Printable Promissory Note Document for New York

The New York Promissory Note form serves as a critical financial instrument in the realm of lending and borrowing. This document outlines the borrower's promise to repay a specified amount of money to the lender, typically accompanied by details regarding interest rates, repayment schedules, and consequences for default. It is essential for both parties to understand the terms laid out in the note, as these terms govern the legal obligations and rights associated with the loan. The form includes essential elements such as the principal amount, the maturity date, and the signature of the borrower, which solidifies the agreement. Additionally, the note may specify whether it is secured or unsecured, impacting the lender's recourse in the event of non-payment. By clearly defining these aspects, the New York Promissory Note form not only facilitates transparency between the parties involved but also provides a framework for resolving disputes should they arise. Understanding the intricacies of this form is vital for anyone engaged in financial transactions in New York, as it ensures compliance with state laws and protects the interests of both lenders and borrowers.

More State-specific Promissory Note Forms

Illinois Promissory Note - Non-compliance can result in loss of trust and financial consequences.

Ohio Promissory Note - The note should legally bind both parties in terms of obligations and rights.

Promissory Note Template Florida Pdf - This document serves as legal evidence of a debt obligation between parties.

The New York Mobile Home Bill of Sale form is vital for anyone looking to buy or sell a mobile home, as it helps clarify the ownership transfer process. For detailed information and access to the form, you can visit mobilehomebillofsale.com/blank-new-york-mobile-home-bill-of-sale, where you will find all the necessary resources to ensure a legally compliant transaction.

Free Promissory Note Template Texas - Each party's rights and responsibilities are clearly laid out in the promissory note.

Common Questions

What is a New York Promissory Note?

A New York Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date or on demand. This document serves as a legal instrument that outlines the terms of the loan, including the interest rate, repayment schedule, and any collateral involved.

Who uses a Promissory Note?

Individuals, businesses, and financial institutions commonly use Promissory Notes. They can be utilized in various situations, such as personal loans between friends or family, business loans, or real estate transactions. Essentially, anyone who lends money or borrows money can benefit from this document.

What are the key components of a New York Promissory Note?

A typical New York Promissory Note includes several important elements: the names of the borrower and lender, the principal amount borrowed, the interest rate, the repayment schedule, and any provisions for default. Additionally, it may specify whether the loan is secured or unsecured.

Do I need to notarize a Promissory Note in New York?

While notarization is not required for a Promissory Note to be legally binding in New York, it is highly recommended. Having the document notarized adds an extra layer of authenticity and can help prevent disputes in the future.

What happens if the borrower fails to repay the loan?

If the borrower does not repay the loan as agreed, the lender has the right to take legal action. This may involve filing a lawsuit to recover the owed amount. If the Promissory Note is secured by collateral, the lender may also have the right to seize the collateral to satisfy the debt.

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is important to document any modifications in writing and have both parties sign the updated agreement. This helps ensure that all parties are on the same page and reduces the risk of misunderstandings.

Is a Promissory Note the same as a loan agreement?

While both documents serve similar purposes, they are not the same. A Promissory Note is a simple promise to pay, whereas a loan agreement is more comprehensive. A loan agreement typically includes detailed terms and conditions, including covenants, representations, and warranties, in addition to the repayment terms.

Can I use a Promissory Note for business loans?

Absolutely. A Promissory Note can be used for business loans, whether you are borrowing money to start a new venture or seeking funds to expand an existing business. It is essential to clearly outline the terms to protect both the lender and the borrower.

Where can I find a New York Promissory Note template?

You can find templates for a New York Promissory Note online through various legal websites or by consulting with an attorney. Ensure that any template you choose complies with New York laws and meets your specific needs.

