Fill Your Mortgage Statement Form

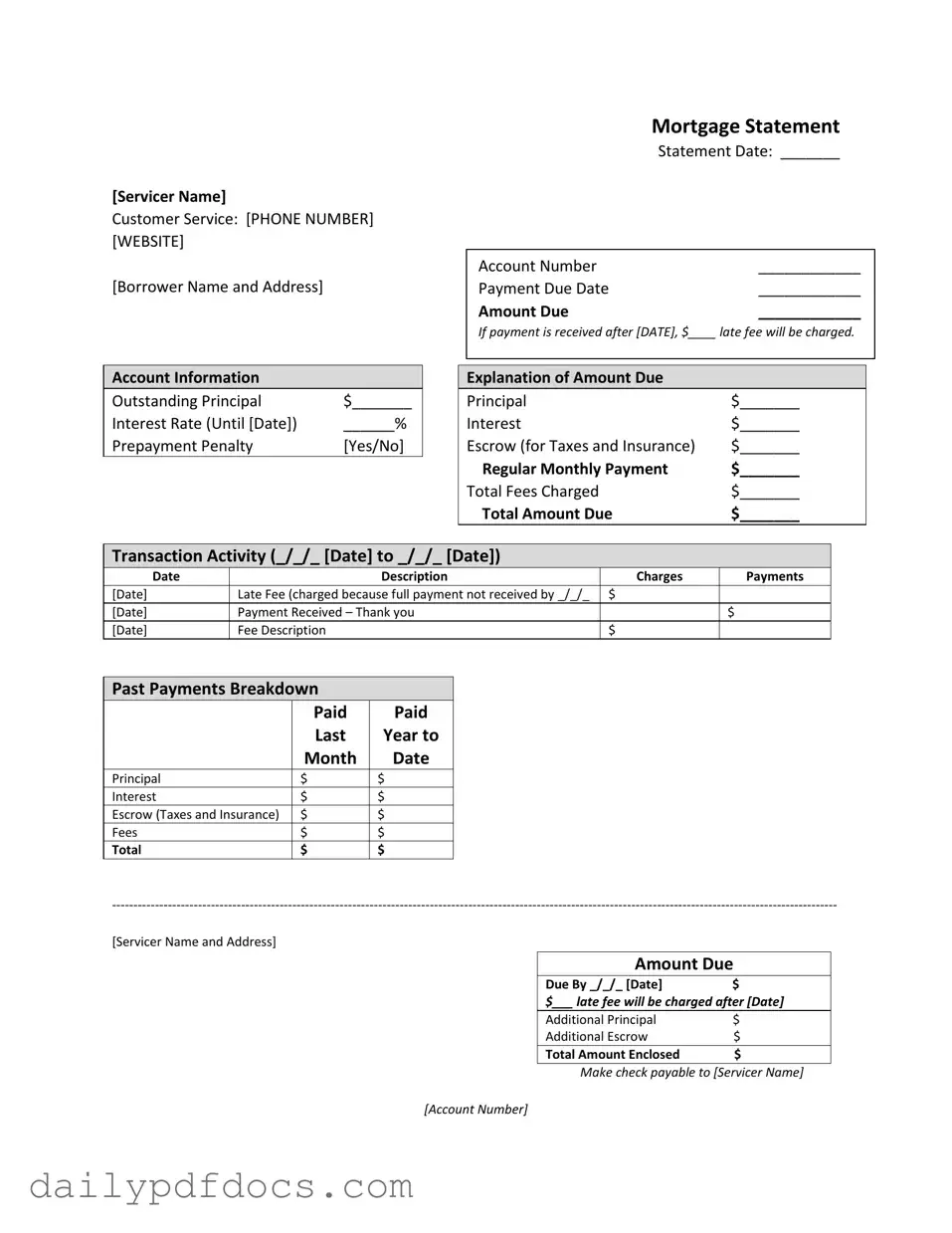

The Mortgage Statement form serves as a crucial document for borrowers, summarizing essential details about their mortgage account. It provides key information such as the servicer's name and contact details, including customer service phone numbers and website links, ensuring borrowers can easily reach out for assistance. The statement includes the borrower's name and address, alongside critical dates like the statement date, payment due date, and account number. A clear breakdown of the amount due is presented, highlighting the principal, interest, and escrow for taxes and insurance. It also outlines any late fees that may be incurred if payments are not made by the specified deadline. Additionally, the form details outstanding principal, interest rates, and whether a prepayment penalty applies. Transaction activity is documented, showing charges and payments over a defined period, while a past payments breakdown offers insight into the borrower’s payment history. Important messages about partial payments and delinquency are included, emphasizing the urgency of maintaining timely payments to avoid potential foreclosure. This form is not merely a statement; it is a vital tool that can significantly impact a borrower’s financial health and homeownership stability.

Find Other Documents

Baseball Tryout Evaluation Sheet - Assess a player's versatility by evaluating them in multiple positions.

The Washington Motorcycle Bill of Sale is not only vital for correctly documenting the transfer of motorcycle ownership in Washington State, but it also helps protect both parties involved in the transaction. For those looking to ensure a seamless transfer, a useful resource can be found at Washington Templates, where you can easily access and fill out the necessary form.

