Printable Transfer-on-Death Deed Document for Ohio

In Ohio, the Transfer-on-Death Deed (TODD) offers a unique opportunity for property owners to manage the future of their real estate without the complexities of probate. This legal instrument allows individuals to designate beneficiaries who will automatically inherit their property upon their death, ensuring a smooth transition of ownership. Unlike traditional methods of transferring property, the TODD does not require the property to go through the probate process, which can be time-consuming and costly. By utilizing this deed, property owners maintain control over their assets during their lifetime, with the added benefit of simplicity for their heirs. The form must be properly executed and recorded to be effective, and it is essential to understand the implications of revoking or changing beneficiaries. With the right knowledge, the Transfer-on-Death Deed can serve as a powerful tool in estate planning, providing peace of mind and clarity for both the property owner and their loved ones.

More State-specific Transfer-on-Death Deed Forms

Tod in California - It’s an important consideration for anyone wanting to streamline their estate planning.

A prenuptial agreement form in Ohio is a legal document that couples create before marriage to outline the division of assets and responsibilities in the event of a divorce. This form helps ensure that both parties have a clear understanding of their rights and obligations. By addressing financial matters ahead of time, couples can foster open communication and reduce potential conflicts in the future. For more information on creating this document, visit Ohio PDF Forms.

Free Printable Transfer on Death Deed Form Georgia - Designating multiple beneficiaries is permitted, allowing you to distribute the property among several heirs.

Common Questions

What is a Transfer-on-Death Deed in Ohio?

A Transfer-on-Death Deed (TOD Deed) in Ohio allows property owners to designate beneficiaries who will receive their real estate upon their death. This deed enables the transfer of property outside of probate, simplifying the process for heirs and ensuring that the property goes directly to the intended beneficiaries without court intervention.

Who can create a Transfer-on-Death Deed?

Any individual who holds title to real estate in Ohio can create a Transfer-on-Death Deed. This includes sole owners and co-owners. However, it is essential that the property owner is of sound mind and legal age when executing the deed.

How does a Transfer-on-Death Deed work?

To use a Transfer-on-Death Deed, the property owner fills out the form, naming one or more beneficiaries. The deed must be signed and notarized, then filed with the county recorder’s office. Upon the owner’s death, the property automatically transfers to the beneficiaries without going through probate, provided the deed was properly executed and recorded.

Can a Transfer-on-Death Deed be revoked?

Yes, a Transfer-on-Death Deed can be revoked at any time before the property owner’s death. The property owner may do this by executing a new deed that explicitly revokes the previous one or by recording a written revocation with the county recorder. It is important to follow the proper procedures to ensure the revocation is valid.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences for the property owner. The property will be subject to estate taxes if applicable upon the owner’s death. Beneficiaries may also face capital gains taxes when they sell the property, depending on the property’s value at the time of the owner's death compared to its value at the time of transfer.

What happens if a beneficiary predeceases the property owner?

If a beneficiary named in a Transfer-on-Death Deed passes away before the property owner, the beneficiary’s share typically passes to their heirs, unless otherwise specified in the deed. It is advisable to include alternate beneficiaries to avoid complications in such situations.

Is legal assistance necessary to create a Transfer-on-Death Deed?

While it is not legally required to have an attorney draft a Transfer-on-Death Deed, consulting with a legal professional is highly recommended. They can provide guidance on the implications of the deed, ensure compliance with state laws, and help avoid potential pitfalls that could affect the transfer of property.

