Printable Deed in Lieu of Foreclosure Document for Pennsylvania

In Pennsylvania, homeowners facing the possibility of foreclosure may find a viable alternative in the Deed in Lieu of Foreclosure. This legal process allows a homeowner to voluntarily transfer their property title to the lender, thereby avoiding the lengthy and often stressful foreclosure process. By signing this document, individuals can relinquish their ownership rights in exchange for the cancellation of their mortgage debt. This arrangement can provide a sense of relief, as it typically results in a quicker resolution and can help protect the homeowner's credit score from the more severe impacts of foreclosure. Additionally, the Deed in Lieu of Foreclosure can often be negotiated to include terms that may assist the homeowner, such as the potential for relocation assistance or a waiver of any deficiency judgment. Understanding the nuances of this form is essential for anyone considering it as a solution to their financial difficulties. With the right information and support, homeowners can navigate this option with confidence, taking a proactive step toward regaining their financial footing.

More State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu of Foreclosure Sample - Borrowers seeking a deed in lieu of foreclosure may need to demonstrate financial hardship to their lenders.

When handling property transfers in Ohio, utilizing a Quitclaim Deed can simplify the process significantly, as it allows one party to convey their interest without providing warranties. For those interested in this straightforward method, it is crucial to understand how to fill out the document accurately. Resources such as Ohio PDF Forms can offer essential guidance and templates to effectively complete this transfer.

Foreclosure Vs Deed in Lieu - This legal document often requires additional paperwork and disclosures for complete agreement.

Common Questions

What is a Deed in Lieu of Foreclosure in Pennsylvania?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to voluntarily transfer ownership of their property to the lender in order to avoid foreclosure. This option can help the homeowner avoid the lengthy and costly foreclosure process. In Pennsylvania, this process typically involves signing a deed that conveys the property back to the lender, who then cancels the mortgage debt associated with the property.

Who is eligible for a Deed in Lieu of Foreclosure?

Homeowners facing financial difficulties may be eligible for a Deed in Lieu of Foreclosure. However, lenders often require that the homeowner has exhausted other options, such as loan modifications or short sales. The property must also be free of any liens or other claims, and the homeowner should be able to demonstrate financial hardship to the lender.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

One of the main benefits is that it can provide a quicker resolution compared to traditional foreclosure. Homeowners may also avoid the negative impact on their credit score that comes with a foreclosure. Additionally, lenders might be more willing to forgive any remaining debt after the deed transfer, which can provide financial relief to the homeowner.

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also drawbacks. Homeowners may lose their home and any equity they have built up. Additionally, the process may not be as straightforward as it seems. Lenders may have specific requirements, and the homeowner must be prepared to negotiate terms. It's also important to note that a Deed in Lieu can still impact credit scores, although typically less severely than a foreclosure.

How does the process of executing a Deed in Lieu of Foreclosure work?

The process generally begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then review the homeowner's financial situation and the property’s status. If approved, both parties will sign the deed, transferring ownership. The lender may also require the homeowner to vacate the property by a certain date. It is advisable for homeowners to consult with a legal professional during this process to ensure their rights are protected.

Can a Deed in Lieu of Foreclosure affect my ability to buy a home in the future?

Yes, a Deed in Lieu of Foreclosure can impact future home buying. While it may not have as severe an effect as a foreclosure, it can still lower your credit score and may remain on your credit report for several years. Lenders will typically look at your credit history when considering a mortgage application. However, with time and good financial habits, many people are able to recover and qualify for a mortgage again.

