Free Operating Agreement Template

When starting a business, particularly a limited liability company (LLC), having a solid plan in place is essential for success. One of the most important documents you'll need is the Operating Agreement. This form outlines the internal structure of your LLC, detailing how the business will be managed and how decisions will be made. It covers key aspects such as the roles and responsibilities of members, voting rights, and profit distribution. Additionally, the Operating Agreement addresses what happens in various scenarios, including the addition of new members or the exit of existing ones. By laying out these fundamental elements, the Operating Agreement helps to prevent misunderstandings and disputes down the line. It serves as a roadmap for your business, ensuring that everyone involved is on the same page. Whether you’re a sole member or have multiple partners, this document is crucial for establishing a clear framework for your operations and protecting your interests.

Find Common Templates

Corrective Deed California - This declaration serves as evidence of a scrivener’s due diligence in document creation.

The California Employment Verification form is a document used to confirm an individual's employment status and history in the state of California. This form is essential for employers and employees alike, ensuring that verification processes are streamlined and compliant with state regulations. To ensure you have the proper documentation for your employment needs, consider filling out the form by clicking the button below, which you can also find among the resources at Top Document Templates.

Generic Bill of Sale for Car - This document often signifies a formal commitment to the sale from both sides.

Creating a Job Application - Answer questions about family members employed by the company.

Operating Agreement - Tailored for Individual States

Operating Agreement Form Subtypes

Common Questions

What is an Operating Agreement?

An Operating Agreement is a document that outlines the ownership and operating procedures of a limited liability company (LLC). It serves as a guide for the members of the LLC, detailing their rights, responsibilities, and how the business will be managed. This agreement is crucial for preventing misunderstandings and disputes among members.

Why is an Operating Agreement important?

This document is important because it helps establish clear rules and expectations for the members. Without an Operating Agreement, state laws will govern the LLC, which may not reflect the members' intentions. Having a tailored agreement can protect personal assets and provide a framework for decision-making and profit distribution.

Who should create the Operating Agreement?

The Operating Agreement should be created by the members of the LLC. All members should participate in drafting the agreement to ensure it reflects their collective vision for the business. It is often beneficial to consult with a legal professional to ensure that the document meets all legal requirements and adequately addresses the needs of the members.

Can an Operating Agreement be changed?

Yes, an Operating Agreement can be amended. Members must agree on any changes, and it is advisable to document these changes in writing. Following the procedures outlined in the original Operating Agreement for making amendments is crucial to ensure that the changes are valid and enforceable.

Is an Operating Agreement required by law?

While not all states require an Operating Agreement for LLCs, it is highly recommended. Having one can help avoid legal issues and provide a clear structure for the business. Some states may require an Operating Agreement if the LLC has more than one member, so it's wise to check local regulations.

What should be included in an Operating Agreement?

An Operating Agreement should include several key elements. These typically cover the LLC's name, purpose, member contributions, profit distribution, management structure, and procedures for adding or removing members. Additionally, it should outline how decisions will be made and what happens if a member wants to exit the LLC.

