Printable Deed Document for New York

The New York Deed form is an essential legal document used in real estate transactions to transfer ownership of property from one party to another. This form plays a crucial role in ensuring that the transfer is executed properly and is recognized by the state. It typically includes vital information such as the names of the grantor (the seller) and grantee (the buyer), a description of the property being transferred, and the date of the transaction. Additionally, the form may require the inclusion of a notary public's signature to validate the document, which adds an extra layer of security to the transfer process. Various types of deeds, such as warranty deeds and quitclaim deeds, can be utilized depending on the nature of the transaction and the level of protection desired by the parties involved. Understanding the nuances of the New York Deed form is critical for anyone looking to buy or sell real estate in the state, as it helps to clarify rights, responsibilities, and potential liabilities associated with property ownership.

More State-specific Deed Forms

Quick Deed - Deeds often specify the type of ownership being granted.

A Quitclaim Deed is a legal document used in Ohio to transfer ownership of real estate from one party to another without any warranties. This form allows the grantor to relinquish their interest in the property, making it a straightforward option for transferring property rights. For those looking to understand how to properly complete and file this form, tools like Ohio PDF Forms can be invaluable in ensuring a smooth transaction.

Pennsylvania Deed Form - The deed often reflects the evolving relationship between ownership rights and personal circumstances.

Common Questions

What is a New York Deed form?

A New York Deed form is a legal document that transfers ownership of real property from one party to another. This form is essential in real estate transactions, as it serves as proof of ownership and outlines the details of the transfer, including the names of the parties involved and a description of the property. It is crucial to ensure that the deed is properly completed and filed with the county clerk’s office to make the transfer official.

What types of deeds are available in New York?

New York recognizes several types of deeds, each serving a different purpose. The most common types include the Warranty Deed, which guarantees that the seller holds clear title to the property; the Quitclaim Deed, which transfers any interest the seller may have without warranties; and the Bargain and Sale Deed, which implies that the seller has the right to sell the property but does not guarantee a clear title. Understanding the differences between these deeds is important for making informed decisions during a property transfer.

Who needs to sign the New York Deed form?

Typically, the New York Deed form must be signed by the person transferring the property, known as the grantor. If the property is owned jointly, all owners must sign the deed. Additionally, the deed may require notarization to verify the identities of the signers and to ensure the document is legally binding. It is advisable to consult with a professional to ensure all necessary signatures are obtained.

Do I need a lawyer to prepare a New York Deed form?

While it is not legally required to have a lawyer prepare a New York Deed form, it is highly recommended. A legal professional can help ensure that the deed is completed accurately and complies with all state laws. This can prevent potential disputes or issues with the property title in the future. If you choose to prepare the deed yourself, it is essential to research the requirements thoroughly.

What information is required on the New York Deed form?

The New York Deed form requires specific information to be valid. This includes the names and addresses of both the grantor and grantee, a legal description of the property being transferred, and the date of the transaction. Additionally, any applicable consideration (the payment or value exchanged) should be noted. Accurate and complete information is crucial for the deed to be enforceable.

How do I file the New York Deed form?

After completing the New York Deed form, it must be filed with the county clerk's office in the county where the property is located. There may be a filing fee, which varies by county. It is important to file the deed promptly to ensure the transfer is officially recorded. Keep a copy of the filed deed for your records, as it serves as proof of ownership.

Are there any taxes associated with transferring property in New York?

Yes, transferring property in New York may involve certain taxes, such as the New York State Real Estate Transfer Tax and potentially local transfer taxes. The amount of these taxes can vary based on the property's sale price and location. It is advisable to consult with a tax professional or real estate expert to understand the specific tax obligations related to your property transfer.

Can a New York Deed form be revoked or changed after it is filed?

Once a New York Deed form is filed and the transfer of property is complete, it cannot simply be revoked or changed. If changes are necessary, a new deed must be created to reflect the desired modifications. This may involve additional legal processes, especially if the property has changed hands multiple times. Always seek legal advice before attempting to alter a recorded deed.

What should I do if I encounter issues with my New York Deed?

