Printable Durable Power of Attorney Document for Pennsylvania

The Pennsylvania Durable Power of Attorney form serves as a crucial legal document that empowers individuals to designate a trusted person, known as an agent, to make financial and legal decisions on their behalf. This form is particularly significant because it remains effective even if the principal becomes incapacitated, ensuring that their affairs can be managed without interruption. Key components of the form include the identification of the principal and agent, a detailed list of the powers granted, and any limitations or specific instructions the principal wishes to impose. Additionally, the form requires signatures from both the principal and a witness, which adds a layer of validation to the document. By understanding the essential elements and implications of this form, individuals can take proactive steps to secure their financial and legal interests, providing peace of mind for themselves and their loved ones.

More State-specific Durable Power of Attorney Forms

California Durable Power of Attorney Form 2023 Pdf - It is recommended to keep a copy of the Durable Power of Attorney in an accessible location.

When engaging in a transaction involving mobile homes, utilizing the correct documentation is vital to avoid any misunderstandings. The Texas Mobile Home Bill of Sale serves this purpose effectively, ensuring all pertinent information is documented. For those looking for a reliable template, you can refer to mobilehomebillofsale.com/blank-texas-mobile-home-bill-of-sale/ for a comprehensive resource that outlines the necessary details for a smooth sale.

Durable Power of Attorney Illinois Pdf - While a Durable Power of Attorney is often associated with financial matters, it can also include healthcare decisions.

Common Questions

What is a Durable Power of Attorney in Pennsylvania?

A Durable Power of Attorney (DPOA) in Pennsylvania is a legal document that allows an individual, known as the principal, to appoint someone else, called an agent, to make decisions on their behalf. This authority remains effective even if the principal becomes incapacitated. It is an important tool for managing financial and legal matters when the principal is unable to do so themselves.

Why should I consider creating a Durable Power of Attorney?

Creating a Durable Power of Attorney can provide peace of mind. It ensures that someone you trust can manage your affairs if you become unable to do so. This can include handling financial transactions, paying bills, or making healthcare decisions. By having a DPOA in place, you can avoid potential conflicts and ensure that your wishes are respected.

Who can be appointed as my agent in a Durable Power of Attorney?

In Pennsylvania, you can appoint any competent adult as your agent. This can be a family member, friend, or even a professional, such as an attorney. It's essential to choose someone you trust, as they will have significant control over your financial and legal matters.

Does a Durable Power of Attorney need to be notarized?

Yes, in Pennsylvania, a Durable Power of Attorney must be signed by the principal and witnessed by two individuals or notarized. Notarization adds an extra layer of authenticity to the document, ensuring that it is legally valid and recognized by financial institutions and other entities.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are still competent to do so. This can be done by creating a new DPOA, which will automatically invalidate the previous one, or by providing a written notice of revocation to your agent and any institutions that may have a copy of the original document.

What happens if I don’t have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your loved ones may need to go through a court process to obtain guardianship. This can be time-consuming, costly, and may not reflect your wishes. Having a DPOA in place helps avoid this scenario and allows you to choose who will make decisions on your behalf.

Can I limit the powers granted in a Durable Power of Attorney?

Absolutely. You can specify which powers your agent will have in the Durable Power of Attorney document. For example, you might allow them to handle financial matters but not make healthcare decisions. Clearly outlining these limitations ensures your agent acts within the boundaries you set.

Is a Durable Power of Attorney the same as a Healthcare Power of Attorney?

No, a Durable Power of Attorney is primarily focused on financial and legal matters. In contrast, a Healthcare Power of Attorney specifically addresses medical decisions. While they can be combined, they serve different purposes, and it’s often advisable to have both documents to cover all aspects of decision-making.

How do I create a Durable Power of Attorney in Pennsylvania?

To create a Durable Power of Attorney in Pennsylvania, you can either use a template or consult an attorney to draft the document. Ensure it meets the state’s requirements, including proper signatures and notarization. Once completed, provide copies to your agent and any relevant institutions, and keep the original in a safe place.

