Printable Articles of Incorporation Document for Pennsylvania

When considering the establishment of a corporation in Pennsylvania, one of the essential steps is completing the Articles of Incorporation form. This document serves as the foundation for your business entity, outlining key details that define its structure and purpose. Among the primary components included in the form are the corporation's name, which must be unique and compliant with state regulations, and the registered office address, where official correspondence will be sent. Additionally, the form requires the identification of the corporation's incorporators, who are responsible for filing the document and initiating the formation process. It's also important to specify the purpose of the corporation, as this informs both the public and the state about the nature of the business activities. Finally, the Articles of Incorporation must include information regarding the number of shares the corporation is authorized to issue, which is crucial for understanding ownership and investment opportunities. Completing this form accurately is vital, as it not only facilitates the legal formation of the corporation but also helps in establishing credibility with potential investors and partners.

More State-specific Articles of Incorporation Forms

Ohio Llc Annual Fees - The Articles must be publicly accessible as part of corporate transparency efforts.

Articles of Incorporation Ny - Sets forth provisions for handling conflicts of interest.

To facilitate this process, you can rely on the https://mobilehomebillofsale.com/blank-missouri-mobile-home-bill-of-sale/, which provides a blank template for the Missouri Mobile Home Bill of Sale, ensuring you have all the necessary information at hand to properly document the sale.

How to Obtain an Llc - The Articles may list the initial directors of the corporation.

Where Can I Find Articles of Incorporation - It requires information about the initial directors of the corporation.

Common Questions

What is the purpose of the Pennsylvania Articles of Incorporation form?

The Pennsylvania Articles of Incorporation form is used to officially create a corporation in the state of Pennsylvania. This document outlines basic information about the corporation, such as its name, purpose, registered office address, and the names of the incorporators. Filing this form is a necessary step to establish the corporation as a legal entity separate from its owners.

What information do I need to provide when filling out the Articles of Incorporation?

When completing the Articles of Incorporation, you will need to provide several key pieces of information. This includes the corporation's name, which must be unique and not already in use by another entity in Pennsylvania. You will also need to state the purpose of the corporation, provide the address of its registered office, and list the names and addresses of the incorporators. Additionally, if the corporation will have shares, you must include details about the types and number of shares authorized.

How do I file the Pennsylvania Articles of Incorporation?

To file the Articles of Incorporation, you can submit the completed form either online or by mail. If filing online, you will need to create an account with the Pennsylvania Department of State. For mail submissions, send the completed form along with the required filing fee to the appropriate address. Make sure to keep a copy of the submitted form for your records. After filing, you will receive confirmation from the state once your corporation is officially registered.

What is the filing fee for the Articles of Incorporation in Pennsylvania?

The filing fee for the Pennsylvania Articles of Incorporation varies depending on the type of corporation being formed. Generally, the fee is around $125 for a standard corporation. However, additional fees may apply for expedited processing or if you are filing for a specific type of corporation, such as a nonprofit. It is advisable to check the Pennsylvania Department of State's website for the most current fee schedule before submitting your application.

