Printable Loan Agreement Document for New York

The New York Loan Agreement form serves as a vital document in the realm of lending, encapsulating the essential terms and conditions that govern the relationship between borrowers and lenders. This form outlines critical aspects such as the loan amount, interest rates, repayment schedules, and any collateral required to secure the loan. Additionally, it includes provisions for default and remedies, ensuring that both parties understand their rights and responsibilities. The clarity provided by this agreement fosters transparency and trust, which are crucial in any financial transaction. By detailing the obligations of each party, the form helps to mitigate misunderstandings and disputes that may arise during the loan period. Furthermore, the New York Loan Agreement adheres to state-specific regulations, ensuring compliance with local laws while accommodating the unique needs of the parties involved. Whether utilized for personal loans, business financing, or real estate transactions, this form is an indispensable tool for facilitating smooth and legally sound lending practices.

More State-specific Loan Agreement Forms

California Promissory Note Template - May detail how contact information should be kept up to date by both parties.

In addition to understanding the significance of the Ohio Unclaimed Funds Reporting Form, businesses may also find it helpful to access resources such as Ohio PDF Forms, which provide essential guidance on properly filling out and submitting necessary documentation.

Promissory Note Georgia - A Loan Agreement may also address what happens in the case of death or bankruptcy.

Promissory Note Illinois - Loan Agreements may include clauses for prepayment without penalties.

Common Questions

What is a New York Loan Agreement form?

The New York Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It specifies the amount borrowed, the interest rate, repayment schedule, and any collateral involved. This form serves to protect both parties by clearly defining their obligations and rights under the loan arrangement.

Who should use a New York Loan Agreement form?

Individuals or businesses looking to borrow or lend money in New York should consider using this form. It is particularly useful for personal loans, business loans, or any situation where formal documentation of the loan terms is necessary. Both parties benefit from having a written agreement that can be referenced in case of disputes or misunderstandings.

What are the key components of a New York Loan Agreement?

A typical New York Loan Agreement includes several important components. These typically consist of the loan amount, interest rate, repayment terms, and maturity date. Additionally, it may outline any fees, penalties for late payments, and the consequences of default. It is crucial for both parties to review these components carefully to ensure they are in agreement.

Is a New York Loan Agreement legally binding?

Yes, once signed by both parties, a New York Loan Agreement is legally binding. This means that both the lender and borrower are obligated to adhere to the terms outlined in the document. If either party fails to fulfill their obligations, the other party may have legal grounds to seek enforcement or compensation through the courts.

Can the terms of a New York Loan Agreement be modified?

Yes, the terms of a New York Loan Agreement can be modified, but any changes must be agreed upon by both parties. It is advisable to document any modifications in writing to avoid confusion in the future. This ensures that both parties have a clear understanding of the new terms and conditions.

