Printable Promissory Note Document for Ohio

In the realm of personal and business finance, the Ohio Promissory Note serves as a crucial document that outlines the terms of a loan agreement between a borrower and a lender. This legal instrument specifies the amount borrowed, the interest rate, and the repayment schedule, ensuring both parties have a clear understanding of their obligations. Typically, it includes essential details such as the names of the parties involved, the date of the agreement, and any applicable fees or penalties for late payments. Additionally, the form may incorporate provisions for default and remedies available to the lender, providing a safety net in case of non-compliance. By clearly delineating the rights and responsibilities of each party, the Ohio Promissory Note not only fosters trust but also serves as a safeguard against potential disputes. Understanding the nuances of this document is vital for anyone engaging in lending or borrowing, as it lays the groundwork for a successful financial transaction.

More State-specific Promissory Note Forms

Illinois Promissory Note - It helps clarify the obligations and rights of each party involved.

Free Promissory Note Template California - This document outlines the borrower's commitment to repay a loan under agreed terms.

When dealing with a mobile home transaction in Florida, it is essential to utilize a Mobile Home Bill of Sale form, which serves as a legal document that facilitates the transfer of ownership. This document includes critical information regarding the buyer, seller, and specific details about the mobile home itself. For those looking for a reliable template, you can find one at https://mobilehomebillofsale.com/blank-florida-mobile-home-bill-of-sale/, ensuring a smooth and legally-binding process for both parties involved.

Promissory Note Template Florida Pdf - Ensuring all terms are documented can prevent future disputes and promote transparency.

Free Promissory Note Template Texas - Documenting a loan with a promissory note helps establish professional lending practices.

Common Questions

What is a promissory note in Ohio?

A promissory note is a legal document in which one party promises to pay a specified amount of money to another party at a designated time or on demand. In Ohio, this note serves as a written promise to repay a loan, detailing the terms of repayment, interest rates, and any other conditions agreed upon by both parties.

Who can create a promissory note?

Any individual or business can create a promissory note. The borrower (the person receiving the money) and the lender (the person providing the money) must both agree to the terms outlined in the note. It’s essential that both parties understand their rights and obligations before signing.

What are the essential components of an Ohio promissory note?

An Ohio promissory note should include the following key components: the names of the borrower and lender, the amount being borrowed, the interest rate (if applicable), the repayment schedule, and the due date. Additionally, it’s wise to include any penalties for late payment and the governing law, which in this case would be Ohio law.

Is a promissory note legally binding in Ohio?

Yes, a promissory note is legally binding in Ohio as long as it meets the necessary legal requirements. Both parties must sign the document, and it should clearly outline the terms. If either party fails to uphold their end of the agreement, the other party may seek legal remedies.

Do I need a lawyer to create a promissory note?

While it’s not mandatory to have a lawyer draft a promissory note, it’s highly recommended, especially for larger amounts or complex agreements. A legal professional can ensure that the document is properly structured and compliant with Ohio laws, minimizing the risk of disputes later on.

Can a promissory note be modified after it is signed?

Yes, a promissory note can be modified after it is signed, but both parties must agree to the changes. It’s best to document any modifications in writing and have both parties sign the amended agreement to avoid confusion in the future.

What happens if the borrower defaults on the promissory note?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may involve filing a lawsuit or pursuing other legal remedies. The specific actions depend on the terms outlined in the note and Ohio law.

Is it necessary to notarize a promissory note in Ohio?

Notarization is not required for a promissory note to be legally binding in Ohio. However, having the document notarized can provide an additional layer of protection and help verify the identities of the parties involved, which may be useful in case of a dispute.

Can a promissory note be used for personal loans?

Yes, promissory notes are commonly used for personal loans between friends, family, or acquaintances. They provide a clear record of the loan terms and protect both parties by outlining expectations regarding repayment.

Where can I find a template for an Ohio promissory note?

Templates for Ohio promissory notes can be found online through various legal websites or document services. It’s advisable to choose a template that complies with Ohio law and to customize it to fit your specific situation. Consider consulting a legal professional to review the document before use.

