Printable Tractor Bill of Sale Document for Ohio

In Ohio, when purchasing or selling a tractor, it is essential to document the transaction with a Tractor Bill of Sale form. This form serves as a legal record that outlines the details of the sale, ensuring that both the buyer and seller are protected in the event of disputes or misunderstandings. Key components of the form include the identification of the parties involved, a thorough description of the tractor—including make, model, year, and Vehicle Identification Number (VIN)—and the agreed-upon sale price. Additionally, the form may require the inclusion of any warranties or representations made by the seller regarding the condition of the tractor. Notably, both parties must sign the document to validate the transaction, and while notarization is not always mandatory, it can add an extra layer of authenticity. By utilizing the Tractor Bill of Sale, individuals can facilitate a smoother transfer of ownership, comply with state regulations, and maintain clear records for future reference.

More State-specific Tractor Bill of Sale Forms

Bill of Sale for a Tractor - A clear method for detailing future obligations tied to the sale.

Understanding the significance of a comprehensive Residential Lease Agreement guide is crucial for both landlords and tenants. This document is key in ensuring that all parties are aware of their rights and obligations, promoting a harmonious rental experience.

Farm Tractor Bill of Sale - Ensures a comprehensive understanding of the sale through clear terms of sale.

Common Questions

What is a Tractor Bill of Sale in Ohio?

A Tractor Bill of Sale is a legal document that records the sale of a tractor from one party to another in Ohio. This form includes details such as the buyer's and seller's information, the tractor's description, and the sale price. It serves as proof of the transaction and can be important for registration and tax purposes.

Do I need a Tractor Bill of Sale to sell a tractor in Ohio?

While it is not legally required to have a Tractor Bill of Sale to sell a tractor in Ohio, it is highly recommended. This document protects both the buyer and the seller by providing a written record of the transaction. It can help resolve any disputes that may arise after the sale.

What information should be included in the Tractor Bill of Sale?

The Tractor Bill of Sale should include several key pieces of information. This includes the names and addresses of both the buyer and seller, the date of the sale, a detailed description of the tractor (make, model, year, VIN), the sale price, and any warranties or conditions of the sale. Both parties should sign the document to validate it.

Is a notary required for the Tractor Bill of Sale in Ohio?

A notary is not required for a Tractor Bill of Sale in Ohio. However, having the document notarized can add an extra layer of authenticity and may be beneficial if there are any disputes later on. It is a good practice to have the signatures witnessed or notarized, especially for high-value transactions.

Can I use a generic Bill of Sale form for my tractor sale?

Yes, you can use a generic Bill of Sale form for your tractor sale, as long as it includes all necessary information. However, using a specific Tractor Bill of Sale form can help ensure that all relevant details are captured and that the document complies with Ohio laws regarding vehicle sales.

What should I do after completing the Tractor Bill of Sale?

After completing the Tractor Bill of Sale, both the buyer and seller should keep a copy for their records. The buyer may need this document to register the tractor with the Ohio Bureau of Motor Vehicles. It is also advisable to inform any relevant authorities about the sale, especially if the tractor is registered or titled.

