Printable Deed in Lieu of Foreclosure Document for Ohio

In Ohio, homeowners facing the prospect of foreclosure often seek alternatives to protect their financial future and preserve their dignity. One such option is the Deed in Lieu of Foreclosure, a legal mechanism that allows a homeowner to voluntarily transfer ownership of their property back to the lender. This process can serve as a more amicable resolution compared to the lengthy and stressful foreclosure proceedings. Key aspects of the Deed in Lieu of Foreclosure include the requirement for the homeowner to be in default on their mortgage, the necessity for the lender to accept the deed, and the potential for the homeowner to avoid the negative consequences of foreclosure on their credit report. Additionally, this form can facilitate a smoother transition for both parties, often allowing the homeowner to negotiate terms that may include the forgiveness of remaining debt or assistance in relocating. Understanding the implications and requirements of this form can empower homeowners to make informed decisions during challenging financial times.

More State-specific Deed in Lieu of Foreclosure Forms

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - This method is often quicker than traditional foreclosure proceedings.

Foreclosure in Georgia - A Deed in Lieu of Foreclosure allows a borrower to transfer property ownership to the lender to avoid foreclosure.

California Voluntary Property Surrender Document - Signing this form can lead to a smoother transition for both borrower and lender during a difficult time.

A prenuptial agreement form in Ohio is a legal document that couples create before marriage to outline the division of assets and responsibilities in the event of a divorce. This form helps ensure that both parties have a clear understanding of their rights and obligations. By addressing financial matters ahead of time, couples can foster open communication and reduce potential conflicts in the future. For more information, you can visit Ohio PDF Forms.

Foreclosure Vs Deed in Lieu - Documentation of all communication and agreements with the lender is vital.

Common Questions

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to voluntarily transfer the ownership of their property to the lender to avoid foreclosure. This option can be beneficial for both the homeowner and the lender, as it can help the homeowner avoid the negative impacts of foreclosure while allowing the lender to recover their investment more quickly.

Who qualifies for a Deed in Lieu of Foreclosure in Ohio?

Eligibility for a Deed in Lieu of Foreclosure generally depends on the lender's policies. Typically, homeowners must be facing financial hardship and unable to make mortgage payments. The property must also be in good condition, and the homeowner should not have any other liens on the property. Lenders often require that the homeowner has attempted to sell the property before considering a deed in lieu.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several potential benefits to a Deed in Lieu of Foreclosure. Homeowners may avoid the lengthy and stressful foreclosure process. This option can also help protect their credit score compared to a foreclosure. Additionally, homeowners may be able to negotiate a cash incentive from the lender to assist with relocation costs.

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also drawbacks to consider. Homeowners may still face tax implications, as the lender may report the forgiven debt to the IRS. Additionally, if there are any liens on the property, the homeowner may need to address those before the deed can be transferred. This option may not be available if the homeowner has filed for bankruptcy.

How does the process of completing a Deed in Lieu of Foreclosure work?

The process typically begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then review the homeowner's financial situation. If approved, the homeowner will need to sign the deed, transferring ownership of the property to the lender. The lender will then record the deed with the county recorder's office to finalize the transfer.

Is legal assistance required for a Deed in Lieu of Foreclosure?

While legal assistance is not strictly required, it is often advisable. A qualified attorney can help homeowners understand their rights and obligations, negotiate with the lender, and ensure that all necessary documents are completed correctly. This can help prevent any potential issues that may arise during the process.

Can a Deed in Lieu of Foreclosure affect my credit score?

A Deed in Lieu of Foreclosure may have a less severe impact on a homeowner's credit score compared to a foreclosure. However, it will still be reported as a negative event on the credit report. The extent of the impact can vary based on the individual's overall credit history and the specific circumstances surrounding the deed.

What should I do if my lender denies my request for a Deed in Lieu of Foreclosure?

If a lender denies the request, homeowners can explore other options. They may consider a short sale, where the property is sold for less than the mortgage balance with lender approval. Alternatively, homeowners could seek assistance from housing counselors or legal professionals to discuss other potential solutions to their financial difficulties.

