Printable Deed in Lieu of Foreclosure Document for New York

In the complex landscape of real estate and mortgage management, the New York Deed in Lieu of Foreclosure form serves as a crucial tool for homeowners facing financial distress. This legal document allows property owners to voluntarily transfer ownership of their home back to the lender, effectively avoiding the lengthy and often stressful foreclosure process. By opting for this route, homeowners can mitigate the negative impact on their credit score and potentially find a more amicable solution to their financial struggles. The form outlines the terms of the transfer, ensuring that both parties understand their rights and obligations. It also addresses any existing liens on the property, making it clear how these will be handled during the transaction. Importantly, the Deed in Lieu of Foreclosure can provide a fresh start for homeowners, allowing them to move on without the burden of an unresolved mortgage. Understanding the nuances of this form is essential for anyone considering this option, as it can lead to a smoother transition and a more positive outcome in a challenging situation.

More State-specific Deed in Lieu of Foreclosure Forms

Will I Owe Money After a Deed in Lieu of Foreclosure - Homeowners can use this option as a last resort, aiming to mitigate potential future financial liabilities.

The importance of a Florida Mobile Home Bill of Sale form cannot be overstated, as it serves as a vital legal document for the transfer of ownership of a mobile home. It is essential for both buyers and sellers to understand this form, which includes critical information such as the buyer, seller, and the specifications of the mobile home. For more information and to access a blank form, visit mobilehomebillofsale.com/blank-florida-mobile-home-bill-of-sale, ensuring clarity and security in your transaction.

Foreclosure in Georgia - Pay careful attention to any repairs or maintenance required before transfer.

Common Questions

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This option can help both parties: the homeowner can avoid the lengthy foreclosure process, and the lender can take possession of the property more quickly and with less expense.

Who is eligible for a Deed in Lieu of Foreclosure?

Typically, homeowners facing financial hardship and unable to keep up with mortgage payments may qualify. However, eligibility can depend on the lender's policies. It is important for homeowners to demonstrate that they have exhausted other options, such as loan modifications or short sales, before pursuing this route.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

One significant benefit is that it can minimize damage to the homeowner's credit score compared to a full foreclosure. Additionally, the process is often quicker and less costly for both the homeowner and the lender. Homeowners may also be relieved from further liability for the mortgage debt after the deed transfer, depending on the agreement with the lender.

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also drawbacks to consider. The homeowner may still face tax implications, as the IRS may view the forgiven debt as taxable income. Additionally, not all lenders accept deeds in lieu, and homeowners may have to negotiate terms that could include a deficiency judgment, depending on the state laws and lender policies.

How do I initiate a Deed in Lieu of Foreclosure?

To initiate this process, homeowners should first contact their lender to express interest. They will likely need to provide documentation of their financial situation. Once the lender agrees to consider the deed, both parties will negotiate terms and prepare the necessary paperwork. It is advisable to consult with a legal professional during this process to ensure all aspects are covered.

What happens after the Deed in Lieu of Foreclosure is completed?

After the deed is executed, the lender will take possession of the property. The homeowner should receive confirmation that the mortgage obligation has been satisfied, which may include documentation stating that they are no longer responsible for the loan. It is crucial to keep copies of all documents for future reference, especially regarding any potential tax implications.