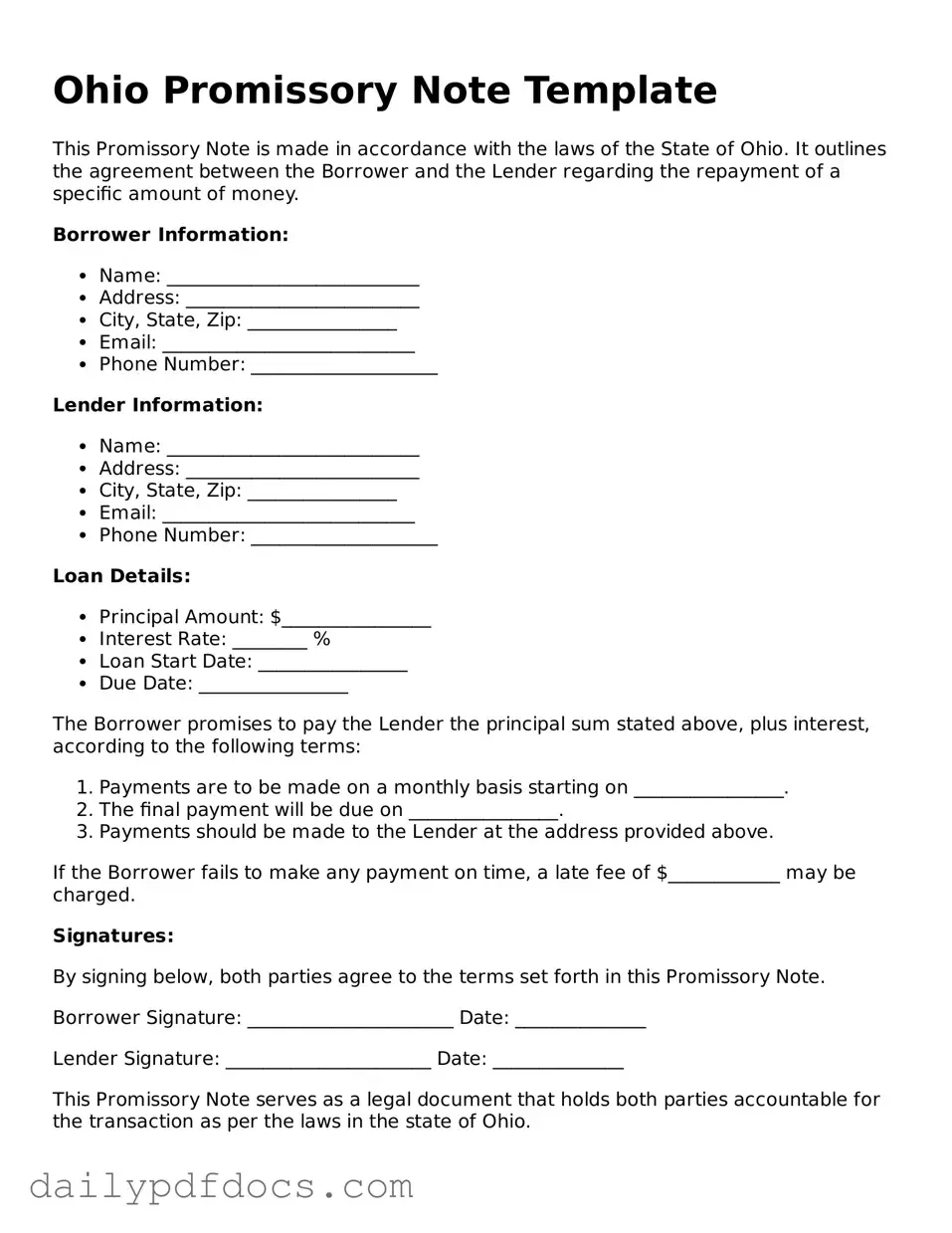

Preview - Ohio Promissory Note Form

Ohio Promissory Note Template

This Promissory Note is made in accordance with the laws of the State of Ohio. It outlines the agreement between the Borrower and the Lender regarding the repayment of a specific amount of money.

