Printable Articles of Incorporation Document for New York

The New York Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in the state. This form serves as the foundation for your business, outlining essential details such as the corporation's name, purpose, and duration. It requires the identification of the registered agent, who will be responsible for receiving legal documents on behalf of the corporation. Additionally, the form mandates the inclusion of the number of shares the corporation is authorized to issue, which is vital for determining ownership and investment potential. Filing this form accurately is not just a bureaucratic step; it is a legal necessity that sets the stage for compliance with state regulations. Understanding the components of the Articles of Incorporation will help ensure that your corporation is set up correctly from the start, enabling you to focus on growth and success.

More State-specific Articles of Incorporation Forms

Ohio Llc Annual Fees - They serve as a foundational document for corporate governance and compliance.

How to Obtain an Llc - The Articles can specify any restrictions on the transfer of shares.

Common Questions

What is the New York Articles of Incorporation form?

The New York Articles of Incorporation form is a legal document required to establish a corporation in New York State. This form outlines key information about the corporation, including its name, purpose, and structure. Filing this document with the New York Department of State is a crucial step in the incorporation process.

What information do I need to provide on the form?

You will need to provide several pieces of information, including the corporation's name, the county where it will be located, the purpose of the corporation, and details about the registered agent. Additionally, you must include the names and addresses of the initial directors and any other pertinent information required by the state.

How do I file the Articles of Incorporation?

To file the Articles of Incorporation, you can submit the completed form online, by mail, or in person at the New York Department of State. If filing by mail, ensure that you include the appropriate filing fee. Online submissions are often faster and can provide immediate confirmation of receipt.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in New York is typically $125. However, fees may vary based on specific circumstances or additional services requested. It is advisable to check the New York Department of State's website for the most current fee schedule.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Generally, it takes about 2 to 4 weeks for the New York Department of State to process the Articles of Incorporation. If you file online, you may receive confirmation more quickly. Expedited services are also available for an additional fee if you need faster processing.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. To do this, you must complete and submit an amendment form to the New York Department of State. This process may involve additional fees and should include details about the changes being made.

Do I need a lawyer to file the Articles of Incorporation?

While it is not legally required to hire a lawyer to file the Articles of Incorporation, consulting with one can be beneficial. A lawyer can provide guidance on the process, ensure compliance with state laws, and help avoid common pitfalls that could delay your incorporation.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, your corporation is officially formed. You will receive a Certificate of Incorporation from the state. After that, you can begin conducting business, but you should also consider obtaining any necessary licenses and permits and setting up your corporate governance structure.

What are the ongoing requirements after incorporation?

After incorporation, your corporation must comply with various ongoing requirements. This includes filing biennial statements, maintaining proper corporate records, and holding regular meetings for shareholders and directors. Additionally, you must adhere to tax obligations and other regulatory requirements specific to your industry.