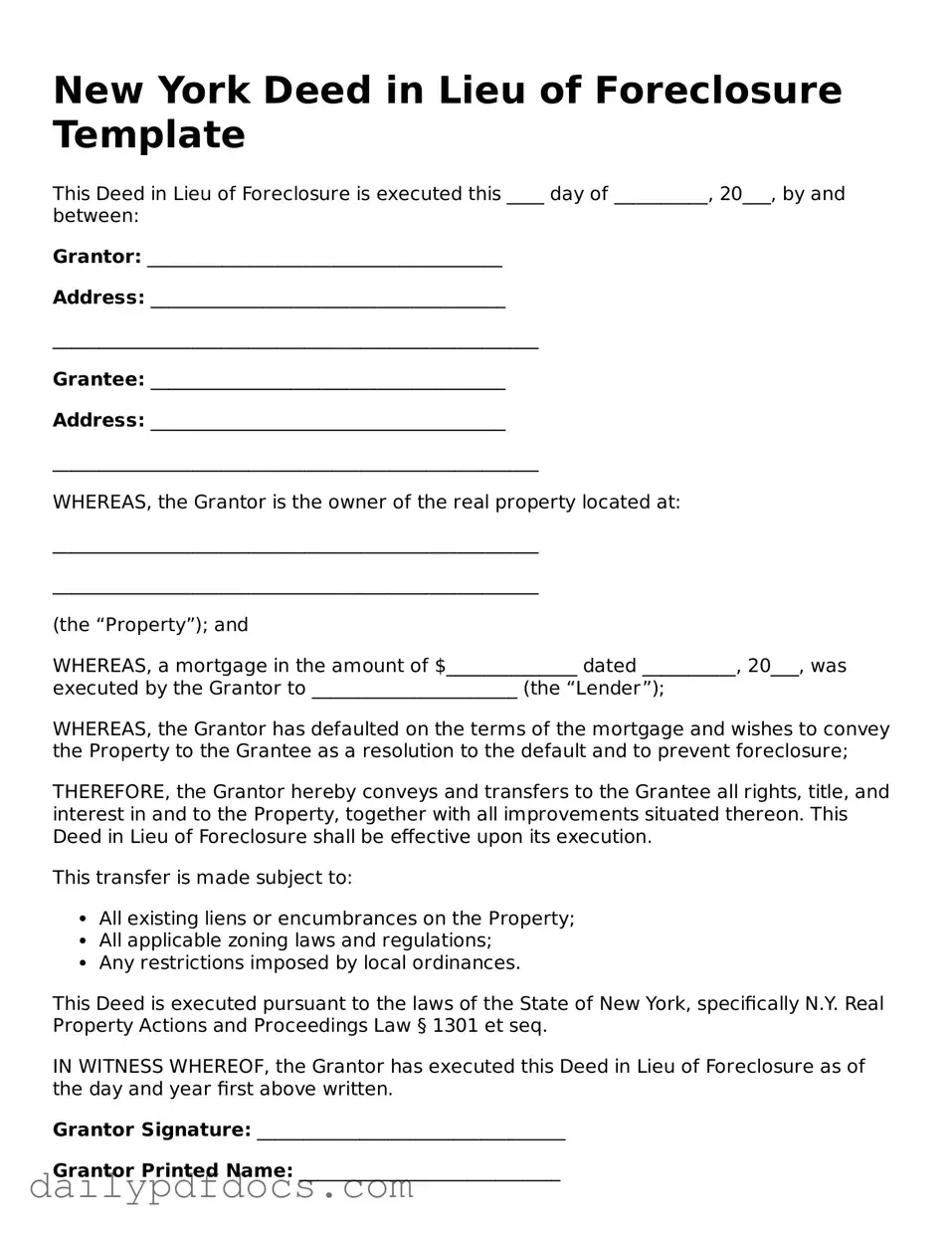

Preview - New York Deed in Lieu of Foreclosure Form

New York Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed this ____ day of __________, 20___, by and between:

Grantor: ______________________________________

Address: ______________________________________

____________________________________________________

Grantee: ______________________________________

Address: ______________________________________

____________________________________________________

WHEREAS, the Grantor is the owner of the real property located at:

____________________________________________________

____________________________________________________

(the “Property”); and

WHEREAS, a mortgage in the amount of $______________ dated __________, 20___, was executed by the Grantor to ______________________ (the “Lender”);

WHEREAS, the Grantor has defaulted on the terms of the mortgage and wishes to convey the Property to the Grantee as a resolution to the default and to prevent foreclosure;

THEREFORE, the Grantor hereby conveys and transfers to the Grantee all rights, title, and interest in and to the Property, together with all improvements situated thereon. This Deed in Lieu of Foreclosure shall be effective upon its execution.