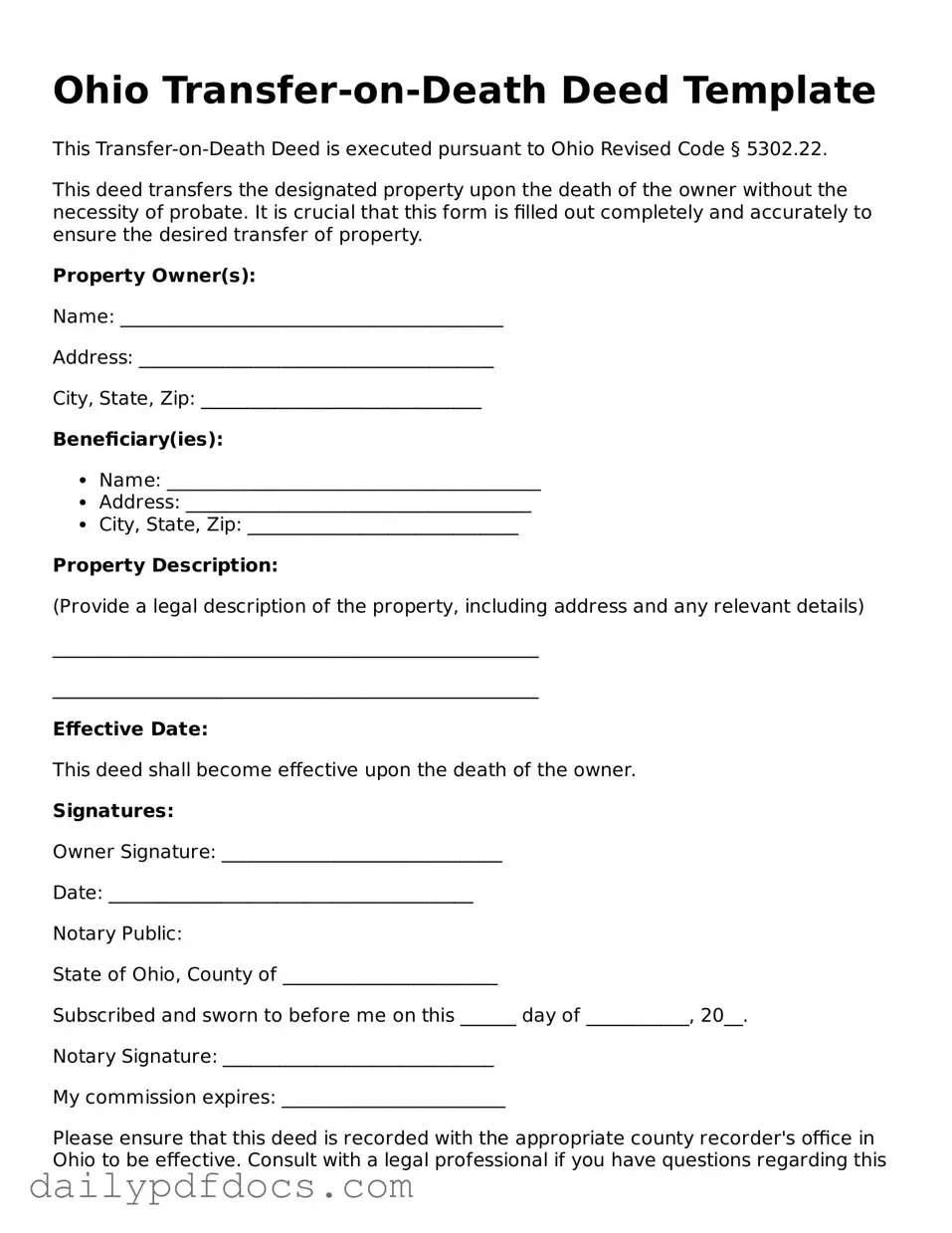

Preview - Ohio Transfer-on-Death Deed Form

Ohio Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed pursuant to Ohio Revised Code § 5302.22.

This deed transfers the designated property upon the death of the owner without the necessity of probate. It is crucial that this form is filled out completely and accurately to ensure the desired transfer of property.

Property Owner(s):

Name: _________________________________________

Address: ______________________________________

City, State, Zip: ______________________________

Beneficiary(ies):

- Name: ________________________________________

- Address: _____________________________________

- City, State, Zip: _____________________________

Property Description:

(Provide a legal description of the property, including address and any relevant details)

____________________________________________________

____________________________________________________

Effective Date:

This deed shall become effective upon the death of the owner.