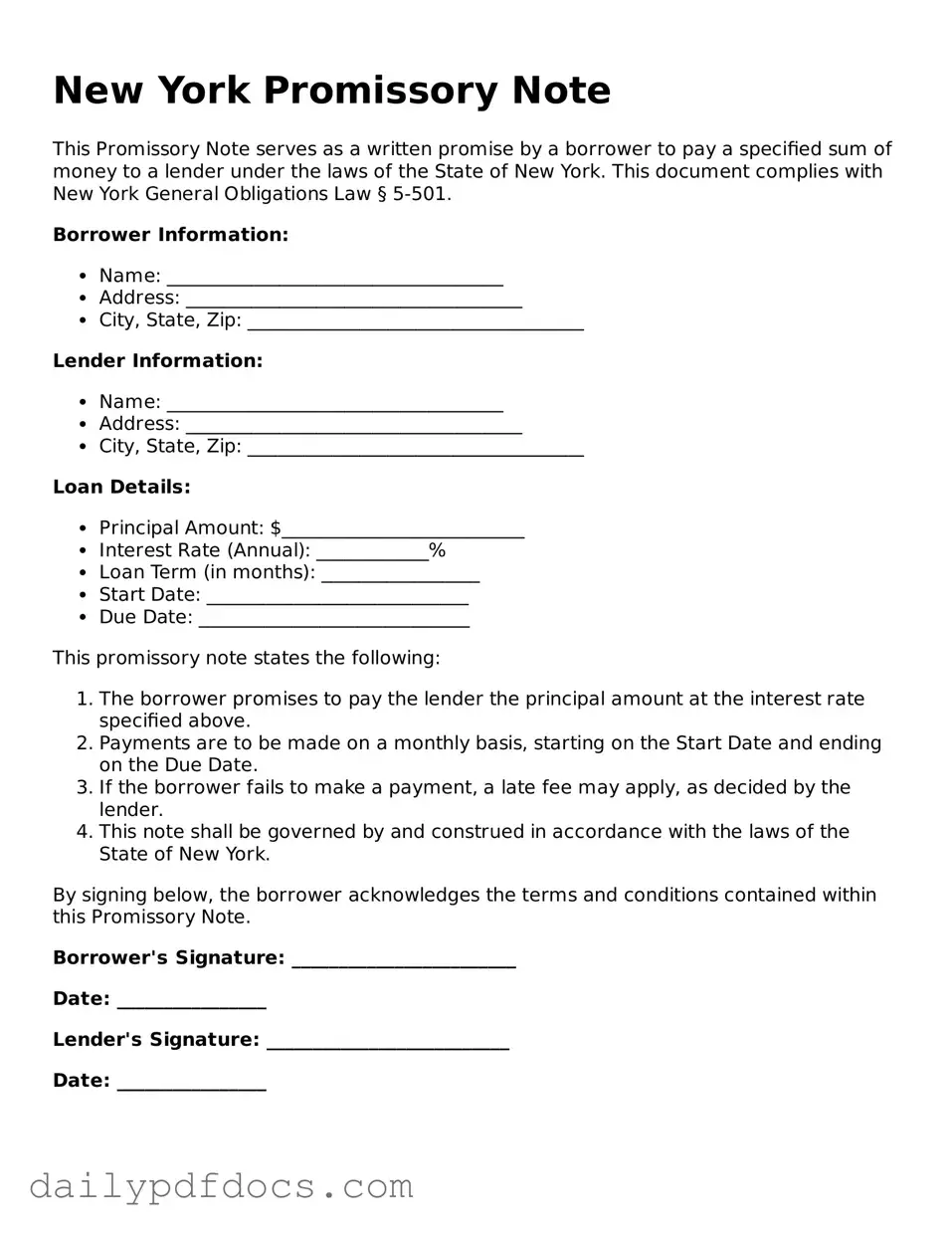

Preview - New York Promissory Note Form

New York Promissory Note

This Promissory Note serves as a written promise by a borrower to pay a specified sum of money to a lender under the laws of the State of New York. This document complies with New York General Obligations Law § 5-501.

Borrower Information:

- Name: ____________________________________

- Address: ____________________________________

- City, State, Zip: ____________________________________

Lender Information:

- Name: ____________________________________

- Address: ____________________________________

- City, State, Zip: ____________________________________

Loan Details:

- Principal Amount: $__________________________

- Interest Rate (Annual): ____________%

- Loan Term (in months): _________________

- Start Date: ____________________________

- Due Date: _____________________________

This promissory note states the following:

- The borrower promises to pay the lender the principal amount at the interest rate specified above.

- Payments are to be made on a monthly basis, starting on the Start Date and ending on the Due Date.

