Printable Articles of Incorporation Document for Ohio

Starting a business in Ohio involves several important steps, one of which is completing the Articles of Incorporation form. This form is essential for anyone looking to establish a corporation in the state. It includes key information about the business, such as its name, purpose, and the address of its principal office. Additionally, the form requires details about the corporation's registered agent, who will receive legal documents on behalf of the business. The Articles of Incorporation also ask for the number of shares the corporation is authorized to issue, which is crucial for understanding ownership structure. By filing this form with the Ohio Secretary of State, individuals can officially create their corporation, ensuring they comply with state regulations. Understanding each part of the form can help streamline the incorporation process and set a solid foundation for the business's future.

More State-specific Articles of Incorporation Forms

Articles of Incorporation Ny - Clarifies what actions require shareholder approval.

In order to ensure a hassle-free transaction, it is important to utilize the Washington Motorcycle Bill of Sale form, which not only records the details of the sale but also serves as a legal protection for both parties involved. For those looking to obtain this vital document, you can find it at Washington Templates.

Pa Division of Corporations - The information provided in the Articles must be truthful and accurate.

Common Questions

What is the Ohio Articles of Incorporation form?

The Ohio Articles of Incorporation form is a legal document that establishes a corporation in the state of Ohio. This form outlines essential details about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document is the first step in creating a corporation and provides the legal recognition needed to operate as a separate entity from its owners.

Who needs to file the Articles of Incorporation?

Anyone looking to start a corporation in Ohio must file the Articles of Incorporation. This includes individuals or groups planning to run a business that will benefit from the limited liability protection that a corporation offers. Nonprofit organizations also need to file this form to gain legal status and operate effectively.

What information is required on the form?

The form requires several key pieces of information. You'll need to provide the corporation's name, which must be unique and not similar to existing businesses. Additionally, you must include the purpose of the corporation, the address of the principal office, and the name and address of the registered agent. If applicable, you should also indicate the number of shares the corporation is authorized to issue.

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation can be done online or via mail. If you choose to file online, visit the Ohio Secretary of State’s website, where you can complete the form and submit it electronically. For mail submissions, print the completed form and send it to the appropriate office along with the required filing fee. Make sure to check for the latest fee schedule, as it may change.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Ohio varies depending on the type of corporation you are forming. As of the latest information, the fee for a for-profit corporation is typically around $99. Nonprofit corporations may have a different fee structure. Always verify the current fees on the Ohio Secretary of State's website to ensure you have the correct amount.

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary based on the method of filing. If you file online, the processing is often quicker, sometimes completed within a few business days. Mail submissions may take longer, potentially up to two weeks or more, depending on the volume of filings. If you need expedited processing, inquire about available options when you file.

Do I need an attorney to file the Articles of Incorporation?

While it is not mandatory to have an attorney to file the Articles of Incorporation, consulting one can be beneficial. An attorney can provide guidance on the best structure for your corporation, help with compliance issues, and ensure that all necessary information is accurately presented. If you feel confident in handling the paperwork yourself, you can certainly proceed without legal assistance.

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, your corporation is officially recognized by the state. You will receive a certificate of incorporation, which serves as proof of your corporation's existence. After that, you should focus on obtaining any necessary licenses or permits, setting up a corporate bank account, and developing your business plan.

Can I amend the Articles of Incorporation later?

Yes, you can amend the Articles of Incorporation if changes are needed in the future. Common reasons for amendments include changes in the corporation's name, modifications to the number of authorized shares, or updates to the registered agent information. To amend the Articles, you will need to file a specific form and pay any applicable fees.

