Fill Your Payroll Check Form

Understanding the Payroll Check form is essential for both employers and employees alike, as it serves as a critical component in the payroll process. This form outlines the details of an employee's earnings, including gross pay, deductions, and net pay, ensuring that everyone is on the same page when it comes to compensation. It typically includes vital information such as the employee's name, identification number, pay period, and the employer's information. Additionally, it breaks down various deductions like taxes, retirement contributions, and health insurance premiums, providing transparency in the payroll process. The importance of accuracy cannot be overstated; even minor errors can lead to significant issues down the line, affecting employee morale and compliance with labor laws. By familiarizing yourself with this form, you can navigate the complexities of payroll with greater confidence and clarity, safeguarding both your financial interests and those of your workforce.

Find Other Documents

Risks of Signing Gift Letter - Buyers can significantly streamline their application process by presenting a Gift Letter.

For those interested in establishing a business, understanding the requirements for Articles of Incorporation is vital. This form sets the framework for your corporation's operations and governance, ensuring compliance with state laws. To learn more about the essential aspects of Articles of Incorporation, visit the comprehensive guide on Articles of Incorporation.

Puppy Health Record - First car trip recorded for socialization efforts.

Common Questions

What is a Payroll Check form?

A Payroll Check form is a document used by employers to issue payments to employees for their work. This form typically includes details such as the employee's name, pay period, gross pay, deductions, and net pay. It serves as a record of the transaction and ensures that employees receive their wages accurately and on time.

How do I fill out a Payroll Check form?

To complete a Payroll Check form, start by entering the employee's name and identification number. Next, specify the pay period for which the payment is being made. Then, list the gross pay amount before any deductions. After that, include any deductions such as taxes, benefits, or retirement contributions. Finally, calculate the net pay, which is the amount the employee will receive after deductions. Ensure that all information is accurate to avoid payment issues.

What information is required on the Payroll Check form?

The Payroll Check form requires several key pieces of information. This includes the employee's full name, identification number, and address. You must also indicate the pay period, gross pay, and any deductions. Additionally, the net pay amount must be clearly stated. Accurate details are essential for compliance with tax regulations and for maintaining clear records.

When should I issue a Payroll Check?

Payroll Checks should be issued according to the established pay schedule of your organization. Common pay periods include weekly, bi-weekly, or monthly. It is important to issue checks promptly to ensure that employees receive their wages on time. Late payments can lead to dissatisfaction and may violate labor laws, so adhering to the schedule is crucial.

What should I do if there is an error on the Payroll Check?

If an error is discovered on a Payroll Check, it is important to address it immediately. First, notify the employee about the mistake. Then, correct the error by issuing a new check or adjusting the next payroll. Keep records of all corrections made to ensure transparency and compliance. Timely communication and resolution are key to maintaining trust with employees.