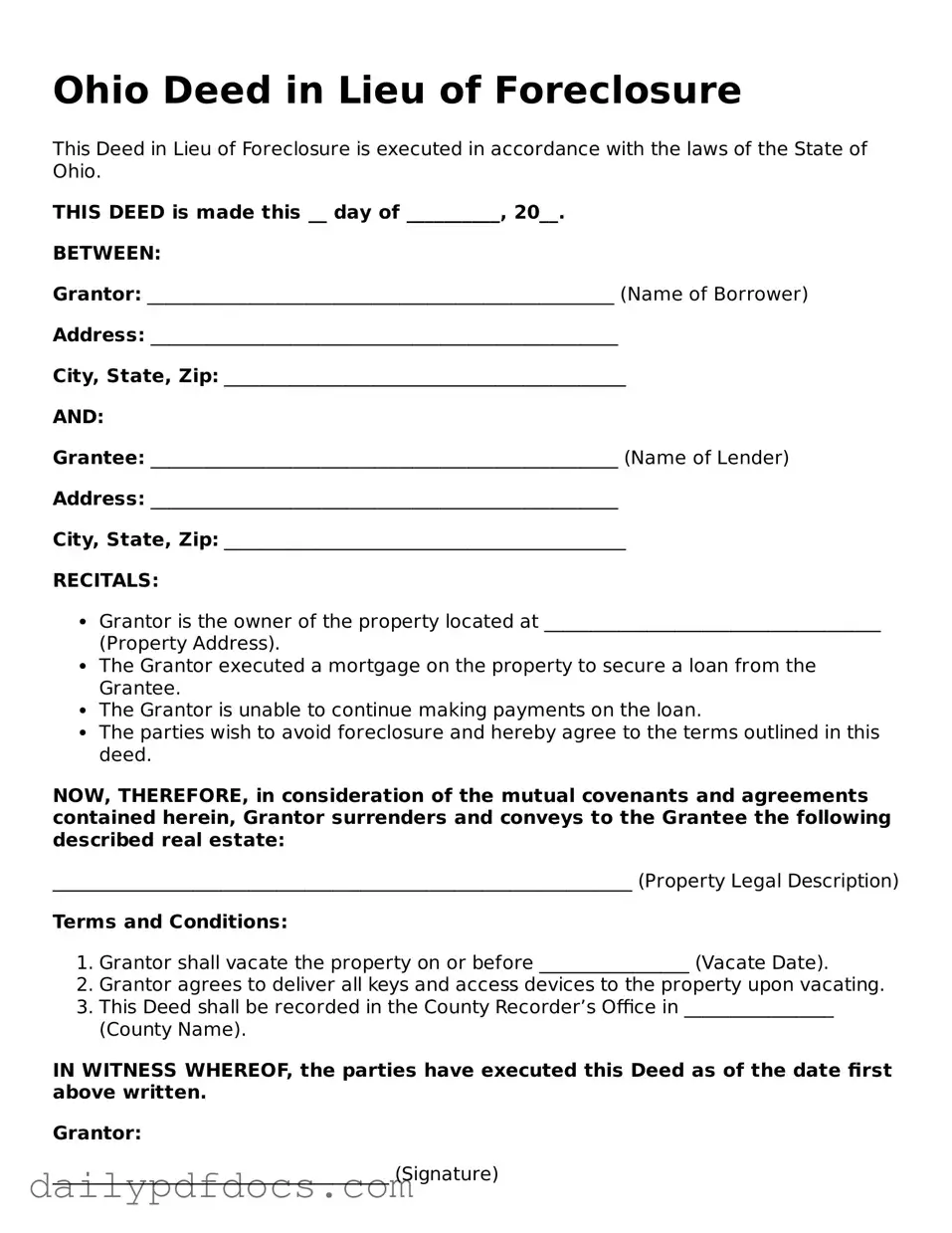

Preview - Ohio Deed in Lieu of Foreclosure Form

Ohio Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the State of Ohio.

THIS DEED is made this __ day of __________, 20__.

BETWEEN:

Grantor: __________________________________________________ (Name of Borrower)

Address: __________________________________________________

City, State, Zip: ___________________________________________

AND:

Grantee: __________________________________________________ (Name of Lender)

Address: __________________________________________________

City, State, Zip: ___________________________________________

RECITALS:

- Grantor is the owner of the property located at ____________________________________ (Property Address).

- The Grantor executed a mortgage on the property to secure a loan from the Grantee.

- The Grantor is unable to continue making payments on the loan.

- The parties wish to avoid foreclosure and hereby agree to the terms outlined in this deed.

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, Grantor surrenders and conveys to the Grantee the following described real estate:

______________________________________________________________ (Property Legal Description)

Terms and Conditions:

- Grantor shall vacate the property on or before ________________ (Vacate Date).

- Grantor agrees to deliver all keys and access devices to the property upon vacating.

- This Deed shall be recorded in the County Recorder’s Office in ________________ (County Name).

IN WITNESS WHEREOF, the parties have executed this Deed as of the date first above written.