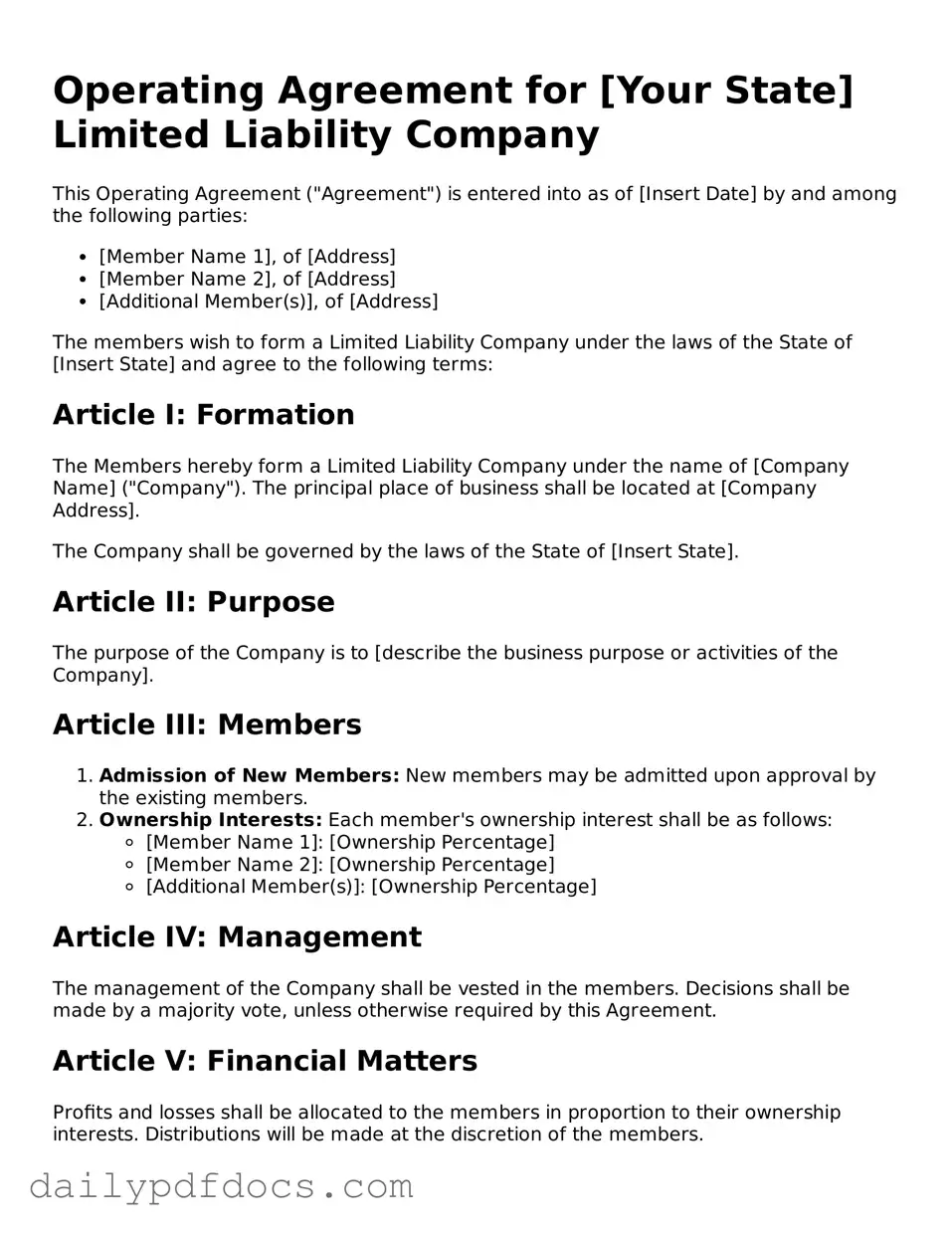

Preview - Operating Agreement Form

Operating Agreement for [Your State] Limited Liability Company

This Operating Agreement ("Agreement") is entered into as of [Insert Date] by and among the following parties:

- [Member Name 1], of [Address]

- [Member Name 2], of [Address]

- [Additional Member(s)], of [Address]

The members wish to form a Limited Liability Company under the laws of the State of [Insert State] and agree to the following terms:

Article I: Formation

The Members hereby form a Limited Liability Company under the name of [Company Name] ("Company"). The principal place of business shall be located at [Company Address].

The Company shall be governed by the laws of the State of [Insert State].

Article II: Purpose

The purpose of the Company is to [describe the business purpose or activities of the Company].

Article III: Members

- Admission of New Members: New members may be admitted upon approval by the existing members.

- Ownership Interests: Each member's ownership interest shall be as follows:

- [Member Name 1]: [Ownership Percentage]

- [Member Name 2]: [Ownership Percentage]

- [Additional Member(s)]: [Ownership Percentage]

Article IV: Management

The management of the Company shall be vested in the members. Decisions shall be made by a majority vote, unless otherwise required by this Agreement.

Article V: Financial Matters

Profits and losses shall be allocated to the members in proportion to their ownership interests. Distributions will be made at the discretion of the members.

Article VI: Records

The Company shall maintain complete and accurate records of its business and financial affairs. Each member shall have access to the records during normal business hours.

Article VII: Indemnification

The Company shall indemnify the members to the fullest extent permitted by law against any losses, expenses, or liabilities incurred in connection with company affairs.

