Printable Transfer-on-Death Deed Document for New York

In New York, planning for the future often involves ensuring that your assets are passed on smoothly to your loved ones. One effective tool for this is the Transfer-on-Death (TOD) Deed form. This legal document allows property owners to designate a beneficiary who will automatically receive the property upon their death, without the need for probate. This can save time and money, making the process much easier for those left behind. The form requires specific information, such as the property description and the names of the beneficiaries. It must be signed and notarized to be valid. Additionally, understanding how this deed interacts with other estate planning tools is crucial. By using the Transfer-on-Death Deed, individuals can maintain control over their property during their lifetime while ensuring a seamless transition to their chosen heirs after they pass away.

More State-specific Transfer-on-Death Deed Forms

Free Printable Transfer on Death Deed Form Georgia - It's advisable to notify beneficiaries of their designation to avoid confusion later on.

In Washington, completing the Homeschool Letter of Intent form is vital for families embarking on the homeschooling journey, as it serves to formally inform the state of their decision. This essential document ensures that the family's educational choice is recognized and adheres to state requirements. For those looking for a convenient template to facilitate this process, you can find an editable version at https://homeschoolintent.com/editable-washington-homeschool-letter-of-intent.

Todi Illinois - This deed is effective upon the death of the property owner, making it a practical tool for estate management.

Ladybird Deed Texas Form - It allows property to transfer outside of the usual probate process.

Common Questions

What is a Transfer-on-Death Deed in New York?

A Transfer-on-Death Deed (TOD Deed) allows property owners in New York to transfer their real estate to a designated beneficiary upon their death. This deed does not take effect until the owner passes away, meaning the property remains under the owner’s control during their lifetime.

Who can be a beneficiary of a Transfer-on-Death Deed?

Any individual or entity can be named as a beneficiary in a Transfer-on-Death Deed. This includes family members, friends, or even organizations. However, it is essential to ensure that the beneficiary is legally capable of receiving the property.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must complete the form, providing details about the property and the beneficiary. The deed must be signed by the owner in the presence of a notary public. After signing, the deed must be recorded with the county clerk's office where the property is located to be legally valid.

Can I revoke or change a Transfer-on-Death Deed?

Yes, you can revoke or change a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed that explicitly revokes the previous one or simply record a revocation document with the county clerk's office. Ensure that you follow the proper procedures to avoid confusion.

What are the benefits of using a Transfer-on-Death Deed?

One of the main benefits of a Transfer-on-Death Deed is that it allows for the seamless transfer of property without going through probate. This can save time and money for the beneficiaries. Additionally, the property owner retains full control of the property during their lifetime, allowing them to sell or mortgage it as they see fit.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when using a Transfer-on-Death Deed. The property is not considered a gift until the owner passes away. However, beneficiaries may be responsible for property taxes and any potential capital gains taxes when they sell the property. Consulting a tax professional is advisable to understand the specific implications.

Is legal assistance necessary to complete a Transfer-on-Death Deed?

While it is not legally required to have an attorney to complete a Transfer-on-Death Deed, seeking legal assistance can be beneficial. An attorney can help ensure that the deed is filled out correctly, complies with all legal requirements, and aligns with your overall estate plan.

