Printable Last Will and Testament Document for New York

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In New York, this legal document serves as a blueprint for how your assets will be distributed and who will take care of any dependents. The form typically includes key components such as the appointment of an executor, who is responsible for managing your estate, and the designation of beneficiaries, those who will inherit your property and possessions. Additionally, it addresses any specific bequests you may wish to make, whether it’s a family heirloom or a monetary gift. The New York Last Will and Testament form also allows you to name guardians for minor children, ensuring they are cared for by individuals you trust. By following the state's guidelines, you can create a valid will that reflects your intentions, providing peace of mind for both you and your loved ones. Understanding the intricacies of this form is vital, as it not only protects your legacy but also minimizes potential disputes among family members in the future.

More State-specific Last Will and Testament Forms

Last Will and Testament Template Illinois - Serves as a safeguard against intestacy, where state laws determine asset distribution.

Creating a Washington Durable Power of Attorney is crucial for safeguarding your financial and legal matters in case of incapacitation, which is why you should explore resources such as Washington Templates to help you fill out the necessary form correctly and effectively.

Will Template Georgia - Having a will can provide a sense of security and preparation.

California Last Will and Testament - Can include trusts to provide for family members over time.

Common Questions

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their passing. It allows individuals to specify who will inherit their property, name guardians for minor children, and designate an executor to carry out their wishes. This document is crucial for ensuring that one's intentions are honored and can help prevent disputes among family members.

Do I need a lawyer to create a Last Will and Testament in New York?

While it is not legally required to hire a lawyer to create a Last Will and Testament in New York, it is highly advisable. Legal professionals can provide guidance tailored to your specific situation, ensuring that all legal requirements are met. They can also help clarify complex family dynamics and ensure that your wishes are clearly articulated and enforceable.

What are the legal requirements for a Last Will and Testament in New York?

In New York, a Last Will and Testament must be in writing and signed by the person making the will, known as the testator. Additionally, it must be witnessed by at least two individuals who are not beneficiaries of the will. These witnesses must also sign the document in the presence of the testator. Following these requirements helps ensure the will is valid and can be executed without complications.

Can I change my Last Will and Testament after it is created?

Yes, you can change your Last Will and Testament at any time as long as you are of sound mind. This is typically done through a codicil, which is an amendment to the original will, or by creating an entirely new will that revokes the previous one. It is important to follow the same legal requirements when making changes to ensure that your updated wishes are recognized.

What happens if I die without a Last Will and Testament in New York?

If you pass away without a Last Will and Testament, your estate will be distributed according to New York's intestacy laws. This means that your assets will be allocated to your closest relatives, which may not align with your personal wishes. Dying intestate can lead to complications and disputes among family members, making it essential to have a will in place.

Can I include specific bequests in my Last Will and Testament?

Absolutely. A Last Will and Testament can include specific bequests, which are gifts of particular items or amounts of money to designated individuals or organizations. This allows you to express your wishes clearly and ensure that cherished possessions or financial support are given to those you care about most.

How do I ensure my Last Will and Testament is valid in New York?

To ensure your Last Will and Testament is valid in New York, adhere to the legal requirements mentioned earlier: it must be in writing, signed by you, and witnessed by at least two individuals. Additionally, consider consulting with a legal professional who can review your will and provide insights into any potential issues. Storing the will in a safe place and informing your executor of its location can also help ensure its validity and accessibility when needed.

What is the role of an executor in a Last Will and Testament?

The executor is the individual responsible for carrying out the instructions outlined in your Last Will and Testament. This includes managing your estate, paying any debts or taxes, and distributing assets to beneficiaries. It is essential to choose someone trustworthy and organized for this role, as they will play a crucial part in ensuring your wishes are fulfilled after your passing.