Article VIII: Amendments

This Agreement may be amended only by a written agreement signed by all members.

Article IX: Miscellaneous

This Agreement constitutes the entire understanding among the members with respect to the subject matter hereof and supersedes all prior agreements. If any provision of this Agreement is found to be invalid, the remaining provisions shall remain in effect.

IN WITNESS WHEREOF, the parties have executed this Operating Agreement as of the date first above written.

- ______________________________

- [Member Name 1]

- ______________________________

- [Member Name 2]

- ______________________________

- [Additional Member(s)]

Similar forms

-

Bylaws: Bylaws govern the internal management of a corporation. Like an Operating Agreement, they outline the roles of members, procedures for meetings, and decision-making processes.

-

Partnership Agreement: This document defines the relationship between partners in a business. It covers profit sharing, responsibilities, and dispute resolution, similar to how an Operating Agreement addresses these aspects for LLC members.

-

Shareholder Agreement: A Shareholder Agreement outlines the rights and obligations of shareholders in a corporation. It includes provisions for transferring shares and decision-making, akin to the provisions in an Operating Agreement for LLC members.

-

Joint Venture Agreement: This agreement outlines the terms of collaboration between two or more parties. It specifies contributions, profit sharing, and management, similar to the operational structure defined in an Operating Agreement.

-

Franchise Agreement: A Franchise Agreement establishes the relationship between a franchisor and franchisee. It details operational guidelines and responsibilities, much like how an Operating Agreement defines member roles and obligations.

-

Operating Plan: An Operating Plan provides a detailed roadmap for running a business. It includes objectives, strategies, and responsibilities, paralleling the operational guidelines found in an Operating Agreement.

-

Management Agreement: This document outlines the terms under which one party manages another's business. It specifies duties and compensation, similar to how an Operating Agreement delineates management roles within an LLC.

-

Employment Agreement: An Employment Agreement sets the terms of employment between an employer and employee. It includes job responsibilities and compensation, akin to how an Operating Agreement defines member roles and contributions.

Misconceptions

Understanding the Operating Agreement is crucial for anyone involved in a business partnership or limited liability company (LLC). However, several misconceptions can cloud this important document. Here are eight common misunderstandings:

-

It's only necessary for large businesses.

Many people believe that only large companies need an Operating Agreement. In reality, even small businesses benefit from having one. It helps clarify roles, responsibilities, and expectations among members.

-

It's a legal requirement in all states.

While some states require an Operating Agreement for LLCs, others do not. However, having one is always a good idea, as it provides structure and can help prevent disputes.

-

It doesn't need to be updated.

Some assume that once an Operating Agreement is created, it can be forgotten. Changes in membership, business structure, or goals may necessitate updates to the document.

-

It only covers financial matters.

This document addresses more than just finances. It outlines management roles, decision-making processes, and procedures for resolving conflicts, making it a comprehensive guide for the business.

-

All members must agree on every detail.

While consensus is important, not every detail requires unanimous agreement. The Operating Agreement can specify how decisions are made, allowing for majority rules in certain situations.

-

It’s a one-size-fits-all document.

Many believe that a standard template will suffice for any business. However, each business is unique, and the Operating Agreement should reflect the specific needs and goals of the members involved.

-

It’s only for partnerships.

While partnerships often use Operating Agreements, LLCs also rely on them. This document is essential for any business structure that has multiple owners, regardless of the form it takes.

-

Once signed, it cannot be changed.

Some think that an Operating Agreement is set in stone. In fact, members can amend the agreement as needed, provided they follow the procedures outlined within it.

By addressing these misconceptions, business owners can better understand the importance of an Operating Agreement and how it can protect their interests and facilitate smoother operations.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC). |

| Members | It identifies the members of the LLC and their respective ownership percentages. |

| Management Structure | The agreement specifies whether the LLC is member-managed or manager-managed. |

| Governing Law | The agreement is governed by the laws of the state where the LLC is formed. |

| Amendments | It outlines the process for amending the Operating Agreement in the future. |

| Dispute Resolution | The agreement may include provisions for resolving disputes among members. |

| Capital Contributions | It details the initial capital contributions made by each member. |

| Profit Distribution | The agreement specifies how profits and losses will be distributed among members. |