- If the borrower fails to make a payment, a late fee may apply, as decided by the lender.

- This note shall be governed by and construed in accordance with the laws of the State of New York.

By signing below, the borrower acknowledges the terms and conditions contained within this Promissory Note.

Borrower's Signature: ________________________

Date: ________________

Lender's Signature: __________________________

Date: ________________

Similar forms

A Promissory Note is a financial document that outlines a borrower's promise to repay a loan under specific terms. Several other documents share similarities with a Promissory Note in terms of their purpose and structure. Here are six such documents:

- Loan Agreement: This document details the terms of a loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. Like a Promissory Note, it serves as a legal contract between the lender and borrower.

- Mortgage: A mortgage is a specific type of loan used to purchase real estate. It includes a promise to repay the loan, similar to a Promissory Note, but also involves the property as collateral, making it distinct.

- Security Agreement: This document outlines the terms under which a borrower offers collateral to secure a loan. It is akin to a Promissory Note in that it establishes the borrower's obligation to repay but focuses more on the collateral aspect.

- Installment Agreement: An installment agreement allows a borrower to repay a debt in regular payments over time. This document shares the repayment promise characteristic of a Promissory Note, but it typically includes a detailed schedule of payments.

- Loan Disclosure Statement: This statement provides borrowers with key information about the terms of their loan, including interest rates and fees. While it does not serve as a promise to pay, it complements the Promissory Note by ensuring borrowers understand their obligations.

- Durable Power of Attorney: This important document allows you to designate someone to manage your financial and legal matters if you are unable to do so yourself. To learn more, visit Washington Templates.

- Debt Settlement Agreement: In this document, a borrower and creditor agree on a reduced amount to settle a debt. Although it differs from a Promissory Note in purpose, it still reflects the borrower's commitment to resolve their financial obligations.

Each of these documents plays a vital role in the financial landscape, helping to clarify the responsibilities and expectations of both lenders and borrowers.

Misconceptions

Understanding the New York Promissory Note form is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

- All Promissory Notes are the Same: Many believe that all promissory notes are identical. In reality, the terms and conditions can vary significantly based on the agreement between the parties involved.

- A Promissory Note Must Be Notarized: Some think that notarization is a requirement for a promissory note to be valid. While notarization can add an extra layer of security, it is not a legal requirement in New York.

- Promissory Notes Are Only for Large Loans: It’s a common belief that promissory notes are only necessary for substantial amounts. However, they can be used for any loan amount, regardless of size.

- Verbal Agreements Are Sufficient: Some individuals assume that a verbal agreement is enough. This is misleading; having a written promissory note provides clarity and legal protection.

- Interest Rates Are Unlimited: There is a misconception that lenders can charge any interest rate they choose. New York law does impose limits on the maximum interest rates that can be charged.

- Promissory Notes Are Non-Transferable: Many think that once a promissory note is created, it cannot be transferred. In fact, promissory notes can often be sold or assigned to another party.

- Default Means Immediate Legal Action: Some believe that defaulting on a promissory note leads to immediate legal consequences. Typically, lenders must first attempt to resolve the issue before taking legal action.

- All Promissory Notes Are Enforceable: It’s a misconception that every promissory note is legally enforceable. Certain conditions, such as lack of capacity or illegal purpose, can render a note unenforceable.

Being aware of these misconceptions can help both borrowers and lenders navigate the complexities of promissory notes with greater confidence.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a certain time or on demand. |

| Governing Law | The New York Uniform Commercial Code (UCC) governs promissory notes in New York. |

| Parties Involved | The note typically involves two parties: the maker (the person promising to pay) and the payee (the person receiving the payment). |

| Payment Terms | Payment terms should clearly outline the amount due, the due date, and any interest rates applicable. |

| Interest Rate | The interest rate can be fixed or variable, but it must be clearly stated in the note. |

| Signatures | The maker must sign the promissory note for it to be legally binding. |

| Consideration | There must be consideration, meaning something of value exchanged between the parties, for the note to be enforceable. |

| Transferability | Promissory notes can be transferred to another party through endorsement, allowing the new holder to collect payment. |

| Default Consequences | If the maker fails to pay as promised, the payee may take legal action to recover the owed amount. |