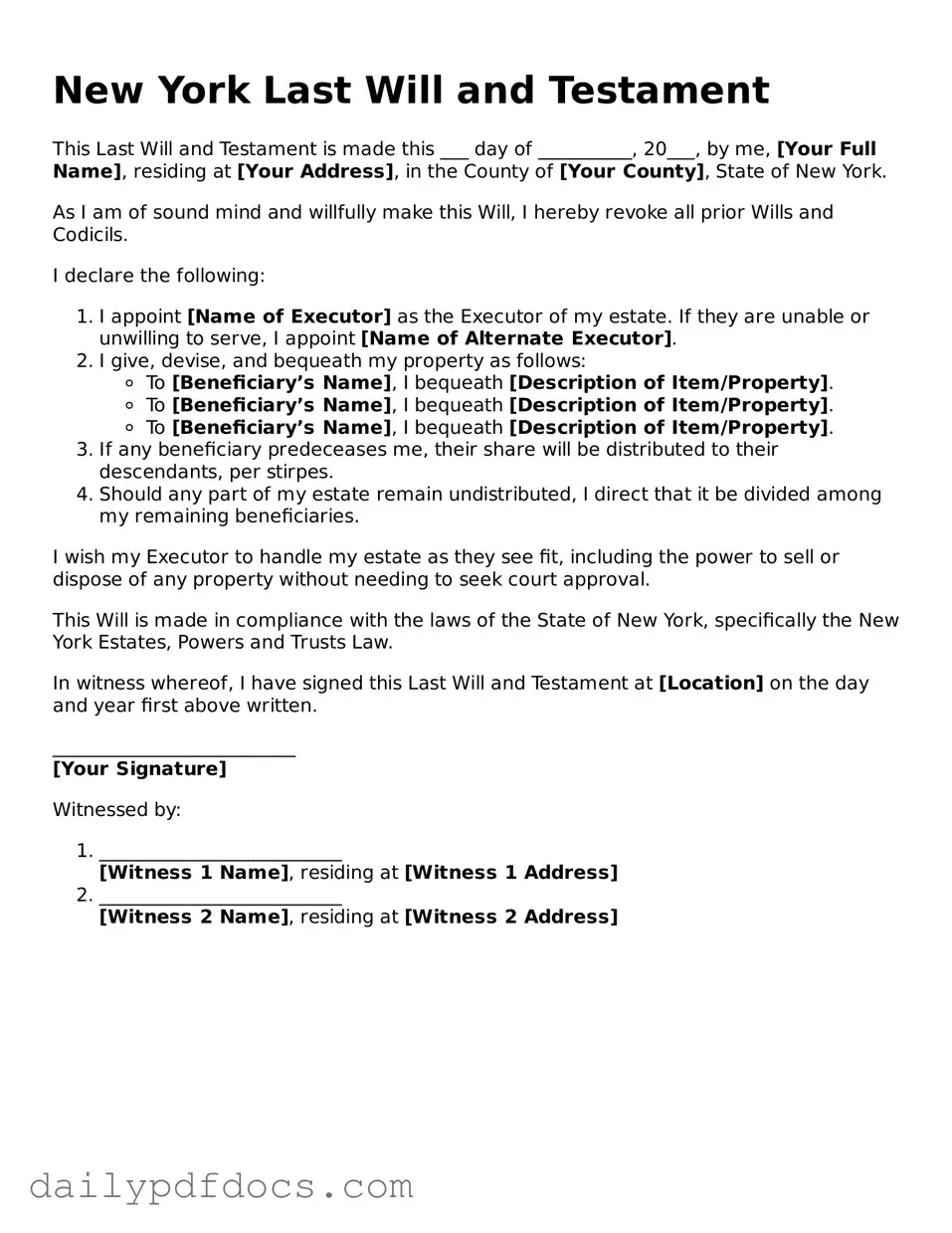

Preview - New York Last Will and Testament Form

New York Last Will and Testament

This Last Will and Testament is made this ___ day of __________, 20___, by me, [Your Full Name], residing at [Your Address], in the County of [Your County], State of New York.

As I am of sound mind and willfully make this Will, I hereby revoke all prior Wills and Codicils.

I declare the following:

- I appoint [Name of Executor] as the Executor of my estate. If they are unable or unwilling to serve, I appoint [Name of Alternate Executor].

- I give, devise, and bequeath my property as follows:

- To [Beneficiary’s Name], I bequeath [Description of Item/Property].

- To [Beneficiary’s Name], I bequeath [Description of Item/Property].

- To [Beneficiary’s Name], I bequeath [Description of Item/Property].

- If any beneficiary predeceases me, their share will be distributed to their descendants, per stirpes.

- Should any part of my estate remain undistributed, I direct that it be divided among my remaining beneficiaries.

I wish my Executor to handle my estate as they see fit, including the power to sell or dispose of any property without needing to seek court approval.