Grantor:

____________________________________ (Signature)

____________________________________ (Printed Name)

Grantee:

____________________________________ (Signature)

____________________________________ (Printed Name)

STATE OF OHIO

County of ________________

Subscribed and sworn to before me this __ day of __________, 20__.

____________________________________ (Notary Public)

My Commission Expires: ________________

Similar forms

The Deed in Lieu of Foreclosure form shares similarities with several other documents in the realm of property and mortgage law. Here are nine documents that have comparable features or purposes:

- Mortgage Release: This document formally releases a borrower from their mortgage obligations when the debt has been satisfied or settled.

- Short Sale Agreement: Similar to a Deed in Lieu, this agreement allows a homeowner to sell their property for less than the amount owed on the mortgage, with lender approval.

- Foreclosure Notice: While this document initiates the foreclosure process, it serves as a precursor to the Deed in Lieu by informing the borrower of impending foreclosure.

- Articles of Incorporation: Essential for establishing a corporation in Washington, the Articles of Incorporation form details important aspects like the corporation's name, purpose, and registered agent. Completing this form is crucial for starting your business; for more information, visit Washington Templates.

- Loan Modification Agreement: This document alters the terms of an existing mortgage to make payments more manageable, potentially avoiding foreclosure.

- Quitclaim Deed: This deed transfers interest in a property without warranties, often used in informal property transfers, similar to how a Deed in Lieu transfers ownership back to the lender.

- Settlement Agreement: This document outlines the terms of a settlement between a borrower and lender, often resolving disputes without going to court, similar in purpose to a Deed in Lieu.

- Release of Lien: This document removes a lien from a property, similar to how a Deed in Lieu resolves the lender's claim on the property.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, which can include signing a Deed in Lieu.

- Notice of Default: This document informs a borrower that they are in default on their mortgage, often leading to discussions about alternatives like a Deed in Lieu.

Misconceptions

When dealing with a Deed in Lieu of Foreclosure in Ohio, several misconceptions can lead to confusion for homeowners. Understanding these misconceptions is crucial for anyone considering this option as a way to handle their mortgage difficulties.

- 1. A Deed in Lieu of Foreclosure is the same as a short sale. Many people believe these two processes are interchangeable. However, a short sale involves selling the property for less than the mortgage balance, while a deed in lieu transfers ownership of the property back to the lender without a sale.

- 2. The lender must accept a Deed in Lieu of Foreclosure. Some homeowners think that they can simply hand over their keys and that the lender is obligated to accept the deed. In reality, lenders have the discretion to accept or reject this option based on their policies and the homeowner's financial situation.

- 3. A Deed in Lieu automatically cancels the mortgage debt. There is a common belief that transferring the property to the lender erases all financial obligations. While it may eliminate the mortgage, it does not necessarily absolve the borrower of any remaining debts, especially if the lender pursues a deficiency judgment.

- 4. Homeowners can easily negotiate terms with the lender. Some individuals think they can negotiate favorable terms when handing over the deed. While negotiation is possible, it often requires a thorough understanding of the lender's policies and the homeowner's financial situation.

- 5. A Deed in Lieu of Foreclosure will not affect credit scores. Many believe that this process is a better option for credit scores compared to foreclosure. In fact, both actions can significantly impact credit ratings, and the effects can be similar.

- 6. You can use a Deed in Lieu of Foreclosure if you are current on your mortgage. Some homeowners think they can opt for this process even if they are making regular payments. Typically, lenders only consider a deed in lieu when the borrower is in default or facing imminent default.

- 7. The process is quick and straightforward. There is a misconception that the deed in lieu process is simple and fast. In reality, it can involve lengthy negotiations and paperwork, which can take time to resolve.

- 8. You can keep your home after a Deed in Lieu of Foreclosure. Some homeowners mistakenly believe they can retain ownership of their home after transferring the deed. Once the deed is executed, the lender takes full ownership, and the homeowner must vacate the property.

Understanding these misconceptions can help homeowners make informed decisions about their options when facing financial difficulties. Seeking professional advice is always recommended to navigate these complex situations effectively.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Deed in Lieu of Foreclosure form allows a borrower to transfer property ownership to the lender to avoid foreclosure proceedings. |

| Governing Laws | This form is governed by Ohio Revised Code § 5301.01 and related foreclosure laws. |

| Eligibility | To use this form, the borrower must be in default on their mortgage and willing to voluntarily surrender the property. |

| Benefits | Using this form can help the borrower avoid the negative impact of foreclosure on their credit report and may expedite the process of resolving their mortgage debt. |