Printable Operating Agreement Document for Ohio

The Ohio Operating Agreement form plays a crucial role in establishing the framework for a limited liability company (LLC) in Ohio. This document outlines the management structure, operational procedures, and member responsibilities, ensuring that all parties are on the same page. It typically includes details such as the distribution of profits and losses, voting rights, and the process for adding or removing members. By clearly defining these aspects, the Operating Agreement helps prevent misunderstandings and disputes among members. Additionally, it can address specific scenarios, such as what happens if a member wants to leave the company or if the company needs to be dissolved. Having a well-crafted Operating Agreement not only fosters a positive working relationship among members but also provides legal protection for the LLC, making it an essential tool for any business owner in Ohio.

More State-specific Operating Agreement Forms

How to File Operating Agreement Llc - This agreement often addresses the transfer of ownership interests.

Operating Agreement Llc Pa - The Operating Agreement may specify voting rights and procedures for business decisions.

When dealing with the transfer of ownership of a mobile home, it's vital to utilize the proper documentation to prevent any misunderstandings; therefore, it's recommended to reference the https://mobilehomebillofsale.com/blank-new-york-mobile-home-bill-of-sale for a reliable template of the New York Mobile Home Bill of Sale form.

Operating Agreement Llc New York - The agreement can address issues related to confidentiality.

Common Questions

What is an Ohio Operating Agreement?

An Ohio Operating Agreement is a legal document that outlines the ownership and operating procedures of a limited liability company (LLC) in Ohio. It serves as an internal guideline for the members of the LLC, detailing how the company will be managed, how profits and losses will be distributed, and the responsibilities of each member. While not required by law, having an Operating Agreement is highly recommended to prevent misunderstandings among members.

Is an Operating Agreement required in Ohio?

No, Ohio law does not require LLCs to have an Operating Agreement. However, having one can provide clarity and structure for the business. It helps protect the members’ limited liability status and can be beneficial in resolving disputes or misunderstandings in the future.

Who should draft the Operating Agreement?

What should be included in an Ohio Operating Agreement?

An Operating Agreement typically includes several key components. These include the name of the LLC, the purpose of the business, the names of the members, their ownership percentages, and the management structure. Additionally, it should outline how profits and losses will be distributed, the process for adding or removing members, and procedures for handling disputes. Including these details helps prevent future conflicts.

Can the Operating Agreement be changed?

Yes, the Operating Agreement can be amended. It is important to include a section in the agreement that outlines how changes can be made. Typically, this requires a vote from the members or a written consent from all members. Keeping the agreement updated ensures that it remains relevant as the business evolves.

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, Ohio law will default to the state's LLC statutes. This can lead to a lack of clarity regarding management and profit distribution, potentially resulting in disputes among members. Without a specific agreement, members may not have a clear understanding of their rights and responsibilities.

How does an Operating Agreement affect liability protection?

An Operating Agreement can help maintain the limited liability status of an LLC. By clearly defining the roles and responsibilities of members, it demonstrates that the LLC is a separate legal entity. This separation is crucial for protecting personal assets from business debts and liabilities. In the absence of an Operating Agreement, a court might find it easier to pierce the corporate veil in case of legal disputes.

Can an Operating Agreement be verbal?

While it is possible to have a verbal Operating Agreement, it is not recommended. Verbal agreements can lead to misunderstandings and are difficult to enforce. A written Operating Agreement provides a clear, tangible reference for all members, reducing the risk of disputes and ensuring that everyone is on the same page.

How do I file the Operating Agreement with the state?

An Operating Agreement does not need to be filed with the state of Ohio. It is an internal document meant for the members of the LLC. However, it is important to keep it in a safe place and ensure that all members have access to it. This document should be reviewed periodically to ensure it remains accurate and relevant.

What if my LLC has multiple members?

For LLCs with multiple members, an Operating Agreement is especially important. It helps define each member's roles, responsibilities, and ownership percentages. It can also outline decision-making processes and how disagreements will be resolved. Having a clear agreement in place can help prevent conflicts and ensure smooth operations within the LLC.

