The Illinois Trailer Bill of Sale form is a legal document that records the sale and transfer of ownership for a trailer in the state of Illinois. This form serves as proof of the transaction and includes essential details such...

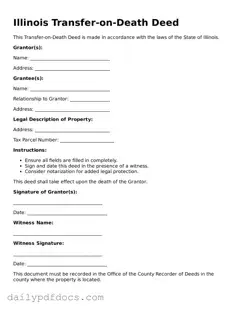

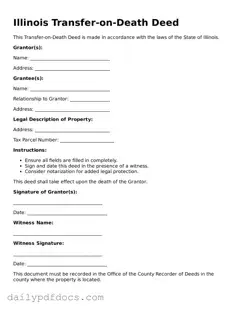

The Illinois Transfer-on-Death Deed form allows property owners to designate beneficiaries who will receive their real estate upon the owner's death, bypassing the probate process. This form provides a straightforward way to transfer property while maintaining control during the owner's...

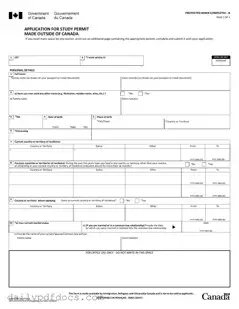

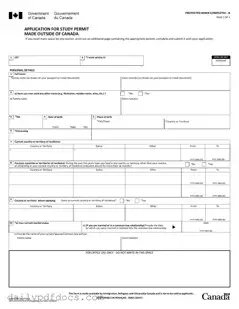

The IMM 1294 form is an application for a study permit for individuals applying from outside Canada. This form is essential for those who wish to pursue their education in Canada and must be completed accurately to ensure a smooth...

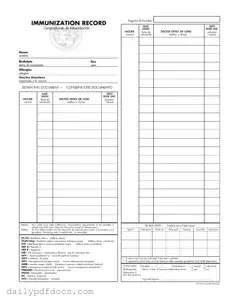

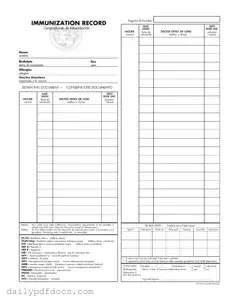

The Immunization Record form is a crucial document that tracks a child's vaccination history, ensuring compliance with state immunization requirements for school and childcare enrollment. This form contains essential details such as the child's name, birthdate, and vaccine reactions, serving...

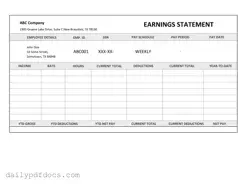

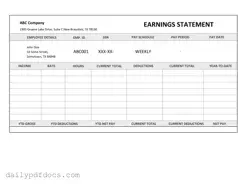

The Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for independent contractors. This form serves as a record of payment for services rendered, providing clarity on how compensation is calculated. Understanding this form is...

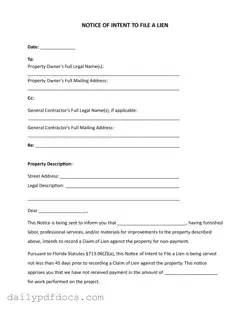

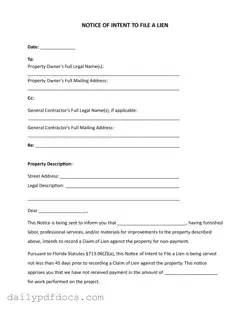

The Intent to Lien Florida form is a legal document that notifies property owners of a contractor's intention to file a lien due to non-payment for services rendered. This notice serves as a warning, giving property owners 45 days to...

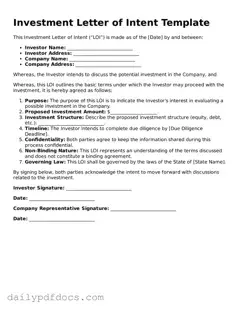

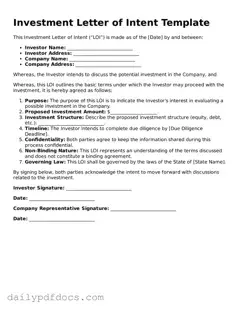

An Investment Letter of Intent (LOI) is a preliminary document that outlines the terms and conditions under which an investor expresses interest in making an investment. This form serves as a critical first step in the investment process, facilitating discussions...

The IRS 1099-MISC form is a tax document used to report various types of income received by individuals and businesses that are not classified as wages. This form is essential for ensuring compliance with tax regulations and helps the IRS...

The IRS 1120 form is a tax return used by corporations to report their income, gains, losses, deductions, and credits. This form plays a crucial role in determining a corporation's tax liability. Understanding its components can help ensure compliance and...

The IRS 941 form is a quarterly tax return that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. This form plays a crucial role in ensuring that the correct amounts are submitted...

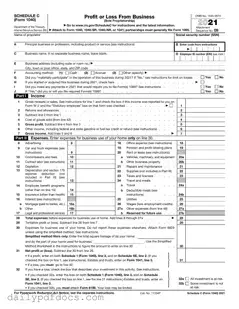

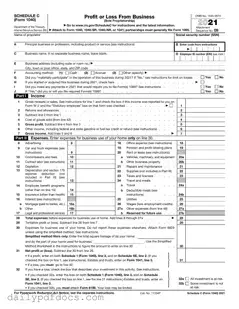

The IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business. This form allows individuals to detail their business expenses and calculate their net profit or loss for the...

The IRS W-2 form is a document that employers use to report an employee's annual wages and the taxes withheld from their paycheck. This form is essential for employees when filing their federal and state income tax returns. Understanding the...