Free Owner Financing Contract Template

In the realm of real estate transactions, the Owner Financing Contract form stands out as a pivotal tool for buyers and sellers alike. This agreement allows property owners to provide financing directly to buyers, circumventing traditional lenders and their often cumbersome processes. Key elements of this contract include the purchase price, down payment, interest rate, repayment schedule, and the duration of the financing period. Additionally, it outlines the responsibilities of both parties, including maintenance obligations and insurance requirements. By clearly delineating terms and conditions, the form helps to minimize misunderstandings and protects the interests of both the seller and the buyer. As the real estate market continues to evolve, understanding the nuances of owner financing becomes increasingly important for those looking to navigate the complexities of property transactions effectively.

Popular Owner Financing Contract Templates:

Purchase Agreement Addendum - This form is important for compliance with legal sales processes.

The Texas Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of a real estate transaction in Texas. This form is essential for buyers and sellers to clearly define their rights and obligations throughout the sale process. To get started on your real estate journey, fill out the form by visiting texasdocuments.net/printable-real-estate-purchase-agreement-form and clicking the button below.

Common Questions

What is an Owner Financing Contract?

An Owner Financing Contract is an agreement between a seller and a buyer where the seller provides financing to the buyer to purchase a property. This arrangement allows the buyer to make payments directly to the seller instead of obtaining a mortgage from a bank or financial institution. This can be beneficial for buyers who may have difficulty securing traditional financing and for sellers who wish to attract more potential buyers.

What are the key components of an Owner Financing Contract?

Key components typically include the purchase price, down payment amount, interest rate, payment schedule, and the duration of the loan. Additionally, the contract should outline the responsibilities of both parties, including property maintenance and insurance requirements. It is essential to ensure that all terms are clearly defined to avoid misunderstandings later on.

What are the benefits of using an Owner Financing Contract?

Owner financing can provide several advantages. Buyers may benefit from lower closing costs and a more flexible approval process. Sellers, on the other hand, can sell their property faster and potentially receive a higher price. This type of financing can also lead to a steady income stream for the seller, as they receive regular payments from the buyer.

Are there any risks associated with Owner Financing Contracts?

Yes, there are risks involved for both parties. Buyers may face the risk of default if they cannot keep up with payments, which could lead to losing their investment. Sellers must also be cautious, as they may have to deal with the complexities of foreclosure if the buyer fails to fulfill their obligations. It is advisable for both parties to seek legal counsel to fully understand their rights and responsibilities before entering into an Owner Financing Contract.