This transfer is made subject to:

- All existing liens or encumbrances on the Property;

- All applicable zoning laws and regulations;

- Any restrictions imposed by local ordinances.

This Deed is executed pursuant to the laws of the State of New York, specifically N.Y. Real Property Actions and Proceedings Law § 1301 et seq.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Grantor Signature: _________________________________

Grantor Printed Name: ____________________________

STATE OF NEW YORK

COUNTY OF __________________

On this ____ day of ___________, 20___, before me, a notary public in and for said state, personally appeared ______________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof I hereunto set my hand and official seal.

Notary Public Signature: ____________________________

My Commission Expires: _____________________________

Similar forms

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage. Similar to a deed in lieu of foreclosure, it helps avoid foreclosure while providing the lender with a way to recoup some losses.

- Loan Modification Agreement: This document modifies the terms of an existing loan to make payments more manageable. Like a deed in lieu, it aims to prevent foreclosure by keeping the homeowner in their property.

- Forbearance Agreement: This agreement allows a borrower to temporarily reduce or suspend mortgage payments. It serves as a way to avoid foreclosure, similar to a deed in lieu, by providing relief to the borrower.

- Mortgage Release: A mortgage release is a document that releases the borrower from the mortgage obligation. It can be similar to a deed in lieu of foreclosure as it relinquishes the lender's claim on the property.

- Quitclaim Deed: This deed transfers ownership of a property without any warranties. It can be similar to a deed in lieu, as it allows the homeowner to transfer the property back to the lender to avoid foreclosure.

- Settlement Agreement: This document outlines the terms of a settlement between a borrower and a lender. It can provide a way to resolve a mortgage dispute without going through foreclosure, akin to a deed in lieu.

- Deed of Trust: This document secures a loan by transferring the property title to a trustee until the loan is paid off. It is similar in that it involves the transfer of property rights related to a mortgage.

- Power of Attorney: This document allows someone to act on behalf of another in legal matters. In some cases, it can facilitate the transfer of property ownership, similar to a deed in lieu.

- Notice of Default: This document notifies a borrower that they are in default on their mortgage. While it does not prevent foreclosure, it is related to the process and often leads to discussions about alternatives like a deed in lieu.

- Residential Lease Agreement: The Ohio PDF Forms provides easy access to the residential lease agreement, which outlines the responsibilities of both landlords and tenants in Ohio, ensuring clarity and protection for both parties involved.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings. While it is a different legal process, it serves a similar purpose of protecting the homeowner from losing their property.

Misconceptions

When dealing with a Deed in Lieu of Foreclosure in New York, several misconceptions can arise. Here are four common misunderstandings:

-

It completely wipes out the mortgage debt.

Many people think that signing a Deed in Lieu of Foreclosure automatically erases all mortgage obligations. However, this is not always the case. If there are any additional liens or debts associated with the property, those may still need to be addressed.

-

It is a quick and easy process.

While a Deed in Lieu may seem straightforward, the process can actually take time. Lenders must review the situation, and both parties need to agree on the terms. It’s important to be prepared for potential delays.

-

It does not affect your credit score.

Some believe that opting for a Deed in Lieu of Foreclosure will not impact their credit. In reality, it can still negatively affect your credit score, similar to a foreclosure. It’s essential to consider the long-term effects on your credit history.

-

It’s only available to homeowners in dire financial situations.

While many individuals facing financial hardship may seek a Deed in Lieu, it is not limited to those in crisis. Homeowners who are struggling but still want to avoid foreclosure may also find this option beneficial.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | This process is governed by New York Real Property Actions and Proceedings Law (RPAPL) and relevant state statutes. |

| Eligibility | Typically, borrowers who are facing financial hardship and unable to make mortgage payments may be eligible for this option. |

| Benefits | It can help borrowers avoid the lengthy foreclosure process, reduce the impact on their credit score, and provide a quicker resolution. |

| Risks | Borrowers may still face tax implications or deficiency judgments depending on the terms of the agreement and state laws. |

| Process | The process typically involves negotiating with the lender, completing the deed form, and ensuring all parties agree to the terms. |