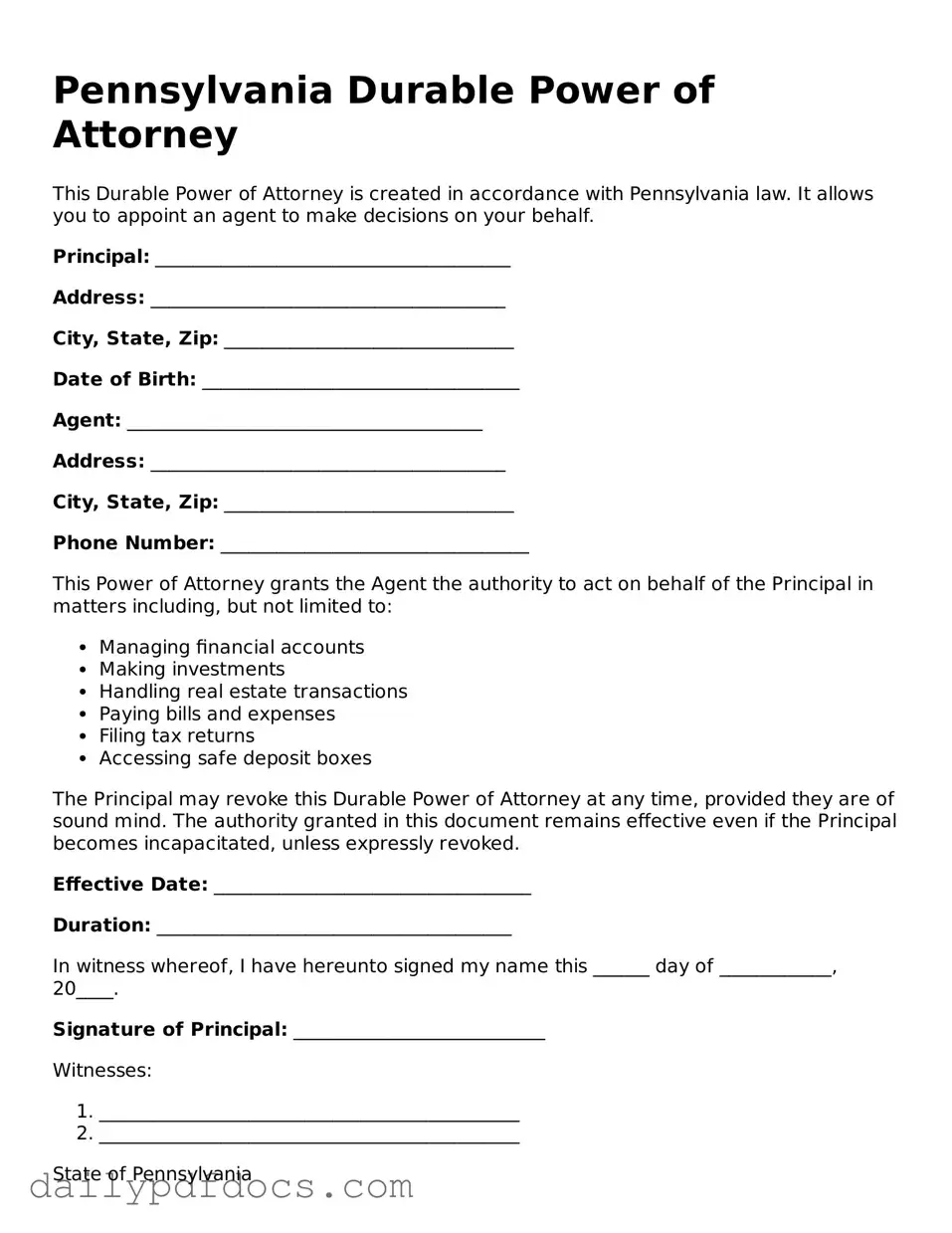

Preview - Pennsylvania Durable Power of Attorney Form

Pennsylvania Durable Power of Attorney

This Durable Power of Attorney is created in accordance with Pennsylvania law. It allows you to appoint an agent to make decisions on your behalf.

Principal: ______________________________________

Address: ______________________________________

City, State, Zip: _______________________________

Date of Birth: __________________________________

Agent: ______________________________________

Address: ______________________________________

City, State, Zip: _______________________________

Phone Number: _________________________________

This Power of Attorney grants the Agent the authority to act on behalf of the Principal in matters including, but not limited to:

- Managing financial accounts

- Making investments

- Handling real estate transactions

- Paying bills and expenses

- Filing tax returns

- Accessing safe deposit boxes

The Principal may revoke this Durable Power of Attorney at any time, provided they are of sound mind. The authority granted in this document remains effective even if the Principal becomes incapacitated, unless expressly revoked.