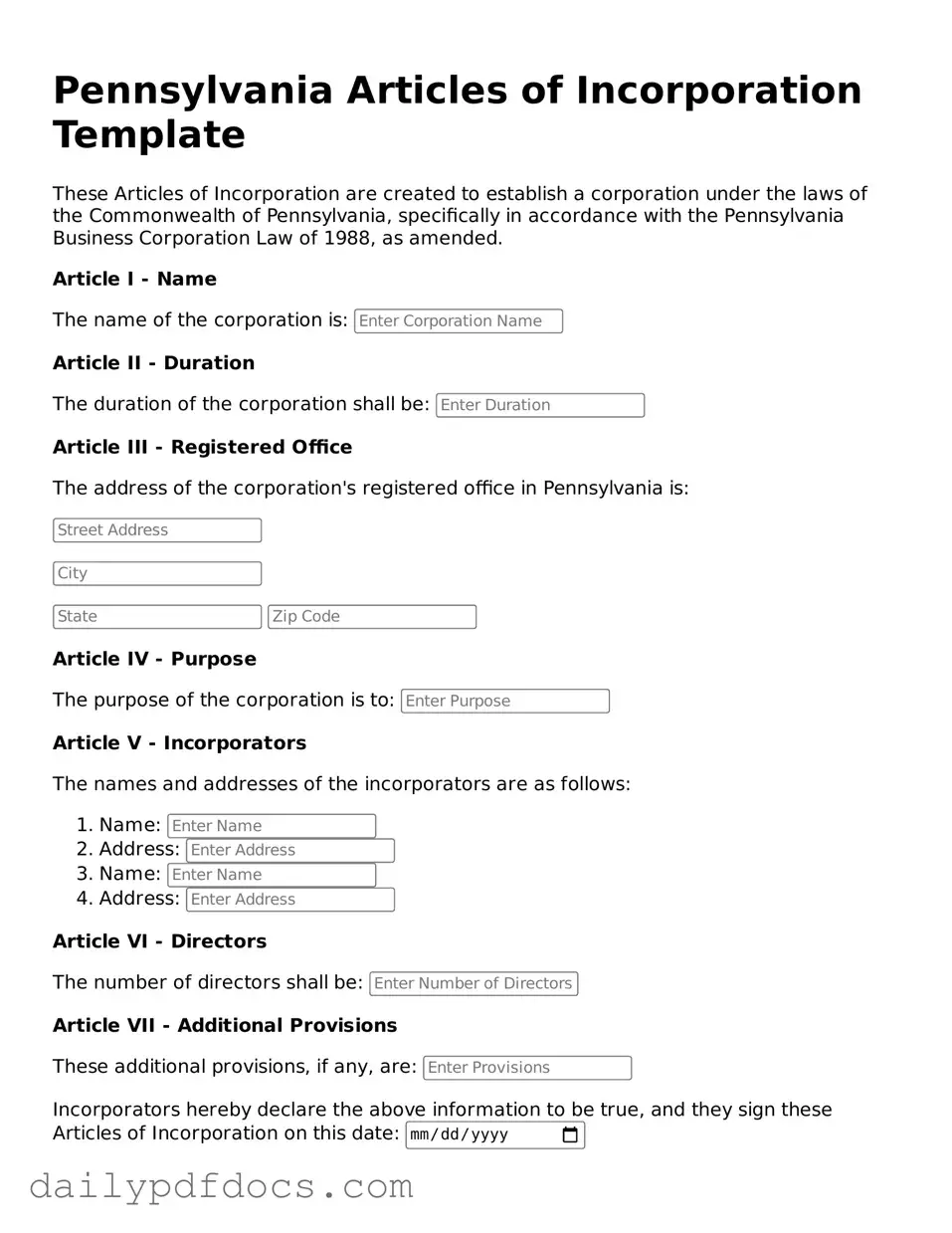

Preview - Pennsylvania Articles of Incorporation Form

Pennsylvania Articles of Incorporation Template

These Articles of Incorporation are created to establish a corporation under the laws of the Commonwealth of Pennsylvania, specifically in accordance with the Pennsylvania Business Corporation Law of 1988, as amended.

Article I - Name

The name of the corporation is:

Article II - Duration

The duration of the corporation shall be:

Article III - Registered Office

The address of the corporation's registered office in Pennsylvania is:

Article IV - Purpose

The purpose of the corporation is to:

Article V - Incorporators

The names and addresses of the incorporators are as follows:

- Name:

- Address:

- Name:

- Address:

Article VI - Directors

The number of directors shall be:

Article VII - Additional Provisions

These additional provisions, if any, are:

Incorporators hereby declare the above information to be true, and they sign these Articles of Incorporation on this date:

Signature of Incorporator:

Print Name:

Similar forms

The Articles of Incorporation is a crucial document for establishing a corporation. It shares similarities with several other important documents in the business realm. Here are five documents that are similar to the Articles of Incorporation:

- Bylaws: These are the internal rules governing the management of a corporation. While the Articles of Incorporation lay the groundwork for the corporation's existence, the bylaws provide detailed procedures for its operation.

- Certificate of Incorporation: Often used interchangeably with the Articles of Incorporation, this document serves the same purpose. It officially establishes the corporation and is filed with the state, outlining key information such as the corporation’s name and purpose.

- Operating Agreement: This document is essential for LLCs (Limited Liability Companies) and outlines the management structure and operational guidelines. Similar to the Articles of Incorporation, it defines how the business will be run, but it is tailored specifically for LLCs.

- Partnership Agreement: This document is used when two or more individuals decide to operate a business together. Like the Articles of Incorporation, it outlines the roles, responsibilities, and profit-sharing arrangements among partners.

- Cease and Desist Letter: This formal document, which can be found in templates such as those provided by Washington Templates, is essential for requesting that an individual or organization stop actions that may be harmful or unlawful.

- Business License: A business license is a legal authorization to operate a business within a specific jurisdiction. While the Articles of Incorporation establish the corporation, the business license is often required to legally conduct business activities.

Misconceptions

Understanding the Pennsylvania Articles of Incorporation form is essential for anyone looking to establish a corporation in the state. However, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- All corporations must file Articles of Incorporation. Some business entities, like sole proprietorships and partnerships, do not require this form.

- The Articles of Incorporation are the same as the bylaws. While both are important, the Articles establish the corporation's existence, whereas bylaws govern internal operations.

- You can use a generic form for all states. Each state has specific requirements and forms, including Pennsylvania, which has its own unique Articles of Incorporation.

- Filing the Articles guarantees tax-exempt status. Incorporating does not automatically confer tax-exempt status; additional steps are necessary for that designation.

- Only for-profit corporations need to file. Non-profit organizations also need to file Articles of Incorporation to gain legal recognition.

- Once filed, the Articles cannot be changed. Amendments can be made to the Articles after they have been filed, allowing for flexibility as the corporation evolves.

- Filing is a one-time process. Corporations must remain compliant with state regulations and may need to file annual reports or other documents.

- The process is quick and simple. While it can be straightforward, careful attention to detail is necessary to avoid delays or rejections.

- You do not need legal assistance. While some may choose to file independently, consulting a legal professional can help ensure compliance and proper completion of the form.

By addressing these misconceptions, individuals can better navigate the process of incorporating in Pennsylvania, ensuring a smoother transition into the business world.

Form Overview

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Articles of Incorporation are governed by the Pennsylvania Business Corporation Law of 1988. |

| Purpose | This form is used to legally create a corporation in Pennsylvania. |

| Filing Requirement | Filing the Articles of Incorporation with the Pennsylvania Department of State is mandatory. |

| Minimum Information | The form requires basic information such as the corporation's name, address, and purpose. |

| Registered Agent | A registered agent must be designated in the Articles of Incorporation to receive legal documents. |

| Filing Fee | A filing fee is required upon submission, which varies based on the type of corporation. |

| Effective Date | The Articles of Incorporation can specify an effective date, or they become effective upon filing. |

| Amendments | Changes to the Articles of Incorporation can be made through a formal amendment process. |