This Will is made in compliance with the laws of the State of New York, specifically the New York Estates, Powers and Trusts Law.

In witness whereof, I have signed this Last Will and Testament at [Location] on the day and year first above written.

__________________________

[Your Signature]

Witnessed by:

- __________________________

[Witness 1 Name], residing at [Witness 1 Address] - __________________________

[Witness 2 Name], residing at [Witness 2 Address]

Similar forms

The Last Will and Testament form shares similarities with several other important legal documents. Each serves a specific purpose in estate planning and management. Below are four documents that are comparable to a Last Will and Testament:

- Living Trust: A living trust allows a person to place their assets into a trust during their lifetime. This document helps avoid probate, similar to a will, and provides instructions on how assets should be distributed after death.

- Power of Attorney: A power of attorney grants someone the authority to make financial or medical decisions on behalf of another person. While a will addresses the distribution of assets after death, a power of attorney is effective during a person’s lifetime.

- Advance Healthcare Directive: This document outlines a person's preferences for medical treatment in case they become unable to communicate their wishes. Like a will, it ensures that a person’s desires are respected and followed, but it focuses specifically on healthcare decisions.

- Mobile Home Bill of Sale: This document is essential for the transfer of ownership of a mobile home, including details about the buyer and seller, as well as the sale price. For further information, you can visit https://mobilehomebillofsale.com/blank-new-york-mobile-home-bill-of-sale.

- Beneficiary Designation: Many financial accounts and insurance policies allow individuals to designate beneficiaries. This document works alongside a will by ensuring that certain assets pass directly to named individuals, bypassing the probate process.

Misconceptions

Understanding the New York Last Will and Testament form can be challenging, especially with various misconceptions floating around. Here are nine common myths, along with clarifications to help you navigate this important document.

-

Myth 1: A will is only necessary for wealthy individuals.

This is not true. Everyone can benefit from having a will, regardless of their financial status. A will helps ensure that your wishes are respected and your loved ones are taken care of.

-

Myth 2: You can write a will anytime without legal requirements.

While you can draft a will on your own, New York has specific legal requirements for a will to be valid. This includes being signed by the testator and witnessed by at least two individuals.

-

Myth 3: A verbal will is just as valid as a written one.

In New York, verbal wills are not recognized. A written will is necessary to ensure that your intentions are legally binding and clear.

-

Myth 4: Once you create a will, it cannot be changed.

This is a misconception. You can amend or revoke your will at any time, as long as you follow the legal procedures. It’s important to keep your will updated to reflect your current wishes.

-

Myth 5: All assets automatically go to your spouse if you die.

This is not always the case. If you have children or other beneficiaries, your assets may be distributed according to your will or New York state laws, rather than automatically going to your spouse.

-

Myth 6: You don’t need a will if you have a trust.

A trust and a will serve different purposes. While a trust can manage assets during your lifetime and after your death, a will is necessary to address any assets not included in the trust.

-

Myth 7: A handwritten will is always valid.

Handwritten wills, known as holographic wills, are not recognized in New York unless they meet specific criteria. It’s safer to follow the formal requirements for a will to ensure its validity.

-

Myth 8: You can use any template for a will.

While templates are available, using a generic one may not meet New York’s legal standards. It’s advisable to use a form specifically designed for New York or consult with a legal professional.

-

Myth 9: Once your will is filed, it remains private.

In New York, a will becomes public record once it is filed for probate. If privacy is a concern, consider discussing alternative estate planning options with a professional.

Understanding these misconceptions can help you make informed decisions about your estate planning. Taking the time to create a valid will ensures that your wishes are honored and your loved ones are protected.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Governing Law | The New York Estates, Powers and Trusts Law (EPTL) governs the creation and execution of wills in New York. |

| Age Requirement | In New York, individuals must be at least 18 years old to create a valid will. |

| Witness Requirement | Two witnesses are required to sign the will in the presence of the testator (the person making the will). |

| Revocation | A will can be revoked by creating a new will or by physically destroying the original document. |

| Self-Proving Wills | New York allows for self-proving wills, which can simplify the probate process by including a notarized affidavit from the witnesses. |

| Probate Process | After death, the will must be submitted to the court for probate, which validates the will and oversees the distribution of assets. |