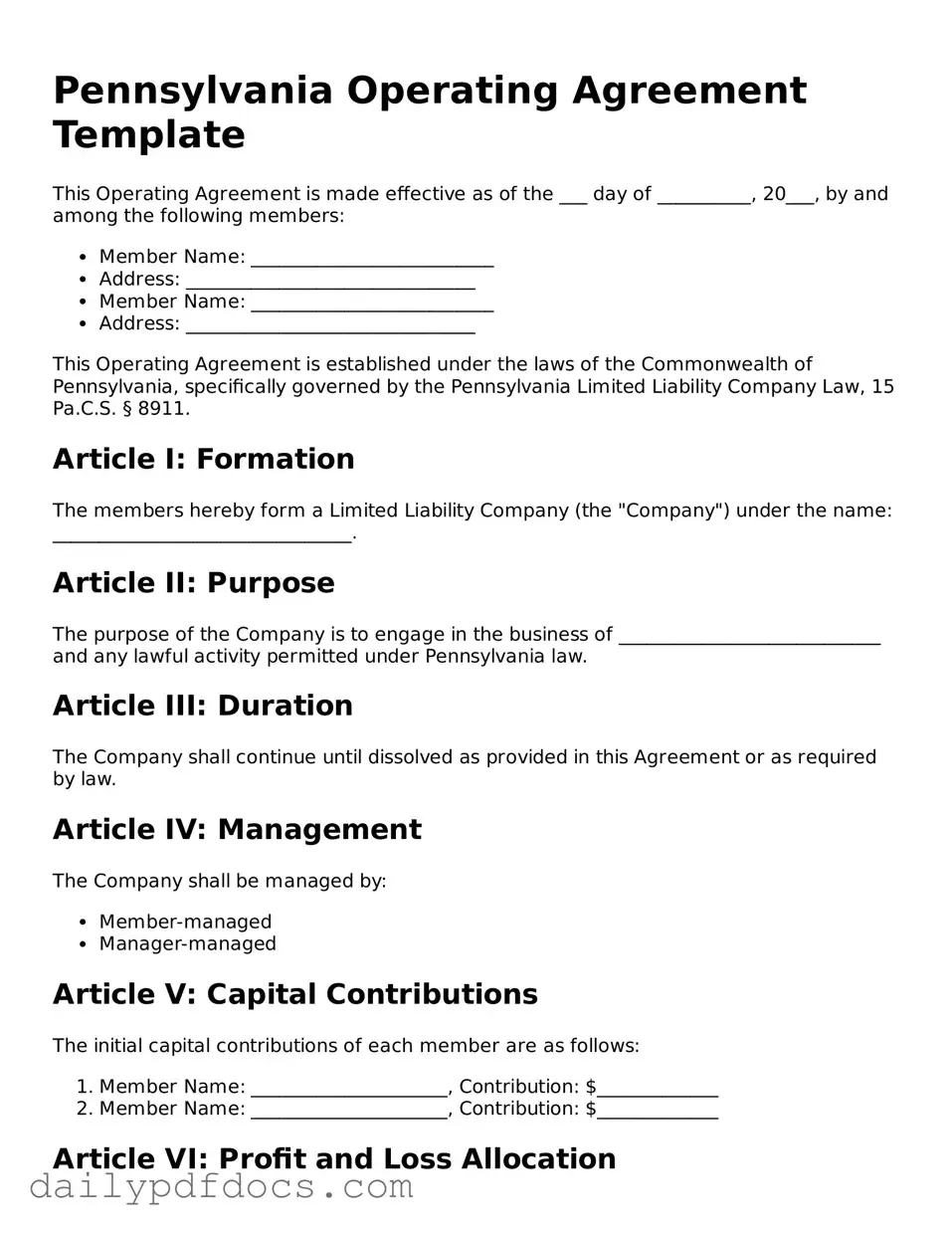

Preview - Pennsylvania Operating Agreement Form

Pennsylvania Operating Agreement Template

This Operating Agreement is made effective as of the ___ day of __________, 20___, by and among the following members:

- Member Name: __________________________

- Address: _______________________________

- Member Name: __________________________

- Address: _______________________________

This Operating Agreement is established under the laws of the Commonwealth of Pennsylvania, specifically governed by the Pennsylvania Limited Liability Company Law, 15 Pa.C.S. § 8911.

Article I: Formation

The members hereby form a Limited Liability Company (the "Company") under the name: ________________________________.

Article II: Purpose

The purpose of the Company is to engage in the business of ____________________________ and any lawful activity permitted under Pennsylvania law.

Article III: Duration

The Company shall continue until dissolved as provided in this Agreement or as required by law.

