Printable Deed Document for Pennsylvania

When it comes to transferring property in Pennsylvania, understanding the Pennsylvania Deed form is essential. This legal document serves as a vital tool in the process of conveying ownership from one party to another. It includes important details such as the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), along with a clear description of the property being transferred. Additionally, the deed must be signed and notarized to ensure its validity. Different types of deeds exist, such as warranty deeds and quitclaim deeds, each serving specific purposes and offering varying levels of protection to the grantee. Knowing the requirements and implications of using the Pennsylvania Deed form can help individuals navigate real estate transactions more confidently and avoid potential pitfalls. By familiarizing yourself with this important document, you can ensure a smoother transfer of property and safeguard your interests in the process.

More State-specific Deed Forms

Ohio Deed Transfer Form - When properties are inherited, a Deed can help facilitate the transfer to new owners.

Texas Deed Forms - A Deed properly executed ensures your rights are protected.

For those looking to protect their proprietary information, understanding a Non-disclosure Agreement in business contexts is critical. This document defines the terms under which sensitive data can be shared while preventing unauthorized disclosure, thereby safeguarding valuable information during discussions and collaborations.

How to Get a Copy of My House Deed - This deed provides legal backing for the ownership claim.

Common Questions

What is a Pennsylvania Deed form?

A Pennsylvania Deed form is a legal document used to transfer ownership of real estate from one party to another within the state of Pennsylvania. This form outlines the details of the transaction, including the names of the grantor (the seller) and the grantee (the buyer), a description of the property, and any conditions or covenants associated with the transfer. It serves as an official record of the change in ownership and is typically filed with the county recorder of deeds.

What types of Deeds are available in Pennsylvania?

Pennsylvania recognizes several types of deeds, each serving different purposes. The most common types include the Warranty Deed, which guarantees that the grantor holds clear title to the property and has the right to sell it; the Quitclaim Deed, which transfers whatever interest the grantor has in the property without any guarantees; and the Special Warranty Deed, which offers limited warranties regarding the title. Choosing the right type of deed depends on the specific circumstances of the property transfer.

How do I complete a Pennsylvania Deed form?

To complete a Pennsylvania Deed form, start by accurately filling in the names of the grantor and grantee. Next, provide a detailed legal description of the property, which can typically be found in previous deeds or property tax records. Include any necessary information regarding consideration (the price paid for the property) and any conditions or restrictions on the transfer. Finally, the deed must be signed by the grantor in the presence of a notary public to ensure its validity.

Is it necessary to have a lawyer when preparing a Pennsylvania Deed?

While it is not legally required to hire a lawyer to prepare a Pennsylvania Deed, doing so can be beneficial. A legal professional can help ensure that the deed is completed correctly, all necessary information is included, and that it complies with state laws. Additionally, they can provide guidance on the implications of the deed type chosen and assist with any potential issues that may arise during the transfer process.