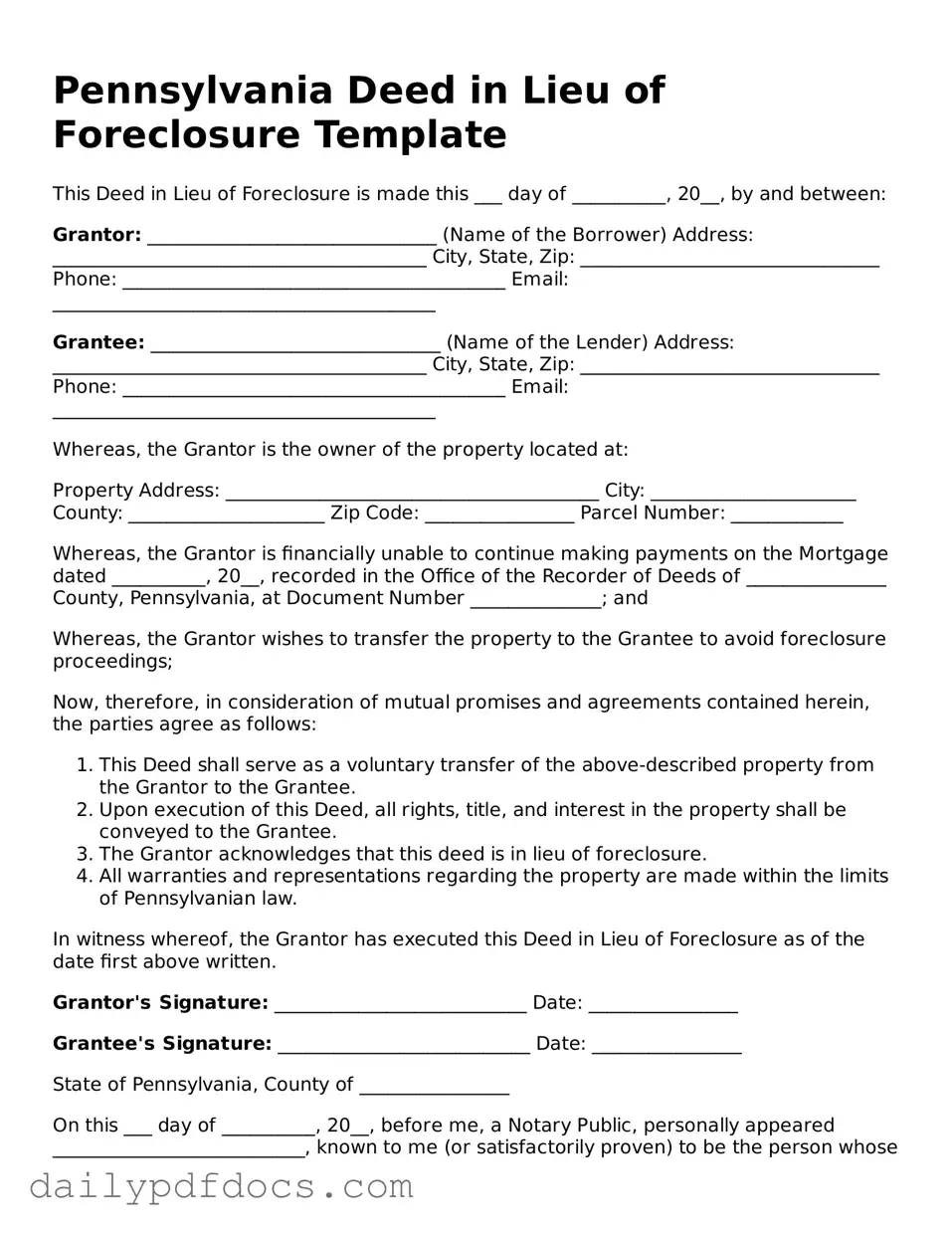

Preview - Pennsylvania Deed in Lieu of Foreclosure Form

Pennsylvania Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ___ day of __________, 20__, by and between:

Grantor: _______________________________ (Name of the Borrower) Address: ________________________________________ City, State, Zip: ________________________________ Phone: _________________________________________ Email: _________________________________________

Grantee: _______________________________ (Name of the Lender) Address: ________________________________________ City, State, Zip: ________________________________ Phone: _________________________________________ Email: _________________________________________

Whereas, the Grantor is the owner of the property located at:

Property Address: ________________________________________ City: ______________________ County: _____________________ Zip Code: ________________ Parcel Number: ____________

Whereas, the Grantor is financially unable to continue making payments on the Mortgage dated __________, 20__, recorded in the Office of the Recorder of Deeds of _______________ County, Pennsylvania, at Document Number ______________; and

Whereas, the Grantor wishes to transfer the property to the Grantee to avoid foreclosure proceedings;

Now, therefore, in consideration of mutual promises and agreements contained herein, the parties agree as follows:

- This Deed shall serve as a voluntary transfer of the above-described property from the Grantor to the Grantee.