Signatures:

Owner Signature: ______________________________

Date: _______________________________________

Notary Public:

State of Ohio, County of _______________________

Subscribed and sworn to before me on this ______ day of ___________, 20__.

Notary Signature: _____________________________

My commission expires: ________________________

Please ensure that this deed is recorded with the appropriate county recorder's office in Ohio to be effective. Consult with a legal professional if you have questions regarding this document.

Similar forms

- Will: A will allows individuals to specify how their assets should be distributed upon their death. Like a Transfer-on-Death Deed, it serves to transfer property but becomes effective only after death.

- Mobile Home Bill of Sale: A legal document essential for transferring ownership of a mobile home in Florida, detailing the buyer, seller, and mobile home's specifications. Understanding this document is crucial for ensuring a smooth transaction, as outlined at mobilehomebillofsale.com/blank-florida-mobile-home-bill-of-sale.

- Living Trust: A living trust is an arrangement where assets are transferred into a trust during a person's lifetime. Similar to a Transfer-on-Death Deed, it allows for the direct transfer of property without going through probate.

- Beneficiary Designation: This document is often used for financial accounts and insurance policies. It allows individuals to name beneficiaries who will receive assets directly upon death, mirroring the intent of a Transfer-on-Death Deed.

- Joint Tenancy with Right of Survivorship: In this arrangement, two or more people own property together. When one owner dies, the property automatically transfers to the surviving owner, similar to how a Transfer-on-Death Deed operates.

- Payable-on-Death Accounts: These accounts allow individuals to designate a beneficiary who will receive the funds upon their death. This process bypasses probate, much like a Transfer-on-Death Deed.

- Transfer-on-Death Registration for Securities: This allows individuals to designate a beneficiary for stocks and bonds. Upon death, the assets transfer directly to the beneficiary, akin to the Transfer-on-Death Deed's function.

- Life Estate Deed: This deed allows a person to retain the right to use property during their lifetime, with the property passing to another upon their death. It serves a similar purpose in property transfer as a Transfer-on-Death Deed.

- Durable Power of Attorney for Finances: While primarily used for financial decision-making, it can include provisions for transferring property upon death. This can align with the goals of a Transfer-on-Death Deed.

Misconceptions

When it comes to the Ohio Transfer-on-Death Deed (TODD), several misconceptions often arise. Understanding the truth behind these can help individuals make informed decisions about their estate planning. Here are five common misconceptions:

- The Transfer-on-Death Deed is only for wealthy individuals. This is not true. The TODD can be beneficial for anyone who owns real estate and wants to ensure a smooth transfer of property upon their passing, regardless of their financial status.

- Using a TODD means you lose control of your property while you are alive. This misconception is misleading. With a TODD, you retain full control over your property during your lifetime. You can sell, mortgage, or change the deed at any time.

- A TODD avoids probate entirely. While a TODD can help simplify the transfer of property and may reduce the amount of property going through probate, it does not eliminate the probate process for other assets or debts that may exist.

- You cannot change or revoke a TODD once it is created. This is incorrect. A TODD can be revoked or changed at any time before the death of the property owner, allowing for flexibility in estate planning.

- All heirs will automatically inherit the property without any issues. This is a common misunderstanding. While a TODD designates beneficiaries, disputes can still arise among heirs, especially if there are other claims or if the beneficiaries are not clearly defined.

Understanding these misconceptions can lead to better estate planning and ensure that your wishes are honored after your passing. It’s always wise to consult with a legal professional to navigate the nuances of property transfer effectively.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | The Ohio Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Ohio Revised Code Section 5302.22. |

| Eligibility | Any individual who owns real estate in Ohio can create a Transfer-on-Death Deed. |

| Beneficiaries | Property owners can name one or more beneficiaries in the deed. |

| Revocation | Property owners can revoke or change the deed at any time before their death. |

| Execution Requirements | The deed must be signed by the owner and acknowledged before a notary public. |

| Filing | To be effective, the deed must be recorded with the county recorder's office where the property is located. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes or income taxes during the owner's lifetime. |