Article IV: Management

The Company shall be managed by:

- Member-managed

- Manager-managed

Article V: Capital Contributions

The initial capital contributions of each member are as follows:

- Member Name: _____________________, Contribution: $_____________

- Member Name: _____________________, Contribution: $_____________

Article VI: Profit and Loss Allocation

Profits and losses shall be allocated to the members in proportion to their respective capital contributions.

Article VII: Distributions

Distributions shall be made to the members at times and in amounts determined by the members.

Article VIII: Meetings

Meetings of the members shall be held at least once a year. Special meetings may be called by any member.

Article IX: Amendment

This Operating Agreement may be amended or modified only by a written agreement signed by all members.

Article X: Indemnification

The Company shall indemnify its members to the fullest extent permitted by law against any losses, expenses, or liabilities incurred in connection with the Company's business.

IN WITNESS WHEREOF, the members have executed this Operating Agreement as of the date first above written.

Member Signature: ____________________________ Date: ______________

Member Signature: ____________________________ Date: ______________

Similar forms

- Bylaws: Similar to an Operating Agreement, bylaws outline the internal rules governing a corporation. They specify the roles of directors and officers, meeting procedures, and voting requirements. Both documents serve to guide the organization’s operations and ensure compliance with applicable laws.

- Partnership Agreement: This document is akin to an Operating Agreement for partnerships. It details the rights and responsibilities of each partner, profit-sharing arrangements, and procedures for resolving disputes. Both agreements aim to clarify the terms of the partnership and prevent misunderstandings.

- Durable Power of Attorney: This form ensures that your financial and legal affairs are managed by a trusted individual in case you become incapacitated. For additional resources, consider visiting Washington Templates.

- Shareholder Agreement: Like an Operating Agreement, a shareholder agreement governs the relationship between shareholders in a corporation. It addresses issues such as the transfer of shares, voting rights, and dividend distribution. Both documents help manage expectations and protect the interests of the parties involved.

- Member Agreement: This document is often used in limited liability companies (LLCs) and serves a similar purpose to an Operating Agreement. It outlines the roles, responsibilities, and financial arrangements among members. Both agreements are essential for defining the structure and governance of the entity.

Misconceptions

Understanding the Pennsylvania Operating Agreement form is crucial for business owners. However, several misconceptions can lead to confusion. Here are nine common misconceptions about this form:

- All businesses in Pennsylvania need an Operating Agreement. Many people believe that every business must have this document. In reality, it is primarily required for limited liability companies (LLCs), while corporations and sole proprietorships do not need one.

- The Operating Agreement is filed with the state. Some assume that submitting the Operating Agreement to the state is necessary. However, this document is typically kept internally and does not need to be filed with any state agency.

- Only large businesses need an Operating Agreement. There is a misconception that only big companies require this form. In truth, even small LLCs benefit from having an Operating Agreement to outline management and operational procedures.

- The Operating Agreement is a rigid document. Many believe that once created, the Operating Agreement cannot be changed. In fact, members of the LLC can amend the agreement as needed, provided they follow the procedures outlined within it.

- All Operating Agreements must include the same provisions. Some think that there is a standard template that all Operating Agreements must follow. However, the contents can vary significantly based on the specific needs and agreements of the business members.

- Having an Operating Agreement eliminates all disputes. While this document can help clarify roles and responsibilities, it does not guarantee that disputes will not arise. It serves as a guideline but cannot prevent disagreements entirely.

- Members of the LLC do not need to sign the Operating Agreement. Some individuals believe that simply creating the document is sufficient. In reality, all members should sign the Operating Agreement to ensure that everyone agrees to its terms.

- The Operating Agreement is only necessary at the formation of the LLC. There is a misconception that this document is only important during the initial setup. In fact, it should be reviewed and updated regularly to reflect any changes in the business structure or operations.

- Legal assistance is not necessary for creating an Operating Agreement. Many people think they can draft this document without professional help. While it is possible, consulting with a legal professional can ensure that the agreement meets all legal requirements and adequately protects the interests of the members.

Addressing these misconceptions can help business owners better understand the importance of the Pennsylvania Operating Agreement and its role in managing their LLC effectively.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Pennsylvania Operating Agreement form outlines the management structure and operational procedures for a limited liability company (LLC). |

| Governing Law | This form is governed by the Pennsylvania Limited Liability Company Law, specifically Title 15, Chapter 89 of the Pennsylvania Consolidated Statutes. |

| Key Components | It typically includes provisions on member roles, voting rights, profit distribution, and procedures for adding or removing members. |

| Filing Requirement | While not required to be filed with the state, having an Operating Agreement is crucial for internal governance and can protect members' interests. |