- Upon execution of this Deed, all rights, title, and interest in the property shall be conveyed to the Grantee.

- The Grantor acknowledges that this deed is in lieu of foreclosure.

- All warranties and representations regarding the property are made within the limits of Pennsylvanian law.

In witness whereof, the Grantor has executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor's Signature: ___________________________ Date: ________________

Grantee's Signature: ___________________________ Date: ________________

State of Pennsylvania, County of ________________

On this ___ day of __________, 20__, before me, a Notary Public, personally appeared ___________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the foregoing instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature: ______________________________ My Commission Expires: ________________________

Similar forms

- Loan Modification Agreement: This document allows borrowers to change the terms of their existing loan, such as the interest rate or repayment schedule, to make payments more manageable and avoid foreclosure.

- Residential Lease Agreement: To understand rental agreements better, explore the essential insights into the Residential Lease Agreement for a clear outline of tenant and landlord responsibilities.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the total amount owed on the mortgage. This document outlines the terms of the sale and the lender's acceptance of the reduced payment.

- Forbearance Agreement: This temporary agreement suspends or reduces mortgage payments for a set period. It helps borrowers regain financial stability without losing their home.

- Mortgage Release: Also known as a satisfaction of mortgage, this document confirms that the borrower has paid off their mortgage in full, releasing them from any further obligations.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal matters. In the context of foreclosure, it can authorize someone to negotiate with the lender or sign documents.

- Notice of Default: This document informs the borrower that they have missed mortgage payments and outlines the steps they need to take to avoid foreclosure.

- Repayment Plan Agreement: This agreement outlines a plan for borrowers to catch up on missed payments over time, allowing them to retain their home while addressing their financial situation.

- Deed of Trust: Similar to a mortgage, this document secures a loan by placing a lien on the property. It outlines the rights and responsibilities of both the borrower and the lender.

- Quitclaim Deed: This document transfers ownership of property without guaranteeing that the title is clear. It can be used in situations where the borrower wants to relinquish their interest in the property.

- Bankruptcy Filing: Filing for bankruptcy can provide relief from foreclosure by temporarily halting the process. This document outlines the borrower's financial situation and their plan to repay debts.

Misconceptions

When discussing the Pennsylvania Deed in Lieu of Foreclosure, several misconceptions often arise. Understanding these can help clarify the process and its implications for homeowners facing foreclosure.

- Misconception 1: A Deed in Lieu of Foreclosure eliminates all debt obligations.

- Misconception 2: The process is quick and easy.

- Misconception 3: Homeowners can simply walk away from their property.

- Misconception 4: A Deed in Lieu of Foreclosure has no impact on credit scores.

This is not necessarily true. While a Deed in Lieu can relieve homeowners of their mortgage obligations, it may not absolve them of other debts related to the property, such as unpaid property taxes or homeowner association fees.

Many believe that a Deed in Lieu of Foreclosure is a straightforward solution. However, the process can involve negotiations with the lender, documentation, and potential delays. Each situation is unique, and timelines can vary significantly.

While a Deed in Lieu allows homeowners to transfer ownership back to the lender, it requires formal acceptance by the lender. Homeowners cannot unilaterally decide to walk away; they must follow legal procedures and obtain the lender's agreement.

In reality, this action can affect a homeowner's credit score. Although it may be less damaging than a foreclosure, it still represents a significant negative mark. Homeowners should consider the long-term implications for their credit before proceeding.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | The process is governed by Pennsylvania state law, specifically under the Pennsylvania Uniform Commercial Code. |

| Eligibility | Homeowners facing financial difficulties may qualify, but they must demonstrate an inability to continue mortgage payments. |

| Benefits | This option can help borrowers avoid the lengthy foreclosure process and may have less negative impact on their credit score. |

| Potential Risks | Borrowers should be aware that they may still be liable for any remaining mortgage debt after the transfer, depending on the terms agreed upon. |