Printable Bill of Sale Document for Ohio

The Ohio Bill of Sale form serves as a crucial document for individuals engaging in the sale or transfer of personal property within the state. This form provides a clear record of the transaction, detailing essential information such as the names and addresses of both the buyer and seller, a description of the item being sold, and the sale price. It may also include the date of the transaction and any warranties or conditions related to the sale. Utilizing this form helps protect both parties by documenting the exchange, which can be beneficial in case of disputes or legal issues in the future. Additionally, the Ohio Bill of Sale can be tailored for various types of property, including vehicles, boats, and general personal items, making it a versatile tool for anyone looking to buy or sell in Ohio.

More State-specific Bill of Sale Forms

Bill of Sale Car Texas - The document may include terms and conditions of the sale.

When selling or purchasing a motorcycle in Washington State, it is important to have a proper document in place. The Washington Motorcycle Bill of Sale ensures that all details regarding the transaction are clearly outlined, protecting both the buyer and the seller. For templates and more information, you can visit Washington Templates to simplify this process.

Bill of Salw - Buyers can use a Bill of Sale to register their newly purchased items.

Common Questions

What is a Bill of Sale in Ohio?

A Bill of Sale in Ohio is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. It typically includes details about the item being sold, the sale price, and the names and addresses of both the buyer and the seller. This document can be crucial for establishing ownership and may be required for registration purposes, especially for vehicles or boats.

Is a Bill of Sale required in Ohio?

While a Bill of Sale is not legally required for all transactions in Ohio, it is highly recommended for significant purchases, such as vehicles, boats, and trailers. Having a Bill of Sale can protect both the buyer and the seller by providing a written record of the transaction. It can also assist in resolving disputes that may arise after the sale.

What information should be included in an Ohio Bill of Sale?

An Ohio Bill of Sale should include essential information such as the names and addresses of both the buyer and the seller, a description of the item being sold (including make, model, and identification numbers if applicable), the sale price, and the date of the transaction. It is also advisable to include any warranties or conditions of the sale, as well as the signatures of both parties.

Do I need to have the Bill of Sale notarized in Ohio?

Notarization is not a requirement for a Bill of Sale in Ohio; however, having the document notarized can provide an additional layer of security and authenticity. A notary public can verify the identities of the parties involved and witness the signing of the document, which may be beneficial if disputes arise later.

Can a Bill of Sale be used for a vehicle in Ohio?

Yes, a Bill of Sale can be used for the sale of a vehicle in Ohio. In fact, it is often required when registering the vehicle in the buyer's name. The Bill of Sale serves as proof of ownership transfer and may be needed when applying for a new title. It is important to ensure that the Bill of Sale includes all necessary vehicle information to facilitate this process.

What should I do if I lose my Bill of Sale?

If a Bill of Sale is lost, it is advisable to contact the other party involved in the transaction to request a duplicate. If the original seller is unavailable, the buyer may need to gather other documentation, such as bank statements or emails related to the transaction, to establish proof of ownership. In some cases, an affidavit may be necessary to affirm the sale occurred.

Can I create my own Bill of Sale in Ohio?

Yes, individuals can create their own Bill of Sale in Ohio. There are no specific state forms required, but it is important to ensure that all relevant information is included to make the document legally valid. Various templates are available online, which can help guide the creation of a comprehensive Bill of Sale.

What are the consequences of not having a Bill of Sale?

Not having a Bill of Sale can lead to complications in proving ownership of the item in question. This may become problematic if disputes arise, such as claims of theft or disagreements over the terms of the sale. In the case of vehicles, lacking a Bill of Sale may hinder the registration process and complicate the transfer of title.