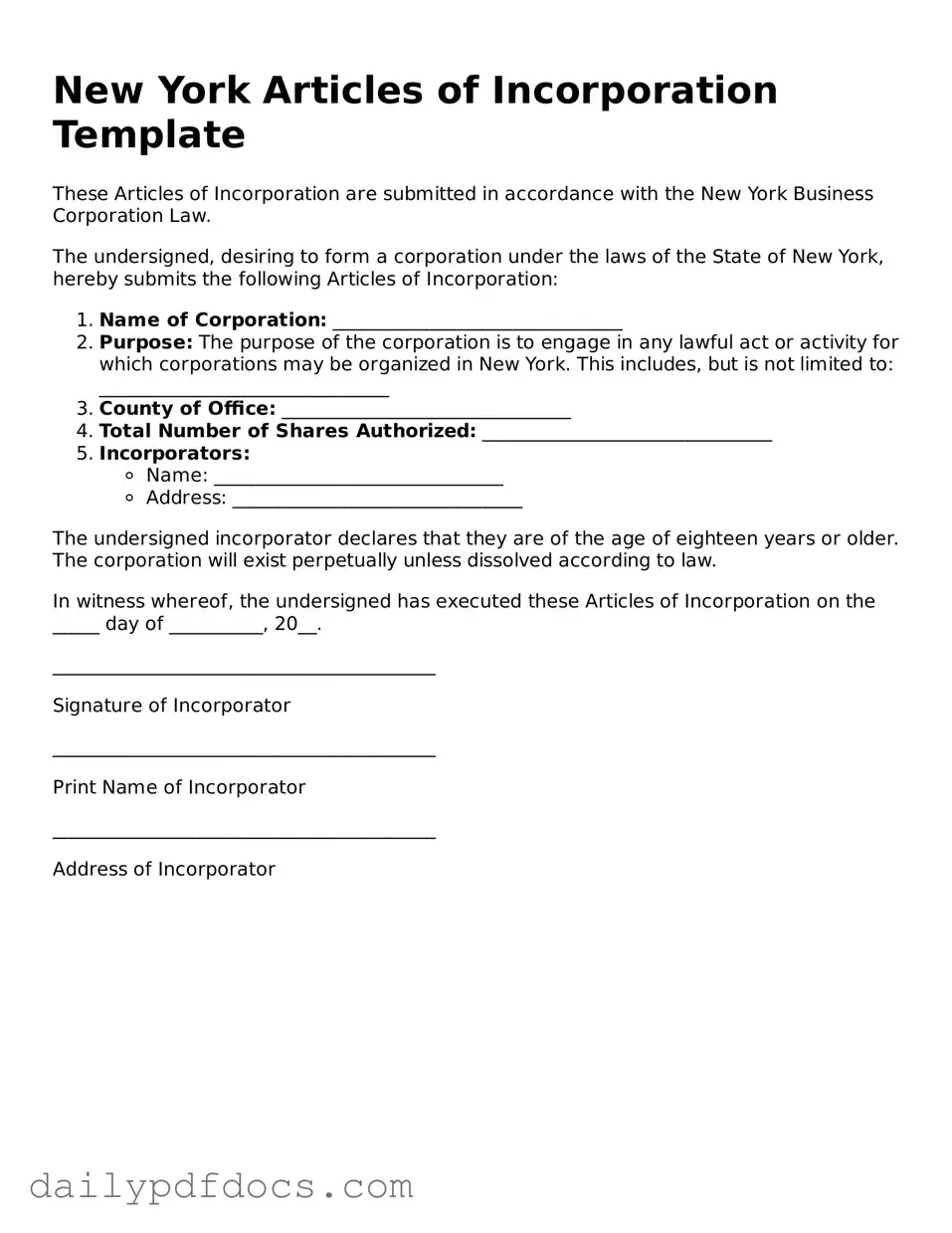

Preview - New York Articles of Incorporation Form

New York Articles of Incorporation Template

These Articles of Incorporation are submitted in accordance with the New York Business Corporation Law.

The undersigned, desiring to form a corporation under the laws of the State of New York, hereby submits the following Articles of Incorporation:

- Name of Corporation: _______________________________

- Purpose: The purpose of the corporation is to engage in any lawful act or activity for which corporations may be organized in New York. This includes, but is not limited to: _______________________________

- County of Office: _______________________________

- Total Number of Shares Authorized: _______________________________

- Incorporators:

- Name: _______________________________

- Address: _______________________________

The undersigned incorporator declares that they are of the age of eighteen years or older. The corporation will exist perpetually unless dissolved according to law.

In witness whereof, the undersigned has executed these Articles of Incorporation on the _____ day of __________, 20__.

_________________________________________

Signature of Incorporator

_________________________________________

Print Name of Incorporator

_________________________________________

Address of Incorporator

Similar forms

- Bylaws: Bylaws outline the internal rules and procedures for a corporation. While the Articles of Incorporation establish the existence of the corporation, the bylaws govern its day-to-day operations.

- Certificate of Incorporation: This document serves a similar purpose to the Articles of Incorporation. Both are required to officially create a corporation, although the terminology may vary by state.

- Operating Agreement: For LLCs, an Operating Agreement is akin to the Articles of Incorporation for corporations. It defines the management structure and operational guidelines for the LLC.

-

Lease Agreement: A California Lease Agreement is crucial for defining the terms between landlords and tenants. This document not only clarifies the obligations of both parties but also provides a roadmap for resolving any potential conflicts. For templates and examples, visit Top Document Templates.

- Partnership Agreement: This document outlines the terms and conditions of a partnership. Like the Articles of Incorporation, it formalizes the relationship between partners and sets expectations for operations.

- Business License: A business license is a legal requirement to operate a business. While the Articles of Incorporation establish the business entity, the license permits it to conduct business legally.

- Shareholder Agreement: This agreement is similar in that it governs the relationship between shareholders. It details rights and obligations, complementing the foundational structure set by the Articles of Incorporation.

Misconceptions

Many people have misunderstandings about the New York Articles of Incorporation form. Here are nine common misconceptions, along with clarifications to help you better understand this important document.

-

Anyone can file Articles of Incorporation.

Only individuals who are authorized to act on behalf of the corporation can file the form. This usually includes directors or officers of the company.

-

Filing Articles of Incorporation guarantees business success.

While filing is a crucial step in forming a corporation, it does not ensure profitability or success. Many other factors contribute to a successful business.

-

All corporations must file Articles of Incorporation.

Only corporations, not other business structures like sole proprietorships or partnerships, need to file this form.

-

The process is the same for all states.

Each state has its own requirements and forms. New York has specific rules that differ from those in other states.

-

Once filed, the Articles of Incorporation cannot be changed.

Amendments can be made to the Articles of Incorporation after they are filed. This allows for changes as the business evolves.

-

Articles of Incorporation are the only paperwork needed.

Additional documents, such as bylaws and business licenses, may also be required to operate legally.

-

The filing fee is the same for all corporations.

Fees can vary based on the type of corporation and other factors. It's important to check the current fee schedule.

-

Filing is a quick process.

Processing times can vary. It’s wise to plan ahead and allow sufficient time for your application to be reviewed.

-

Once incorporated, you can ignore state requirements.

Ongoing compliance with state regulations is necessary. This includes annual reports and other filings to maintain your corporation's status.

Form Overview

| Fact Name | Details |

|---|---|

| Governing Law | The New York Articles of Incorporation are governed by the New York Business Corporation Law. |

| Purpose | This form is used to legally establish a corporation in the state of New York. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for all corporations operating in New York. |

| Information Needed | Key details required include the corporation's name, purpose, and address. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Filing Fee | There is a filing fee associated with submitting the Articles of Incorporation, which may vary. |

| Approval Timeline | Once submitted, the processing time for approval can take several weeks. |

| Public Record | The Articles of Incorporation become part of the public record once filed. |

| Amendments | Changes to the Articles can be made through a formal amendment process. |