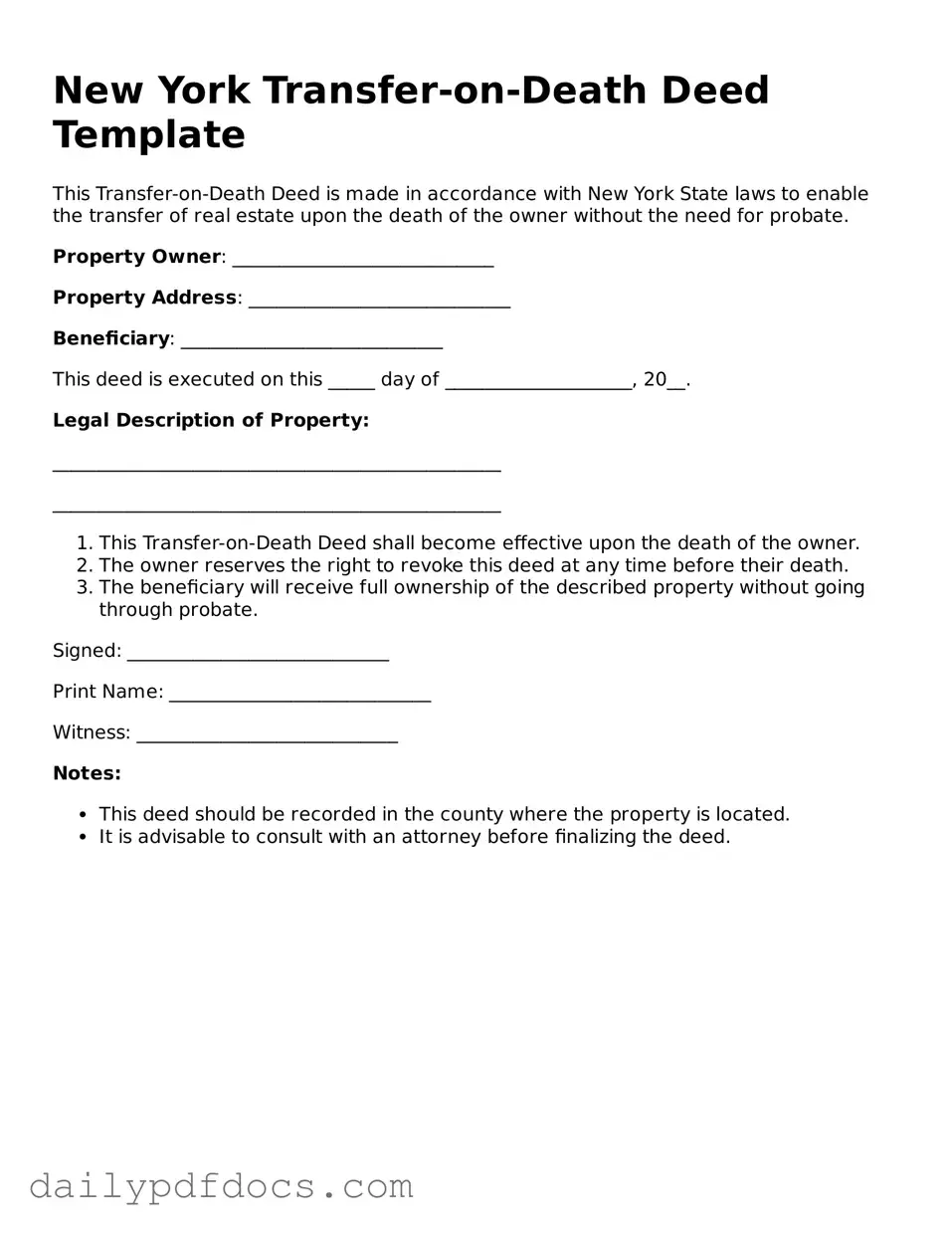

Preview - New York Transfer-on-Death Deed Form

New York Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with New York State laws to enable the transfer of real estate upon the death of the owner without the need for probate.

Property Owner: ____________________________

Property Address: ____________________________

Beneficiary: ____________________________

This deed is executed on this _____ day of ____________________, 20__.

Legal Description of Property:

________________________________________________

________________________________________________

- This Transfer-on-Death Deed shall become effective upon the death of the owner.

- The owner reserves the right to revoke this deed at any time before their death.

- The beneficiary will receive full ownership of the described property without going through probate.

Signed: ____________________________

Print Name: ____________________________

Witness: ____________________________

Notes:

- This deed should be recorded in the county where the property is located.

- It is advisable to consult with an attorney before finalizing the deed.

Similar forms

- Will: A will outlines how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to designate beneficiaries for their property. However, a will must go through probate, while a Transfer-on-Death Deed does not.

- Living Trust: A living trust is a legal arrangement that holds a person's assets during their lifetime and specifies how they will be distributed after death. Both documents enable the transfer of property outside of probate, but a living trust requires more management and formalities.

- Beneficiary Designation: Certain financial accounts, such as life insurance policies and retirement accounts, allow individuals to name beneficiaries. This is similar to a Transfer-on-Death Deed, as both documents facilitate the direct transfer of assets upon death without going through probate.

- Ohio Unclaimed Funds Reporting Form: The Ohio PDF Forms provide necessary resources for entities to navigate and comply with regulations regarding unclaimed funds in Ohio, ensuring proper reporting and potential filing of negative reports.

- Joint Tenancy with Right of Survivorship: In this arrangement, property is owned jointly, and upon the death of one owner, the property automatically transfers to the surviving owner. This is akin to a Transfer-on-Death Deed in that it allows for immediate transfer of ownership upon death.

- Payable-on-Death Accounts: Bank accounts can be set up to transfer to a designated beneficiary upon the account holder's death. Like a Transfer-on-Death Deed, this method avoids probate and allows for a straightforward transfer of assets.

- Life Estate Deed: A life estate deed allows a person to retain the right to use a property during their lifetime while designating a beneficiary to receive the property after their death. Both documents serve to transfer property outside of probate, but a life estate deed grants rights during the grantor's lifetime.

Misconceptions

The New York Transfer-on-Death Deed (TOD) form allows property owners to transfer real estate to a designated beneficiary upon their death. However, several misconceptions surround this legal tool. Below are ten common misunderstandings regarding the New York Transfer-on-Death Deed.

- It is the same as a will. Many people think a Transfer-on-Death Deed functions like a will. In reality, it directly transfers property outside of probate, whereas a will must go through the probate process.

- All types of property can be transferred using a TOD deed. Not all properties are eligible. Only real estate, such as land and buildings, can be transferred using this deed.

- It eliminates the need for a will. A TOD deed does not replace the need for a will. Other assets and personal belongings may still require a will for distribution.

- Beneficiaries cannot be changed. Beneficiaries can be changed or revoked at any time before the property owner’s death, allowing for flexibility in estate planning.

- The deed must be notarized. While notarization is recommended, it is not strictly required for the deed to be valid. However, proper execution is essential.

- It automatically includes all property owned. A TOD deed only applies to the specific property listed in the deed. Other properties require separate deeds.

- There are no tax implications. While the transfer may avoid probate, there could be tax implications for the beneficiary, such as capital gains tax upon sale.

- Only one beneficiary can be named. Multiple beneficiaries can be designated in a Transfer-on-Death Deed, allowing for shared ownership after the owner’s death.

- It is only for married couples. Anyone who owns real property can use a TOD deed, regardless of marital status.

- Once filed, it cannot be revoked. The deed can be revoked or modified at any time before the death of the property owner, providing control over the estate.

Understanding these misconceptions can help individuals make informed decisions regarding their estate planning and the use of the New York Transfer-on-Death Deed.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by New York Estates, Powers and Trusts Law (EPTL) § 2-1.11. |

| Eligibility | Only individuals who own real property in New York can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property upon their death. |

| Revocation | The deed can be revoked or changed at any time before the owner's death, provided the proper procedures are followed. |

| Recording Requirement | The deed must be recorded with the county clerk in the county where the property is located to be effective. |

| Impact on Taxes | Transfer-on-Death Deeds do not affect property taxes during the owner's lifetime. |

| Legal Assistance | While legal assistance is not required, it is highly recommended to ensure the deed is completed and recorded correctly. |