Effective Date: __________________________________

Duration: ______________________________________

In witness whereof, I have hereunto signed my name this ______ day of ____________, 20____.

Signature of Principal: ___________________________

Witnesses:

- _____________________________________________

- _____________________________________________

State of Pennsylvania

County of _____________________

On this ___ day of ____________, 20___, before me, the undersigned notary public, personally appeared the Principal, known to me (or satisfactorily proven) to be the person whose name is subscribed to the foregoing Durable Power of Attorney, and acknowledged that they executed the same for the purposes therein contained.

Notary Public: ___________________________________

My Commission Expires: _________________________

Similar forms

- General Power of Attorney: Like the Durable Power of Attorney, this document allows one person to act on behalf of another in financial matters. However, it typically becomes invalid if the principal becomes incapacitated, unlike the durable version, which remains effective.

- Healthcare Power of Attorney: This document grants someone the authority to make medical decisions for another person. Similar to the Durable Power of Attorney, it remains effective even if the person becomes incapacitated, ensuring that healthcare choices are made according to the principal's wishes.

- Living Will: While a Living Will outlines specific wishes regarding medical treatment in end-of-life situations, it complements a Durable Power of Attorney by providing guidance to the appointed agent about the principal's healthcare preferences.

- Employee Handbook: For detailed guidelines on company policies, refer to our comprehensive Employee Handbook resources to ensure a clear understanding of workplace standards.

- Revocable Trust: A Revocable Trust allows an individual to manage their assets during their lifetime and designate beneficiaries after death. Both documents provide a way to manage financial affairs, but a trust can also help avoid probate, which a Durable Power of Attorney does not do.

- Advance Directive: This document combines elements of a Living Will and a Healthcare Power of Attorney. It provides instructions for medical care and designates an agent, similar to a Durable Power of Attorney, ensuring that healthcare decisions align with the individual's values and preferences.

Misconceptions

Understanding the Pennsylvania Durable Power of Attorney form is essential for effective estate planning. However, several misconceptions can lead to confusion. Here are ten common misconceptions:

- A Durable Power of Attorney is only for elderly individuals. Many people believe this document is only necessary for seniors, but anyone can benefit from having one, regardless of age.

- A Durable Power of Attorney can make decisions after death. This form is valid only while the individual is alive. Once a person passes away, the authority granted through this document ends.

- The agent must be a family member. While many choose family members, anyone can serve as an agent, including friends or professionals, as long as they are trustworthy.

- A Durable Power of Attorney is the same as a healthcare proxy. These are distinct documents. A Durable Power of Attorney deals with financial matters, while a healthcare proxy addresses medical decisions.

- You cannot change or revoke a Durable Power of Attorney. This document can be revoked or modified at any time, as long as the individual is competent to do so.

- The agent can do anything they want with the authority granted. The agent must act in the best interest of the principal and follow any specific instructions provided in the document.

- A Durable Power of Attorney must be notarized. While notarization is recommended, it is not always required. Witnesses may suffice in certain situations.

- A Durable Power of Attorney is valid in all states. This document is state-specific. A Durable Power of Attorney executed in Pennsylvania may not hold the same validity in another state.

- If I have a will, I don’t need a Durable Power of Attorney. A will only takes effect after death. A Durable Power of Attorney is necessary for managing financial matters while the individual is still alive.

- Once signed, a Durable Power of Attorney is permanent. This is not true. Individuals can change their minds and revoke the document whenever they choose, as long as they are mentally competent.

Clarifying these misconceptions can help individuals make informed decisions about their estate planning needs.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Pennsylvania Durable Power of Attorney allows an individual to appoint someone else to make decisions on their behalf, even if they become incapacitated. |

| Governing Law | The form is governed by the Pennsylvania Consolidated Statutes, Title 20, Chapter 56. |

| Durability | This type of power of attorney remains effective even after the principal becomes incapacitated, ensuring that decisions can still be made. |

| Agent Authority | The appointed agent can have broad or limited powers, depending on how the document is drafted by the principal. |

| Revocation | The principal can revoke the durable power of attorney at any time, as long as they are mentally competent. |

| Witness Requirements | In Pennsylvania, the document must be signed by the principal and witnessed by two individuals or acknowledged before a notary public. |