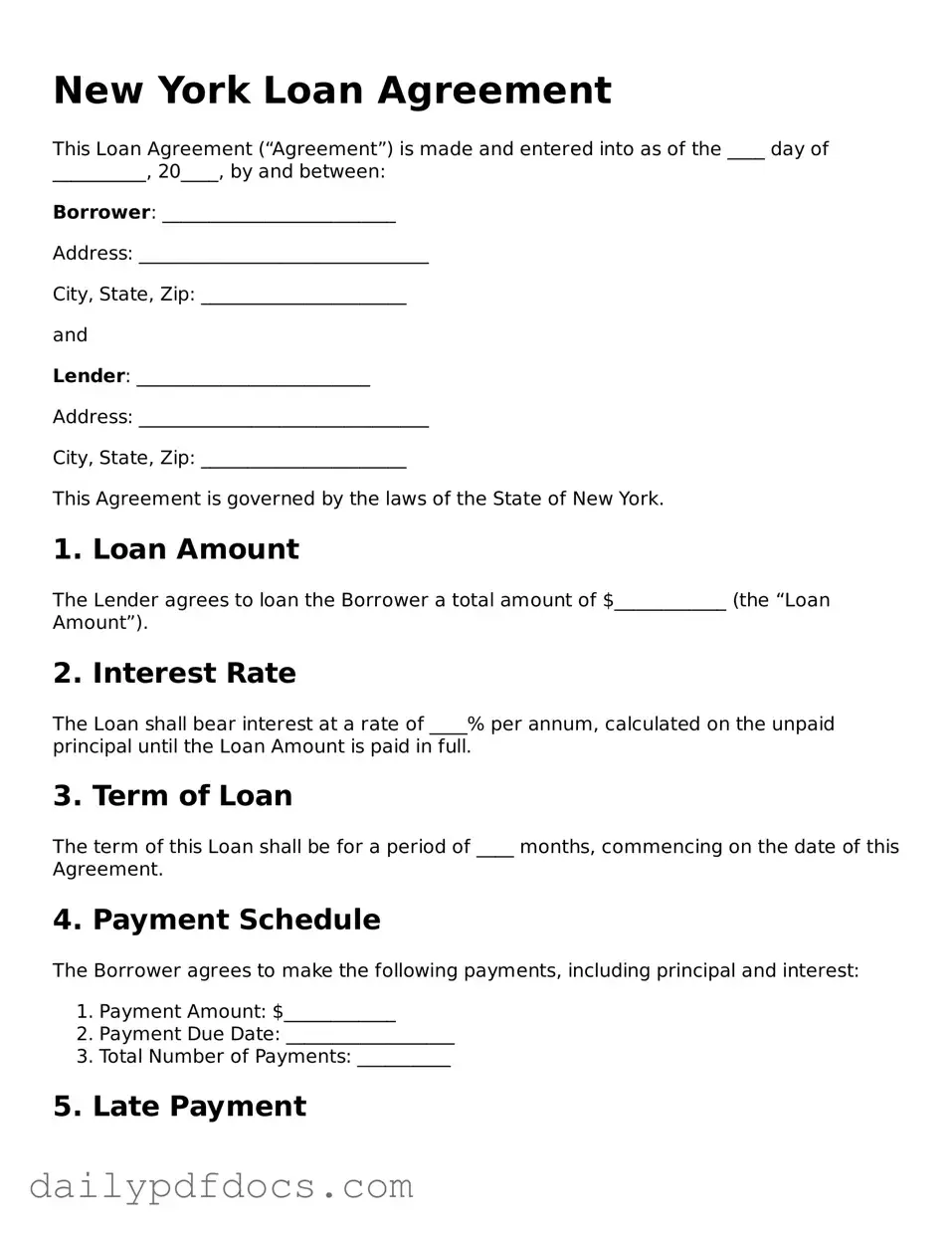

Preview - New York Loan Agreement Form

New York Loan Agreement

This Loan Agreement (“Agreement”) is made and entered into as of the ____ day of __________, 20____, by and between:

Borrower: _________________________

Address: _______________________________

City, State, Zip: ______________________

and

Lender: _________________________

Address: _______________________________

City, State, Zip: ______________________

This Agreement is governed by the laws of the State of New York.

1. Loan Amount

The Lender agrees to loan the Borrower a total amount of $____________ (the “Loan Amount”).

2. Interest Rate

The Loan shall bear interest at a rate of ____% per annum, calculated on the unpaid principal until the Loan Amount is paid in full.

3. Term of Loan

The term of this Loan shall be for a period of ____ months, commencing on the date of this Agreement.

4. Payment Schedule

The Borrower agrees to make the following payments, including principal and interest:

- Payment Amount: $____________

- Payment Due Date: __________________

- Total Number of Payments: __________

5. Late Payment

If any payment is not received within ____ days of the due date, a late fee of $____________ may be charged.

6. Default

The Borrower will be in default if:

- The Borrower fails to make any payment when due.

- The Borrower becomes bankrupt or insolvent.

- The Borrower breaches any term of this Agreement.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of New York.

8. Miscellaneous

This Agreement may only be amended in writing signed by both parties. Any notices given under this Agreement shall be in writing and sent to the addresses listed above.

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement as of the date first written above.

__________________________ Borrower Signature

Date: ____________________

__________________________ Lender Signature

Date: ____________________

Similar forms

-

Promissory Note: This document outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. Like a Loan Agreement, it includes details such as the loan amount, interest rate, and repayment schedule, making it a fundamental document in lending situations.

-

Mortgage Agreement: A Mortgage Agreement secures a loan with real property as collateral. Similar to a Loan Agreement, it contains terms regarding the loan amount and repayment but also specifies the property involved and the lender's rights in case of default.

- Homeschool Letter of Intent: This document is essential for families who choose to educate their children at home, notifying the state of their decision to homeschool. For more information on this vital form, visit homeschoolintent.com/editable-washington-homeschool-letter-of-intent/.

-

Security Agreement: This document establishes a lender's rights to specific assets as collateral for a loan. It shares similarities with a Loan Agreement by detailing the obligations of the borrower and the terms of the loan, ensuring that the lender has recourse in the event of non-payment.

-

Credit Agreement: A Credit Agreement governs the terms under which a borrower can access credit from a lender. Like a Loan Agreement, it outlines the amount of credit, interest rates, and repayment terms, but it often allows for a revolving line of credit rather than a fixed loan.

Misconceptions

-

Misconception 1: The New York Loan Agreement form is only for large loans.

This is not true. While many people associate loan agreements with substantial sums, the New York Loan Agreement form can be used for loans of various sizes. Whether you are borrowing a small amount for personal use or a larger sum for business purposes, this form is adaptable to different financial situations.

-

Misconception 2: The form is overly complicated and difficult to understand.

Many individuals believe that legal documents are inherently complex. However, the New York Loan Agreement form is designed to be straightforward. It outlines the terms clearly, making it accessible for both lenders and borrowers. With a little attention, anyone can navigate the form without extensive legal knowledge.

-

Misconception 3: Once signed, the terms of the loan cannot be changed.

This is a common misunderstanding. While the agreement is binding, it is possible to modify the terms if both parties agree. Communication is key. If circumstances change, the lender and borrower can negotiate new terms and create an amendment to the original agreement.

-

Misconception 4: The New York Loan Agreement form is only valid in New York.

While the form is tailored to comply with New York laws, it can be used in other jurisdictions as well. However, it is essential to ensure that the terms align with local regulations. Borrowers and lenders outside New York should verify that the agreement meets their specific legal requirements.

Form Overview

| Fact Name | Description |

|---|---|

| Governing Law | The New York Loan Agreement is governed by New York State law. |

| Purpose | This form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Parties Involved | The agreement identifies the lender and the borrower, including their legal names and addresses. |

| Loan Amount | The specific amount of money being loaned is clearly stated in the agreement. |

| Interest Rate | The agreement specifies the interest rate applicable to the loan, whether fixed or variable. |

| Repayment Terms | Details about how and when the borrower will repay the loan are outlined in the form. |

| Default Conditions | The agreement includes conditions under which the borrower would be considered in default. |

| Collateral | If applicable, the form specifies any collateral that secures the loan. |

| Amendments | Any changes to the agreement must be made in writing and signed by both parties. |

| Signatures | The agreement requires signatures from both the lender and the borrower to be legally binding. |