Certapet Letter - Landlords often require this letter to comply with federal housing regulations.

Common Questions

What is a Mortgage Statement?

A Mortgage Statement is a document provided by your mortgage servicer that outlines important details about your mortgage account. It includes information such as the amount due, payment due date, outstanding principal, interest rate, and any fees charged. This statement is typically sent monthly and serves as a reminder of your financial obligations related to your mortgage.

What should I do if I notice an error on my Mortgage Statement?

If you find an error on your Mortgage Statement, it is crucial to act quickly. Contact your mortgage servicer’s customer service at the phone number provided on the statement. Clearly explain the issue and provide any necessary documentation to support your claim. Keeping a record of your communication can help resolve the matter efficiently.

What happens if I miss a payment?

Missing a payment can lead to serious consequences. If your payment is not received by the due date, a late fee will be charged. Additionally, your account may become delinquent, which can lead to further fees and even foreclosure if the situation is not rectified. It is essential to pay the total amount due as soon as possible to avoid these repercussions.

What is a prepayment penalty?

A prepayment penalty is a fee that some lenders charge if you pay off your mortgage early. This penalty can vary based on your loan agreement. It is important to check your Mortgage Statement for details about whether a prepayment penalty applies to your loan. Understanding this can help you make informed decisions about your payments.

What should I do if I am experiencing financial difficulty?

If you are facing financial difficulties, it is vital to seek help as soon as possible. Your Mortgage Statement may contain information about mortgage counseling or assistance programs. Contact your servicer directly to discuss your situation. They may offer options to help you manage your payments and avoid foreclosure.

Preview - Mortgage Statement Form

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Similar forms

The Mortgage Statement form serves as a key document for borrowers, providing essential details about their mortgage account. Several other documents share similar characteristics and functions. Here’s a closer look at four such documents:

- Loan Estimate: This document outlines the estimated costs associated with a mortgage loan. Like the Mortgage Statement, it provides crucial information such as loan terms, monthly payments, and projected costs, helping borrowers understand their financial obligations before finalizing a loan.

- Closing Disclosure: Issued at the end of the mortgage process, this document details the final loan terms and closing costs. Similar to the Mortgage Statement, it includes a breakdown of payments and fees, ensuring borrowers are fully aware of what they will owe at closing.

- Annual Escrow Statement: This statement provides a summary of the escrow account, detailing how much was collected and disbursed for taxes and insurance over the year. Like the Mortgage Statement, it helps borrowers track their payments and understand any adjustments needed for the upcoming year.

- Operating Agreement: To structure your LLC effectively, consider our informative Operating Agreement template resources that clearly define roles and responsibilities among members.

- Payment History Statement: This document lists all payments made on the mortgage over a specific period. It shares similarities with the Mortgage Statement by showing payment dates, amounts, and any fees incurred, allowing borrowers to monitor their payment history and ensure accuracy.

Misconceptions

Understanding your mortgage statement is crucial for managing your loan effectively. Here are eight common misconceptions about the Mortgage Statement form:

- Late fees are automatic. Many people believe that late fees are charged immediately after the due date. In reality, there is often a grace period before any fees are applied.

- Partial payments count towards the mortgage. Some borrowers think that making a partial payment will reduce their outstanding balance. However, these payments are held in a suspense account until the full amount is paid.

- Escrow is optional. Many homeowners assume they can opt out of escrow for taxes and insurance. In some cases, lenders require escrow accounts as part of the loan agreement.

- All fees are disclosed upfront. Borrowers often believe that all potential fees are clearly listed on the statement. However, additional fees can arise from late payments or other actions.

- The interest rate is fixed. Some people think their interest rate remains constant throughout the loan. In reality, many mortgages have adjustable rates that can change over time.

- Payments are applied equally. There’s a misconception that payments are split evenly between principal and interest. In fact, a larger portion often goes toward interest, especially in the early years of the loan.

- Delinquency notices are sent immediately. Many borrowers expect to receive a delinquency notice right after missing a payment. Notices may take time to be generated and sent out.

- Mortgage counseling is unnecessary. Some homeowners think they can handle financial difficulties on their own. Seeking mortgage counseling can provide valuable assistance and options.

Being aware of these misconceptions can help you navigate your mortgage more effectively. Take the time to review your statement and understand your obligations.

File Attributes

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for borrower inquiries. |

| Borrower Details | It lists the borrower's name and address, ensuring accurate identification of the account holder. |

| Payment Due Date | The statement specifies the payment due date and the amount due, making it clear when payments are expected. |

| Late Fee Notification | A late fee will be charged if payment is received after a specified date, alerting borrowers to potential additional costs. |

| Account Information | The statement provides essential account details, including outstanding principal, interest rate, and whether a prepayment penalty applies. |

| Transaction Activity | It outlines transaction activity over a specified period, detailing charges and payments made during that time. |

| Delinquency Notice | A notice warns borrowers of delinquency, indicating the number of days late and the consequences of failing to bring the loan current. |

| Financial Assistance Information | The statement may provide resources for borrowers experiencing financial difficulty, including counseling or assistance options. |