If you encounter issues with your New York Deed, such as errors or disputes regarding ownership, it is important to address them promptly. Consulting with a real estate attorney can provide clarity and guidance on the best course of action. They can help resolve disputes, correct errors, or navigate any legal challenges that may arise. Taking proactive steps can help protect your property rights.

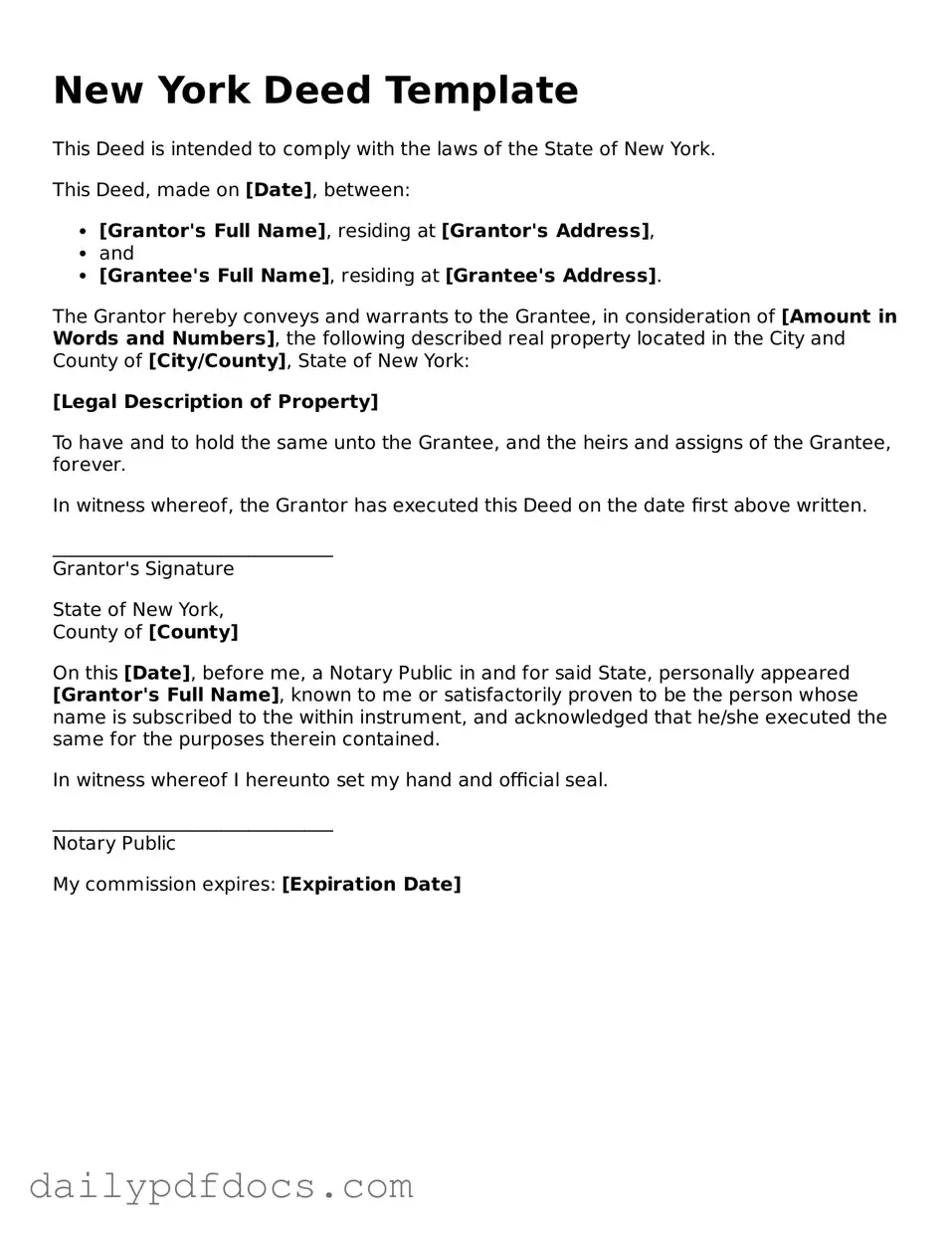

Preview - New York Deed Form

New York Deed Template

This Deed is intended to comply with the laws of the State of New York.