Borrower Information:

- Name: ___________________________

- Address: _________________________

- City, State, Zip: ________________

- Email: ___________________________

- Phone Number: ____________________

Lender Information:

- Name: ___________________________

- Address: _________________________

- City, State, Zip: ________________

- Email: ___________________________

- Phone Number: ____________________

Loan Details:

- Principal Amount: $________________

- Interest Rate: ________ %

- Loan Start Date: ________________

- Due Date: ________________

The Borrower promises to pay the Lender the principal sum stated above, plus interest, according to the following terms:

- Payments are to be made on a monthly basis starting on ________________.

- The final payment will be due on ________________.

- Payments should be made to the Lender at the address provided above.

If the Borrower fails to make any payment on time, a late fee of $____________ may be charged.

Signatures:

By signing below, both parties agree to the terms set forth in this Promissory Note.

Borrower Signature: ______________________ Date: ______________

Lender Signature: ______________________ Date: ______________

This Promissory Note serves as a legal document that holds both parties accountable for the transaction as per the laws in the state of Ohio.

Similar forms

- Loan Agreement: A loan agreement outlines the terms of a loan, including the amount, interest rate, and repayment schedule. Like a promissory note, it serves as a formal acknowledgment of the debt.

- Mortgage: A mortgage is a specific type of loan agreement secured by real property. Both documents detail the borrower's obligation to repay the borrowed amount, but a mortgage also includes the property as collateral.

- Credit Agreement: This document governs the terms under which credit is extended to a borrower. Similar to a promissory note, it specifies the repayment terms and conditions for borrowing funds.

- Installment Agreement: An installment agreement allows a borrower to repay a debt in a series of scheduled payments. Both documents clearly outline the payment structure and the total amount owed.

- Prenuptial Agreement: This legal document, such as the one available at Ohio PDF Forms, allows couples to define asset division and responsibilities before marriage, closely resembling the function of financial agreements like promissory notes.

- Personal Guarantee: A personal guarantee involves an individual agreeing to repay a debt if the primary borrower defaults. Like a promissory note, it creates a legal obligation for repayment.

- Secured Note: A secured note is similar to a promissory note but includes collateral to back the loan. Both documents establish the borrower's commitment to repay, but a secured note provides additional security for the lender.

Misconceptions

Understanding the Ohio Promissory Note form can be challenging due to several misconceptions. Below is a list of common misunderstandings and clarifications regarding the form.

- Misconception 1: A promissory note must be notarized to be valid.

- Misconception 2: Promissory notes can only be used for large loans.

- Misconception 3: A verbal agreement is as binding as a written promissory note.

- Misconception 4: Interest rates on promissory notes are always fixed.

- Misconception 5: Only banks can issue promissory notes.

- Misconception 6: A promissory note does not need to include a repayment schedule.

- Misconception 7: Promissory notes are not enforceable in court.

- Misconception 8: All promissory notes are the same.

- Misconception 9: Once signed, a promissory note cannot be modified.

While notarization can provide additional legal protection, it is not a requirement for the validity of a promissory note in Ohio.

Promissory notes can be used for any amount, whether large or small. They are simply a written promise to pay.

A written promissory note offers clear evidence of the terms agreed upon, which is not always the case with verbal agreements.

Interest rates can be either fixed or variable, depending on the terms specified in the note.

Any individual or business can create a promissory note, as long as the terms are clear and agreed upon by both parties.

A repayment schedule is important for clarity. It helps both parties understand when payments are due.

Promissory notes are legally enforceable documents, provided they meet the necessary requirements under Ohio law.

Promissory notes can vary significantly in terms, conditions, and language. Each note should be tailored to the specific agreement.

Promissory notes can be modified if both parties agree to the changes and document them properly.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | An Ohio Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time or on demand. |

| Governing Law | The Ohio Promissory Note is governed by the Ohio Revised Code, specifically Section 1303.01 through 1303.99. |

| Requirements | The note must include the date, the amount to be paid, the name of the payee, and the signature of the maker. |

| Types | There are various types of promissory notes, including secured and unsecured notes, depending on whether collateral is involved. |

| Enforceability | A properly executed promissory note is legally enforceable in a court of law, provided it meets all legal requirements. |

| Interest Rates | The interest rate on a promissory note can be fixed or variable, but it must comply with Ohio's usury laws. |