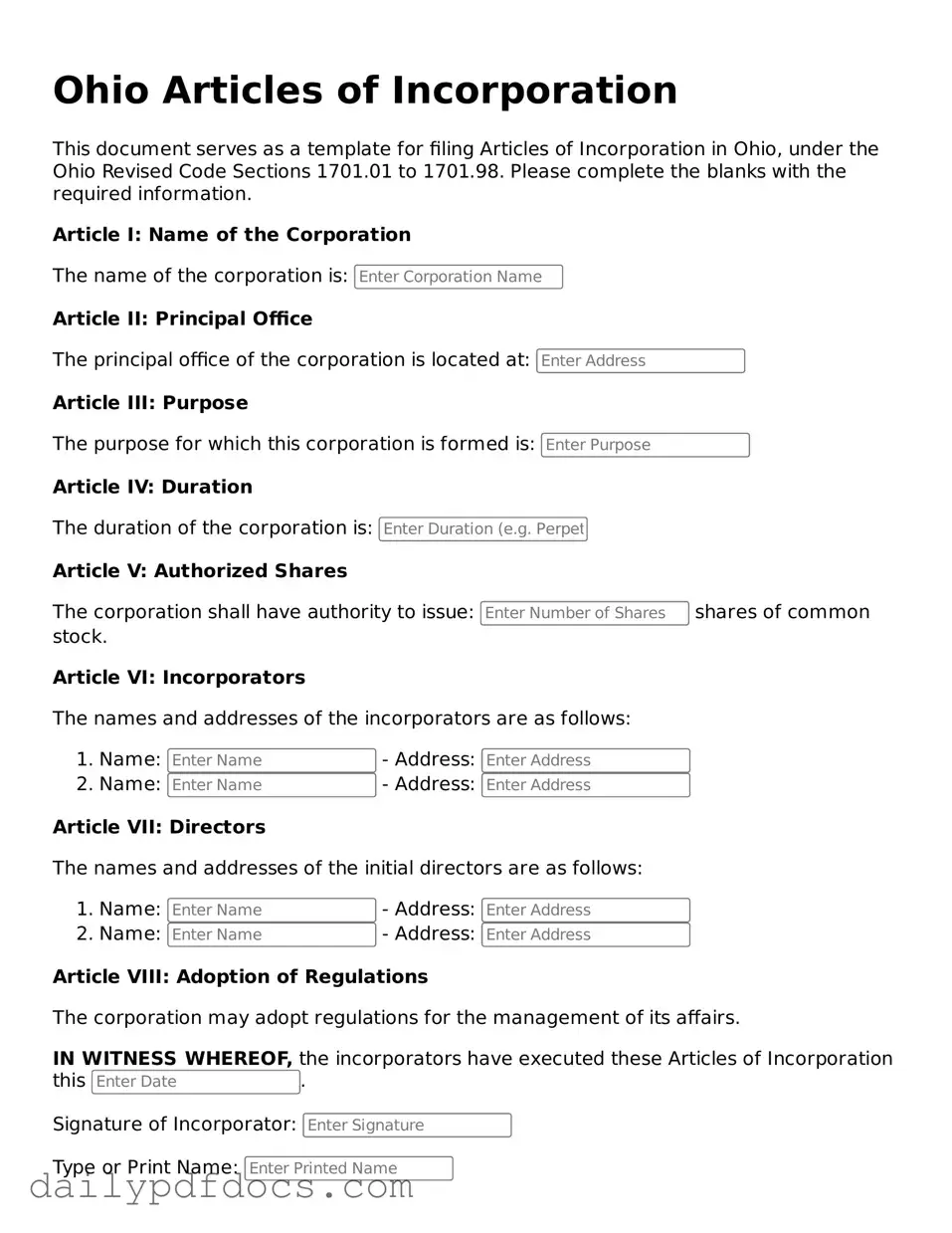

Preview - Ohio Articles of Incorporation Form

Ohio Articles of Incorporation

This document serves as a template for filing Articles of Incorporation in Ohio, under the Ohio Revised Code Sections 1701.01 to 1701.98. Please complete the blanks with the required information.

Article I: Name of the Corporation

The name of the corporation is:

Article II: Principal Office

The principal office of the corporation is located at:

Article III: Purpose

The purpose for which this corporation is formed is:

Article IV: Duration

The duration of the corporation is:

Article V: Authorized Shares

The corporation shall have authority to issue: shares of common stock.