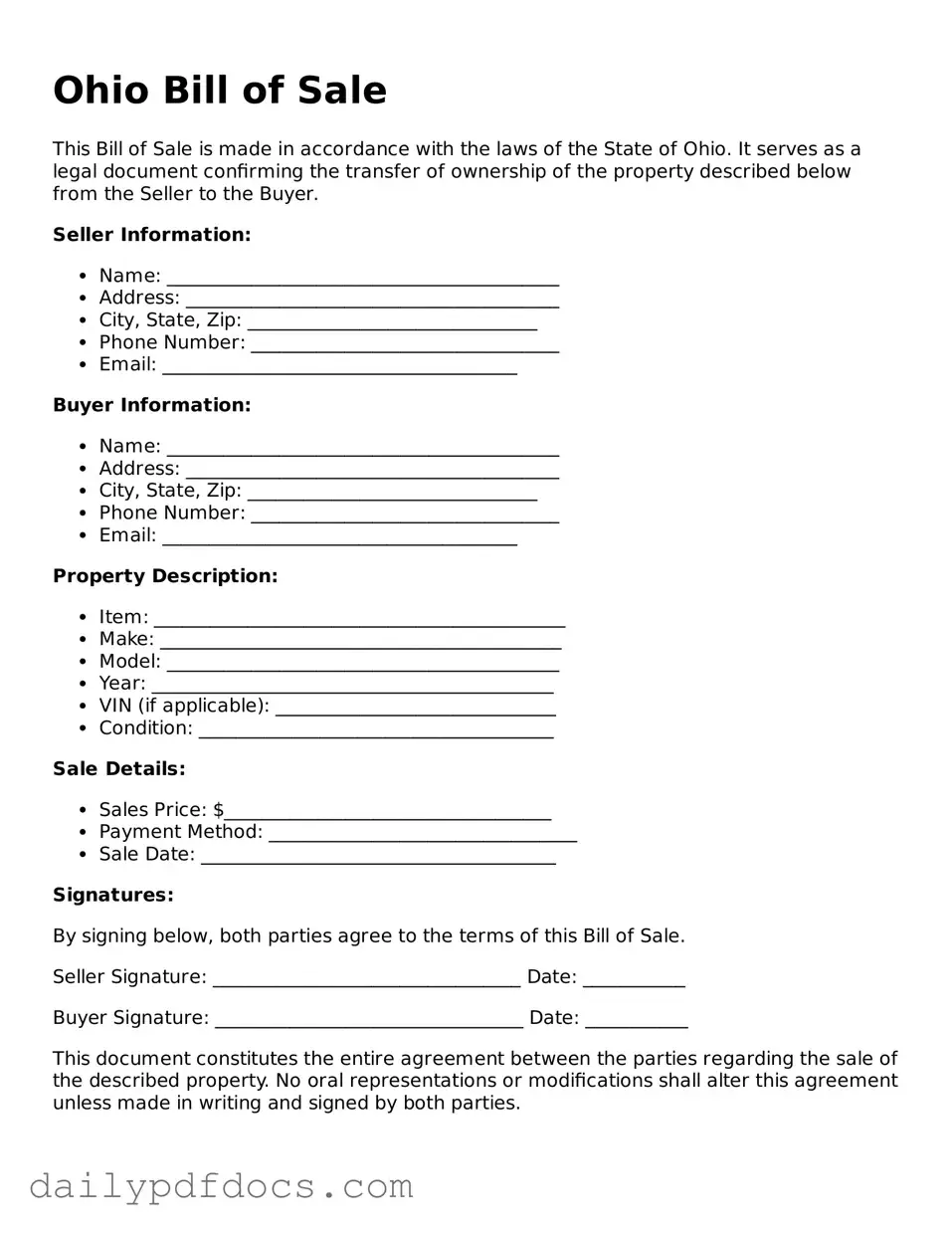

Preview - Ohio Bill of Sale Form

Ohio Bill of Sale

This Bill of Sale is made in accordance with the laws of the State of Ohio. It serves as a legal document confirming the transfer of ownership of the property described below from the Seller to the Buyer.

Seller Information:

- Name: __________________________________________

- Address: ________________________________________

- City, State, Zip: _______________________________

- Phone Number: _________________________________

- Email: ______________________________________

Buyer Information:

- Name: __________________________________________

- Address: ________________________________________

- City, State, Zip: _______________________________

- Phone Number: _________________________________

- Email: ______________________________________

Property Description:

- Item: ____________________________________________

- Make: ___________________________________________

- Model: __________________________________________

- Year: ___________________________________________

- VIN (if applicable): ______________________________

- Condition: ______________________________________

Sale Details:

- Sales Price: $___________________________________

- Payment Method: _________________________________

- Sale Date: ______________________________________

Signatures:

By signing below, both parties agree to the terms of this Bill of Sale.