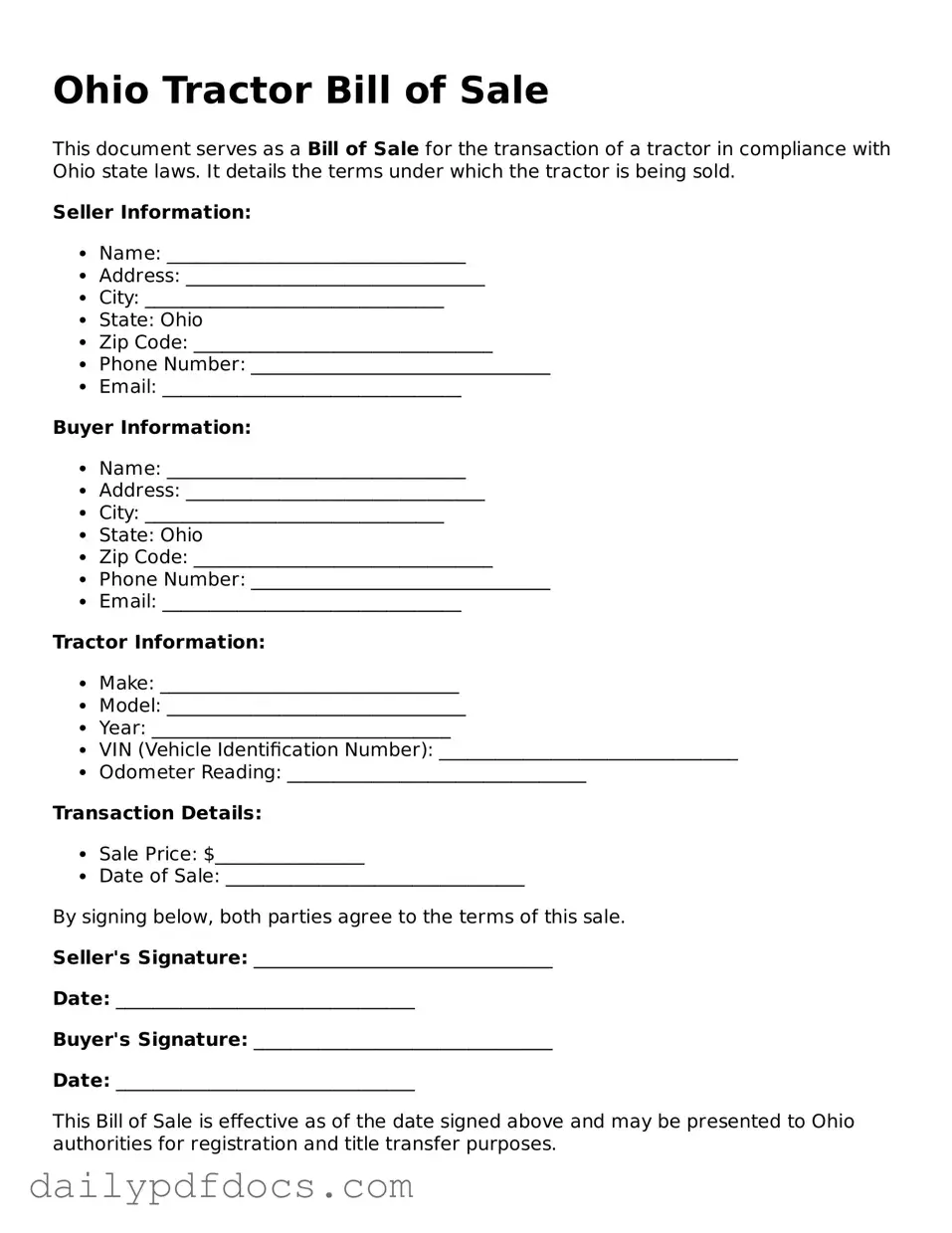

Preview - Ohio Tractor Bill of Sale Form

Ohio Tractor Bill of Sale

This document serves as a Bill of Sale for the transaction of a tractor in compliance with Ohio state laws. It details the terms under which the tractor is being sold.

Seller Information:

- Name: ________________________________

- Address: ________________________________

- City: ________________________________

- State: Ohio

- Zip Code: ________________________________

- Phone Number: ________________________________

- Email: ________________________________

Buyer Information:

- Name: ________________________________

- Address: ________________________________

- City: ________________________________

- State: Ohio

- Zip Code: ________________________________

- Phone Number: ________________________________

- Email: ________________________________

Tractor Information:

- Make: ________________________________

- Model: ________________________________

- Year: ________________________________

- VIN (Vehicle Identification Number): ________________________________

- Odometer Reading: ________________________________

Transaction Details:

- Sale Price: $________________

- Date of Sale: ________________________________

By signing below, both parties agree to the terms of this sale.

Seller's Signature: ________________________________

Date: ________________________________

Buyer's Signature: ________________________________

Date: ________________________________

This Bill of Sale is effective as of the date signed above and may be presented to Ohio authorities for registration and title transfer purposes.

Similar forms

-

Vehicle Bill of Sale: This document serves a similar purpose by transferring ownership of a motor vehicle from one party to another. It includes details such as the vehicle's make, model, year, and Vehicle Identification Number (VIN), ensuring both parties have a clear record of the transaction.