Article VI: Incorporators

The names and addresses of the incorporators are as follows:

- Name: - Address:

- Name: - Address:

Article VII: Directors

The names and addresses of the initial directors are as follows:

- Name: - Address:

- Name: - Address:

Article VIII: Adoption of Regulations

The corporation may adopt regulations for the management of its affairs.

IN WITNESS WHEREOF, the incorporators have executed these Articles of Incorporation this .

Signature of Incorporator:

Type or Print Name:

Important: This template must be submitted to the Ohio Secretary of State along with the required filing fee. Ensure all information is accurate and complete to avoid delays in processing your incorporation.

Similar forms

- Bylaws: Bylaws outline the internal rules for managing a corporation. Like the Articles of Incorporation, they are essential for establishing the structure and governance of the organization.

- Certificate of Incorporation: This document is often used interchangeably with the Articles of Incorporation. Both serve to formally create a corporation and detail basic information such as the company name and purpose.

- Operating Agreement: Similar to bylaws, an Operating Agreement is crucial for LLCs. It defines the management structure and operating procedures, similar to how the Articles of Incorporation define corporate governance.

The Operating Agreement is vital for LLCs, delineating the management structure and operational guidelines. For those drafting this crucial document, accessing our thorough Operating Agreement form resources can greatly assist in ensuring that all necessary elements are included.

- Partnership Agreement: This document outlines the terms of a partnership. Like the Articles of Incorporation, it establishes the framework for the business relationship among partners.

- Business License: A business license is required to operate legally. While it serves a different purpose, it is similar in that both documents are necessary for legal compliance in starting a business.

- Registration Statement: This document is often required for securities offerings. It shares similarities with the Articles of Incorporation in that both are filed with the state and provide essential information about the business.

Misconceptions

When it comes to the Ohio Articles of Incorporation form, several misconceptions can lead to confusion for those looking to start a business. Here are five common misunderstandings:

-

All businesses must file Articles of Incorporation.

While many businesses choose to incorporate, not every business is required to file Articles of Incorporation. Sole proprietorships and partnerships do not need to file this form, although they may choose to for liability protection.

-

Filing Articles of Incorporation guarantees business success.

Filing this form is a crucial step in establishing a corporation, but it does not guarantee that the business will be successful. Many other factors, such as a solid business plan, market research, and effective management, play significant roles in a company's success.

-

The Articles of Incorporation are the same as the operating agreement.

These two documents serve different purposes. The Articles of Incorporation outline the basic structure of the corporation, while an operating agreement details the management and operational procedures of the business. Both are important but distinct.

-

You can file Articles of Incorporation anytime.

Although you can technically file at any time, it’s often best to do so before starting business operations. Filing too late can lead to legal complications and potential liabilities.

-

Once filed, the Articles of Incorporation cannot be changed.

This is not true. While the Articles of Incorporation are a formal document, they can be amended if necessary. Changes to the corporation's structure or purpose may require an amendment to the original filing.

Understanding these misconceptions can help individuals navigate the incorporation process with more confidence and clarity.

Form Overview

| Fact Name | Description |

|---|---|

| Governing Law | The Ohio Articles of Incorporation are governed by the Ohio Revised Code, specifically Chapter 1701. |

| Purpose of Form | This form is used to officially create a corporation in the state of Ohio. |

| Filing Requirement | To form a corporation, the Articles of Incorporation must be filed with the Ohio Secretary of State. |

| Corporate Name | The corporation must have a unique name that complies with Ohio naming requirements. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Incorporator Information | The form requires the name and address of the incorporator(s) who are filing the Articles. |

| Duration of Corporation | The Articles can specify a duration for the corporation, or it can be perpetual. |

| Business Purpose | A brief statement of the corporation's business purpose is required in the Articles. |

| Share Structure | The Articles must outline the number of shares the corporation is authorized to issue. |

| Filing Fees | There is a filing fee associated with submitting the Articles of Incorporation to the Secretary of State. |