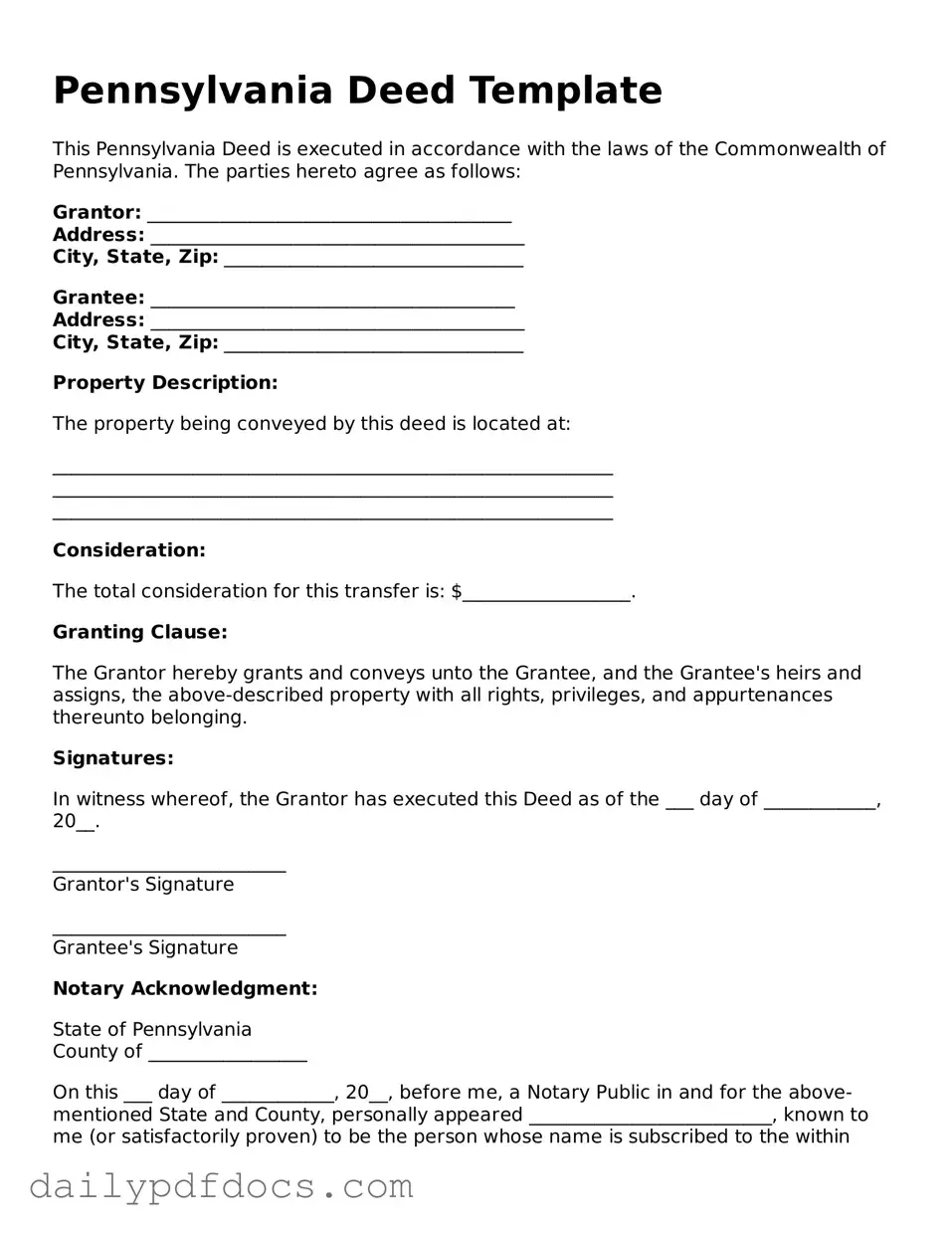

Preview - Pennsylvania Deed Form

Pennsylvania Deed Template

This Pennsylvania Deed is executed in accordance with the laws of the Commonwealth of Pennsylvania. The parties hereto agree as follows:

Grantor: _______________________________________

Address: ________________________________________

City, State, Zip: ________________________________

Grantee: _______________________________________

Address: ________________________________________

City, State, Zip: ________________________________

Property Description:

The property being conveyed by this deed is located at:

____________________________________________________________

____________________________________________________________

____________________________________________________________

Consideration:

The total consideration for this transfer is: $__________________.

Granting Clause:

The Grantor hereby grants and conveys unto the Grantee, and the Grantee's heirs and assigns, the above-described property with all rights, privileges, and appurtenances thereunto belonging.

Signatures:

In witness whereof, the Grantor has executed this Deed as of the ___ day of ____________, 20__.

_________________________

Grantor's Signature

_________________________

Grantee's Signature

Notary Acknowledgment:

State of Pennsylvania

County of _________________

On this ___ day of ____________, 20__, before me, a Notary Public in and for the above-mentioned State and County, personally appeared __________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

_________________________

Notary Public

My Commission Expires: _____________________

Similar forms

The Deed form is an important legal document used primarily in real estate transactions. However, several other documents share similarities with the Deed form in terms of purpose and function. Here’s a look at six such documents:

- Title Insurance Policy: This document protects against potential defects in the title. Like a Deed, it establishes ownership but focuses on safeguarding that ownership from future claims.

- Prenuptial Agreement: This legal document, like the Deed form, outlines the rights and responsibilities of parties involved. The Ohio PDF Forms provide resources for creating a clear agreement that helps prevent disputes in the future.

- Bill of Sale: Used for the transfer of personal property, this document functions similarly to a Deed by formalizing the transfer of ownership from one party to another.

- Lease Agreement: This contract outlines the terms under which one party can occupy property owned by another. It shares the Deed's purpose of defining rights and responsibilities related to property use.

- Mortgage Agreement: This document secures a loan with the property as collateral. It is similar to a Deed in that it involves the transfer of interest in property, albeit temporarily, until the loan is repaid.

- Trust Agreement: In this document, property is held by a trustee for the benefit of others. It is akin to a Deed as it establishes ownership and the rights associated with that ownership.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. It complements the Deed by enabling the transfer of property rights through an authorized representative.

Misconceptions

Understanding the Pennsylvania Deed form is crucial for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings:

- All deeds are the same. Many believe that all deeds serve the same purpose. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each with unique implications.

- A deed must be notarized to be valid. While notarization is often required for a deed to be recorded, a deed can still be valid without it. However, notarization is recommended for legal protection.

- Only attorneys can prepare a deed. Although attorneys can provide valuable assistance, individuals can also prepare their own deeds, provided they understand the requirements.

- A deed transfers ownership immediately. Some think that signing a deed automatically transfers ownership. In reality, ownership transfer may depend on additional factors, such as recording the deed with the county.

- Once a deed is recorded, it cannot be changed. Many assume that a recorded deed is permanent. However, it can be modified or revoked through a new deed if necessary.

- All deeds must be filed with the county clerk. While recording a deed with the county is common, it is not legally required for the deed to be valid. However, recording provides public notice.

- Property taxes are unaffected by the type of deed. Some believe that the type of deed has no impact on property taxes. In fact, certain transactions may trigger reassessment of property taxes.

- Deeds are only necessary for sales. Many think deeds are only needed for buying and selling property. However, deeds are also essential for transfers between family members or as gifts.

- All signatures on a deed must be notarized. While the grantor’s signature typically requires notarization, other signatures may not, depending on the circumstances.

- Once a deed is executed, it cannot be contested. Some believe that an executed deed is immune to challenges. In truth, a deed can be contested in court under specific circumstances, such as fraud or undue influence.

Awareness of these misconceptions can help individuals navigate the complexities of real estate transactions more effectively.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Pennsylvania Deed form is a legal document used to transfer ownership of real estate from one party to another. |

| Governing Law | The Pennsylvania Deed form is governed by Title 21 of the Pennsylvania Consolidated Statutes. |

| Types of Deeds | In Pennsylvania, common types of deeds include warranty deeds, quitclaim deeds, and special purpose deeds. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property) to be valid. |

| Witnesses and Notarization | While witnesses are not required, notarization of the deed is necessary for it to be recorded. |

| Recording | To ensure public notice of the property transfer, the deed must be recorded in the county where the property is located. |

| Transfer Tax | Pennsylvania imposes a real estate transfer tax on the sale of property, which must be paid at the time of transfer. |

| Legal Description | A complete and accurate legal description of the property must be included in the deed for it to be enforceable. |