Mobile Home Bill of Sale: This form is essential for the sale of a mobile home, documenting the transaction and including details such as sale price, buyer and seller information, and mobile home description. For more information, visit https://mobilehomebillofsale.com/blank-indiana-mobile-home-bill-of-sale.

-

Boat Bill of Sale: Like the Tractor Bill of Sale, this form is used to document the sale of a boat. It outlines the boat's specifications and the terms of sale, protecting both the buyer and seller by providing proof of ownership transfer.

-

Motorcycle Bill of Sale: This document is specifically for the sale of motorcycles. It includes important information such as the motorcycle's VIN, odometer reading, and sale price, similar to how a Tractor Bill of Sale details the equipment being sold.

-

Equipment Bill of Sale: This form is used for the sale of various types of equipment, including construction machinery. It details the equipment's specifications and sale conditions, much like the Tractor Bill of Sale does for tractors.

-

Real Estate Purchase Agreement: While more complex, this document outlines the terms of a real estate transaction. It includes details about the property and the sale price, providing a legal framework for the transfer, akin to how the Tractor Bill of Sale formalizes the sale of a tractor.

-

Personal Property Bill of Sale: This document can be used for various personal items, including furniture or electronics. It serves to document the sale and transfer of ownership, similar to how the Tractor Bill of Sale functions for agricultural equipment.

Misconceptions

Understanding the Ohio Tractor Bill of Sale form is crucial for anyone involved in the buying or selling of tractors in the state. Unfortunately, several misconceptions can lead to confusion and potentially problematic transactions. Below is a list of common misunderstandings regarding this important document.

- The form is only necessary for new tractors. Many believe that the Bill of Sale is only needed for new tractor purchases. In reality, it is essential for both new and used tractors to establish ownership and protect the buyer's rights.

- Only licensed dealers can provide a Bill of Sale. This misconception suggests that only professional dealers can issue a Bill of Sale. In fact, private individuals can also create and sign this document, making it a flexible option for private transactions.

- A Bill of Sale is not legally binding. Some people think that a Bill of Sale holds no legal weight. However, it serves as a formal agreement between the buyer and seller, providing evidence of the transaction and the terms agreed upon.

- The form needs to be notarized. While notarization can add an extra layer of authenticity, it is not a requirement for the Ohio Tractor Bill of Sale. The form can be valid without a notary’s signature, provided it is signed by both parties.

- All sales must be recorded with the state. Many assume that every tractor sale must be reported to a state agency. While it is important to keep records for personal use and tax purposes, there is no requirement for all sales to be officially recorded.

- Only the seller needs to sign the Bill of Sale. This belief overlooks the importance of both parties’ signatures. Both the buyer and seller should sign the document to ensure mutual agreement on the transaction details.

- The Bill of Sale is unnecessary if a title is transferred. Some think that if a title transfer occurs, a Bill of Sale is redundant. However, the Bill of Sale serves distinct purposes, including documenting the sale price and terms, which may not be detailed on the title.

- There is a standard format for the Bill of Sale. While there are common elements that should be included, there is no single standard format mandated by law. Buyers and sellers can customize the form to meet their specific needs, as long as it includes essential information.

- The Bill of Sale is only for personal use. This misconception implies that the document has no relevance beyond the immediate transaction. In fact, it can be crucial for future reference, especially if disputes arise or for tax documentation.

- Once signed, the Bill of Sale cannot be amended. Some believe that any changes to the document after signing invalidate it. While amendments can complicate matters, they can be made if both parties agree and initial the changes, ensuring clarity and mutual consent.

It is vital to dispel these misconceptions to ensure smooth transactions and protect the rights of both buyers and sellers. Understanding the true nature of the Ohio Tractor Bill of Sale can prevent legal complications and foster trust in the marketplace.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor in Ohio. |

| Governing Law | This form is governed by Ohio Revised Code § 4505.06, which outlines the requirements for vehicle transfers. |

| Essential Information | It typically includes details about the buyer, seller, tractor make, model, year, and VIN (Vehicle Identification Number). |

| Notarization | While notarization is not always required, having the document notarized can provide additional legal protection for both parties. |

| Record Keeping | Both the buyer and seller should keep a copy of the completed form for their records, as it serves as proof of the transaction. |