Preview - Ohio Operating Agreement Form

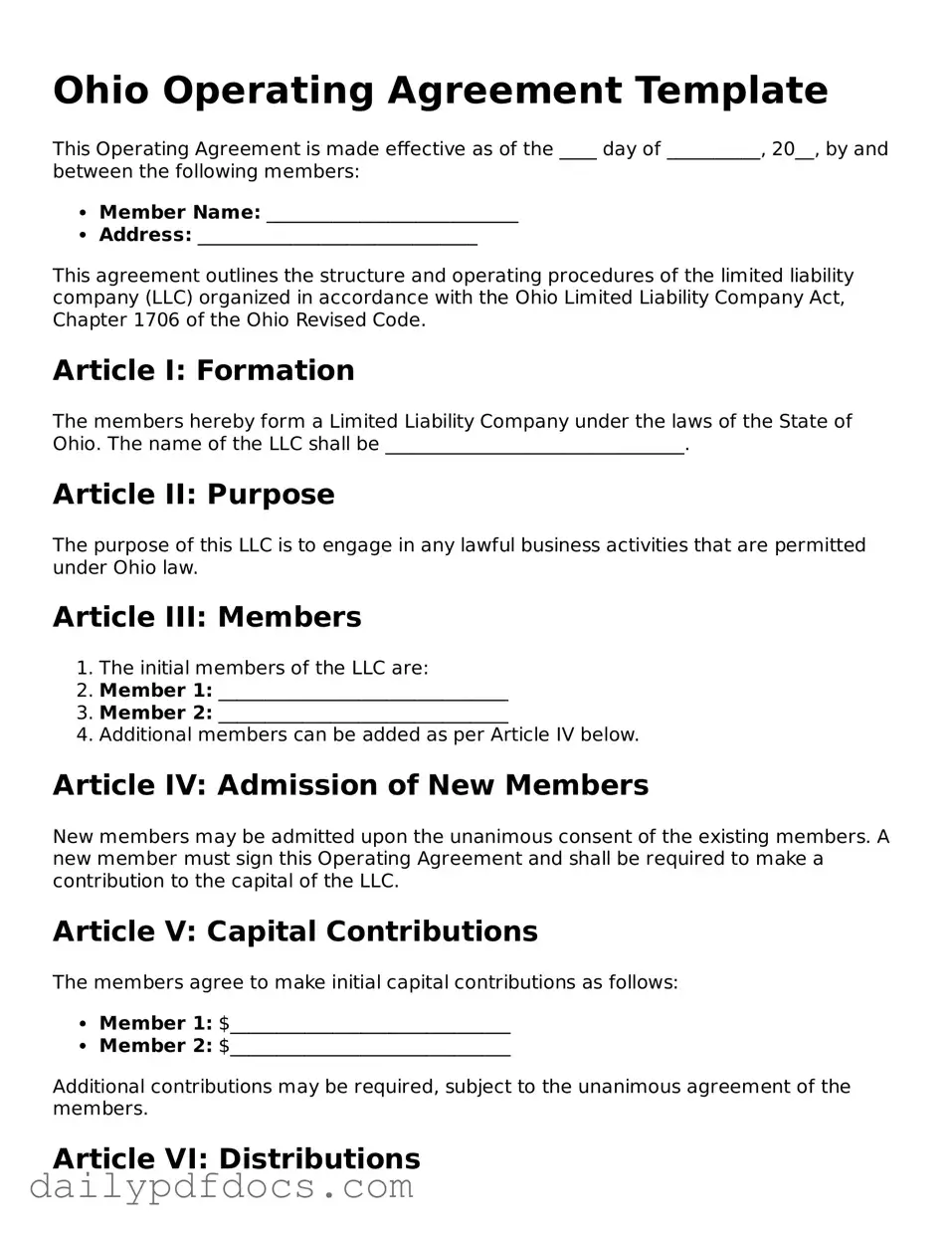

Ohio Operating Agreement Template

This Operating Agreement is made effective as of the ____ day of __________, 20__, by and between the following members:

- Member Name: ___________________________

- Address: ______________________________

This agreement outlines the structure and operating procedures of the limited liability company (LLC) organized in accordance with the Ohio Limited Liability Company Act, Chapter 1706 of the Ohio Revised Code.

Article I: Formation

The members hereby form a Limited Liability Company under the laws of the State of Ohio. The name of the LLC shall be ________________________________.

Article II: Purpose

The purpose of this LLC is to engage in any lawful business activities that are permitted under Ohio law.

Article III: Members

- The initial members of the LLC are:

- Member 1: _______________________________

- Member 2: _______________________________

- Additional members can be added as per Article IV below.

Article IV: Admission of New Members

New members may be admitted upon the unanimous consent of the existing members. A new member must sign this Operating Agreement and shall be required to make a contribution to the capital of the LLC.