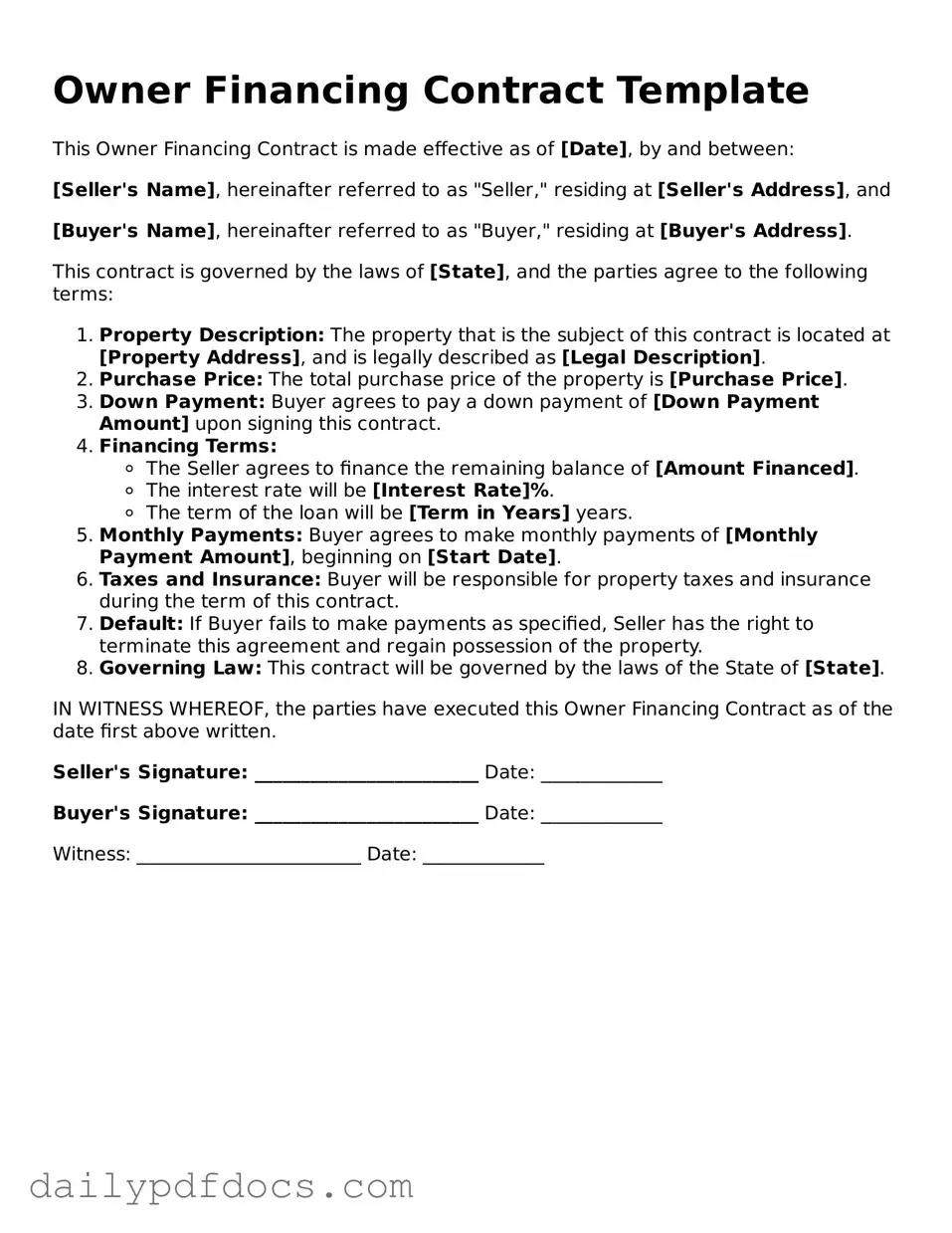

Preview - Owner Financing Contract Form

Owner Financing Contract Template

This Owner Financing Contract is made effective as of [Date], by and between:

[Seller's Name], hereinafter referred to as "Seller," residing at [Seller's Address], and

[Buyer's Name], hereinafter referred to as "Buyer," residing at [Buyer's Address].

This contract is governed by the laws of [State], and the parties agree to the following terms:

- Property Description: The property that is the subject of this contract is located at [Property Address], and is legally described as [Legal Description].

- Purchase Price: The total purchase price of the property is [Purchase Price].

- Down Payment: Buyer agrees to pay a down payment of [Down Payment Amount] upon signing this contract.

- Financing Terms:

- The Seller agrees to finance the remaining balance of [Amount Financed].

- The interest rate will be [Interest Rate]%.

- The term of the loan will be [Term in Years] years.

- Monthly Payments: Buyer agrees to make monthly payments of [Monthly Payment Amount], beginning on [Start Date].

- Taxes and Insurance: Buyer will be responsible for property taxes and insurance during the term of this contract.

- Default: If Buyer fails to make payments as specified, Seller has the right to terminate this agreement and regain possession of the property.

- Governing Law: This contract will be governed by the laws of the State of [State].

IN WITNESS WHEREOF, the parties have executed this Owner Financing Contract as of the date first above written.

Seller's Signature: ________________________ Date: _____________

Buyer's Signature: ________________________ Date: _____________

Witness: ________________________ Date: _____________

Similar forms

Purchase Agreement: This document outlines the terms and conditions of the sale of a property. Like the Owner Financing Contract, it specifies the purchase price and details about the buyer and seller.

Real Estate Purchase Agreement: This essential document governs the terms of a property sale and purchase, similar to the Colorado PDF Templates, ensuring all parties are fully informed and protected throughout the transaction.

Lease Option Agreement: This agreement allows a tenant to rent a property with the option to buy it later. Similar to owner financing, it provides a pathway to ownership while the tenant builds equity.

Promissory Note: A promissory note is a written promise to pay a specified amount of money at a certain time. It is similar to the Owner Financing Contract in that it details the repayment terms and obligations of the borrower.

Deed of Trust: This document secures a loan by transferring the title of the property to a trustee until the loan is paid off. It functions similarly to an Owner Financing Contract by ensuring that the seller has a claim to the property until the buyer fulfills their payment obligations.

Sales Agreement: A sales agreement specifies the sale of goods or services. Like the Owner Financing Contract, it includes payment terms and conditions, ensuring both parties understand their responsibilities.

Installment Sale Agreement: This agreement allows the buyer to make payments over time while gaining ownership of the property. It mirrors the Owner Financing Contract by providing a structured payment plan that benefits both parties.

Misconceptions

- Owner financing is only for buyers with bad credit. This is a common misconception. Owner financing can be beneficial for buyers with good credit as well, offering more flexible terms than traditional lenders.

- All owner financing agreements are the same. Each agreement can vary significantly. Terms such as interest rates, payment schedules, and duration can differ based on negotiations between the buyer and seller.

- Owner financing eliminates the need for a real estate agent. While some buyers and sellers choose to work without an agent, having professional guidance can help navigate the complexities of the agreement.

- Owner financing is a risky option for sellers. While there are risks, such as the buyer defaulting, sellers can mitigate these risks through careful screening and clear contract terms.

- Buyers have no rights in owner financing contracts. Buyers retain rights just like in traditional financing. The contract outlines both parties' responsibilities and rights, ensuring protection for the buyer.

- Owner financing is only for residential properties. This is not true. Owner financing can also be used for commercial properties, land sales, and other types of real estate transactions.

- Once the owner financing contract is signed, it cannot be changed. Modifications can be made if both parties agree. It's important to document any changes to ensure clarity and legality.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract is an agreement where the seller provides financing to the buyer to purchase property. |

| Down Payment | Typically, the buyer makes a down payment, which is a percentage of the purchase price, before financing the remaining balance. |

| Interest Rate | The contract specifies the interest rate, which can be fixed or variable, affecting the total cost of the loan. |

| Repayment Terms | Repayment terms include the duration of the loan and the schedule of payments, often monthly. |

| Governing Law | In the United States, the governing law varies by state. For example, California's laws on real estate financing apply to contracts executed there. |

| Default Clauses | The contract includes clauses that outline what happens if the buyer defaults on payments, including potential foreclosure. |

| Title Transfer | Title to the property typically transfers to the buyer, but the seller may retain a lien until the loan is paid off. |

| Legal Requirements | Owner financing contracts must comply with federal and state laws, including disclosure requirements and usury laws. |

| Benefits | This financing option can benefit buyers who may not qualify for traditional loans and sellers who want to attract more buyers. |