Preview - Payroll Check Form

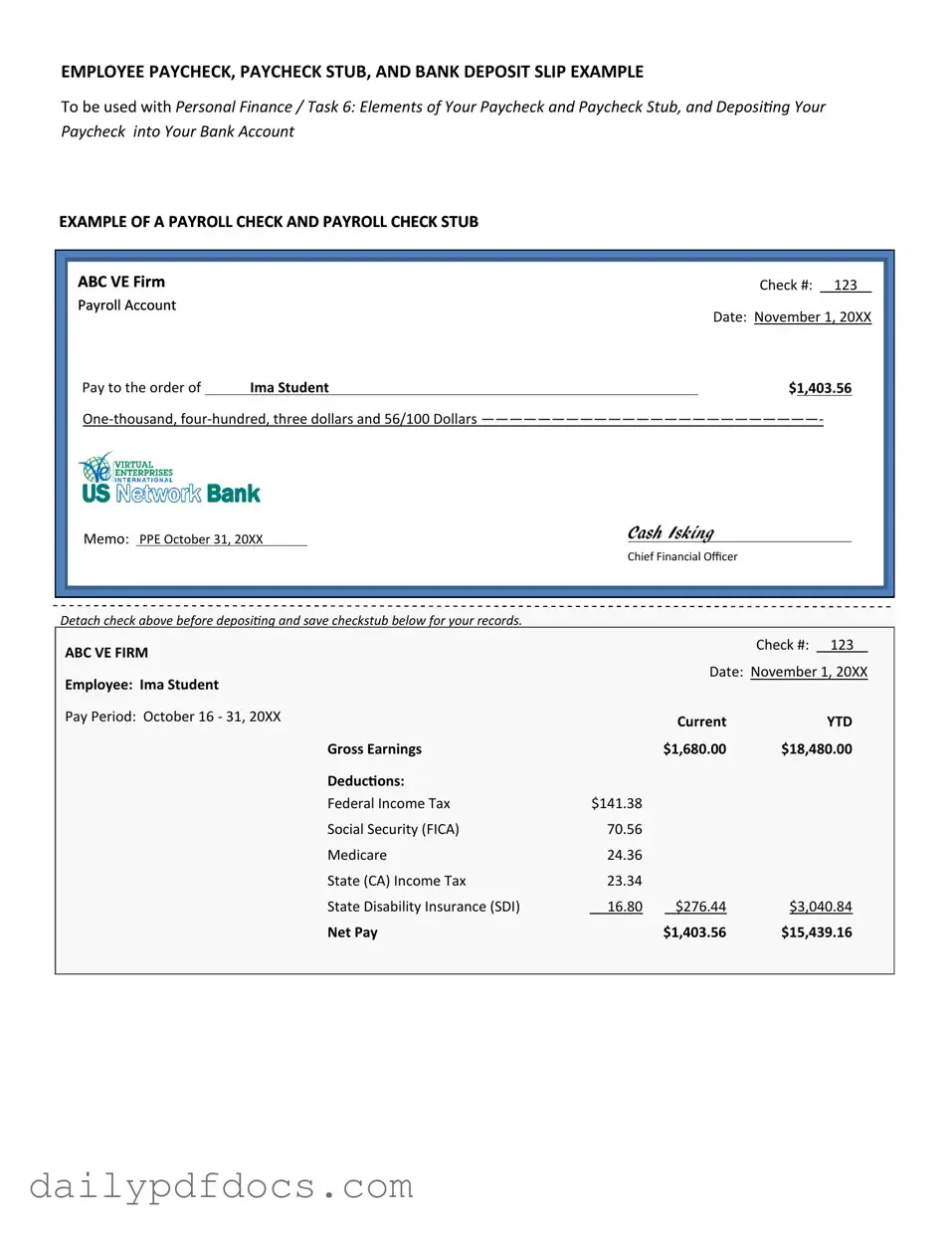

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

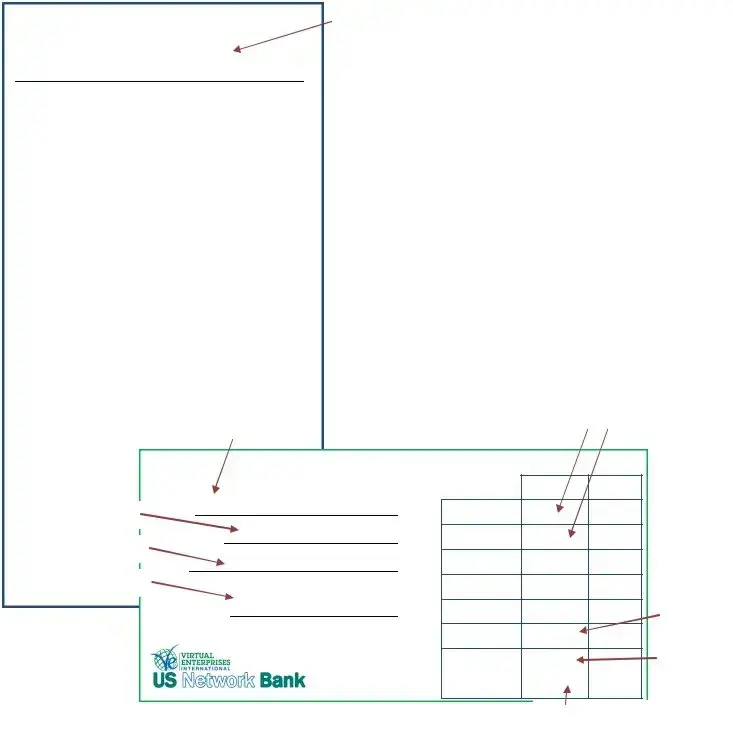

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Similar forms

The Payroll Check form serves a vital role in the payroll process, and it shares similarities with several other important documents. Here are six documents that resemble the Payroll Check form, along with explanations of how they are alike:

- Pay Stub: A pay stub provides a breakdown of an employee's earnings for a specific pay period. Like the Payroll Check form, it details gross pay, deductions, and net pay, ensuring transparency in compensation.

- W-2 Form: This form summarizes an employee's annual wages and the taxes withheld. Similar to the Payroll Check form, it is an official document that reflects income and tax information, used for tax filing purposes.

- Direct Deposit Authorization Form: This document allows employees to receive their pay directly into their bank accounts. It relates to the Payroll Check form in that both facilitate the payment process and ensure employees receive their earnings securely.

- Time Sheet: A time sheet records the hours worked by an employee during a pay period. It complements the Payroll Check form by providing the necessary data to calculate wages accurately.

- Payroll Register: This document lists all employees and their respective wages for a given pay period. Like the Payroll Check form, it serves as a record of payments made to employees and is essential for accounting purposes.

- Hold Harmless Agreement: This document serves to protect parties from liability associated with certain risks, providing clarity on responsibilities; more information can be found at Washington Templates.

- Employee Contract: An employee contract outlines the terms of employment, including salary and payment frequency. It is similar to the Payroll Check form in that both documents establish the financial obligations of the employer to the employee.

Misconceptions

Understanding the Payroll Check form is essential for accurate payroll processing. However, several misconceptions can lead to confusion. Here are four common misconceptions:

-

All employees must receive a physical check.

Many believe that payroll checks are only issued in physical form. In reality, electronic payments are increasingly common. Direct deposit is often preferred for its convenience and efficiency.

-

The Payroll Check form is the same for all states.

This is not true. Payroll regulations can vary significantly from one state to another. Employers must ensure compliance with their specific state laws when using the Payroll Check form.

-

Payroll checks are only for hourly employees.

Some think that payroll checks are exclusively for hourly workers. However, both salaried and hourly employees can receive payroll checks, depending on the company's payment structure.

-

Once a Payroll Check form is submitted, it cannot be changed.

This misconception can cause issues. While changes may be more complicated after submission, corrections can often be made if errors are identified promptly.

File Attributes

| Fact Name | Description |

|---|---|

| Definition | A Payroll Check form is used to issue payments to employees for their work. |

| Purpose | This form ensures employees receive their wages accurately and on time. |

| Components | Typically includes employee name, pay period, hours worked, and total pay. |

| Frequency | Payroll checks can be issued weekly, bi-weekly, or monthly, depending on company policy. |

| State Regulations | Each state has its own laws governing payroll practices, including payment frequency and deductions. |

| Record Keeping | Employers must keep records of payroll checks for a specified period, often three to seven years. |

| Tax Deductions | Payroll checks must reflect federal and state tax deductions as required by law. |

| Direct Deposit Option | Many employers offer direct deposit, allowing funds to be electronically transferred to employees' bank accounts. |

| Employee Access | Employees should receive a copy of their payroll check and a pay stub detailing their earnings and deductions. |

| Compliance | Employers must comply with the Fair Labor Standards Act (FLSA) and state-specific wage laws. |