Article V: Capital Contributions

The members agree to make initial capital contributions as follows:

- Member 1: $______________________________

- Member 2: $______________________________

Additional contributions may be required, subject to the unanimous agreement of the members.

Article VI: Distributions

Profits and losses will be allocated to the members in proportion to their respective capital contributions. Distributions shall be made at least annually, or as otherwise agreed upon by the members.

Article VII: Management

The management of the LLC will be vested in the members. Decisions will require the consent of a majority of the members unless stated otherwise in this Agreement.

Article VIII: Amendments

This Operating Agreement may be amended only with the written consent of all members. Amendments must be documented and attached to this Agreement.

Article IX: Governing Law

This Agreement will be governed and construed in accordance with the laws of the State of Ohio.

Execution

The undersigned members agree to the terms of this Operating Agreement.

Member Signature: _____________________________ Date: ___________

Member Signature: _____________________________ Date: ___________

This Operating Agreement is a crucial document that outlines the operational framework for the LLC. Please ensure all members understand their rights and responsibilities under this Agreement.

Similar forms

-

Bylaws: Similar to an Operating Agreement, bylaws govern the internal management of a corporation. They outline the roles of officers, the process for holding meetings, and voting procedures. While an Operating Agreement is specific to LLCs, bylaws serve a similar purpose for corporations, ensuring clarity in governance.

-

Partnership Agreement: This document outlines the terms of a partnership, detailing the rights and responsibilities of each partner. Like an Operating Agreement, it addresses profit sharing, decision-making processes, and dispute resolution, providing a framework for collaboration among partners.

- Employment Verification Form: This form is crucial for confirming an employee's work history and is often required for processes such as loan applications and background checks. To learn more about it, visit Washington Templates.

-

Shareholder Agreement: This agreement is used by corporations to define the relationship between shareholders. It covers issues such as share transfers, voting rights, and the management of the company. Both documents aim to protect the interests of their respective members and ensure smooth operations.

-

Joint Venture Agreement: In a joint venture, two or more parties come together for a specific project. This agreement outlines each party's contributions, responsibilities, and profit-sharing arrangements. Similar to an Operating Agreement, it establishes a framework for cooperation and conflict resolution.

-

Operating Agreement for a Corporation: While typically associated with LLCs, corporations can also have operating agreements that define management structure and operational procedures. This document serves a similar function, ensuring all members understand their roles and responsibilities.

-

Franchise Agreement: This agreement governs the relationship between a franchisor and a franchisee. It details the rights and obligations of both parties, including fees, territory, and operational guidelines. Like an Operating Agreement, it establishes clear expectations and procedures for the business relationship.

Misconceptions

Many people have misunderstandings about the Ohio Operating Agreement form. Here are six common misconceptions:

- It is not necessary for all LLCs. Some believe that an operating agreement is optional for all LLCs in Ohio. However, having one is highly recommended, even if it is not legally required.

- It must be filed with the state. There is a misconception that the operating agreement needs to be submitted to the state. In reality, this document is kept internally and does not need to be filed.

- It can only be created by lawyers. Many think that only legal professionals can draft an operating agreement. In fact, members of the LLC can create it themselves, as long as it meets their needs.

- It cannot be changed once signed. Some individuals believe that once an operating agreement is signed, it cannot be altered. In truth, members can amend the agreement as needed, following the procedures outlined within it.

- It covers only profit distribution. There is a notion that the operating agreement only addresses how profits are shared. However, it can also outline management structure, member responsibilities, and other important operational details.

- It is the same as the Articles of Organization. Some confuse the operating agreement with the Articles of Organization. While both are important documents, they serve different purposes and contain different information.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Ohio Revised Code, specifically Chapter 1705. |

| Members | All members of the LLC must agree to the terms outlined in the Operating Agreement. |

| Flexibility | The agreement allows for flexibility in defining roles, responsibilities, and profit-sharing among members. |

| Not Mandatory | While it is not required by law, having an Operating Agreement is highly recommended for LLCs in Ohio. |

| Dispute Resolution | The Operating Agreement can include provisions for resolving disputes among members, helping to prevent conflicts. |

| Amendments | Members can amend the Operating Agreement as needed, provided they follow the procedures outlined within the document. |

| Record Keeping | It is essential to keep a copy of the Operating Agreement with other important business documents for reference. |