Seller Signature: _________________________________ Date: ___________

Buyer Signature: _________________________________ Date: ___________

This document constitutes the entire agreement between the parties regarding the sale of the described property. No oral representations or modifications shall alter this agreement unless made in writing and signed by both parties.

Similar forms

Purchase Agreement: This document outlines the terms of sale between a buyer and a seller. Like a Bill of Sale, it includes details about the item being sold, the sale price, and the responsibilities of both parties.

Receipt: A receipt serves as proof of payment for goods or services. Similar to a Bill of Sale, it confirms that a transaction has taken place and typically includes the date, amount, and item description.

- Mobile Home Bill of Sale: This document is essential for the transfer of ownership of a mobile home, outlining buyer and seller information, the specifications of the mobile home, and the sale price. For more details, you can refer to the https://mobilehomebillofsale.com/blank-texas-mobile-home-bill-of-sale/.

Transfer of Title: This document is used to formally transfer ownership of property, such as vehicles or real estate. Like a Bill of Sale, it provides evidence of the change in ownership and may include similar details about the item.

Lease Agreement: A lease agreement outlines the terms under which one party rents property from another. While it is not a sale, it shares similarities with a Bill of Sale in that it details the rights and responsibilities of both parties involved in the transaction.

Warranty Deed: This document transfers ownership of real estate and guarantees that the seller holds clear title to the property. It is similar to a Bill of Sale in that it provides legal proof of ownership transfer and includes pertinent details about the property.

Misconceptions

Many people have misunderstandings about the Ohio Bill of Sale form. Here are nine common misconceptions:

- It is not legally required. Some believe that a Bill of Sale is unnecessary for every transaction. However, having a Bill of Sale can provide proof of ownership and protect both the buyer and seller.

- It only applies to vehicles. While many associate the Bill of Sale with vehicle transactions, it can be used for various items, including personal property, furniture, and equipment.

- It must be notarized. A common myth is that a Bill of Sale must be notarized to be valid. In Ohio, notarization is not required, although it can add an extra layer of security.

- It is the same as a receipt. A receipt confirms payment but does not provide the same level of detail regarding the item and the transaction. A Bill of Sale includes specific information about the item and the parties involved.

- It can be verbal. Some people think a verbal agreement is sufficient. However, having a written Bill of Sale is crucial for clarity and legal protection.

- It is only for private sales. Many assume that Bills of Sale are only needed for private transactions. However, they can also be beneficial in business transactions.

- It does not need to include seller information. Some believe that only the buyer's information is necessary. In reality, including the seller's information is essential for establishing accountability.

- It is not important for tax purposes. Some people think a Bill of Sale has no relevance for taxes. However, it can serve as documentation for tax purposes, especially if the item sold is valuable.

- It is a one-size-fits-all document. Many think any Bill of Sale will suffice for any transaction. However, it is important to tailor the document to fit the specific details of the sale.

Form Overview

| Fact Name | Details |

|---|---|

| Purpose | The Ohio Bill of Sale is a legal document used to transfer ownership of personal property from one party to another. |

| Governing Law | Ohio Revised Code Section 1302.01 governs the sale of goods and the use of bills of sale. |

| Types of Property | This form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | While notarization is not required, having the document notarized can provide additional legal protection. |

| Buyer and Seller Information | The form requires the full names and addresses of both the buyer and seller to ensure clarity in the transaction. |

| Consideration | The bill of sale must state the purchase price or consideration exchanged for the property. |

| As-Is Condition | Many bills of sale include an "as-is" clause, indicating that the buyer accepts the property in its current condition. |

| Record Keeping | Both parties should keep a copy of the bill of sale for their records, as it serves as proof of the transaction. |