This Deed, made on [Date], between:

- [Grantor's Full Name], residing at [Grantor's Address],

- and

- [Grantee's Full Name], residing at [Grantee's Address].

The Grantor hereby conveys and warrants to the Grantee, in consideration of [Amount in Words and Numbers], the following described real property located in the City and County of [City/County], State of New York:

[Legal Description of Property]

To have and to hold the same unto the Grantee, and the heirs and assigns of the Grantee, forever.

In witness whereof, the Grantor has executed this Deed on the date first above written.

______________________________

Grantor's Signature

State of New York,

County of [County]

On this [Date], before me, a Notary Public in and for said State, personally appeared [Grantor's Full Name], known to me or satisfactorily proven to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof I hereunto set my hand and official seal.

______________________________

Notary Public

My commission expires: [Expiration Date]

Similar forms

-

Title Transfer Document: This document serves to officially transfer ownership of property from one party to another. Like a deed, it requires signatures and often must be recorded with a government office to be effective.

-

Mobile Home Bill of Sale: This form is specifically designed for the transfer of ownership of a mobile home in Florida, ensuring that all necessary details are documented. It is important for both parties to understand the implications of this form, as it protects their rights during the transaction. For more details, visit https://mobilehomebillofsale.com/blank-florida-mobile-home-bill-of-sale.

-

Bill of Sale: A bill of sale is used to transfer ownership of personal property. Similar to a deed, it outlines the details of the transaction and provides proof of the transfer.

-

Lease Agreement: A lease agreement allows one party to use property owned by another for a specified time. It includes terms and conditions, similar to a deed, which outlines the rights and responsibilities of both parties.

-

Power of Attorney: This document grants one person the authority to act on behalf of another in legal matters. Like a deed, it requires clear identification of the parties involved and must be executed according to specific legal standards.

Misconceptions

When it comes to the New York Deed form, several misconceptions can lead to confusion for those involved in real estate transactions. Understanding these misconceptions is crucial for ensuring a smooth process. Here are six common misunderstandings:

- All Deeds Are the Same: Many people believe that all deed forms serve the same purpose. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each with its own implications and protections.

- A Deed Does Not Need to Be Recorded: Some assume that once a deed is signed, it does not require recording. However, failing to record a deed can lead to complications, including disputes over ownership.

- Only Lawyers Can Prepare a Deed: While it is advisable to consult a lawyer, especially for complex transactions, individuals can prepare a deed themselves if they understand the requirements and format.

- All Parties Must Be Present for Signing: There is a belief that all parties involved must be physically present to sign the deed. In many cases, remote notarization options are available, making the process more flexible.

- Deeds Are Permanent and Cannot Be Changed: Some think that once a deed is executed, it cannot be altered. In fact, deeds can sometimes be amended or corrected, depending on the circumstances and state laws.

- Tax Implications Are Not Related to the Deed: Many overlook the fact that transferring property through a deed can have tax consequences. It's important to understand these implications to avoid unexpected financial burdens.

By clarifying these misconceptions, individuals can better navigate the complexities of real estate transactions in New York. Knowledge is key to making informed decisions and ensuring a successful transfer of property ownership.

Form Overview

| Fact Name | Description |

|---|---|

| Document Purpose | The New York Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Warranty Deed, Quitclaim Deed, and Bargain and Sale Deed. |

| Governing Laws | The transfer of property in New York is governed by the New York Real Property Law. |

| Signature Requirements | The deed must be signed by the grantor (seller) in the presence of a notary public. |

| Recording | To protect ownership rights, the deed should be recorded with the county clerk's office where the property is located. |

| Consideration | A nominal consideration is often stated in the deed, although it is not required. |

| Legal Description | The deed must include a precise legal description of the property being transferred. |

| Tax Implications | New York State imposes a transfer tax on the sale of real property, which must be paid at the time of recording. |